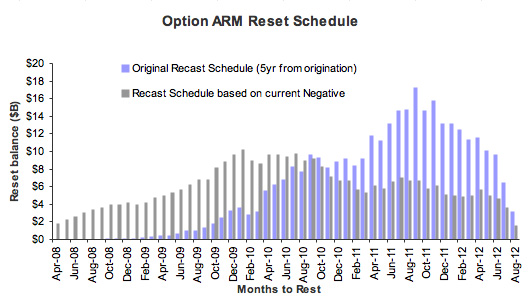

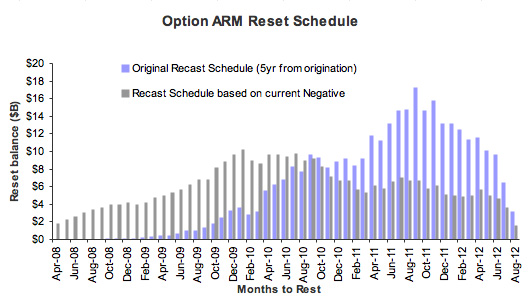

Blue bars on the chart represent the recast schedule if all the loans were to recast five years after origination date. Gray bars represent the expected schedule of option ARM resets, which show loans recasting sooner after hitting the principal cap

Blue bars on the chart represent the recast schedule if all the loans were to recast five years after origination date. Gray bars represent the expected schedule of option ARM resets, which show loans recasting sooner after hitting the principal capPosted on 06/13/2008 8:41:03 AM PDT by BGHater

By April, 2009, hundreds of thousands of option ARM mortgages will begin resetting, bringing on a fresh wave of foreclosures

The American homeowner must feel like one of those characters in an old cartoon who has just been hit by a falling piano. After dusting himself off and touching the large bump on his head, he probably doesn't expect another piano to be dangling overhead. But he'd be wrong.

But what's often funny in a cartoon is anything but in real life. With the subprime mortgage crisis already crippling the U.S. economy, some experts are warning that the next wave of foreclosures will begin accelerating in April, 2009. What that means is that hundreds of thousands of borrowers who took out so-called option adjustable-rate mortgages (ARMs) will begin to see their monthly payments skyrocket as they reset. About a million borrowers have option ARMs, but only a fraction have already fallen due.

Blue bars on the chart represent the recast schedule if all the loans were to recast five years after origination date. Gray bars represent the expected schedule of option ARM resets, which show loans recasting sooner after hitting the principal cap

Blue bars on the chart represent the recast schedule if all the loans were to recast five years after origination date. Gray bars represent the expected schedule of option ARM resets, which show loans recasting sooner after hitting the principal cap

(Excerpt) Read more at businessweek.com ...

but what do you do if you don’t have a mortgage?

anyone who is not refinancing into fixed rate now, with interest rates in the 5’s, is too stupid, too greedy, or too poor to be able to afford their home anyway.

I still have trouble understanding why people get ARMs at the low end of interest rate cycles, and why banks don’t have a fiduciary responsibility not to send people down the ARM road to begin with.

Many cannot do that because the value of their home is below the ARM amount they need to refinance. These people barely scrap enough money for the down payment on the ARM, and live pay check to pay check because they are so leveraged, they cannot come up with the cash to pay off the ARM and replace it with a new fixed rate.

The real estate “crisis” won’t end until the people who now own homes they can’t afford them sell them to people who can.

For anyone who lived through the homebuying nightmare of the Carter years, rates in recent years have been a Godsend. I remember how happy I was when our first house was financed at 12% via FHA when prevailing rates were 15-16%. Our current mortgage is below 5%, and fixed. People sometimes forget (or never learn) history.

Not to worry. You/we will get to pay for those fools who gambled with the ARM and and lost.

yes, I remember writing an offer to buy a house with a Jimmy Carter-era 14% VA mortage. That looked good compared to 17% conventional rates. We lucked out as Carter’s incompetence lost steam and our mortage rate deflated to a mere 11.5% by time of closing. That is the house where we sat outside and toasted the landlside election of Ronald Reagan and also his inauguration day and the simultaneous release of American hostages after 444 days held by Iran.

History- ain’t it grand to have lived it, ain’t it awful to see the blind and greedy repeating it... Cant even imagine what an Obama-mortgage rate is going to look like by April 2009. “Change” for sure.

Many people who don’t have mortgages have a good chunk of their net worth tied up in their home. In normal times, this provides an important cushion against job loss or other unexpected financial downturns, since they can raise a lot of cash by either borrowing against their homes, or selling them and buying a much less expensive one as a replacement. This financial cushion is being severely reduced for many people, at a time when they or their adult children are especially likely to lose jobs or have their own businesses take a severe downturn. There’s a domino effect when these people can’t work out of their financial jam as they normally would.

“The American homeowner must feel like one of those characters in an old cartoon who has just been hit by a falling piano.”

are these people and their pretense at being unbiased for real???

which “American homeowner”???

“the” American homeowner - as in all homeowners

or, quite factually,

1. just some of those who recently took an ARM and

2. just some of those in 1. who do not have the incomes with which to pay the rise in their ARM payment

quite factually, the statistics show that this has not been an issue for the majority of re-setting ARMs to date and not even for a majority of sub-prime ARMs

in as much as neither sub-primes or ARMs represent a majority of all U.S. mortgage holders, and even for a majority of ARM holders this is not an issue, how in the hell is this an issue for “the American homeowner” as in “all” homeowners???? It’s NOT, not by a long shot.

April 2009. Freddie Mac and Fanny Mae will go to zero. They own all a huge % of these ARMs as far as I can tell, and they’re all junk.

Our first house was financed at 14%. Our second home was financed at 7.5 and it was some kind of government loan that you had to be under a certain income to get. The rates at the time were 8-9. OF course at those rates we bought exactly what we could afford and nothing more. They weren’t much.

You aren't allowed to participate in the apocalypse until you get one...

Same here. Our first house was a 2BR/1 bath, 984 square-footer. We paid $169,000 in Long Beach, CA. Our rate was just over 8%, and the broker struggled to get that for us. That was in ‘95.

We moved up the coast to Oxnard in ‘99, and we got a $224,000 loan at 6 and 7/8%. Refi’d to 5.5% four years ago. We looked at houses here that were $260,000 then, but our limit was $250,000, so we went to a more affordable area.

We have friends who bought a house three years ago. They absolutely had to buy, because the market was going nowhere but up, according to their other friends. They paid $660,000 for 1,500 square feet. Put no money down. The wall of their house is the wall of their neighbor’s yard. The wife was staying home with the kids, but she immediately had to get two jobs waiting tables.

I have no idea how they must be feeling right now. I’m sure they can’t get $450,000 for the place now.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.