Skip to comments.

Bankruptcy Mortgage Cramdowns Would Hurt Housing Market

Heritage Foundation ^

| February 25, 2009

| David C. John

Posted on 02/26/2009 7:11:32 AM PST by pilgrim

by David C. John WebMemo #2310

Bad policy is not improved by limiting it to certain situations. The Helping Families Save Their Homes Act (H.R. 1106) would allow bankruptcy judges to reduce the principal owed on a mortgage, a practice often referred to as a "cramdown." Judges would also be able to reduce interest rates or lengthen the term of the mortgage. This is a huge policy mistake that will help only a few people while raising the cost of borrowing for thousands of moderate-income and first-time homebuyers.

Although supporters claim that this is a limited provision that applies only to existing mortgages, the cramdown language can easily be amended to make it permanent at a later date—which would then be priced into future mortgages. In addition, the House bill even lacks many of the targeted limitations designed to make sure that bankruptcy is a last resort—limitations that were included in President Obama's poorly considered housing plan.[1] It even weakens language passed earlier by the House Judiciary Committee that was designed to keep those who filed fraudulent mortgage applications from taking advantage of cramdowns.

Problems with Cramdowns

Allowing bankruptcy judges to modify mortgages would:

* Raise mortgage costs. Cramdowns would add additional risk that mortgages will not be repaid as the contract requires. Lenders must charge for that added risk, and experts estimate that the additional costs would raise mortgage rates by as much as two full percentage points or substantially increase required down payments.

These added costs would fall hardest on moderate-income and first-time homebuyers, who have a higher risk of defaulting on a mortgage. This will price many families out of the housing market.

* Further undermine the value of mortgage-backed securities. Banks and other investors are already facing heavy losses because mortgage-backed securities have lost much of their value because of uncertainties about whether the mortgages will be paid. The language in H.R. 1106 increases this uncertainty. Investors will be at risk of both foreclosure and cramdowns that reduce the earnings of these securities. Many cramdown mortgages will later go into foreclosure. Since investors have no idea what this new provision will do to the value of their securities, prices will drop further. * Fail to help many homeowners. Only one-third of all Chapter 13 filers complete the process successfully and get the fresh start that bankruptcy promises. The other two-thirds "pay court fees, pay attorney's fees, pay fees to the bankruptcy trustee, invest time and money to restructure their financial affairs, and then wind up with nothing more than temporary relief. It is therefore not surprising that a substantial number of Chapter 13 filers—nearly one-third—go on to file for bankruptcy again."[2] (end snip)

Please read the rest!!!!!!!! http://www.heritage.org/Research/Economy/wm2310.cfm

TOPICS: Business/Economy; Constitution/Conservatism; Government; News/Current Events

KEYWORDS: badnews; interestrates; mortgages

Navigation: use the links below to view more comments.

first previous 1-20, 21-37 last

To: longtermmemmory

4. the cram down is AT CURRENT MARKET VALUE to the person in the house.And who decides that? You really trust that every bankruptcy judge will give the banks a fair valuation?

21

posted on

02/26/2009 8:30:39 AM PST

by

Arguendo

To: longtermmemmory

Also, it’s irrelevant that we have it now with investment property. Congress exempted owner-occupied homes because it recognized that cramdown is undesirable to banks, who will demand a higher interest rate if it’s an option, and it wanted to make home mortgages more affordable. That was not the smartest move, but it’s inappropriate to change it retroactively.

22

posted on

02/26/2009 8:33:06 AM PST

by

Arguendo

To: DonaldC

Maybe this will drive banks to be more flexible in tougher times. If I held a $400k mortgage on a property which is now underwater at a $250k market value, I would MUCH rather make a deal with the mortgage holder to revalue the principal at, say, $325k, than have him mail me the keys and walk away.

On the other hand if a judge told me I HAD to do that I would fight it all the way to the Supreme Court.

To: Old North State

Could not have said it better.

