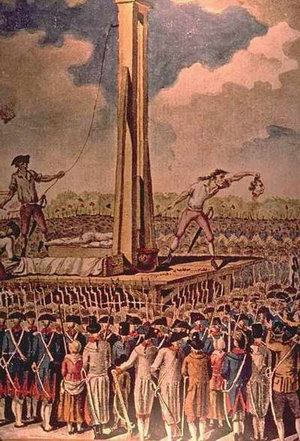

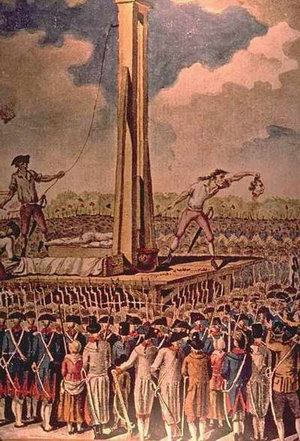

Well, not necessarily "mass", but definitely well-placed, and unpleasant for the thief class members...

Posted on 01/18/2009 7:55:37 AM PST by TigerLikesRooster

Reviving the world's burst-bubble economy seems further away than ever

In the US and in Ireland, governments have been scrambling again to support their banks.

By Ian Campbell, breakingviews.com Last Updated: 6:25PM GMT 16 Jan 2009

For the economic prospects of these countries, and the world economy, that is troubling. Recession is only just beginning and yet many banks are holed.

Governments are being obliged to pour in more capital, adding to the huge liabilities they now face. This vicious circle augurs poorly for recovery.

/snip

It's not yet the time. But monetising bad debt and devaluing paper money may in the end be the only way of reviving the world's burst-bubble economy.

(Excerpt) Read more at telegraph.co.uk ...

By the time Obamunists finish there will be very little private property left. Do not forget who they are. The omnipotent state will own wverything.

You mean Mugabama or is it Obagabe?

Them with nukes.

Your post is right on. What was created by Wall Street was not wealth but the illusion of it.

I will say it again. Main Street could live without Wall Street but not the other way around.

50%, if not more, of Wall Street should be locked up.

They have ruined the American economy and many lives. And are not being held accountable.

“Main Street could live without Wall Street but not the other way around”

BINGO!

Even my husband is in that situation, and he isn’t of the Baby Boomer generation, one underneath. He is 47 and worked 27 years at a factory that is gone, finite, capoot. Along with 5,000 other people just like him in the same area. But the Big 3 get “bailed out”...

Now at near 50, he is having to go to college to start a new career, start on the ground level or just putter through on take whatever jobs he can get until retirement.

Now, I’m not saying this is the government’s fault, or that it is anyone else’s problem, but when you have 1/4 of a nation in this situation, it becomes everyone’s problem. Like it or not.

What does this mean?

Monetizing the debt won’t work, because the debt is based on self multiplying fantasy—it actually exceeds the GDP of the planet, into the hundreds of trillions of dollars.

For this reason, the only alternative is to split the economy into the “real” economy, based on goods and services, and the “imaginary” economy based on multi-level leveraging. Then while the imaginary economy collapses, all effort is put into protecting the real economy.

To explain what is meant by the imaginary economy, say you owned a building worth $100k, but using it as marginal collateral, you were able to get a $1M loan. Instantly, $900k of imaginary money has been created with no basis in reality. This is your basic leverage.

Then imagine if you took this $1M loan, and used *it* to get loans worth $10M! This is multi-level leveraging. $9.9M of imaginary money has been created out of thin air, theoretically based on a building worth only $100k, but practically speaking, only based on its own fantasy.

Since WWII, when this experimental and improbable economy was created, leverage and multi-level leverage have created the world we know. But it is a fatally flawed economic concept, which in retrospect is obvious.

And this is why monetizing the debt, “printing money” won’t work. Because we have been monetizing the debt, in a manner of speaking, since WWII. Every bit of inflationary adjustment that could be achieved has been squeezed out of it, so it will be a futile and painful exercise.

