Skip to comments.

Bill may add taxes on imports

Home Textiles Today ^

| 06/07/2007

Posted on 06/07/2007 3:16:22 PM PDT by Ultra Sonic 007

Washington -- A bipartisan quartet of Congressmen today introduced legislation that would levy a border tax on imported goods unless the U.S. Trade Representative negotiates with other countries to end their border taxes on U.S. exports as well as tax rebates to their own manufacturers.

The Border Tax Equity Act was sponsored by Rep. Bill Pascrell (D-NJ), Rep. Duncan Hunter (R-CA), Rep. Mike Michaud (D-ME) and Rep. Walter Jones (R-NC). The sponsors argue U.S. producers and services providers face a $379 billion trade disadvantage due to foreign border-adjusted taxes on U.S. goods, as well as value-added taxes (VAT).

Further, proponents of the bill note that while World Trade Organization rules do not allow the United States to rebate the corporate taxes its exporters pay, the majority of U.S. trading partners still do so under an exemption in the WTO rules. Under the proposed legislation, if the US Trade Representative fails to negotiate a remedy by an as-yet unspecified date, the federal government will issue rebates to U.S. exporters equal to the amount of taxes they've paid on their goods to an importing nation. It will also levy new taxes on goods being imported into the United States.

"I strongly support fair trade, but it needs to be on a level playing field," said Jones. "Differential treatment of direct and indirect taxes under international trade rules puts U.S. producers at a profound disadvantage."

The action is being supported by the American Manufacturing Trade Action Coalition, the AFL-CIO and the United States Business and Industry Council.

TOPICS: Business/Economy; Front Page News; News/Current Events

KEYWORDS: business; duncanhunter; economy; trade

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

To: Paperdoll

If you mean by “globalist” a believer in free trade, then I’m guilty as charged. America’s trade problems are self-inflicted, through a defective education “system”, a government-wounded healthcare system, and excessive taxes due to extra-Constitutional federal government spending. We won’t solve these problems by building a trade fence.

21

posted on

06/07/2007 4:57:05 PM PDT

by

AZLiberty

(President Fred -- I like the sound of it.)

To: Paperdoll

22

posted on

06/07/2007 4:58:08 PM PDT

by

AuntB

(" It takes more than walking across the border to be an American." Duncan Hunter)

To: AZLiberty

No one is going to build a “trade fence”, so don’t start ugly untrue rumors. Levelling the playing ground is not negating free trade. It is working toward fair free trade. If you like our country being taken to the cleaners while the other country makes big bucks at our expense, then you are not a good American, IMHO.

23

posted on

06/07/2007 5:11:02 PM PDT

by

Paperdoll

( Duncan Hunter '08)

To: Toddsterpatriot

Oh, yes. You are the show me the facts man, who is never satisfied with anything you do not agree with. Do your own digging. I have other things to do.

24

posted on

06/07/2007 5:16:44 PM PDT

by

Paperdoll

( Duncan Hunter '08)

To: TxCopper

1 in 6 of the 250 corporations paid NO tax from 1996-1998. Were they profitable?

25

posted on

06/07/2007 5:28:40 PM PDT

by

Rodney King

(No, we can't all just get along.)

To: Paperdoll

Keep spouting those feelings honey, they’re so cute.

26

posted on

06/07/2007 5:35:41 PM PDT

by

Toddsterpatriot

(Why are protectionists (and goldbugs) so dumb?)

To: Rodney King

To: Rodney King

Loopholes. Corporations keep two sets of books. GAAP/FASB and the ones that taxes are based on. It is possible to show a profit to your shareholders, yet show a loss to the gov’t.

28

posted on

06/07/2007 5:57:03 PM PDT

by

TxCopper

To: lewislynn

A January 17 analysis of Enron's financial documents by Citizens for Tax Justice finds that Enron paid no corporate income taxes in four of the last five years-- although the company was profitable in each of those years.I thought Enron's problem was profits that didn't really exist?

but the company was able to use tax benefits from stock options and other loopholes to reduce its five-year tax total to substantially less than zero.

Yes, when you pay employees, you get to write the expense off. The good news is, the employees paid taxes on those stock options.

29

posted on

06/07/2007 6:00:53 PM PDT

by

Toddsterpatriot

(Why are protectionists (and goldbugs) so dumb?)

To: TxCopper; lewislynn

Thanks. I am aware of the GAAP/Tax books difference, which I have always found outrageous. However, i disagree with the anylsis of the tax-deducibility of stock option grants being a loophole. They are a real cost of the shareholders to the employees, just as salary is, and the tax is paid by the recipients.

30

posted on

06/07/2007 6:03:27 PM PDT

by

Rodney King

(No, we can't all just get along.)

