Posted on 01/13/2009 3:42:56 PM PST by Xenophon450

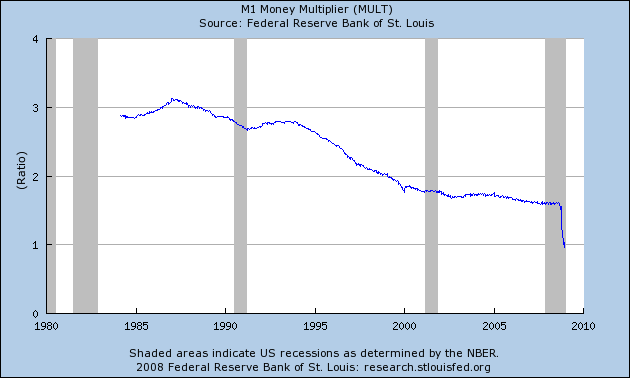

That has gone "just below" 1.0.

What is this?

I could go through the derivation of how money supply works in a fractional reserve monetary system (any), but won't, because most readers would have their eyes glaze over.

The important part of this graph is what it denotes. Bernanke has lost control of "N" (or velocity), which is the actual knob that he is trying to diddle when borrowing rates are changed (and in fact its the market that sets that, despite his protests.)

In fact the most useful tool in The Fed's box in terms of influencing monetary policy is the soapbox, that is, jawboning (whether it be by cajoling or threatening.)

The problem with an M1 multiplier below one is that the effect of printing money is of course multiplied by the velocity. That is, if you print up $10 into the economy the impact it has on economic activity depends on how many times that $10 circulates in a given amount of time. The more it circulates the higher the impact and the more your efforts do for the economy.

The bad news is that when the multiplier is less than one the more money you spew into the economy the worse the impact, as you get less for each additional dollar.

If you remember the "GDP for each dollar of debt" graph....

M1's multiplier going below 1 strongly implies (but does not yet prove) that we have reached that "zero hour".

Why? Because all money is in fact debt; this is inherent in all modern monetary systems.

When Bernanke "creates" money he is doing so against an asset - that is, he is issuing debt. A Federal Reserve Note (whether electronic or paper) is in fact effectively a bond of zero maturity and indefinite expiration against the future tax collection capacity of The United States.

That is, it's a treasury bond (via a circuitous route)

The paradox that Bernanke is in danger of discovering (the hard way) is the paradox of a pilot who finds himself in a flat spin. As the ground approaches he wants to pull back on the stick but if he does so, the spin simply tightens as the wings are not producing lift - the angle of attack is too high, not too low. As such if he does what his brain screams at him to do instinctively, he dies.

Or the scuba diver who sucks on the reg and gets nothing. Your instinct is to hold your breath and kick for the surface. If you do it you die.

In both cases your only hope of survival is to do exactly the opposite of your instinct. In the case of the pilot you must not only give counter-rudder (to stop the rotation) but also push the stick forward. In the case of the diver you must exhale that last breath you have in your lungs, knowing there are no more in the tank while you kick to ascend.

If you succumb to instinct you are dead. Really dead, as in splat (or exploded lungs.)

Bernanke is effectively in the same box. The foundation of his entire thesis as a banker is that a central bank can always reverse a deflation by printing money. Unfortunately as he has done so velocity has fallen and the multiplier has now gone below 1. If this induces him to do even more of what caused this decrease there is a very real risk that the actual market reaction will be to tighten the monetary flat spin.

This is because the underlying problem in the economy isn't the lack of debt (money) in the system. It is that there is too much debt of all sorts, and since money is in fact a form of debt, you can't fix the problem by playing helicopter drop!

As I have said for more than a year the only way out is to force the bad debt out into the open and default it. Yes, this will produce bankruptcies - lots of them, including some for "inconvenient" people like Paulson's buddies on Wall Street.

But until and unless that happens adding more debt to the system depresses the multiplier effect of that debt on circulation further, and harms, rather than helps the situation.

