Posted on 04/30/2010 7:05:05 AM PDT by blam

Silver Surges to $18.68/oz Breakout Could Lead to March 2008 Record High of $20.88/oz

Commodities / Gold and Silver 2010

Apr 30, 2010 - 08:21 AM

By: GoldCore

Gold reached new 2010 high in dollars (over $1,175 per ounce) in Asian trading overnight and again Europe this morning (over $1,177 per ounce) as investors continue to allocate funds to gold in order to hedge sovereign debt contagion risk. Gold was marginally lower in dollar terms yesterday but rose sharply in Asian trading with unusually strong Japanese buying and this buying has continued in early European trade.

Concerns of a meltdown in European debt markets have abated somewhat but gold’s continuing strength in euros and other currencies signals that the worst may not be past. Gold slow and steady rise continues and gold is up some 6% in April alone. Market sentiment towards gold has definitely shifted and gold’s safe haven asset attributes are now being accepted by even the most bearish gold analysts. Gold now looks good both fundamentally and technically having closed above $1,165/oz and with the trend firmly up, $1,200 per ounce seems quite likely next week.

SILVER

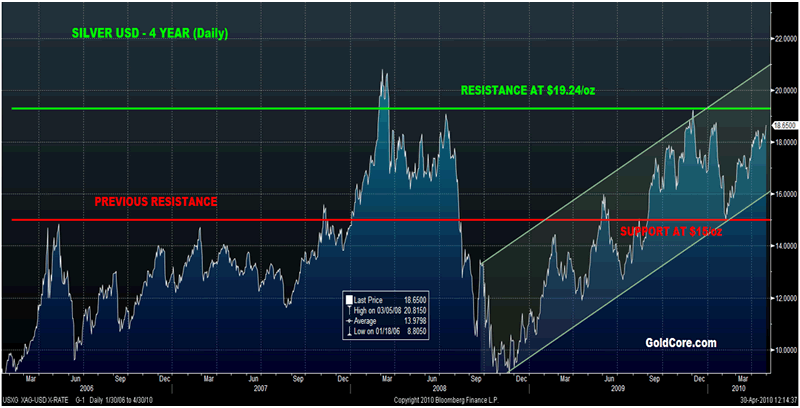

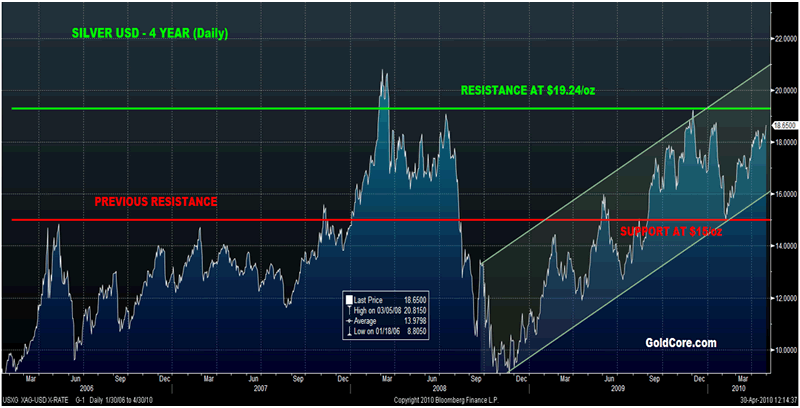

Silver surged 2.4% yesterday and traded higher throughout most of trade in New York and ended near its late session high of $18.56. Silver is up by more than 3% so far in the week and 8% in April. Silver looks very well technically (see chart above) and is in a rising trend channel with support at $15 and $16 per ounce. Resistance is between $19.20 and $19.30 per ounce and a close above these levels should see rapid price moves to $20 per ounce and above that the next level of resistance is at the March 2008 highs at $20.81 per ounce.

Indeed, it is interesting that after a similar period of consolidation in 2006 and 2007 below resistance at $15 per ounce (see chart above), that once resistance was taken out, silver quickly rallied nearly 50% in less than 3 months (from $14/oz to nearly $21/oz). In recent years, silver has tended to lag gold prior to sharp moves up after gold has already made significant gains.

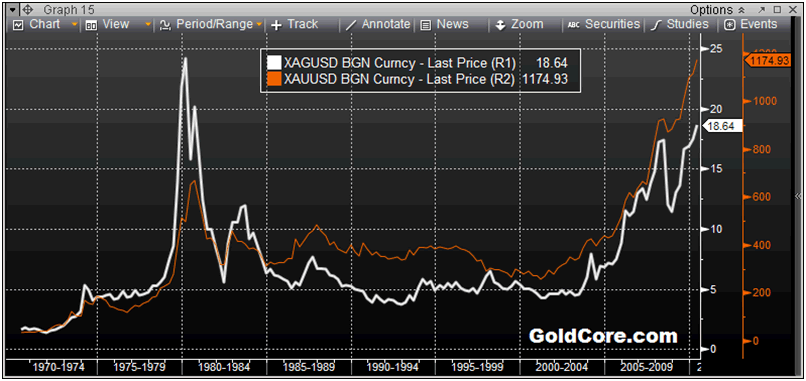

Silver Versus Gold Performance - 1970 to Today (Quarterly)

[snip]

should have bought more.

Although, I still think that less than $ 20 an ounce is prolly a bargain.

Wonder what my former boss, who pissed away money on $ 6.00 lunches out, is now doing. When silver was nine dollars, I told him maybe he should pack lunch a few days a week and buy silver for his kid’s college....

I am quite happy that I have set aside a good amount of the stuff. I get paid in a couple of days - time to buy more.

?silver ping?

Well, imho the important thing is to have some in your hands, not on some account. If it all goes to hell in a handbasket, it does no good in an account. With that, how can you be certain that you got solid Ag and not cheated. I know there are websites about this, but that concerns me. I’d like to get some.

I only buy tangible gold and silver and I do not keep it in a bank.

I wish I’d saved it, but there is a website that will let you hear what real silver coins sound like.Perhaps someone will “chime in” later with it. Pun intended. lol

It’s a distinctive and lovely sound.

I hold my own stuff. I pay a bit more, but it’s worth it to me to do business with an old timer, local coin shop. I pay cash; no names or records. The privacy is worth the bit of extra premium I pay.

My advice is to look around in your local area for a coin dealer, one who has been around forever. Check out his/her background and credentials. Often, they deal in stamps, as well. Call first and make sure you can make an anonymous cash purchase. I told my guy (first time) that I was buying silver eagles as graduation gifts for relatives.

Do your due diligence. www.goldismoney.info is often helpful; there are a lot of regular collectors there.

I never thought in my life that I’d place a premium on privacy; maybe you don’t share that notion. But never in my 40+ years on this planet that I felt I should fear my gov’t...until now.

Oh sure, I’ve been as mad and ticked off as everyone with gov’t and different policies. But not until now, have I felt a need to protect myself from American gov’t. This is the first time I’ve ever felt that I’m on one side, and my gov’t is on the other.

I’ve chosen to act accordingly.

Kindest regards to you.

SgtHooper, I bought many old US silver dollar coins (90% silver), I got the 'slicks' at a reduced price.

Everybody accepts US silver dollars...and, they are legal currency.

Goldbug ping

(bad link in the original post but a good link is in response #3)

Mail me to get on or off the Free Republic Goldbug Ping List.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.