Posted on 12/24/2007 7:55:05 AM PST by Alex Murphy

WASHINGTON — Mike Huckabee, one of the most conservative Republicans in the 2008 presidential race, has embraced one of the most radical ideas on the campaign trail: a plan to abolish all federal income and payroll taxes and replace them with a single 23% national sales tax.

The idea -- dubbed the "fair tax" by proponents -- has been a political asset for Huckabee; its well-organized backers have helped catapult him from the back of the presidential pack to its top tier.

Sales tax proponents have tapped into seething voter hostility toward the Internal Revenue Service to become a below-the-radar political force, popping up at campaign events and candidate forums in Iowa and elsewhere.

The efforts on Huckabee's behalf by sales tax advocates helped spur his surprise second-place showing in an August Iowa straw poll -- the breakthrough that marked the beginning of his rise in the state and nationwide.

He is the only major presidential candidate to make the idea central to his campaign. "The first thing I'd love to do as president: Put a 'going out of business' sign on the Internal Revenue Service," he said at one debate.

Some wonder, however, whether his embrace of the plan eventually could turn into a liability.

The sales tax proposal has been around for years but languished on the fringes of practical politics and policy. Tax professionals generally regard the idea as impractical, regressive and even "crackpot," as one critic puts it.

It has gone nowhere in Congress. The 2005 Presidential Advisory Panel on Federal Tax Reform soundly rejected the idea. And many politicians shy away from it because it is easy for opponents to portray it as a huge tax increase -- as Democrats did in a 2006 Senate race in South Carolina.

(Excerpt) Read more at latimes.com ...

it is NOT a “30% tax on spendingAFFT FAQ # 47

I know the FairTax rate is 23 percent when compared to current income and Social Security rate quotes. What is the rate of the sales tax at the retail counter?30 percent. This issue is often confusing, so we explain more here.....

It's pretty clear. A 30% tax at the retail counter is a 30% tax on spending.

Apparently you don't know as much about the Fairtax as you pretend...or maybe you do know but choose to lie instead.

Anyone who can write off an immense amount of mileage at forty-eight and a half cents a mile...

Your average courier in cities like Philadelphia, Chicago, Kansas City, Oklahoma City (spread out cities with multiple major business districts), etc., who make 40-50K a year and drive 70K miles to do it.

There are those in the transportation industry writing off eighty percent of their income because of the mileage exemption.

The transportation industry is in somewaht of a glut, where anyone thinks they can operate/own one...particularly the courier industry.

The bill is written so that the same amount of money that is presently taken from the income tax system is taken from the FairTax for the SS & MC entitlements.A $128 purchase and the total tax paid is $28. You claim 9% of the $100 is embedded tax making the total tax collected as the result of the sale before the Fairtax Act, $37.00.You should read the bill where it is explained.

567 posted on 12/26/2007 1:53:00 PM PST by baybabe

you already had to earn the $128 and pay the income tax on that ($28) to have the $100 to buy with. So in effect to you it was really a $128 purchase

After the Fairtax and the (9%) embedded tax is removed, the price is reduced to $91. The after tax price including the deceptive 23% inclusive tax of $27.18 is $118.18 making the total tax collected after the Fairtax $27.18.

I couldn't find anywhere in the bill that says collecting $27 rather than $37 is revenue neutral.

I did as you suggested. I went back through the threads and all the information and I found where the Fairtax economist says the current take home would be the new gross after the fairtax, IOW, no 100% paychecks.

So in the above example, under the income tax the purchaser had enough to buy the product.

Under the Fairtax the purchaser would be $18.18 short of having enough to purchase the product from his/her paycheck...AND there isn't enough tax collected to make it revenue neutral.

That just proves you are a sock puppet, or an alter ego, or the incognito return of someone already engaged in fairtax debates on FR.

Congress, Federal bureaucracy, tax cheats, underground economy, kleptomaniac voters, special interest groups, human nature, none of which will change under the Fair Tax, and they will all influence the outcome - “Don’t tax me, don’t tax thee, tax that man behind that tree.” (turn of the 20th century cartoon).

However retaining the entitlements as wage taxes only continues to penalize those who work and pay the tax over which they have no control (and also keeps the tax bureaucracy ant the burdens on the employer in place). Despite your stating that these sorts of taxes are not regressive, in fact they are - very much so. Any perceived benefit (greater or less) does not relate to whether the taxes themselves are regressive or not but merely whether the worker gets a greater percentage return (relative to his income) than another taxpayer. Both of these “social insurance” taxes are among the most regressive taxes we have.

If it is the “progressivity” of the benefits that concerns you perhaps a better solution would be to find a way to limit the payout on that end - though that seems questionable. As I mentioned earlier, the bills implementing these social insurance give aways are the worst ever of their type in our history and - as I said - I’d prefer to see them both eliminated.

As it is, though, looking at the handling of these amounts in the FairTax bill and even projecting a reasonable increase year to year from the current baseline it is more likely that the amount representing the FairTax rate would drop over the coming years rather than rise which seems to be your assumption. The mechanism funding the social insurance is not automatically increased by an increase in the FairTax rate in any event but by the wage amounts involved just as at present.

If your “family of four” knows they’ll pay no more than zero they know something that is hardly predictable since the amount (rate) they pay is based upon taxable end consumption and the HHS definition of income classifications rather than income per se. That calculation is anything but automatic. The point is - it varies but is within the purview of the family to influence to their own benefit one would suppose. If at a given FT rate/HHS class the benefit level actually reduces, then that family might even pay more in FairTax unless they altered their spending habits ... but they have the ability to do just that.

And in addition, the voters do not vote directly on the FairTax rate, so claiming that they can do so and thereby vote themselves more money to the detriment of others is more that just unlikely. The rate is established by congressional action and those desiring increasing benefits in this way would have to have the voting power to overcome all the voters who would end up paying more as a result - which in the most recent figures I’ve seen would be the group which now has an overall income tax effective rate of 11.8% whose individual income tax rate is -2.9%. IOW they are already benefiting considerably from the present system. There are about 23 million households in this category so they’d have a lot of political inertia to overcome (and little capital) to boost the tax rate on themselves (assuming there would be any real reason to do so).

I also can’t understand your effective tax rate calculation for the $100,000 family of four but that’s just arithmetic. I guess I also don’t grasp your rationale for choosing that family - are they supposedly “poor”? Since people haven’t the option of automatically causing the FairTax the benefit themselves only, I can’t accept your reasoning. The FairTax rate even with a percentage increase of the entitle amounts thrown in each year will actually cause the FairTax rate to reduce, not increase. In fact I believe that it is far more likely that political action will reduce the FairTax rate even beyond the reduction caused by the entitlements since most likely tax revenues will actually increase overall under the FairTax. After all there will be millions of additional taxpayers added to the rolls under the FairTax due to the underground economy.

Do I believe that it is “good thing”?? Leaving aside the fact that I don’t think ANY taxes are “good”, I’d say that yes - within the context of having to have them (taxes) then having those who are not citizens, are here illegally, and/or who are making their livelihood illegally at present - having these groups contribute to our tax revenues is both fair and good since it helps reduce the tax burden on the rest of us. If those in this (underground economy) category feel strongly enough - as do you - about the “unfairness” (of contributing to our tax revenue when they presently do not) then they can certainly go through the effort to become citizens and vote against it. And, in fact the 20 or more million in this category would probably absolutely offset the apocryphal “$40,000 in tips waitress” you cite - but you present no figures to back that up. Were she to cite tips not received to boost her income, thinking to receive more in eventual social insurance benefits, first of all that would be a federal crime (a type of tax fraud or an attempt to defraud the social insurance agency) and were it to be observed as a common practice the government would no doubt set a limit that you have apparently observed in HR25. Setting that limit initially merely helps preclude some of the temptation for criminal activity or put her in the position of insisting her employer pay more in wages. Either way, her taxes under the FairTax will depend upon her consumption habits.

As I said there have been several. The fact you can’t (don’t want to) find one is indicative of something else ...

If you’re talking about your current paycheck and savings from it then you’ll no doubt be paying tax on those earnings unless you’ve gone to lengths to prevent that (and that if the current laws remain unchanged).

With the FairTax, not all spending from savings is taxed ... once again it is the effective tax rate that one must considerm not some marginal rate.

You do!!

It is the anti-FairTax crew that pretends all income is taxed because that is the only way anyone will ever pay an effective rate of 23% inclusive. Anything not taxed (and many things are not under the FairTax) goes to lower the effective tax rate.

See post #282.

It sounds as though all of those things you claim as writeoffs are properly business expenses and would not be taxed in any event under the FairTax.

I think you need to find out how it actually works rather than make unjustified assumptions.

mighty hard to do for one who only joined in jan of 2007

Send them my way. LOL!

No. What you're talking about is charging me 30% more on my already taxed savings when I spend it under the FairTax.

Source???

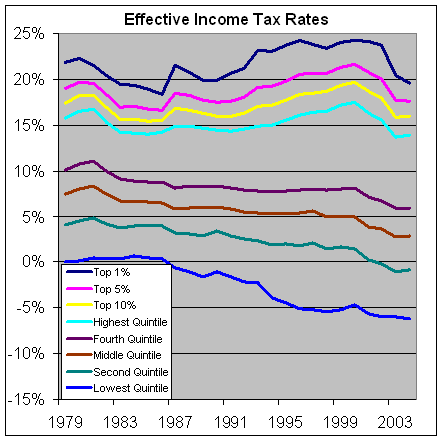

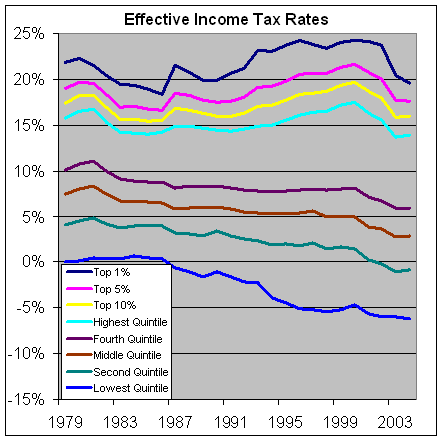

Those are income tax figures at any rate which leave out several million people from the tax base. What it will do is lower the effective rates of those you show in that chart.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.