To: Don Corleone

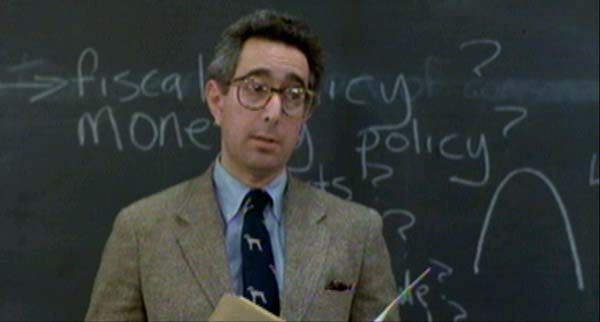

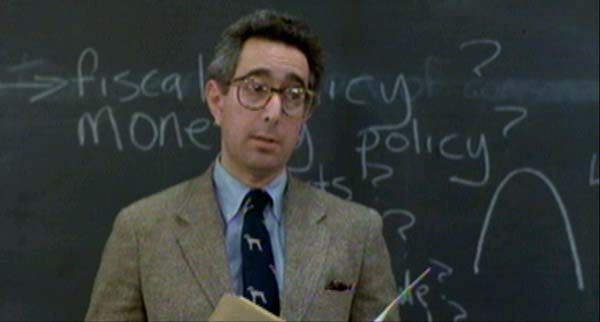

Smoot-Hawley....Hoot Smally???

... Anyone? Anyone?... the Great Depression, passed the... Anyone? Anyone? The tariff bill? The Hawley-Smoot Tariff Act? Which, anyone? Raised or lowered?... raised tariffs, in an effort to collect more revenue for the federal government. Did it work? Anyone? Anyone know the effects? It did not work, and the United States sank deeper into the Great Depression.

31

posted on

06/07/2007 6:06:01 PM PDT

by

dfwgator

(The University of Florida - Still Championship U)

To: dfwgator

We are not in a depression, and IMO, this is a revenue-neutral bill. It is designed to correct some of the outrageous tariff inequities between our trading partners and us.

32

posted on

06/07/2007 6:15:18 PM PDT

by

TxCopper

To: Paperdoll

I don't know much about Duncan Hunter except that his name shows up on virtually every thread here. I even found out last night that Ann Coulter likes him.

But if he's proposing tariffs then I wouldn't support him.

When will people sit down, think for a minute and realize that WE pay those tariffs. Americans cough up more to buy something -- it isn't the foreigners who pay.

Sheesh, it ain't free money and if I want to buy something from a company located in a country whose tax policies Duncan Hunter disapproves of, it's none of his damned business.

He doesn't sound very free-market to me based on this.

33

posted on

06/07/2007 6:16:25 PM PDT

by

BfloGuy

(It is not from the benevolence of the butcher, the brewer, or the baker, that we can expect . . .)

To: AZLiberty

We also are fools for allowing trade & tax incentives for corporations to move their manufacturing elsewhere. It’s suicidal.

34

posted on

06/07/2007 6:51:34 PM PDT

by

pissant

To: BfloGuy

He did vote yes for a free trade deal with Austrailia. He’s mostly fixated on China, NAFTA, and the WTO. I haven’t heard him complain about anything else.

Read posts #12 and #14.

35

posted on

06/07/2007 8:22:05 PM PDT

by

Ultra Sonic 007

(Why vote for Duncan Hunter in 2008? Look at my profile.)

To: BfloGuy

When will people sit down, think for a minute and realize that WE pay those tariffs. I see it more as a negotiating tool - to get other countries to drop their tariffs on US goods.

Ideally nobody would pay any import taxes.

To: Ultra Sonic 007

Two years ago the WTO ruled against us and we had to stop the foreign tax credits that companies received for exporting product.

The EU and EEC sued the USA stating unfair business practice so we lost our tax credits for exporting.

I am always amazed at how we always loose in WTO decisions.

Fiji films can export and sell film in the USA but Kodak cannot sell film in Japan.

37

posted on

06/08/2007 6:07:40 AM PDT

by

edcoil

(Reality doesn't say much - doesn't need too)

To: edcoil; pissant; Paperdoll; AuntB; AZLiberty; BfloGuy

38

posted on

06/08/2007 6:25:03 AM PDT

by

Ultra Sonic 007

(Why vote for Duncan Hunter in 2008? Look at my profile.)

To: edcoil; 1rudeboy; snowsislander

I am always amazed at how we always loose in WTO decisions.Always?

Fiji films can export and sell film in the USA but Kodak cannot sell film in Japan.

Really?

39

posted on

06/08/2007 7:01:05 AM PDT

by

Toddsterpatriot

(Why are protectionists (and goldbugs) so dumb?)

To: edcoil; Toddsterpatriot

Fiji films can export and sell film in the USA but Kodak cannot sell film in Japan.Kodak film is sold in Japan, both at the consumer level and the professional level; in some professional applications, I believe that it is still preferred.

(Also, it's "Fuji" film, not "Fiji" film.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson