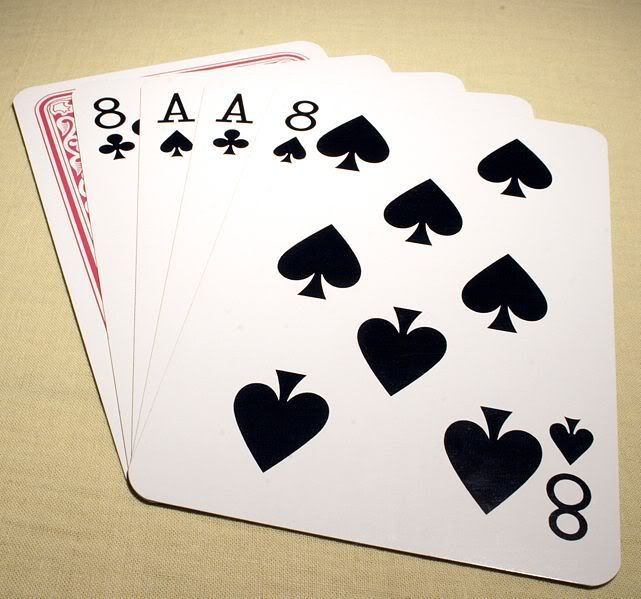

Dead man's hand.

Dead man's hand.

Posted on 10/19/2007 3:07:45 PM PDT by DogByte6RER

IRS to poker winners: Pay up!

Fri Oct 19, 11:02 AM ET

WASHINGTON - They're not bluffing: Tax collectors will start requiring poker tournaments to report the winners' take.

Casinos and other sponsors of poker tournaments will be required to report winnings of more than $5,000 to the Internal Revenue Service beginning March 4, 2008, the tax agency said Friday.

Sponsors who meet the reporting requirement won't need to withhold federal income tax at the end of a tournament, it said.

If a sponsor does not report winnings, it is responsible for withholding the taxes and sending the money to the IRS, normally 25 percent of the amount subject to reporting.

The IRS said poker tournament winners must provide their taxpayer identification number, usually a Social Security number, to the sponsor. If the winner fails to do so, the sponsor must withhold federal income at a rate of 28 percent.

Casinos and sponsors of tournaments completed before March 4 next year will not be required to report winnings to the IRS or withhold tax.

By law, the winners already must report poker earnings on their federal income tax returns.

(Excerpt) Read more at news.yahoo.com ...

It looks like Friday evening poker games out on my patio are in jeopordy.

My wife is into those bunco nights too...

The IRS Press Release:

http://www.irs.gov/irs/article/0,,id=174937,00.html

IR-2007-173, Oct. 19, 2007

WASHINGTON — Starting next year, casinos and other sponsors of poker tournaments will be required to report most winnings to winners and the Internal Revenue Service, according to the IRS.

The new requirement, which goes into effect on March 4, 2008, was contained in guidance released Sept. 4 by the Treasury Department and the IRS. The guidance is designed to clear up confusion about the tax reporting rules that apply to poker tournaments. In recent years, some casinos and players have been confused over whether poker tournament sponsors who hold the money for participants in a poker tournament are required to report the winnings to the IRS and withhold tax on the winnings.

For tournaments completed during 2007 and before March 4, 2008, casinos and other sponsors of poker tournaments will not be required to report the winnings to the IRS or withhold tax on the winnings. But beginning March 4, 2008, the IRS will require all tournament sponsors to report tournament winnings of more than $5,000, usually on an IRS Form W-2G.

Tournament sponsors who comply with this reporting requirement will not need to withhold federal income tax at the end of a tournament. If any tournament sponsor does not report the tournament winnings, the IRS will enforce the reporting requirement and also require the sponsor to pay any tax that should have been withheld from the winner if the withholding requirement had been asserted. The withholding amount is normally 25 percent of any amounts that should have been reported.

So that tournament sponsors can comply with this requirement, tournament winners must provide their taxpayer identification number, usually a social security number, to the tournament sponsor. If a winner fails to provide this identification number, the tournament sponsor must withhold federal income tax at the rate of 28 percent.

The IRS reminds tournament winners that, by law, they must report all their winnings on their federal income tax returns. This rule applies regardless of the amount and regardless of whether the winner receives a Form W-2G or any other reporting form. This is true for 2007 and earlier years, and will continue to be the case after the new reporting requirement goes into effect.

Poker Tournament Winnings Must be Reported to the IRS

So it is. But it's actually debatable whether Wild Bill was holding that hand when shot from behind. Eyewitness reports differ. Makes for a good story, though.

I can’t believe the IRS hadn’t thought of this before. I won $100 in a bar trivia contest a few weeks back, and they made me fill out a 1099 before they handed over the cash!

ping

Poker winners to IRS: bite me (bite us technically)

My bar trivia team and I just hosted a BBQ with our accumulated winnings (only $235 in cash). If the IRS wants a piece, they can have some leftover cole slaw and warm beer!

.............will be required to report winnings of more than $5,000 to the Internal Revenue Service ...........

WasUpWitDat! $5000! - I do consulting and am forced to get a 1099 for anything over $600 as taxable income.

Any gambling losses during the same year are allowed as offsets to the winnings. So be sure to save all your losing lottery tickets and OTB receipts.

It would have been nice to have had a conservative in the White House for the last seven years trying to get rid of the IRS instead of spending all his political capital on stuff like surrendering to Mexico and increasing the public trough.

So your Friday patio poker games have winners of over $5,000?

If so, security would be a bigger issue...

BUMP to that!

He could try. It would be a better effort than surrendering our sovereignty to a third world cesspool, don’t you agree?

Remember President Reagan and his impossible goal of destroying the Soviet Empire once and for all? Nothing happens until something moves. The IRS is in deep conflict with the founding ideals of the United States. Some President should take it on, don’t you think?

WASHINGTON — Starting next year, the IRS will be required to prove that it deserves the money it demands, and Congress will be forced to prove that it won’t waste money on vote buying entitlement schemes.

The new requirement, which goes into effect on March 4, 2008, was contained in guidance released Sept. 4 by fed up Americans. The guidance is designed to clear up confusion about the right of government officials to steal money from one person to buy the vote of another. In recent decades, some politicians have deliberately acted confused about their constitutional duties.

From now on, politicians will be forced to provide proof that any bill they submit is within Congress’ constitutional limits...

A guy can wish...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.