http://www.freerepublic.com/focus/news/2488552/posts?page=32#32

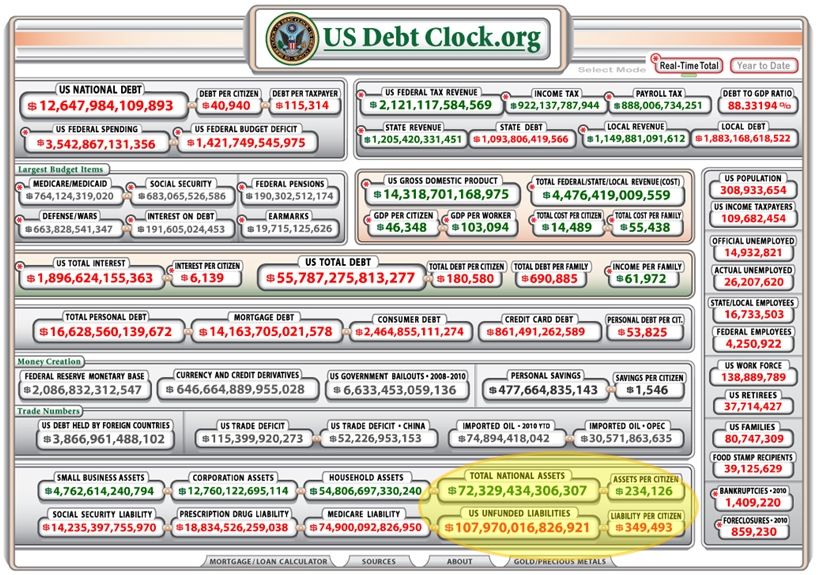

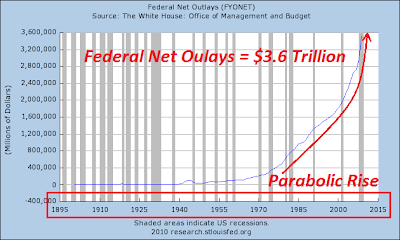

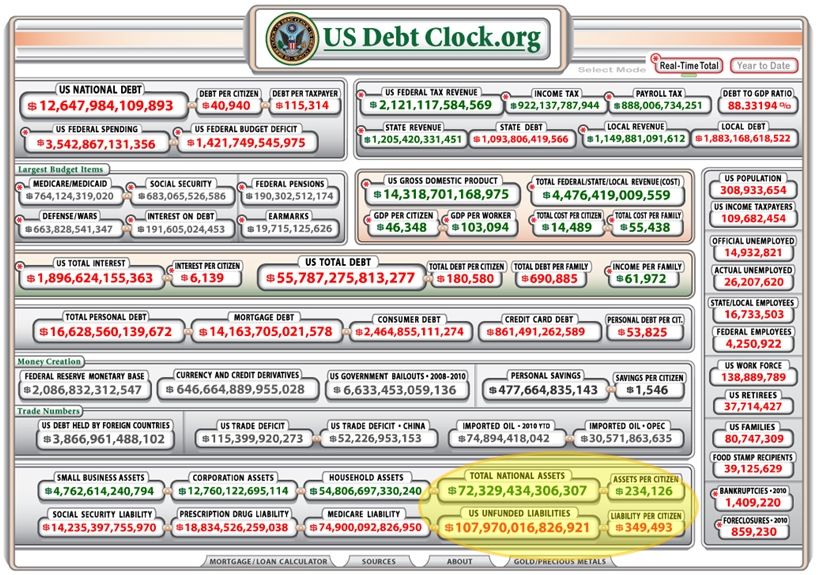

…the real amount of money spent on interest last year alone nearly equals the total amount of money our government takes in!