The same also with trying to “grow the economy” (the Republican method), out of the problem as well. It will fail, because reality can no longer transcend fantasy. People can make imaginary money so fast that reality has no chance in catching up.

So what now? Simple, as I said, we have to split the economy. We have to protect real goods and services from the collapsing imaginary economy and its supporters.

Ironically, we have a tool to do this. The currency. This is because paper money and coins are in a perpetual shortage, and cannot be quickly or easily physically created.

Therefore, we can split the economy by splitting the currency. Money that physically exists, paper and coins, becomes the money of the real economy; and money that only exists on computer, electronic money, becomes the money of the leverage economy.

Only 5% of America’s daily retail is backed by paper money and coins. This is with the US Bureau of Engraving and Printing operating at 100% capacity to print paper money. As such, if it was the only money, it would be terribly deflated, worth 20 times its face value. And it would take the US government months or years to make more paper money and coins, so they cannot inflate.

But can’t they just increase the denomination of bills? Not really, because while there are over 520 billion 1 dollar bills in circulation, there are only a few hundred million 100 dollar bills. Even if the government just printed 1000 dollar bills, nobody could make change for them. They cannot inflate.

Ironically, to split the economy, the government needs to print Very High Denomination (VHD) bills, from $100k to $10M. But these would be given to real economy corporation to protect the from going bankrupt, in exchange for an equal amount of their virtual money. Such VHD bills could *only* be transferred with the permission of the US Treasury, which would keep them out of the hands of leverage corporations.

So even if a real economy corporation had no virtual money left, it would still have 100% collateral to get business operations loans from an authorized lender. So it literally couldn’t go bankrupt, and no leverage corporation could loot them to try and save itself.

However, at the same time, virtual and electronic money would be going nuts, first massively deflating, then hyperinflating. This will wipe out leverage corporations which must happen before a real recovery back to a mostly real economy.

The US government will likely have to default on its debt, which will kill most foreign trade, but this means that “buy American” is no longer a choice. America will have to rebuild all the industries it outsourced, and in this lies the roots of economic recovery.

Just when us baby boomers are headed into fixed income retirement, too. This doesn't auger well. Investments crushed and down 40% or 50% from what we thought we had, then 20%/year inflation to completely erode the little that's left. So much for the "Golden Years" we all planned, scrimped and saved for.

Sorry, that doesn't wash. You've got millions of people put into homes they never could afford courtesy of misguided federal policies. Just because you bring their loans current with public money doesn't mean that those people will be able to pay those loans in future. If anything, they are less creditworthy than they were before.

You are the winner of economics 101 also known as how to steal the last big pot of money in the United States. They will not steal directly but will spend it indirectly via massive inflation.

Yup. I've read that about half of the homeowners who were bailed out this summer are back in trouble again.

Righto. Socialists always blame capitalism for the failures of socialism. For every socialist problem they come up with another government program to fix it. Examjple. Medicare is bankrupt and unaffordable. Heck give medicare to everybody. The Obamans and socialist democrats are going to be 24/7 coming up with stupid programs to fix the problems they cause. This will cause more problems and the need for more stupid solutions. The death spiral. It can only end in total collapse and chaos.

Enough financiers are thieves. I never said all were

They built this mountain of credit default swaps

They got rich off that and bundling mortgages

The present crop of Wall St "financiers" is more responsible for this mess than the idiot Feds who failed to properly regulate them

Though I hold no brief for bought and paid for stooge Chris Cox

And George Bush who were infected with the libertarian virus

Which dictated hands off the OTC derivatives markets and the collateralized mortgage obligation market

Wall St made billions on these wacked out schemes some of which were concocted in coked up get away weekends. That's where Morgan Stanley invented credit default swaps. On a big Florida weekend for their quants and geniuses...about 1994 (I'm surmising coke was used and whores were there)

Cheers!

Correct diagnosis but your solution is unique. I would have to think about that. I do know everyone loves US currency in other nations

Quite amusing that within the USA people prefer plastic

Equities are a hedge on inflation.

Cheers!

Well, not necessarily "mass", but definitely well-placed, and unpleasant for the thief class members...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.