Posted on 06/04/2007 1:32:46 AM PDT by bruinbirdman

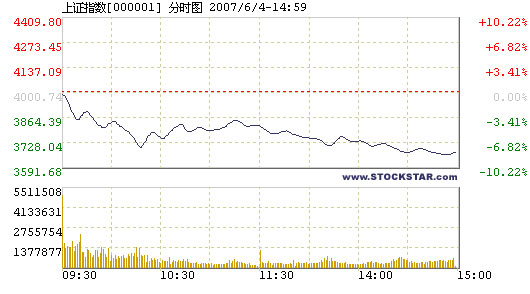

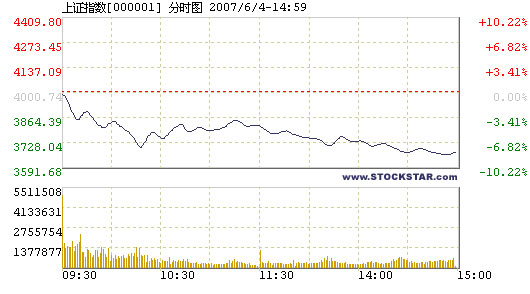

Chinese stocks had the largest single-day drop in 10 years today, with the Shanghai Composite Index plunging 330.34 points or 8.26 percent to 3,670.40. Starting lower from 3,981.82, the index failed to bounce back to the 4,000-point foothold, with 3,987.27 as the highest right after the opening. But soon it slipped all the way down to the lowest 3,659.09 with little resistance. The few, weak turning-backs did not stop the sliding.

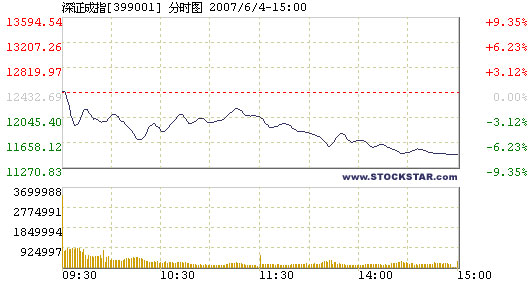

The Shenzhen Component Index, tracking the smaller Shenzhen Stock Exchange, closed at 11,468.46, down 964.23 points or 7.76 percent. It went through the day within a rang between 11,464.23 and 12,468.58.

P>

P>

Total turnover of the stocks included by the Shanghai index and the Shenzhen Component Index was 220.3 billion yuan, much lower than that of last Friday.

Of the A shares listed on the two exchanges, only 25 saw their prices rising this morning, leaving 1,303 dropping and 122 unchanged. Heavyweight blue chips also failed to have the slightest growth to make the index look better.

The Industrial and Commercial Bank of China, Bank of China, China Unicom and Sinopec, ranking on top of the trading volume and transaction value on the Shanghai bourse, all slid to press the index down.

Shanghai Light Industry Machinery moved against the trend with a 10.01 percent rise to 18.25 yuan, while Hainan Donghai Tourism Center (Holdings) surged 5.04 percent, ranking on top of the few gainers in Shanghai and Shenzhen respectively.

B-shares fell, with 19 stocks closing up among the total of 109. Funds did not beat the downward trend today, with all the funds listed on the bourses went down.

It appears doubtful that freight fuel will generally go down in the long term.

That’s quite a drop.

Didn’t we buy enough of their crap over the Memorial Day weekend? Or maybe toothpaste sales plummeted.

Ruh roh!!

There’s too much unending bad news over the quality of Chinese foodstuffs, etc

They implemented a new tax on share trading equal to 4% of their total national budget. They are looking to redistribute the wealth to rural areas. At least that was what they said.

Watch the price of oil.

Only ChiComs can trade on Shanghai ChiCom market. You could try a play at the Hang Seng or Taiwan markets.

"rumors that the government is planning a capital gains tax and other strong measures to control the market put pressure on the market."

"They implemented a new tax on share trading equal to 4% of their total national budget."

"Analysts said the government's decision to raise the stamp tax on securities trading from 0.1 percent to 0.3 percent was undoubtedly a factor in the fall."

I read an article that claimed millions of ChiCom day traders sit at computer monitors at brokerage houses and play the stock market like slot machines. They insert credit cards.

yitbos

The DJIA is down about 100. The Big Board is mostly red. Might be worth taking a look at some fundamentals right about now even though MSM is mostly saying the future never looked brighter (begin major worry mode now).

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.