Posted on 10/18/2009 9:25:09 AM PDT by Son House

Funny things happen when the government borrows trillions and transfers a rising chunk of it to individuals: GDP goes up and so does the dependence on government borrowing.

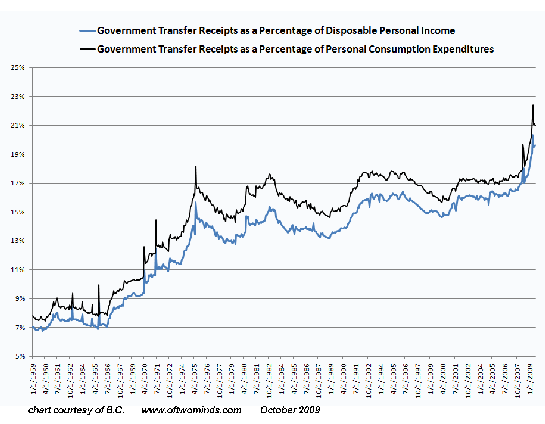

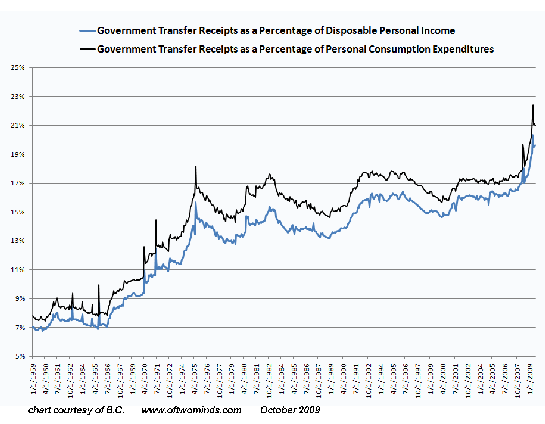

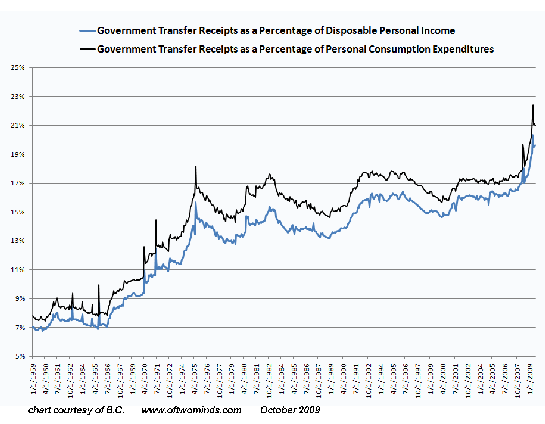

Frequent contributor B.C. submitted a fascinating and deeply disturbing chart which depicts government transfers skyrocketing to 22% of personal consumption and 20% of personal income.

That means that one out of every five dollars in personal income now comes from the Federal government.

Note that this is fully triple the 7% rate at the end of the great postwar Bull market (1967). Also note that the percentage of income has leaped from 16% before the recession (2007) to 20% in 2009--a 25% increase in only two years.

The percentage of personal income received from the Federal government stayed within a fairly narrow band of 13% to 16% for roughly 30 years--from the 1975 recession to 2004.

Clearly, the government has countered the drop in personal incomes resulting from the current Great Recession by borrowing and transferring unprecedented amounts of cash to its citizenry.

The generally accepted idea, of course, is this is a temporary move to "tide us over until economic growth resumes." But what happens if organic (non-governmental borrowing) growth does not return? What if all GDP "growth" depends entirely on the Federal government borrowing and spending $2 trillion a year (or more) from now until Doomsday?

B.C. offered these comments about the chart's implications for future GDP "growth."

U.S. M1 (one measure of money supply) is up year-over-year (YoY) at a double-digit rate, whereas US gov't transfer payments (unemployment, Social Security, Medicare, Medicaid, etc., not counting veteran's benefits) are up 17-18% YoY or an equivalent amount of ~100% of the YoY growth of M1 and ~40% of M2 (broader measure of money supply).Transfer payments make up ~15% of GDP and ~20-21% or more (and rising) of US personal income and spending.

Federal gov't spending is ~26-27% of GDP. A 17-18% growth of gov't spending implies ~4.5% net positive incremental YoY contribution to GDP. With the YoY contraction in investment, personal consumption, and exports contributing a net -6.4% to nominal GDP YoY, it is conceivable that the GDP will be reported to have grown at a 3.7% annualized quarterly rate, albeit down ~1.8% YoY.