24

posted on

02/26/2009 9:34:16 AM PST

by

NEMDF

To: longtermmemmory

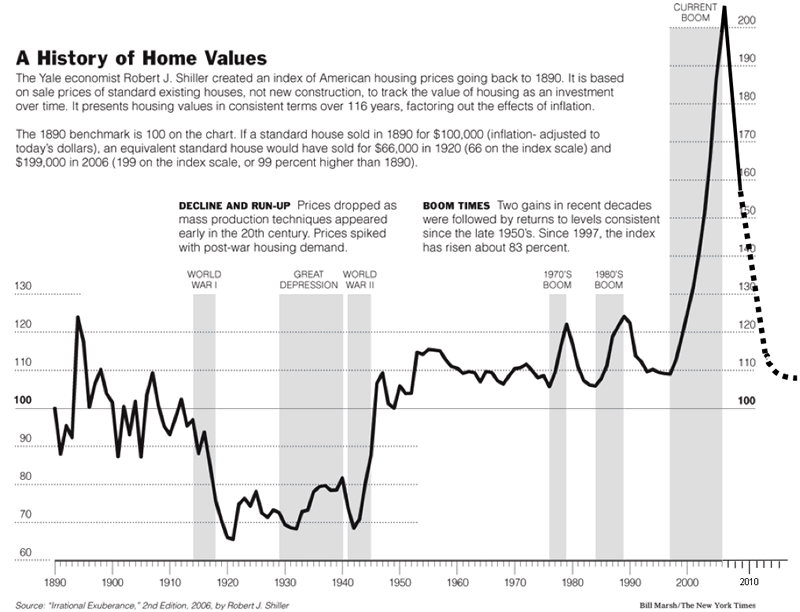

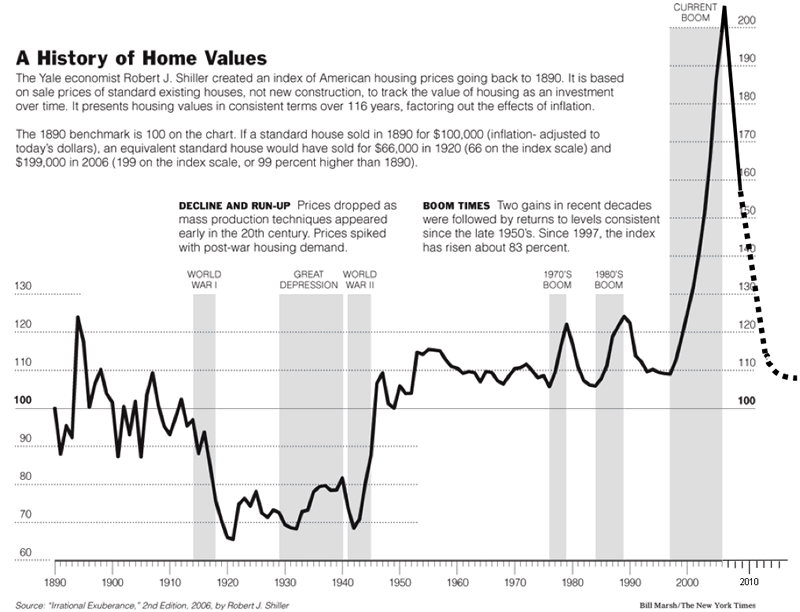

There are normal cycles in housing. Prices go up and prices go down. The last boom (imo) was an artificial boom caused by some urging by congress. (jmo)

Take care………pilgrim

“The American people will never knowingly adopt socialism, but under the name of liberalism, they will adopt every fragment of the socialist program until one day America will be a socialist nation without ever knowing how it happened.” Norman Thomas, a socialist and member of the American Civil Liberties Union

25

posted on

02/26/2009 9:37:30 AM PST

by

pilgrim

To: Arguendo

A lot of lenders were breaking the “rules” right and left when they made these loans, actually encouraging borrowers to falsify their claims of income or omit other debts, and using appraisers who were under instructions to inflate appraisals so that the lender could make a bigger loan and earn a larger origination fee. Most of these loans were packaged and re-sold, but the vast majority of buyers knew how fraud-filled the origination process was and bought anyway, on the assumption that everything would be okay even if there were a lot of foreclosures, because home prices were just going to keep going up. I just don’t see any reason to protect businesses who operated in this way.

We shouldn’t be allowing cramdowns for standard, 20% down, full-documentation loans, but for the rest of the crap, cram away!

To: GovernmentShrinker

Again (imo) these people should be prosecuted and JAILED!!

This was criminal and the same people (started to say something else) are going to be paid again for the refinance program. Double fraud?

Take care………pilgrim

“The American people will never knowingly adopt socialism, but under the name of liberalism, they will adopt every fragment of the socialist program until one day America will be a socialist nation without ever knowing how it happened.” Norman Thomas, a socialist and member of the American Civil Liberties Union

27

posted on

02/26/2009 9:50:14 AM PST

by

pilgrim

To: longtermmemmory

Paging Roland Burris II, your cramdown is available in courtroom A.

28

posted on

02/26/2009 9:50:57 AM PST

by

Oldexpat

(Drill Here, Drill There..we must drill everywhere.)

To: pilgrim

agreed, the prices were artificially inflated due to government.

These has to be a free market reality mechanism.

Essentially the cramdown “price” is the forclosure sale price after the bank has possession.

PRE obamanomics, that price would be available to ANYONE. Essentially under the pre2005 style cramdown it would be avalable under the bankruptcy for the debtor. It is not a essentially allowing the asset to return to the stream of commerce at real market value outside of some obamacrat determining the price. (see price controls, value caps, etc.)

Pursuit of happiness is pursuit of property. As long as the obamacrats have created a logjam then there is no way for the free market to take action.

Keep in mind if this homeown can STILL not afford a house at real market value, then they don’t get to do the cramdown. Part of the lienstrip is the proof that the debtor can actually make the payments to the value of the collateral.

We need to get ecconomics out of the hands of the executive branch.

29

posted on

02/26/2009 10:23:45 AM PST

by

longtermmemmory

(VOTE! http://www.senate.gov and http://www.house.gov)

To: Old North State

the change is not arbitrary.

This is not a Christopher Dodd senator special loan.

the process requires 1. fair market valuation and 2. proof of payment ability on the actual market value.