Posted on 04/12/2010 4:29:35 AM PDT by Candor7

In a statement to the Congressional Hearing, Alan Greenspan, the former chairman of the Federal Reserve, defended his policy on interest rates and placed the blame for the recent crash on the fact that most new mortgages in the final years of the property boom were securitized. According to Mr. Greenspan: “By the first quarter of 2007, virtually all sub-prime originations were being securitized, and sub-prime mortgage securities outstanding totalled more than $900bn.” An economist of equal weighting and stature, Mark Zandi, chief economist of Moody's Analytics, countered Mr. Greenspan’s comments by suggesting to the hearing that “aggressive monetary policy in the wake of the technology bubble contributed to the inflating of the housing bubble.” He went on to say that “There's strong evidence that the Federal Reserve kept interest rates too low for too long.”It is interesting to know just how one goes about determining the impact of low interest rates on the creation of bubbles, since Mr. Zandi made that statement with the same degree of certitude that a physicist uses to explain the speed of a car. How can we say that a housing bubble might have been averted had interest rates been 1 or 2 percentage points higher? Many of us can remember the housing bubble in the U.K. in the 1980s, and where the interest rates were at that point, ranging between 9% and 12%. It took an increase to around 15% to bring the house of cards down. Can we also suggest that it was the access to cheap money that caused the property bubble during this period? Is 9% a low interest rate? Of course, we are told that it is the real interest rates that determine bubbles even though borrowers have no idea of what the real rate really is? But, even if we were to look at real rates, they were in excess of 5% in the U.K. in the late 1980s.

The fact is that there is never any logic to bubbles and no one can really explain why people fall prey to them. Were interest rates to blame for the Internet bubble? When the dot.com bubble was at its full strength no one was willing to accept that the way some of these companies were priced had no bearing on reality. Most investors simply refused to accept that this was all a fantasy and that it made no sense for a company with no profits and $14 million in revenues to have a market capitalization of in excess of $3 billion. Yet, when the crash happened everyone asked why did so many people mortgage their homes to buy more shares in dot.com businesses. It made sense at the time to those who had invested and they refused to believe anyone who stated the obvious. In fact, it took more than three years from when the same Mr. Greenspan made his famous Irrational Exuberance speech in 1986 for the markets to correct themselves. They even refused to listen to Mr. Greenspan at a time when people thought he was the god of finance since what he was saying went against what they wanted to hear.

What Mr. Zandi and the people sitting on that committee fail to realize is that the way Mr. Greenspan managed the U.S. economy in response to the bursting of the Internet bubble was absolutely remarkable. The U.S. stock market lost more than 60% of its capitalization, significantly more than the amount lost in the crash that preceded the Great Depression. Many of us did think that the danger might be that the crash is simply delayed and not completely averted, but no one can deny that what he did was beyond remarkable. That was the first successful response to a major stock market crash since the Great Depression.

More importantly, if low interest rates are responsible for the recent crash, then why are we not witnessing another bubble today? Interest rates have been kept very low for more than a year now and an unprecedented amount of liquidity has been pumped into the economy and yet if anything house prices are still feeling downward pressure. Japan is an even better example of the lack of relationship between housing bubbles and interest rates.

The problem with economics is that no one really knows if the bubble might have been averted had interest rates been higher. However, one thing we can be certain about, and I am very glad that Mr. Greenspan also agrees with us, is that securitization allowed banks to pass on the risks of their mortgages onto unsuspecting investors and forgo due diligence. Once the banks’ main source of income became arrangement fees from mortgages, rather the spread between borrowing and lending, they were incented to lend as much as they could to as many people as they could. If there was to be any default, the loan was not sitting on the banks’ books and it was not their problem. Now, the fact that some banks bought these highly questionable assets and used them as collateral with the Fed illustrates just what happens when the left hand does not talk to the right hand. If those who were investing in these securitized assets had taken two minutes to talk to their mortgage banking departments to see just how much due diligence goes into each new issue they would not have touched them.

If those on the Committee wish to prevent similar crises in the future they need to sort out the securitization mess that still exists. Banks cannot be allowed to divert the entire risk of a mortgage to investors who have no access to the underlying pool of mortgages. Banks must be forced to keep a minimum percentage of the loan on their books so that they are forced to undertake some due diligence for the loan and that they also share in the pain when there is default. Trying to determine whether better monetary policy will be able to prevent future speculative bubbles will not achieve anything. We should try and sort out the mechanical inefficiencies within the system first and then hope that if future bubbles appear we have the wherewithal to use monetary policy effectively. The problem, of course, is that we would not know if it was managed effectively until a few years after it was implemented. So, if I was Mr. Bernanke I would not feel too confident just yet that he has effectively managed the current crisis, as his many supporters have led him to believe. He could just as easily find himself in front of another Committee to explain why he felt it was necessary to pump so much liquidity into the market and cause a gold bubble, or something like it, and having another world renowned economist, such as Mr. Zandi, handing out first class economic advice about how he got it completely wrong.