Were the deflator to maintain, and the personal consumption trend from Mar.-May were to have held through Sept., real GDP annualized for Q3 could be up as much as 5-7%, as hard as it is to believe.

Mind you, the overwhelming majority of the incremental "growth" will have resulted from federal gov't borrowing and spending at a rate that is triple or more the trend nominal GDP rate.

If the growth gap from the negative wealth effect of asset deflation is as large as I suspect it is, the trend of federal gov't borrowing and deficit spending is for all practical purposes permanent in order to prevent nominal GDP from contracting. (emphasis added, CHS)

However, the large scale of low-multiplier deficit spending will likely mean falling money velocity, with money supply/loans/deposits growing at around (no faster than) the growth of gov't transfer spending, which is generally what the Japanese have experienced since the mid- to late '90s when persistent price deflation took hold.

As economic growth continues to slow and Boomers draw down on gov't programs en masse, low-multiplier transfer payments will continue to rise as a share of GDP, income, and spending with predictable results for retail sales, private investment, incomes, and employment hereafter.

Thank you, B.C. for an enlightening extrapolation of this data.

In effect, the government is creating a false-positive GDP growth number (e.g. "the recession is over, the GDP grew by 5% in the third quarter!") by borrowing and spending (via stimulus and transfers to individuals) stupendous sums of money.

Recall that the $2 trillion being borrowed this year amounts to roughly 15% of the entire U.S. GDP. The consequences of this are truly pernicious: the Federal government has to borrow (and pay interest on) $3 to generate $1 of GDP "growth."

As B.C. observed, transfer payments are low-multipliers. The government borrows $3 to generate $1 of GDP, but the money transferred does not generate much "multiplier" effect.

So the government (in conjunction with the Federal Reserve) ramps up money supply and government borrowing/spending at unprecendented rates, and what happens? Well, now it can't stop expanding money and deficit spending lest the true decline in GDP make itself visible.

This is akin to the Red Queen's Race: (wikipedia)

The Red Queen's race is an incident that appears in Lewis Carroll'sThrough the Looking-Glass and involves the Red Queen, a representation of a Queen in chess, and Alice constantly running but remaining in the same spot.Interest on the rising national debt is already running at a staggering $470 billion a year. And this is at short-term interest rates which are essentially zero and long-term rates which are extraordinarily low by historic standards."Well, in our country," said Alice, still panting a little, "you'd generally get to somewhere else — if you run very fast for a long time, as we've been doing."

"A slow sort of country!" said the Queen. "Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!"

As "the Red Queen" Federal government runs faster to keep GDP from falling, it must create ever-greater sums of money and borrow ever-greater sums of money, which means interest paid rises every year. If rates were to double to a still-modest 6%, the Federal government would be paying $1 trillion in interest alone.

Which would require even greater borrowing the following year, and so on, until the Great Implosion occurs: a Federal default on obligations or the massive devaluation of the U.S. dollar, which would wipe out much of the wealth of the nation along with its unpayable debts.

This is what you get with an ad hoc continuation of bankrupt policies and Power Elite (financial-rentier-banking) gaming, collusion, embezzlement and fraud. "Stimulus 2.0" is already in the works, starting with a $250 freebie to all Social Security recipients, even if they make $100,000 a year in other income. (How fair to the taxpayers saddled with the interest on that additional debt forever.)

The housing credit giveaway is not just poised for renewal, but expansion--more giveaways funded by borrowing. No doubt unemployment will be extended indefinitely, as I suggested last year, as the alternatives--mass marches on Washington D.C. and food riots--don't appeal much to our overfed "leaders."

The U.S. consumer is still tapped out, and his/her assets are still declining in value, along with the purchasing power of their dollars. Housing is still in a long-term decline, and the number of owners with zero or negative equity is slated to rise to 50% within the next few years. Those who still have equity will no longer be able to borrow against it, so it is in effect trapped capital.

Banks are still D.O.A. if their assets and liabilities were marked to reality, so more financial bailouts are also in the cards, and with the two hot wars still plenty hot, the expenses of Empire aren't going down soon, either. Congressional pork and giveaways will soon see a massive expansion in "free money" being distributed to political cronies and special interests via the "sick-care" bill winding its way through the "pork for every supporter" process.

Meanwhile, the holiday retailers are gearing up for a "cash for clunker toys" giveaway, lest the all-important Christmas borrowing/buying orgy fails to meet expectations. (Who knows which industry will get the next giveaway/bailout? Why not the toy "industry"?)

