Posted on 10/12/2009 11:27:41 PM PDT by myknowledge

As the Nobel Prize committee was voting one way on Barack Obama's promise for the world's future, the global marketplace was holding a very different vote on America's future.

The Norwegian Nobel Committee awarded the US President the peace prize for 2009 for having "created a new climate in international politics", the citation said, in part.

Yet, at the same time, the world's foreign exchanges have been busy reassessing the climate in international realpolitik.

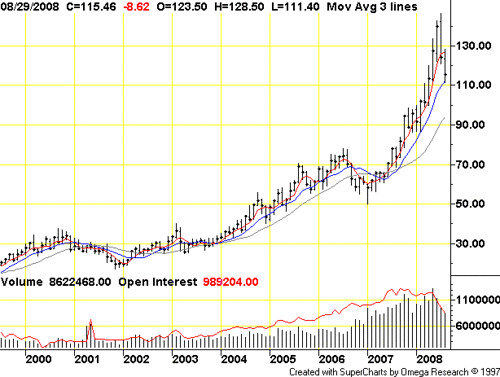

The US dollar is falling sharply against currencies around the world. Since March it has lost 9 per cent of its value against the yen, 17 per cent against the Canadian loonie, 18 per cent against the euro and 40 per cent against the Australian dollar.

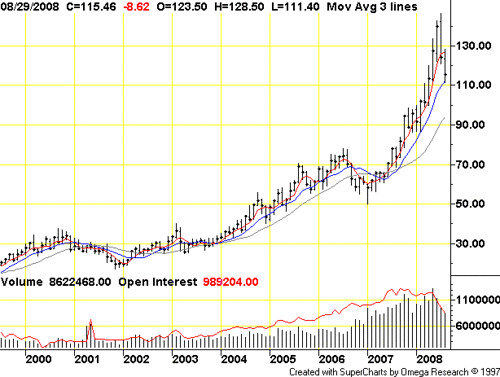

And the price of gold rose to an all-time high of $1040 an ounce in the past week, partly on fears over the future of the greenback as a store of value.

The divergence between Obama's Nobel honour and the marketplace repricing of his country's future would appear to be a stark lesson in the difference between hope and reality. Hope for Obama's plans may soar, but his ability to meet those hopes is shrivelling with the value of the currency.

Obama's political enemies, such as Sarah Palin, are using the dollar's distress against him.

But serious people are troubled. Robert Zoellick, president of the World Bank, said last week that "the US would be mistaken to take for granted the dollar's place as the world's predominant reserve currency".

And even a political sympathiser of Obama's has warned that America could be about to suffer "a punishing dollar crisis".

A former US deputy Treasury secretary under Bill Clinton, Roger Altman, wrote at the weekend that while the US recession may be a problem today, it pales into insignificance next to the danger of America's vast government debt.

The "dismal deficit outlook poses a huge longer-term threat", he wrote in the Financial Times. "Indeed, it is just a matter of time before global financial markets reject this fiscal trajectory."

And that, of course, implies a savage sell-off of the US dollar. And the consequences "could jeopardise the entire recovery" of the American economy.

The root problem is simple. The world increasingly doubts that the US Government can repay its debts. Altman set out why: "For 2011 and beyond, the fiscal challenge is fearsome. A combination of prior tax cuts, years of high spending and a brutal recession have produced the worst budget conditions in 75 years."

The national debt is projected to hit 85 per cent of the value of the total US economy in 10 years from now. Merely paying the interest on this sum would consume as much money as the annual US defence budget. A debt ratio around this level is the threshold where debt becomes unsustainable and snowballs, and where countries lose control of their destinies.

One way or another, the US must cut its spending. And that implies a shrunken US ability to deliver on just about all of Obama's ambitions.

And the party of Sarah Palin and George Bush, of course, was responsible for the deterioration in the US budget over the preceding eight years. Bush's vice-president, Dick Cheney, once argued that "deficits don't matter".

And the Bush administration behaved accordingly. The US deficit is a bipartisan disaster. It demands a bipartisan solution.

History suggests that we should be extremely careful with forecasting the decline and fall of America.

As Josef Joffe wrote in the American journal Foreign Affairs, "every 10 years, it is decline time in the US". He recounted the episodes from the 1950s to the 1980s, though declinism "took a break in the 1990s".

He is right to counsel against a panicked despair over America's future. But its future will not be secured by complacency or boosterism.

Its future success, or failure, lies in the wisdom of its policy choices.

Its relative decline is unarguable. At the end of World War II, the US economy accounted for half the global economy. Today it is somewhat less than a quarter. Now, against the rise of China and India, its relative power is slipping again.

But America has the ability, as it has shown repeatedly, to regenerate itself, as long as it is ruled wisely. America is not predestined to rule the world, nor is it fated to collapse. Its future is in its own hands.

Obama's Treasury Secretary, Tim Geithner, tried rather lamely to talk up the dollar at the weekend: "It is very important to the US that we continue to have a strong dollar.

''We recognise that the dollar's important role in the system conveys special burdens and responsibilities on us and we are going to do everything necessary to make sure we sustain confidence."

Everything necessary? That should start with a credible plan for cutting the deficit, but some Americans have had other ideas, too. When a New York Times blog, The Caucus, asked readers to suggest how Obama should use his $US1.4 million ($1.55 million) in Nobel Prize money, some of them advised him to put it towards the national debt.

Another Nobel laureate, Lech Walesa, Poland's former president, said it was too soon to give Obama the prize after just nine months in office. He said: "Who, Obama? So fast? For the time being Obama's just making proposals. But sometimes the Nobel committee awards the prize to encourage responsible action."

The global marketplace could be interpreted as doing the same.

Just wait!

Another undeserved award!

Do you think that BO expected to win the NP for Economics?

Lobbyists and the democrat leaders played this socialist fool like a frickin violin.

Trillions in new pork and destroying the US dollar too. It was like their wet dream power grab.

They got it warmed up. They’ll award it to him when he’s made sure oil is traded in chinese yuan and russian rubles.

part of the problem with the dollar

is that interest rates are near zero, with that said.

Bush policies are the problem, not President Peaceful’s.

2 wars that Bush did not end.

Bush dereliction of duty —> the sub-prime mortgage disaster.

Bush dereliction of duty —> other Wall Street disasters

.................................

if Bush did anything to help out during the

4 buck gasoline era, please enlighten me.

Our total public debt is at $11,927,435,900,948.90 as of October 6, 2009, and our most recent annualized GDP number was 14.152 trillion dollars, so that ratio is already 84% today.

Worse, the total public debt has shot up an incredible $1,300,558,852,035.82 in the 9 months since the Kenyan Clown's inauguration --- and almost all of that increase has been in the debt held by the public (intragovernmental holdings have "only" grown by $100 billion.) At that pace, and assuming that GDP continues its current movements (edging down, for the most part), then the total public debt will be larger than the GDP before the end of 2011.

I am glad I bought a bunch of old silver US half dollars a while back.

And the party of Sarah Palin and George Bush, of course, was responsible for the deterioration in the US budget over the preceding eight years.

My, my! Two gratuitous digs at Palin in the article. Palin Derangement Syndrom extends across the Pacific to far off Sydney and Peter Hartcher.

BO=NO BELL WINNER

He’s bringing about CHAOS in order to put SOCILAISM in!!

Why would it be like herding cats?

The U.S. dollar, Canadian dollar and Mexican peso would be invalid from Day 1 of the NAU’s existence.

>that Bush was dictating <

not all all, my claim is more like, he was

asleep at the wheel.. or more likely, he went along with what the Dems wanted in exchange for two more years of

occupation of Iraq.

Bush had a Republican Congress for six years,

what am I suppose to believe?......

just because I supported the WOT in 2002,

does mot mean that I support a 30 year, 20 Trillion occupation of Afghanistan.

just get out.

Congratulations to all the Independants who elected this bunch of psychotic adolescent punks.

If you all thought you were brilliant when you voted for Democrat slugs, just think of how brilliant you’ll have to be to figure out how to repair what they will damage.

Congratulations to all of you.

/S/

IMHO

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.