Skip to comments.

Dow Goes Res! Off 500 points fron Days High

MSN ^

| 10/14/08

| MSN

Posted on 10/14/2008 7:52:51 AM PDT by illiac

Let's give the banks more $$$$$$$$!

(Excerpt) Read more at moneycentral.msn.com ...

TOPICS: Business/Economy

KEYWORDS: dowjones; economy; imamoron; killmenow; vanitypalooza; vanityrepublic; vanityvanityvanity; yayanothervanity

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80, 81-88 next last

1

posted on

10/14/2008 7:52:51 AM PDT

by

illiac

To: illiac

2

posted on

10/14/2008 7:53:27 AM PDT

by

illiac

(If we don't change directions soon, we'll get where we're going)

To: illiac

If the market is going to rally long term, at some point there will have to be a re-testing of the low that was established last week.

3

posted on

10/14/2008 7:54:22 AM PDT

by

johncocktoasten

(Obama/Biden '08, in and of itself, A Bridge To Nowhere)

To: illiac

This is the most idiotic, incomprehensible vanity thread yet.

4

posted on

10/14/2008 7:54:28 AM PDT

by

Petronski

(Please pray for the success of McCain and Palin. Every day, whenever you pray.)

To: johncocktoasten

Yup - and I think it will....

5

posted on

10/14/2008 7:54:52 AM PDT

by

illiac

(If we don't change directions soon, we'll get where we're going)

To: illiac

Bailout the auto, tech, food, construction, raw materials, clothing, animal shelter, and casino companies!

It’s unfair that only Wall Street and Banks get to suck at the Federal Teat!

6

posted on

10/14/2008 7:55:12 AM PDT

by

Uncle Miltie

(Bushonomics: Privatize Gains, Socialize Losses......."PAULSON'S THEFT")

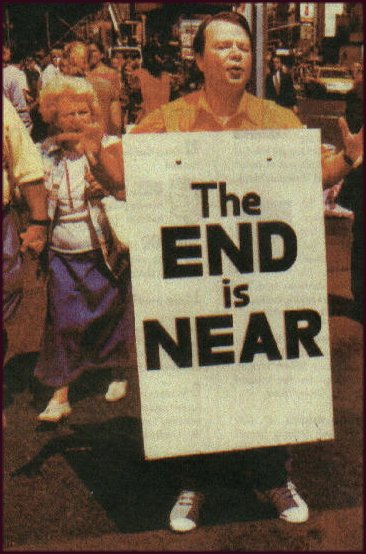

To: illiac

7

posted on

10/14/2008 7:55:22 AM PDT

by

Lazamataz

(Secondhand Aztlan Smoke causes drug addiction obesity in global warming cancer immigrant terrorists.)

To: Petronski

To: Petronski

Thanks....I’ll take that in to account when I see your next post. Just information I thought we’d be interested in.

9

posted on

10/14/2008 7:56:10 AM PDT

by

illiac

(If we don't change directions soon, we'll get where we're going)

To: Petronski

To: illiac

11

posted on

10/14/2008 7:58:26 AM PDT

by

mcmuffin

(.) , (.)

To: illiac

A very predictable sell off after yesterday’s ridiculously huge jump.

To: Petronski

You mean you don't want a new thread every time the market makes a slight shift?

At least it's not in Breaking News......

13

posted on

10/14/2008 7:59:17 AM PDT

by

TexasNative2000

(Be bold. Be brave. You're an American.)

To: Petronski

To: Petronski

Oh, I don’t know, there’s some pretty strong contenders out there for that title. But speaking of titles, it’s always good if one can manage not to have 2 typos in a 9-word thread title. Res? Fron?

15

posted on

10/14/2008 7:59:45 AM PDT

by

-YYZ-

(Strong like bull, smart like ox.)

To: illiac

So the market’s up 500 points from the day before yesterday. I think profit-taking was expected. Once the bottom is established, the wild swings will diminish, and the market will gradually rise.

16

posted on

10/14/2008 7:59:55 AM PDT

by

Aquinasfan

(When you find "Sola Scriptura" in the Bible, let me know)

To: BenLurkin

Can we see a few quarters of earnings first? That will determine the true level of the indices.

17

posted on

10/14/2008 8:00:07 AM PDT

by

misterrob

(Obama-Keep the Change!)

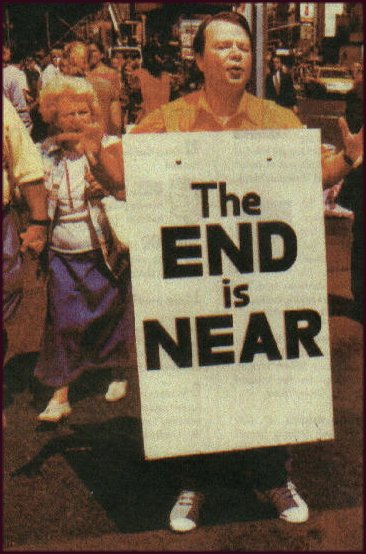

To: illiac

18

posted on

10/14/2008 8:00:31 AM PDT

by

Bommer

(Who was Obama's diction coach? Bevis or Butthead? Uhhhhhh.....)

To: TexasNative2000

We need a breaking vanity thread

every time the Dow goes res!

19

posted on

10/14/2008 8:00:45 AM PDT

by

Petronski

(Please pray for the success of McCain and Palin. Every day, whenever you pray.)

To: illiac

fron=from

how fast were you typing exactly?

20

posted on

10/14/2008 8:00:45 AM PDT

by

thefactor

(yes, as a matter of fact i DID only read the excerpt.)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80, 81-88 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson