Posted on 08/09/2009 5:35:26 PM PDT by Clintonfatigued

The unprecedented, improbable and indeed almost unimaginable global financial crisis has virtually put an end to the comfortable notion that American and Western capitalism would dominate the world economy. In turn, the financial meltdown threatening another Great Depression has been the rationale for a phenomenal expansion of government spending to prop up demand and fend off economic disaster.

As a result, the deficit quadrupled from $459 billion in 2008 to $1.85 trillion this year. It has gone from 3.2% of gross domestic product to 13.1%, twice the post-World War II record of 6% in 1983 under President Reagan. What's more, the debt surge is unlike the one that accompanied WWII in that it will not be temporary.

The nonpartisan Congressional Budget Office reckons that the deficit will run for a decade and will still exceed $1.2 trillion in 2019. By that time, the United States will have virtually doubled its national debt, to over $17 trillion. Then, after 2019, we get another turn of the screw as the peak waves of baby boomers move into their retirement years and costs soar for the major entitlements, Social Security and Medicare.

At 41% of GDP in 2008, the accumulated federal debt will rise to 82% by 2019. One out of every six dollars spent then by the feds will go to interest, compared with 1 in 12 dollars last year. These out-year budgets will require an increase in everyone's income taxes, raising federal income taxes an average of $11,000 for families, a hike of 55% per household - a political impossibility.

The Government Accountability Office estimates that by 2040, interest payments will absorb 30% of all revenues and entitlements will consume the rest, leaving nothing for defense, education or veterans' pensions.

(Excerpt) Read more at nydailynews.com ...

Money in savings fueled the economy too. It was loaned to business which created jobs. Now business are scared to expand, they don’t want to become targeted.

The government is buying its own debt. staggering. Inflation will come, if deflation comes first people better stock up

You gotta wonder what it will take to get an audit of the Fed.

Until the 20th Century the Federal government was adequately funded on tariffs and fees. It wasn’t until the constitution was amended to institutionalize the income tax that revenue was sufficient to support big government programs and constituencies demanding more federal dollars.

Tariffs also provided protection from foreign competition for emerging US manufacturing. If we want to rebuild our manufacturing base, and pay down the debt, we need to seriously look at higher tariffs. Our population is large enough to support our manufacturing. No matter what the globalists say, higher tariffs will benefit US manufacturing and permit more jobs to be created in America.

Cold turkey. Like I say, I wouldn't want to live near anywhere near DC. A big federal gov't is passe. The DC Berlin Wall wall is going to fall. Not going to be pretty.

HMMMMmmmm.....more like the WELFARE WALL......we should start promoting it’s fall....

Fix or just kibosh our failed income tax system so we have a system that encourages personal savings and capital investment in the USA and our economy would turn around faster than an F-16 fighter doing a 9-G turn.

When push comes to shove the Supremes can cut spending, just all of a sudden realize that most of it is in fact unconstitutional.

Downsize the government to its constitutional limit.

Agreed. We will have to eventually go to higher tariffs on imports, as inflation destroys us,and the economy goes south. We will have to rebuild, and that means higher tariffs on imports for 20 years or more.

Thanks for the pings. Last I posted from them, you didn’t have to excerpt the NY Daily News or The Hill.

thanks Clintonfatigued.

DRUDGE: Pelosi/Hoyer op-ed in Monday USATODAY

calls townhall protesters ‘un-American’

http://www.drudgereport.com/

Posted on 08/09/2009 3:02:30 PM PDT by RatsDawg

http://www.freerepublic.com/focus/news/2312122/posts

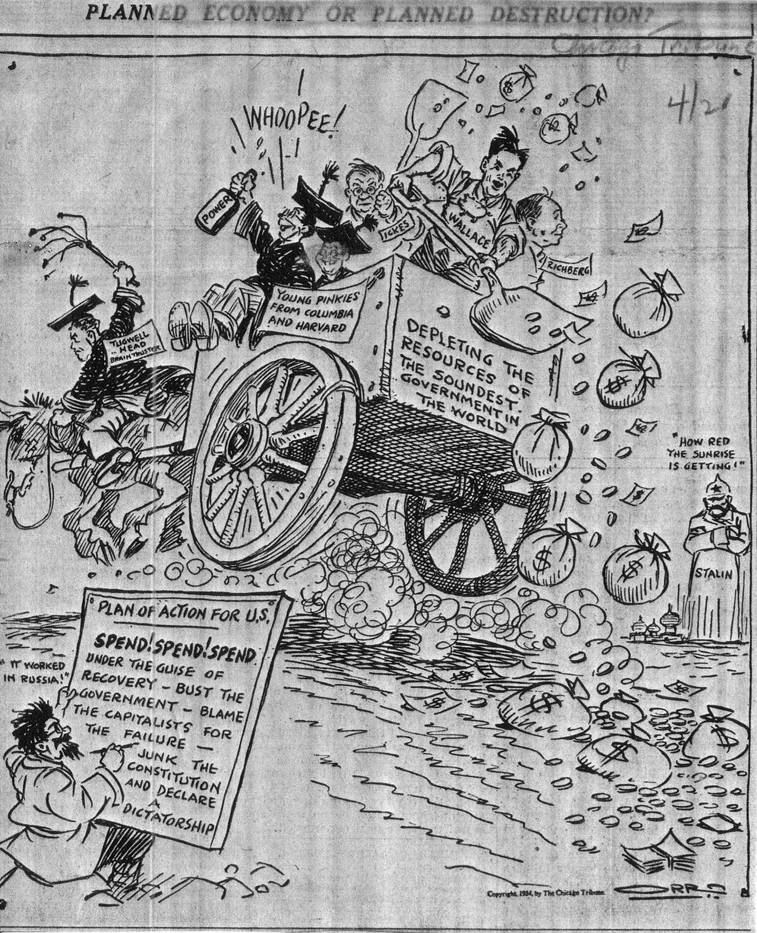

History is repeating itself. Obama’s socialism is just like FDR's, only on steroids this time around.

Apt observation.

“Because a decent chunk of our T-bills are now short-term instead of long term. There appears to be a lot of “waiting and watching” going on by those buying our debt.”

That’s all I’m holding. Anyone holding long term t bills right now is a fool. Interest rates are going up up up. When they do, the price of long term t bills goes down down down.

Thanks very much!

: )

Zuckerman just figured this all out? LOL.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.