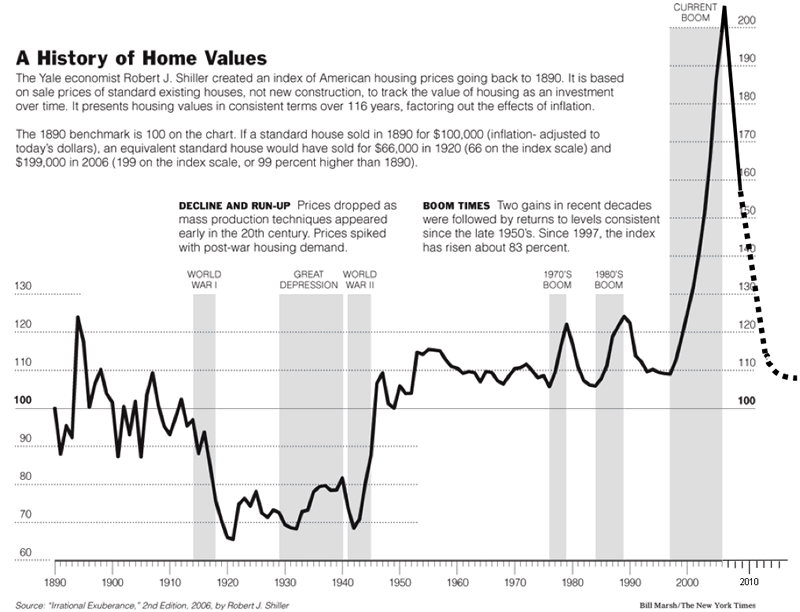

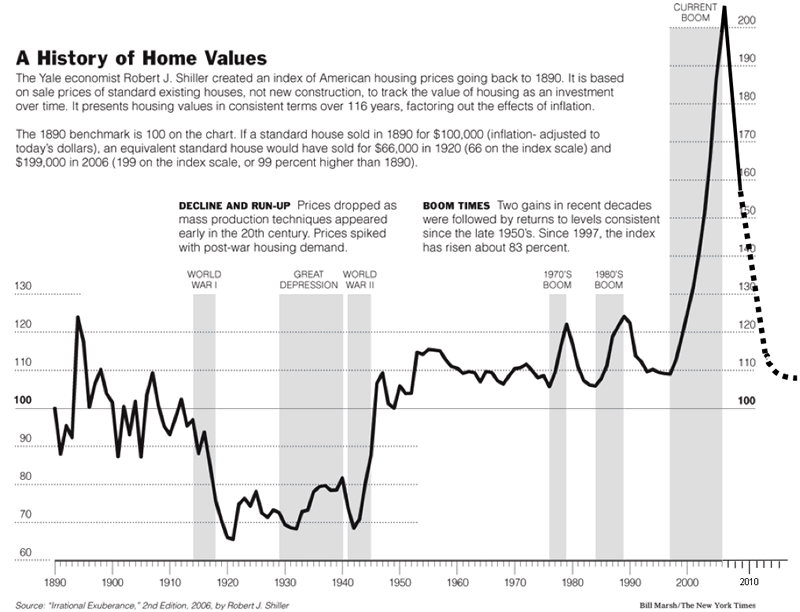

There are normal cycles in housing. Prices go up and prices go down. The last boom (imo) was an artificial boom caused by some urging by congress. (jmo)

Take care………pilgrim

“The American people will never knowingly adopt socialism, but under the name of liberalism, they will adopt every fragment of the socialist program until one day America will be a socialist nation without ever knowing how it happened.” Norman Thomas, a socialist and member of the American Civil Liberties Union

agreed, the prices were artificially inflated due to government.

These has to be a free market reality mechanism.

Essentially the cramdown “price” is the forclosure sale price after the bank has possession.

PRE obamanomics, that price would be available to ANYONE. Essentially under the pre2005 style cramdown it would be avalable under the bankruptcy for the debtor. It is not a essentially allowing the asset to return to the stream of commerce at real market value outside of some obamacrat determining the price. (see price controls, value caps, etc.)

Pursuit of happiness is pursuit of property. As long as the obamacrats have created a logjam then there is no way for the free market to take action.

Keep in mind if this homeown can STILL not afford a house at real market value, then they don’t get to do the cramdown. Part of the lienstrip is the proof that the debtor can actually make the payments to the value of the collateral.

We need to get ecconomics out of the hands of the executive branch.