Posted on 09/21/2007 10:49:53 PM PDT by Freedom_Is_Not_Free

Sep 17, 2007 -- When you rent, most people mistakenly assume the decision is made out of necessity, not rationality. But there is a very good reason to rent in today's bubble-stricken market: median incomes do not support median home prices.

By Ben W. (bdarbs)

Median income household cannot buy median priced home

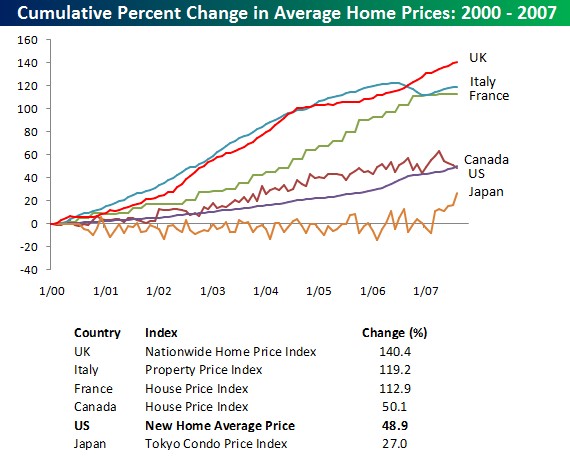

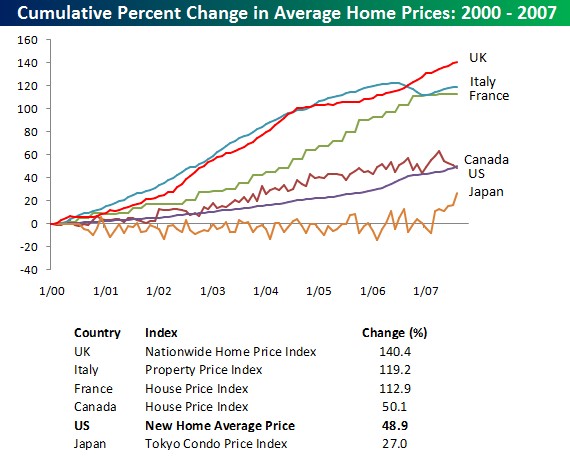

The graph above demonstrates three very important facts.

* Whenever prices rise more than the normal trend, they eventually correct and drop back in line. * This housing bubble is an absolute giant when compared to the housing bubbles of the previous decades. * Income levels haven't come close to keeping up with home price inflation. For decades, home prices strongly correlated with median incomes. In 1997, everything changed.

What does this mean?

Now is perhaps the best time in US history to be a renter. You are far better off paying high rents for the next few years than buying a home and watching your equity disappear while the market takes a freefall.

Not convinced? Here's my argument...

The home prices that we are seeing today are artificial and not sustainable. This is because home prices have deviated from the fundamental formula that has always ruled the real estate market. Nationally, median home prices increased by nearly 50 percent in the last decade. The median income, on the other hand, has gone up 10 percent in the last ten years--a very meager increase compared to the change in home prices.

Incomes simply cannot support the bubble-inflated prices. In many places, Americans earning the median income have no chance of reasonably affording a median priced home with a conventional home loan.

(Excerpt) Read more at efinancedirectory.com ...

Owning provides a different form of freedom than renting; freedom from the whim of a landlord. Over time, it has proven to be a wise financial choice as well.

Besides, it’s hard to rent a heated garage big enough to hold 5 motorcycles, 2 cars, a Coke machine, two work benches, a compressor and a whole lot of tool cabinets.

Once I passed the minimalist stage of my life, my house became my warehouse.

sounds like a dream. but my job requires me to live in 1 of 12 counties. oh, and those counties are among the highest in housing costs on earth. there is just no way to buy. the good thing is, when i retire in 16 years i’ll have a nice pension, deferred comp, variable supplement and i can leave this damn state, buy a house and enjoy life. need to find a state where they dont tax pensions...

You might find more to your liking there.

I live in Illinois and Illinois does not tax pensions, I'm considering a move to Missouri, where they do tax pensions. However, property taxes are lower in Missouri, Missouri has concealed carry, Illinois does not. There's a lot to consider.

It costs me ALOT more to try to keep what I have...bought 8 years ago and it’s so much more expensive even when my salary goes up.....I’m not ahead.