We highlighted the risks of securitization and the limitations of risk management within banks in a recent paper entitled: Economists’ hubris – The case of risk management. You can read the article at http://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID1550622_code342721.pdf?abstractid=1550622

This briefing is provided as general information, and does not constitute definitive advice or recommendations. Any views expressed in the above articles are those of the author concerned and do not necessarily reflect the views of Capco or any other party. Capco has not independently verified any facts relied upon in any of the comments made in any of the articles referred to. Please send any comments or queries to Shahin Shojai (shahin.shojai@capco.com). Shahin Shojai is the Editor of The Capco Institute journal (www.capco.com).

No wonder Barney Franks has decided to retire.He is a key player in this fraud and deception.

Your headline insertion does not line up with what Mr. Greenspan said.

Subprime mortgage does not necessarily equal affirmative action mortgage.

More subprime mortgages went to white borrowers than to black and hispanic borrowers.

Certainly a higher percentage of mortgages (2-3x) made to minorities were subprime, but most of that can be explained by their lower incomes and poorer credit scores.

So considerably more subprime mortgages, by number, went to whites. I would suspect “white” subprimes were on average considerably higher in value, so the value involved with white subprime mortgages is probably at least 2x that for minorities.

Look, there is no question at all that the mortgage mess was made worse by enthusiastic government support of loans to minorities who didn’t qualify financially. But these loans didn’t CAUSE the meltdown.

So, now Greenspan has this great ephiphany? Sorry Alan—its too late to save your tarnished reputation.

“The liberal Fascists are on the march to destroy our economy and no one is blinking.

No wonder Barney Franks has decided to retire.He is a key player in this fraud and deception. “

According to Liz, either Dodd or Frank has retained a criminal lawyer. I think Dodd. I’ll ping her.

Panel got the wrong people. Try getting Moody analysts who had no loan data from the client banks when they tried rating their mortgage back securities and somehow with the lack of data rated the products AAA. Try asking borrowers of prime mortgages why they put a huge salary on their applications when their tax filing showed otherwise. Try asking the bank underwriting departments why they did not validate the info on loan applications and why they created high RICO ratings for loan applicants to cover the bad credit scores. All these discrepencies can be tracked and documented and the people involved can be hauled in front of Congress for an explanation. All this does not involve new regulations but rather exsisting regulations. Before Congress uses these hearings to create new rules and regs, they should be using these hearings to determine if existing rules and regs were violated and why no one in the government is pursuing these cases.

Time to replay “Burning Down the House”

http://www.youtube.com/watch?v=NU6fuFrdCJY

Watch the rats. When they leave the ship, it bodes ill. I have a feeling that when the economy is about to sink, they will all be overseas laughing at those of us who can't even see them in the viewfinder..,

Timeline shows Bush, McCain warning Dems of financial and housing crisis; meltdown

Youtube ^ | 9-24-08 | Proud To Be Canadian

http://www.youtube.com/watch?v=cMnSp4qEXNM&NR=1

The Bush Admin and Senator McCain warned repeatedly about Fanny Mae and Freddy Mac and what thus became the 2008 financial crisis — starting in 2002 (and actually even earlier — in the Clinton and Carter White Houses.

Democrats resisted and kept to their party line, extending loans to people who couldn’t afford them — just like you would expect of socialists.

http://www.freerepublic.com/focus/f-news/2451424/posts

~~~~~~~~~~

The CRA Scam and its Defenders (ACORN’s role in the subprime crisis)

http://www.freerepublic.com/focus/news/2084666/posts

The myth that the CRA would not be harmful to bank-industry profits was hidden for years by the Fed-created housing bubble, which allowed for easy refinancing of all the bad debt. “[The] CRA increased lending and homeownership in poor communities without undermining banks’ profitability,” Robert Gordon proudly proclaims.”

How ACORN Helped The Housing Crisis Harm Taxpayers

The Virginian ^ | 9/27/2008 | Moneyrunner

http://www.freerepublic.com/focus/f-bloggers/2091698/posts

WHAT CAUSED THE ECONOMIC CRISIS

Now we know what a community organizer does

http://www.jeffhead.com/obama/communityorgan.htm

Obama sued Citibank Under CRA to Force it to Make Bad Loans

http://www.freerepublic.com/focus/news/2101106/posts

~~~~~~~~~

Freeper Liz has done great research on financial corruption. Here she ties in Rahm Emmanuel and the BHO administration:

Rahm Emanuel’s Profitable Raping of Freddie_Mac

Freddie Mac records exempt from FOIA (Obama Admin Denies Request)

Rahm Emanuel’s Profitable Raping of Freddie_Mac

http://www.freerepublic.com/focus/news/2296845/posts?page=46#46

~~~~~~~~~~

Truth Comes Out at Financial Crisis Hearings; State-Run Media Ignores: Greenspan says the subprime crisis started it all.

http://www.rushlimbaugh.com

RUSH: “Now, it’s fascinating because Angelides, when the microphones are off, after Greenspan finished, there was a little audio from the former chairman. Angelides said that Greenspan had given a lights-out performance. And that’s in the Politico: “Greenspan Defends Legacy, Jabs Hill.” So Angelides, Democrat, he told the truth.

It’s just fascinating. Well, it’s not fascinating. It’s interesting to point out that when they’re leaving the game, when Washington and the culture there can no longer do anything for them, they tell the truth. In the middle of the scandal don’t dare tell the truth if you want to remain a player in the game.”

