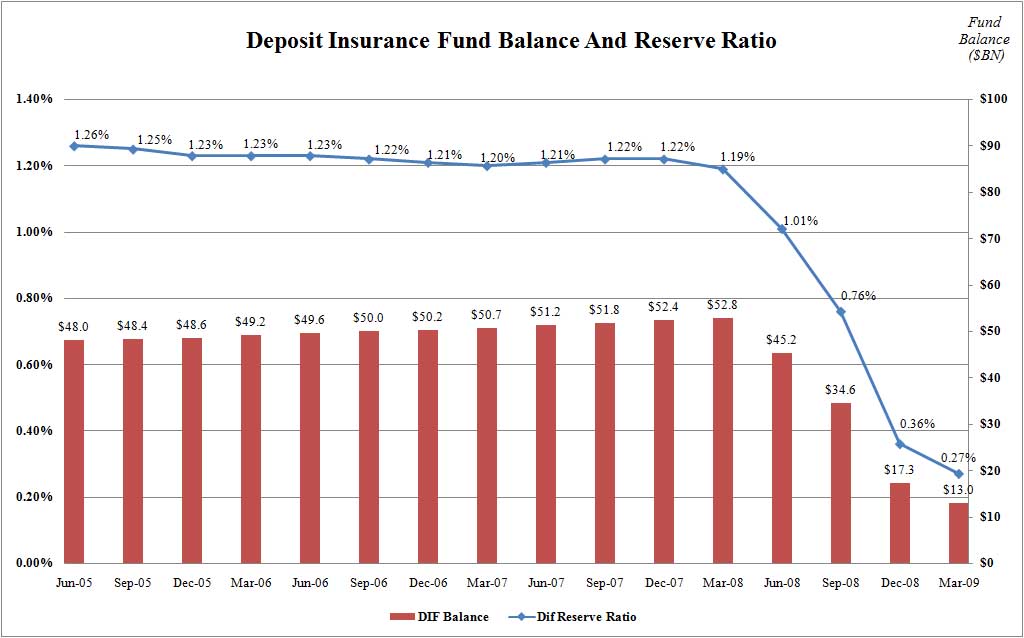

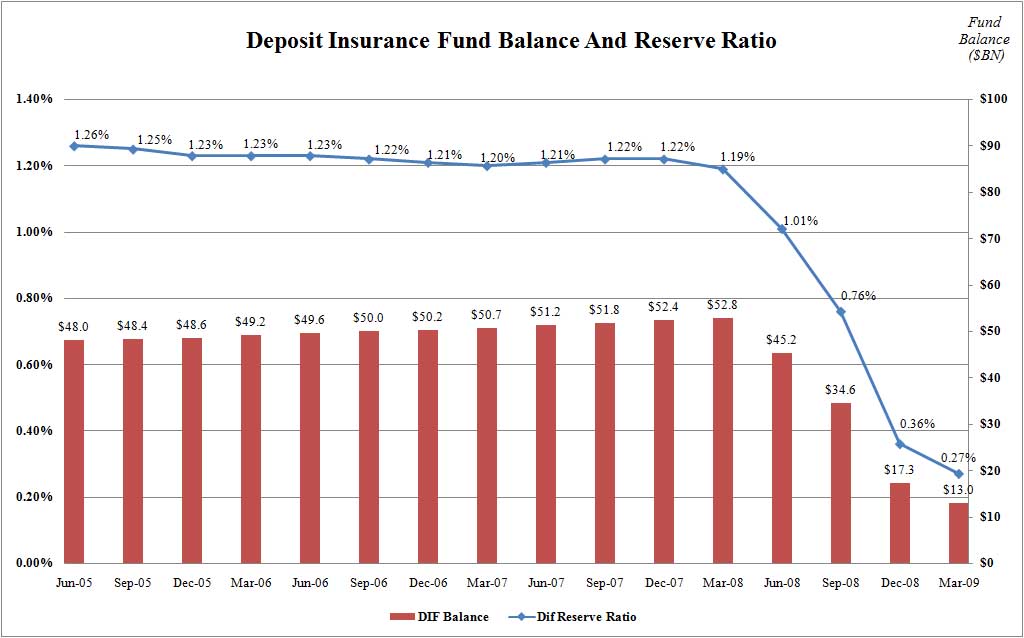

Following the line at the top of this chart to the bottom right..

... it sure seems there may be something to that rumored "bank holiday" next month month after all

Posted on 07/31/2009 12:37:47 PM PDT by rabscuttle385

NEW YORK (Fortune) -- Guaranty Bank is hardly a household name. But the Austin, Texas-based thrift's looming failure is shaping up as a big headache for bank supervisors -- not to mention a black eye for Carl Icahn and others in the smart money set.

Guaranty (GFG) could be soon seized by the government in what would be the biggest bank failure in a year that has already had 64 of them. Last week, the bank warned investors to expect a federal takeover after regulators forced a writedown of its risky mortgage investments and a bid to raise new capital failed.

Guaranty has $13.4 billion in assets and operates 160 branches in Texas and California -- two of the three best banking markets in the nation, thanks to their size and population growth.

. . . . .

A big tab on Guaranty would be costly to the deposit fund, whose balance was $13 billion at the end of the first quarter. The FDIC has estimated failure costs on cases since then at $11.2 billion.

A spokesman for the FDIC stresses that it has already set aside an additional $22 billion for failure-related costs in 2009, and adds that congressional action this spring gave the agency access to $500 billion in Treasury credit.

(Excerpt) Read more at money.cnn.com ...

If the units in the “FDIC Balance” column are “millions”, then it really is 0.826 billion left.

And you are a disgusting troll.

Well, yes. But the last dollar starts pretty early around these parts!

I take it very seriously when an institution lobbies to take a step toward turning the whole nation into a bigger version of California.

But no, I am not off the mark. I called the recovery for this year, last fall at the worst of it, and it is happening. The doom mongers did not call it.

I told everyone here to buy US corporates last fall at the depression peaks in yields; they have soared since.

As other men claimed that all the big banks were still going to fail and sold them to ridiculous revisited lows in March, I told everyone they were fine and profitable and would survive and recover from those lows.

The doom mongers have missed a 50% rally in stocks and a much lower risk, easy, called and delivered, run up in corporates. By not fighting the Fed I've been right; by letting their hate for it direct their judgment they have been hopelessly wrong about every major financial event this year.

You don't need to like these things for them to be true.

I dont know what your agenda is, but in a large enough window, both you (irrational perma bull) and the doomers (irrational perma bears) will both be right. Enjoy it while you can.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.