The other aspect that is positive, I think, is that ALL these motions are public record and ONLINE via pacer (federal online court data system). No obamaesque secret acorn deal rooms.

You don’t just have judges you also have the US Trustees office involved and they are pretty expert at valuations of property.

30

posted on

02/26/2009 10:29:24 AM PST

by

longtermmemmory

(VOTE! http://www.senate.gov and http://www.house.gov)

To: mrmargaritaville

see this is where the mistake is happening.

The judge is only determining how much of the loan is undercollateralized.

upon filing you create an “estate” much like a death creates an “estate”.

The judge is determining the asset value, with the help of the US Trutees office.

The lender has a full opportunity to say that the mortgage is worth less than the collateral.

KEEP IN MIND, second mortgages are being wiped out now and this process is available to investment property under current law.

Essentially this is the bankruptcy system giving primary residence owners the first right of refusal at a liquidation value auction.

If it did not go to the debtor at the liquidation price, then it would have been sold in a forclosure sale at that liquidation price.

remember the goal is to get this asset valued and back into the stream of commerce.

31

posted on

02/26/2009 10:36:03 AM PST

by

longtermmemmory

(VOTE! http://www.senate.gov and http://www.house.gov)

To: GovernmentShrinker

the origianl reason for cramdown, in part, is exactly what you said. to discourage irresponsible lending.

years ago this was used in the predatory refinancers who loaned senior citizens 125% loan to value stuff. Of course property values dropping was very rare.

In 2005 the bankrupcy reform said even if you lent one million dollars on a 25 thousand dollar cottage, the mortgage had to be paid. There was no need for the banks to hold back inflating values. In fact they had their “must use” list of appraisers to get loans because those appraisers were “team players”.

32

posted on

02/26/2009 10:39:00 AM PST

by

longtermmemmory

(VOTE! http://www.senate.gov and http://www.house.gov)

To: longtermmemmory

I respectfully disagree w/ your assessment of the impact of cramdowns.

Such a move would dampen the lending market and raise costs to all borrowers.

Further, in a business bankruptcy situation, creditors not paid in full usually become owners by taking stock or some other similar security. Would cramdowns on personal mortgages be treated the same? Would lenders become part owners of an individual's home?

To: Loyal Buckeye

no because the collaters does not cover the full amount fo the mortgage.

Essentially the mortgages, at the very end, is split into two parts, secured and unsecured.

I was not even talking about commercial property. I was talking about an invidividual with investment property right now can avail themselves of the lienstrip and cram down provisions.

keep in mind this is the law now. The reason we have this mortgage crisis is because the banks were inflating the mortgages via insane valuations. They gamed the laws in 2005 on the ASSUMPTION that home owners would not walk away.

They did not consider the fact that leaving an upside mortgage made more sense than paying for the home.

remember the goal is to value the property at that moment in time of the bankruptcy filing. If the debtor can not afford to pay then the judge orders them out.

What this is doing is just putting the prohibition of self dealing aside and putting a bankruptcy judge in charge of overseeing that the sale to anyone is done legit.

Otherwise the banks should just do the short sales to the present home owner and avoid the whole bankruptcy issue.

34

posted on

02/26/2009 12:51:53 PM PST

by

longtermmemmory

(VOTE! http://www.senate.gov and http://www.house.gov)

To: longtermmemmory

Understand, but one size does not fit all.

Cramdown provisions would hurt the mortgage market. In general, those pushing it want to reduce the loan to the home value, not have a secured piece and an unsecured piece.

While there were games played with respect to some lenders, there was a lack of common sense displayed by many borrowers. How many of them read the loan terms or hired a lawyer to explain the terms to them?

Then we have the whole concept of precedent. A move to cramdowns will only encourage more bad borrowing in the future and leave the terms up to judges who will play games.

I agree with the concept of short sales; they are market driven and are valid where there are credible buyers.

To: pilgrim

I believe that before the creditor-friendly 2005 reform of the bankruptcy laws, cramdowns were permitted. This merely returns the law to the status quo ante 2005.

I don’t see this doing much to mortgage rates on conforming mortgages with income documentation, income falling within traditional guidelines, and where the buyers make a 20% downpayment.

This will probably increase the price of mortgage insurance for buyers who finance more than 80% of their purchase, and will also increase the cost of second mortgages that go beyond 80% LTV.

But if that discourages some people from borrowing more than 80% of the value of their house, that’s not necessarily a bad thing, either.

36

posted on

02/26/2009 2:11:49 PM PST

by

sitetest

(If Roe is not overturned, no unborn child will ever be protected in law.)

To: longtermmemmory

The problem, as I see it, is that US Trustees, et al, are are not parties to the contract. They are more like expert witnesses. They are not filing a brief, they are to assist the judge. If the parties to the contract decide to modify the terms, then I have nothing to say, it is their right. But if the judge changes the terms unilaterally or ex parte, then the judge has voided the contract by fiat and, in my opinion has exceeded his legal authority. The judge has not ruled on the facts, the judge has not ruled on the law, he has just voided the initial agreement.

Navigation: use the links below to view more comments.

first previous 1-20, 21-37 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson