Posted on 11/03/2009 6:58:08 AM PST by blam

Property Values Set to Fall 43% From Current Depressed Levels

Michael David White

November 02, 2009

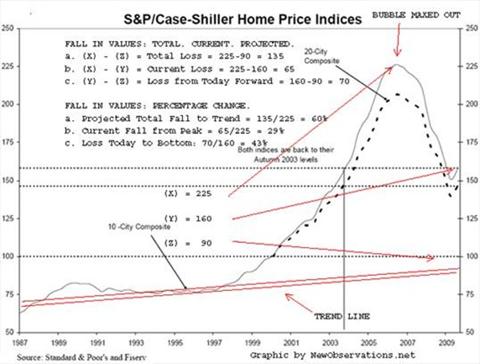

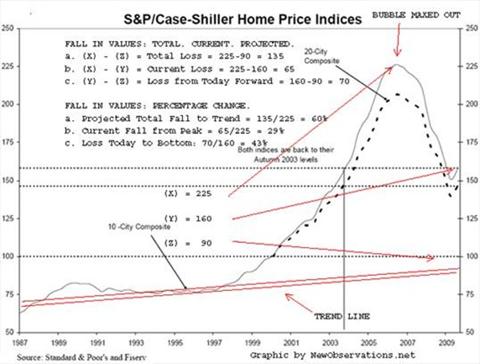

Price Trends / WAR OF THE WORLDS: If you use a 20-year time horizon, and assume prices will return to the trend line, then our residential property bubble will bottom after values fall over 40% from current levels (see above (c) aka “(y) - (z)” aka “Loss Today to Bottom”). I make no predictions. I do watch numbers. The chart shows a catastrophe of falling real estate values loaded up on top of our current catastrophe in real estate values.

No one would question these numbers absent The War of the Worlds. The War of the Worlds is the United States Government versus aggregate borrower income. Uncle Sam is funding every new mortgage – high, low and in between (see chart below--the blue and red represent government-backed loans and the private market is the yellow and green).

It takes very little imagination to see the world of real estate prices vaporizing without government support. If that support was lost, values would crash down faster than a big rock dropped into a shallow puddle.

[snip]

It’s even worse. Financial people are trying to keep this quiet, but what has happened is that as global warming has increased, the percentage of CO2, CO, and CH3 in the atmosphere have passed what is known as the Bernoulli Point: the point at which gold begins to corrode. The current rate of corrosion is approximately .5% a year but it accelerates geometrically. For a long-term investor in physical gold, it means the gold will have turned completely to AuO3 — a useless alloy — within several decades. Once word of this gets out to the public, all bets are off.

We are already there. Lawyers on the radio selling scam to sue banks for not having perfect paperwork.

When arson becomes ‘performance art.’

“I don’t believe this at all - the market is currently at or very near bottom, look for an upswing in the next 6 months.”

You are kidding right? There is a little bounce right now with super low intrest rates and desparate sellers.

Our whole financial system is totally screwed up thanks to SACORN/SEIU, Frank, Dodd and Congressional black caucus.

Nothing will improve unless Repubs win in a landslide in 2010. More than a year away.

That is low ... in the Peoples Republik of Kalifornia (I don’t live there, but I have looked up and computed it), property taxes run about 10% of market value last time I computed it.

I’ve seriously thought about it.

Okay, I guess we’ll see won’t we? Not like I would mind it if the guy was right, I still haven’t bought my first house so I’m perched like a vulture and waiting.

House prices have been increasing slightly the last few months, but that has been artificially induced by the gubmint and their $8K for first time home buyers. If they stop the program, I think that home prices start sliding again.

We think alike.

do you have any reference material or links that support gold turning into AuO3 ?

Au into AuO3? It’s a hoax. Only a combination of two strong acids touches Au. Nitric and sulfuric acid combined can do that - not much else.

On the other hand, somebody’s been forging 400 oz. gold bars with tungsten - easy to detect, but first you have to suspect.

I don’t believe this at all - the market is currently at or very near bottom, look for an upswing in the next 6 months.

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

I will bet a Franklin against a Jackson that you are wrong.

No room for people just barely surviving? (I'm not trying to be combative but would like your viewpoint)

I don’t know- what does a person of honor do when faced with a matter of survival?

It is a dilemma, not being physically able to afford the house - and now, in this recession/depression, not being able to sell the house (home owners so far underwater the debt of the lost equity, even if swallowed, is unaffordable in itself). I guess you deal with the bank and return the keys and declare bankruptcy.

Do you watch or listen to the Dave Ramsey Show? Many callers seek his advice on exactly this situation. In the end, you do what you have to do, and what you can do, and pray for the wisdom to know what that is and the serenity to accept it.

Thanks. $11 Trillion in the housing market I would have to agree.

Wilbur Ross: Commercial Real Estate to Cause ‘Tragedies’

Vulture investor Wilbur Ross is sure talking down the commercial real estate market.

He told CNBC this morning that:

Everything’s going in the wrong direction and I think we’re going to see quite a lot of tragedies in that sector...The same reckless lending that characterized the subprime mortgage business in residential was also characterizing what went on in commercial real estate in the mid 2000s.

“I don’t think the federal government is going to do much to help the commercial building side, because individual home owners vote, but buildings don’t vote,” he said.

He did point out that the commercial market is about $3 trillion versus an $11 trillion residential market.

However, he failed to mention that Goldman Sachs doesn’t appear to have any significant exposure to commercial real estate, so they won’t be around muscling the government to prop it up. In fact, friends tell me they are probably net short CRE.

http://www.economicpolicyjournal.com/2009/11/wilbur-ross-commercial-real-estate-to.html

You make a great point. It used to be I’d show someone a 200K house, and the taxes would be about $250 per month, a significant but not insurmountable component of their payment. But now, houses that were valued a few years ago at 380K are selling for 200k, but they still have taxes up over $450 per month, so the buyers can afford the principal and interest, but not the taxes. The taxes are coming down a bit, but it’ll take years for them to catch up - if the state ever allows it to happen. This will be a drag on prices for several more years. Michigan has been a great forecaster for the rest of the nation, by about 18-24 months, something I noticed about 2 years ago, and it has kept up like clockwork. Several regions here are getting close to 1987-1990 prices. I think we’ll see 1980 prices before it turns around. I don’t think it means the end of ownership, but we’ll see people paying reasonable amounts for houses, putting 30% or more down and financing for 10 years like our grandparents used to do. It just sucks for the rest of us who bought in the last 10 years and will be upside down for the next 10.

>>Chip board palaces are real alright, a real rip off.

And what happens when the “real” glue breaks down?

Take cheap Chinese copper pipes that contain iron flecks, combine the resulting rusted pin-holes with chip-board and Sulpher containing chi-com plasterboard... and Yippee a big ol stinky mess.

Not your father’s McMansion at all.

ALL YOU MCMANSION ARE BERONG TO US. HA HA HA.

Why would anyone just arbitrarily walk away? They have to live somewhere!

“IMHO:

Depending on the area, go back to late 2003, compare sold prices in a given area.

Ignore the highest and lowest price, get the average price of the rest.

Again, depending on the area, add 4%-6% appreciation to that average price for each of the following years up until 12/09.

Assuming the property and it’s neighbors have been well maintained, you will have the fair market value of your home.”

That seems like a long way around a simple problem.

An appraisor and a real estate professional would look at the actual sales of comparable properties within the last six months.

Make adjustments for size, age, condition, improvements and you get the best estimate of “fair market value” for the subject property.

Laypersons can do this quite easily, because the actual sales prices are public information.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.