Posted on 05/12/2008 4:34:46 PM PDT by freerepublic_or_die

Note:I took literary license to post this as "What Does $120 Oil Mean for the Global Economy? from What Would $120 Oil Mean for the Global Economy?

The pdf is a short report written by Robert F. Wescott and published in April 2006 by Securing America’s Future Energy. It was written when oil was ~$60 a barrel and addressed a scenario where the price of oil surged to $120 due to coordinated terrorist attacks on global oil transport infrastructure. Well, here we are, two years on at $120 oil (without the attacks) so it’s worth revisiting the analysis in light of the conclusion:

The main conclusion of this note is that $120 oil would have profound negative effects on the world economy and global financial markets. ... Such oil prices would almost certainly precipitate a global recession.

The scenario is not identical to the present situation, Wescott’s terrorism induced $120 involves a rapid spike upwards however the analysis is based on the $120 price being sustained for a year. This long term high price is similar to today’s situation.

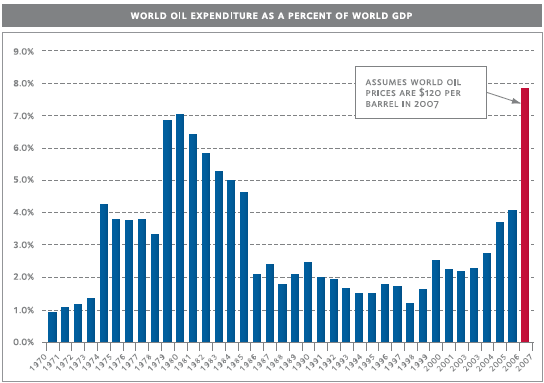

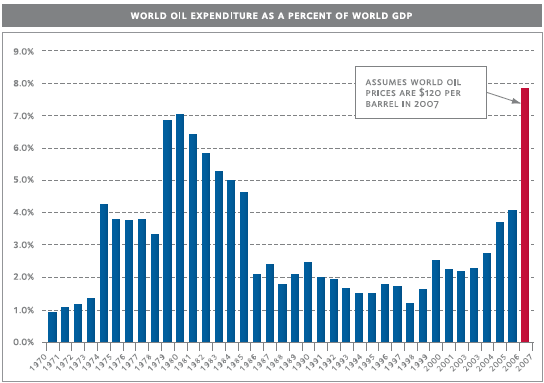

The most interesting chart from the report shows world oil expenditure as a percentage of world GDP

Wescott points out that historically this metric has been in the range of 1-3% and recessions have occurred when the expenditure exceeded 4%. $120 represents approximately 8% of world GDP, higher than at any time in modern history. Two studies are cited: The International Monetary Fund (IMF) suggesting a $5 increase cuts world GDP by 0.3% so it follows that the $60 to $120 doubling would reduce world GDP by 3.6% and the US Federal Reserve estimates that a $20 increase reduces GDP by 0.75%, which would result in a loss of 2.3% from increase $120.

(Excerpt) Read more at theoildrum.com ...

No doubt not helping the situation, but the True Cause lies elsewhere.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.