~~~~~~~~~~

Greenspan says Congress pushed Fed on housing boom

http://www.freerepublic.com/focus/f-news/2488415/posts

Greenspan Could Have Prevented Housing Collapse Claims NY Times Op-Ed

http://www.freerepublic.com/focus/f-news/2486757/posts

~~~~~~~~~~~

PBS Frontline: The Warning — How Greenspan, Summers & Rubin Conspired To Silence Derivatives Whistleblower Brooksley Born:

Born says. “That puzzled me. What was it that was in this market that had to be hidden?”

http://www.pbs.org/wgbh/pages/frontline/warning/view/

Agreed, This is just a sophistcated CYA operation. The Dems do NOT want to face the music,as usuual.Therefore no fix is possible.

It will ruin the country.

…the real amount of money spent on interest last year alone nearly equals the total amount of money our government takes in!

Senator Still Stonewalling On Curious Loans. A Democratic president who feels "a righteous wind" at his back has at least six more Democratic senators and realized a net gain of 22 seats in the House of Representatives ought to make this the age of influence for 28-year Senate veteran Christopher Dodd. But the fates divide our fortune, and not always equally.

As the Democrats moved toward victory at the end of October, a story by NBC's Lisa Myers set Dodd apart from his triumphant fellow Democrats. Myers reported that federal agents are investigating the notorious "Friends of Angelo" list maintained by subprime mortgage giant Countrywide Financial's co-founder Angelo Mozilo. Dodd was the most prominent member of that exclusive club.

Since the Dodd story broke in June, the five-term senator has offered contradictory fragments of explanations and intentions. Scheherazade after a six-pack of Red Bull would not have told more desperate tales. Dodd gallops the gamut from calling the allegations of special treatment "outrageous" to pledging repeatedly and specifically to release documents related to the $800,000 in sweetheart deals he got from Countrywide.

Still claiming "there's nothing there," Dodd refuses to say whether his Senate campaign committee's payments of $60,000 last summer to a Washington law firm, which has a history of representing Democratic senators in trouble, were for his defense in the Senate ethics investigation of his dealings with Countrywide. Dodd suggested, before he fled to his third home in Ireland in August, that Countrywide was not cooperating in providing information.

|

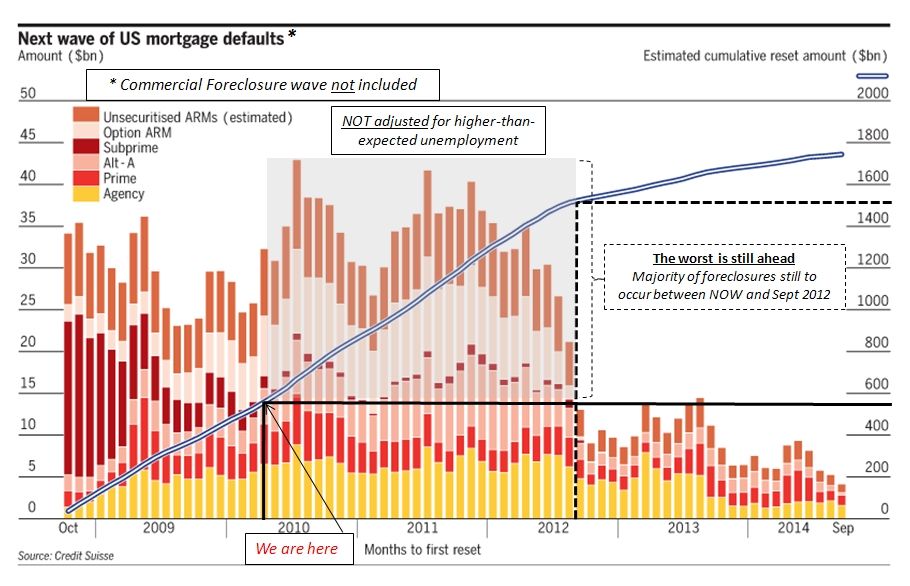

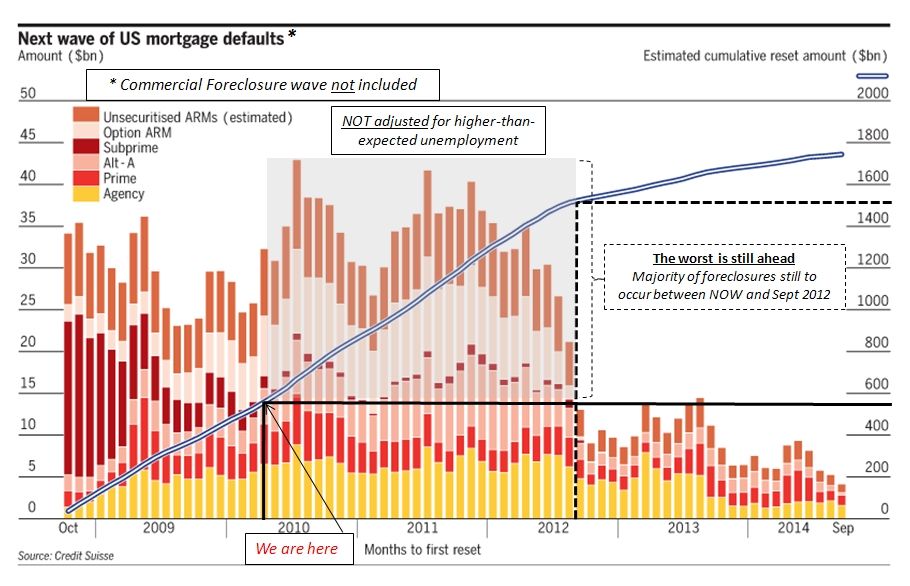

Thanks for the compliment. On Friday, Greece's credit rating got dropped from A+ to BBB-. That can translate to about a 15% interest rate when they borrow. Two days earlier, on March 30, the Federal Reserve terminated its historical $1.25 trillion dollar mortgage-backed securities purchase (MBS) program. The buying spree, which helped to boost the Fed's balance sheet from around $750 billion dollars in the summer of 2007 to north of $2 trillion dollars now, is likely to result in higher mortgage rates as the Fed begins to sell these securities. As the M1 money supply enters the consumer money supply from the sell-off of these mortgage-backed securities, that will translate into an overabundance of dollars, a/k/a INFLATION. Remember those days of interest rates in the 20s? They'll be back before too long. And when Adjustable Rate Mortgages (ARMS) that are TIED to 1-year constant-maturity Treasury (CMT) securities, the Cost of Funds Index (COFI), and the London Interbank Offered Rate (LIBOR) go up at a VERY high rate of increase ... well, many analysts think the UPDATED chart (AT THE BOTTOM OF THIS POST), based upon the ORIGINAL chart (IMMEDIATELY BELOW) produced in a report by Credit Suisse in March 2007 (pg. 47) is a LOWBALL estimate for the "second wave" of mortgage defaults.

|

April 1, 2010

The Fed Admits To Breaking The Law

Now how long will it be before something is done about it?

The Fed has effectively usurped Article 1 Section 7 of The Constituion which reads in part:

All bills for raising Revenue shall originate in the House of Representatives; but the Senate may propose or concur with Amendments as on other Bills.

The Fed effectively appropriated taxpayer funds without authorization of Congress. At the time these facilities were put in place neither TARP or any other Congressional authorization existed for them to do so, and to date no bill has been put through Congress authorizing the expenditure of taxpayer funds, either through putting them at risk or via outright expense, for this purpose.

This was and remains a blatantly unlawful activity.

Nor does it stop with a "mere" Constitutional violation - The Federal Reserve Act's Sections 13 and 14 do not permit Fed asset purchases except, once again, for items carrying "full faith and credit" guarantees. Credit-default swaps and trash mortgages most certainly do not meet these qualifications.

I know I've harped on this for more than two years, but here we have a raw admission of exactly what was done - and there is simply no way to construe any of it in a light that conforms with either The Constitution or black-letter statutory law.

What's worse is that Tim Geithner, head of the NY Fed at the time, was very much involved in this - that is, he in effect personally, along with Ben Bernanke, usurped the power of the United States House.

The Fed has spent two years trying to hide this from the public and Congress. It has fought off both Congressional demands for disclosure and multiple FOIA lawsuits, the latter of which has resulted in a series of adverse rulings (and, it appears, was ultimately going to force disclosure anyway.)

These actions are unacceptable but promising "never to do that again" is insufficient. In a Representative Republic where the rule of law is supposed to be paramount - that is, where we do not crown Kings and relegate everyone else to the status of knaves, unlawful actions such as this demand that strong and unmistakable sanction also be applied to all wrongdoers in addition to protection against future abuse.

In this case this means that both Geithner and Bernanke must go - for starters.

Amending The Federal Reserve Act of 1913 (as Chris Dodd has proposed to prevent future lending bailouts) is not sufficient in that The Fed did not lend in this case, it purchased, and by buying what we now know were trash loans it violated the black letter of existing law.

There is only one effective remedy for an institution that has proved that it will not abide the law: it must be stripped of all authority that has been in the past and can be in the future abused.

This means that The Fed, if we are to keep it at all, must be relegated to a body that only practices and provides monetary policy - nothing more or less - and that all monetary operations must be performed openly, transparently, and within those constraints.

We cannot have a republic where an unelected body is left free to violate The Constitution with wild abandon and those acts are then allowed to stand.

One final thought: If the individuals responsible for this blatant black-letter violation of the law do not face meaningful sanction for these acts, and neither does The Fed as an institution, can you fine folks over at The Executive, Judiciary and Legislative branches of our government please explain to us ordinary Americans why we should obey any of the laws of this land when you will not enforce the laws that already exist?

I xcall the affirmative action mortgages, beasue they were nade to people who could not afford them, without adequate income or security.

ull.

Barney Frank affirmatively wanted financing for the gay community and facilitated an affirmative action building boom on the gay communities of Key West and Provincetown, for example.

This was a hogs to the trough boondoggle from the very first days of Jimmy Carters FHA that got out of hand.Harry Reids family made a fortune in Nevada.

Its time to start calling it what it is. Affirmative “ACTION” lending driven by discrete community interest and exploitation of that community. There is an elephant in the effing room. Call it what you want. I do so without reference to race.

Just as I've been saying the GOP didn't want this administration and they played hot potato over to the RATs. The GOP didn't want to face the music either. Greenspan needs to do some looking in the mirror as well. Of course, look who all was getting kickbacks from Fannie/Mac. There's your boatload of rats and the head rat, the usurper himself, was right at the top.

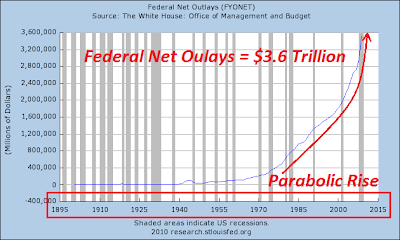

Those are accurate charts. Good post!

Don't hold your breath what with the crew we got running our govt at the moment.

===================================

EXCERPT Affirmative Action Mortgages ruined the economoy. If the banks wish to prevent similar crises, the securitization mess needs rectifying. Banks must be forced to keep a minimum percentage of the mortgage loan on their books so that they are forced into due diligence so that they also share in the financial pain of default. Banks cannot be allowed to divert the entire risk of a mortgage to investors who have no access to the underlying pool of mortgages.

===================================

Yes, the banksters messed it up. But there's a secondary problem----the secularization of the culture--- wherein moral certitudes and the Golden Rule were tossed aside in favor of self-absorbed individuality. At one time, getting a mortgage was considered a moral obligation----mortgage-holders took on the responsibility; they budgeted and had second jobs in order to pay their obligations.

CASE IN POINT A TV documentary "House of Cards" showed an illegal who could not speak English, who mowed loans for a living, getting a sub-prime mortgage for a posh California property worthy of a multi-millionaire. Of course he defaulted----the illegal had lied about his income on the mortgage application.

REFERENCE Financial Bust Connected to Illegal Alien Mortgages

Human Events | October 5, 2009 | William Campenni

FR Posted by machogirl

......the new alchemists: mortgage bankers and investors. They found a way to turn worthless mortgages into hordes of gold. Or at least they thought they had.

There were other factors that contributed to the collapse of the credit markets. Low interest rates by the Federal Reserve, lowered standards by FannieMae and FreddyMac, securitized mortgages (derivatives and collateralized debt obligations -- a real alchemic brew), the machinations of Barney Frank and Chris Dodd, the Community Reinvestment Act, Alan Greenspan, and so forth. etc. But of themselves, and even in concert, they could not have brought about a collapse of the magnitude that ensued.

So what supplied this quintessential element? It was the opportunity to exploit the sudden and coincidental housing needs of millions of illegal aliens with subprime mortgages.

The grand schemes and diabolical financial instruments would otherwise lie fallow without a huge base of mortgages to hold up the Ponzi pyramid, and the new market of the 12 -- more likely 20 -- million housing-starved illegal alien populace was the ripe, low hanging fruit. (Excerpt) Read more at humanevents.com ...

===================================

As FReeper raybbr postulated: "the sense of entititlement to tear down our government while enjoying US prosperity, the principles of democracy, our legislative process, and our thriving society is an affront to every real American."

The subprime mortgage meltdown is attributed to illegal invaders fraudulently getting loans with stolen identities; if they could breathe and make an X, they got a mortgage, no questions asked. The conniving illegals then flipped the mortgaged houses among relatives at higher and higher prices.......the last relative absconds to Mexico with loads of cash, leaving banks (and taxpayers) holding the bag.

???

Did The Fed Just (Surreptitiously) Bail Out Europe?

The Market Ticker ^ | 04/12/2010 | Karl Denninger

Posted on Monday, April 12, 2010 2:37:24 PM by Zeddicus

No, not just Greece - all of Europe. Without Congressional authorization or notice, of course.

http://www.freerepublic.com/focus/f-news/2491539/posts

|

> Did The Fed Just (Surreptitiously) Bail Out Europe? Possibly, but my developing theory that the $500 billion Student Loan Program Federal grab (that took place within the ObamaCare bill) is a way to re-collateralize part of that $2 Trillion printed and placed in the 13 Federal Reserve Banks to cover a partial Derivatives bailout and the $550 billion that was called in on Sept 15, 2008. It's about the ONLY way to absorb the cash — by BLOATING the Federal government — without causing MASSIVE inflation. |

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.