I don't expect our government officials to understand the math on this, nor would trying to go through it help 99% of the readers, but unfortunately, mathematics is the only true science - and you can't twist it, no matter how hard you try.

Bernanke knows this at an intellectual level, just as the diver - or pilot - knows that if he holds his breath (or pulls the stick) he is going to die.

The question now becomes whether Bernanke can overcome not only instinct but also political pressure to do the wrong thing and instead use his intellect - and the math - to do the right thing.

What is the right thing? Paradoxially, it is to withdraw liquidity and by doing so force the bad debt into the open where it does (and must) default.

How far can the above ratio contract before we cross an "event horizon" from which there is no escape?

I don't know.

But I do know that there is a "too late" point, as there is for all such things, and that we are approaching it, as I have been saying for months.

BTW, evidence that Bernanke's Monetary Flat Spin is already impacting the economy in ways that may do critical (if not fatal) damage was found this morning in the Case-Schiller numbers. Everyone, including Bernanke, was expecting the rate of home price declines to start to slow in the second half of the year. Instead, they accelerated.

We're in uncharted territory folks, and the forecast is for dark-and-stinky storms.

Buckle up.

Right, so, they'll just take your word as gospel.

it's called "pushing on a string." What, do you think you discovered it?

OK, to balance out my criticism above, this is a pretty cool analogy.

Fascinating. Not sure I understand it, but still interesting.

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The question is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."

It is clear that the politicians of both parties, who have driven this nation into a ditch, are committed to catastrophe, and devil take the hindmost.

Plaintive bleats for "international €cooperation" will fall on deaf ears abroad just as they did in 1930. Foreign governments will perceive instantly that the US is not serious about doing what has to be done, and will not sacrifice their own slim chances for the sake of an incompetent novice president.

Weimar Republic alert.

Were I PM of the UK I’d worry about the UK first and to hell with the USA. France, Germany, Canada, Japan...all their leaders will do the same. We will be on our own in this.

The article contradicts itself. It predicts inflation yet shows a graph indicating deflation (velocity of money below 1 on the chart).

This is the achille's heel of the logic: Mathematics is incidental to Economics.

People will use the credit that's available to them (increasing the "velocity," that beloved, misleading, scientific-sounding term economists like to use to pretend what they study is a science and that they can control it through absolute natural laws, which they cannot) when it makes individual economic sense.

Karl feels that deflation will be the road we will travel, his outlook hinges on the Federal Reserve and congress coming to their collective senses and exercising both fiscal and monetary discipline. Sadly, I believe Karl is wrong, they will not. Not only that, the politicians will pursue more decadent spending policies to come.

“Fascinating. Not sure I understand it, but still interesting.”

Whew. I was afraid I might be the only one.

The Market Works.

Government Doesn't.

This is a blessing in disguise. We should instantly call all foreign held bonds. print ten or eleven trillion dollars and pay them off. This should get us out of the deflationary spiral. And the kicker...no more defecit.

Doesn’t he know that all the rules have been rescinded since “The One” has been elected?

All that he does, and all that he touches will be wonderful, and marvelous.

He will lead us to Nirvana (or is that Nobama?)

Inflation is one thing and one thing only, the increasing of the money supply. How that money travels through the economy is merely the effects of inflation. Inflation’s best measurement is M3 which the government ceased publishing after Bush announced “devaluation” 6 years ago. A current St. Louis chart did make it onto the web(and thence FR) a few weeks ago and it showed that the money supply about doubled between “devaluation” and September of last year then doubled again in the month of October. It has apparently been increasing at high rates since then. That is the way of Zimbabwe.

And a 100% tax rate applied to a GNP of zero is _______ tax collection capacity?

I missed that. Got a link?

where ‘dja get the zero?

If I knew where it was I would put it up. I had been trying to find a current m3 measurement from somewhere for a lo-o-o-ng time and then there it was and I neglected to copy it or bookmark it.

The money in circulation has not increased very much at all since last year.

The Fed "gangsters" are funding things through other ways on their balance sheet.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.