...meant to add that I would NEVER rent.....pay money for nothing. If I really had too, I’d move back the arm pit of society (Buffalo, NY) and buy a house there....you get them really cheap there.

The place I found is just a few miles south of Gray Ridge, nearby are Essex, Morehouse, Dexter and Sikeston. I was born and raised in that area of Missouri. (The Boot Heel)

You do realize that you ARE paying taxes and insurance and all the rest (repairs, etc) and you don’t own a thing afterwards. I used to rent apts...and every year I’d raise the rent due to increase in taxes and insurance. You think I’m going to pay it when I don’t have too?

And when you finally pay off the house for your landlord, he will kick you out, sell his other home and make a $100,000 profit and move into the house you paid off for him. Nice deal.

My wife and I like to watch the "flip that house" style shows. We both find it fascinating that three realtors come in, look at the same house, and give pricing estimates as much as 10% to 15% different from each other. The fact that the so-called "professionals" can't figure out within 5% or so what the house is worth tells me that they're just making up the prices and hoping for the best.

My house is worth about $275,000 now and my mortgage payment is around $550.00 a month (not including tax/ins)...15 year mortgage. Can’t wait till I’m paid off!! I won’t have to worry about rent or mortgage the rest of my life after that. It’s a secure feeling.

The value of a house on the market probably has more to do with the net annual cost of carry than it does with the nominal price.

If your income is such that you can qualify for a $2,500-odd house payment (+the escrow for taxes and insurance), the amount you can borrow will depend on the interest rate and the repayment term. Looking only at the 'traditional' 30-year fixed loan:

With interest rates at 15%, where they were in the mid-1980s, you could borrow about $200,000 for 30 years, as the payment would be $2,528.89 (+escrow)

With interest rates at 5% (where they were 2 years ago or so) the same $200,000 loan would have a $1,073.64 payment, so you could borrow much more; when rates have dropped to 5%, you could borrow $470,000 -- more than twice as much - and still have a lower payment ($2,523.06).

We've come out of a period where rates have been at lows not seen since the 1960s, and as rates now rise, the amount a buyer can borrow on the same level of income will decrease.

As the amount borrowable decreases, all other things being equal, prices will decline as well. The analysis in the article completely ignores this.

Also you have to remember that people who had loans at higher rates who refinanced without taking equity out are pocketing the difference putting a huge number of homeowners on firmer ground financially.

interest rates may bump up a point or 2 but The doom and gloom seems pretty overstated to me.

Move to Battle Creek - we need more people here. Housing is very reasonable. Buyers’ market here in Center city.

You make some good points...I am in the stoick market (heavily) and right now my real estate looks a lot better than the market, but I lucked out in a lot of ways and this area is getting hot.I lost a lot in the tech bubble and downturn as did a lot of folks ...Diversification is important and the good thing for most people is that owning your own home is a tax subsidized way of forced savings.

It used to be that real estate loans were "non-recourse", meaning that the lender was limited to repossession of the property in satisfaction of the loan. I'm not sure whether the latest bankruptcy laws changed that.

But I do have a comment regarding the frequently quoted fact that the median-income buyer can't afford the financing costs of the median priced home. This statement seems to overlook the fact that a great percentage of buyers are not "first-time" buyers.

In order to relocate, or move up, many buyers are selling homes with considerable equity and then, of necessity, moving that equity into a different property.

I am certainly among those who could never afford to buy the house I am living in if I had to purchase it outright. But if I sold this house, I could buy one roughly equivalent while living off my modest retirement savings. So the fact is, the median income does not have to be able to purchase the median priced home.

Young people, who have the median income, may be disapponted to realize that they cannot buy their dream home first. But few of us have ever been able to do that.

Another thing that people miss is that home loans are typically very highly leveraged. (Duh! We can see that now.)

Except for exceptional times like this, the typical home buyer might put only 10% down. The long-term appreciaton of single-family homes is about 8%, I think. But if one holds an asset like a $100k house with 10% equity, then the early returns on the equity approach 80%. That compares very well with un-leveraged returns on the S&P 500 of about 10%.

The answer to the question of whether to invest in a home or invest in stocks is probably "both".

Great post! While it is all good, especially noteworthy to me is your note is that home owners must keep investing in their home, while too many renters will likely put that investment off or reduce it. That is a great point.

This goes back to my point that the best way to save money is to save money and not blow it. Money spent can’t work for you. It sounds like you have really done your homework. Gret post.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.