All this will require $3 trillion in borrowing next year to keep nominal GDP from falling, and then $4 trillion the following year, and so on, until there is no money left to borrow and creating more further devalues the dollar.

When Alice finally tires, the game is over.

Recall that the $2 trillion being borrowed this year amounts to roughly 15% of the entire U.S. GDP. The consequences of this are truly pernicious: the Federal government has to borrow (and pay interest on) $3 to generate $1 of GDP "growth."

As B.C. observed, transfer payments are low-multipliers. The government borrows $3 to generate $1 of GDP, but the money transferred does not generate much "multiplier" effect.

So the government (in conjunction with the Federal Reserve) ramps up money supply and government borrowing/spending at unprecendented rates, and what happens? Well, now it can't stop expanding money and deficit spending lest the true decline in GDP make itself visible.

I don’t get a damn thing from the Federal Government for ‘income’ My problem is effing ‘outgo’ with them!

And this is before all the wealth transfer they will promise in Cophenhagen.

It's no accident that as (1) government shirks fiscal responsibility and expands its footprint upon the economy (2) perception grows that the US government views the constitution and contract law as an inconvenience and (3) politics becomes increasingly partisan and divisive, the de facto reserve currency of the world....the fiat dollar.... is depreciating. It's all tied to gether.

As I have noted earlier, we are rapidly approaching the point where national debt equals GDP; many prominent economists view this as the practical limit for governement borrowing primarily because of rising debt servicing costs.

We will soon hit a wall and be forced to contain further increases in spending. Global capital markets will step in and impose the financial discipline that should have been imposed by our craven congress.

I’ll try to make it huge to make out, not that I didn’t already, but I couldn’t read them that time

Fascinating article.

I have seen many such depressing articles. I notice that anyone on the other ie) Obama, side of the debate ignores the long-term consequences and/or says “we had to do something because Bush made such a mess.”

Has anyone seen ANY serious, reasonable articles that gives a logical postulation that we can get out of this situation without serious inflation, joblessness or default? Seriously - I have seen none, but I am trying to understand all arguments and potential scenarios.

What? No Nobel Prize For Obama-Nomics?

Umm...SHRINK GOVERNMENT through big tax cuts, individual and corporate! That is the only way. The fed government is sapping up unsustainable, to use a term the left loves, quantities of private wealth.

Massive injections of private capital into the economy are what is needed. If we are doomed to joblessness, let us make sure it is in the public sector, not the private.

I have seen many such depressing articles.

^

I am trying to avoid the worst case scenario stuff, this seemed to present information that should be easy to understand

The simple goal should be lower tax rates to improve the GDP and job opportunities, plus reduce Government spending

Apparently all this spending is magically going to stimulate so much economic growth that the debt will be paid off in no time at all

According to them, you can spend your way to prosperity.

At this point, IMO, the best thing about cutting taxes is that it can help starve the feds out of all their collectivist, utopian dreams.

If we are doomed to joblessness, let us make sure it is in the public sector, not the private.

^

Yep,

Including the folks who gave us Stimulus bills, Democrat majorities in the 110th and 111th United States Congress

a. February 17, 2009: American Recovery and Reinvestment Act

b. October 3, 2008 — Emergency Economic Stabilization Act of 2008

c. February 13, 2008 — Economic Stimulus Act of 2008

^

My Congress Rep should resign for his ignorance;

Statement from Walz’s congressional office

http://www.bluestemprairie.com/a_bluestem_prairie/2009/01/walz-votes-for-stimulus-bill.html

This legislation will create and save 3 to 4 million jobs, rebuilding America, making us more globally competitive and energy independent, and transforming our economy for long-term growth;

Read Paul Krugman, Robert Reich and the rest of the fossilized Keynesians.

————————————————————————————>>

I have, and I don’t think of those two as economists. They are simply PR-seeking politicians pretending to be objective scientists.

“And this is before all the wealth transfer they will promise in Cophenhagen.”

And watch unemployment of American skyrocket while the ‘green’ jobs are handed off to foreigners.

The article makes it all clear - throw truckloads of borrowed money into the economy, and add it into GDP. Instant growth! And entirely illusory...

When you take into account ALL government employees, i.e. state and municipal in addition to federal, the % is even greater.

Government jobs are not a response to free market demands. They are jobs of wealth transfer, not wealth creation- of consumption, not production.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.