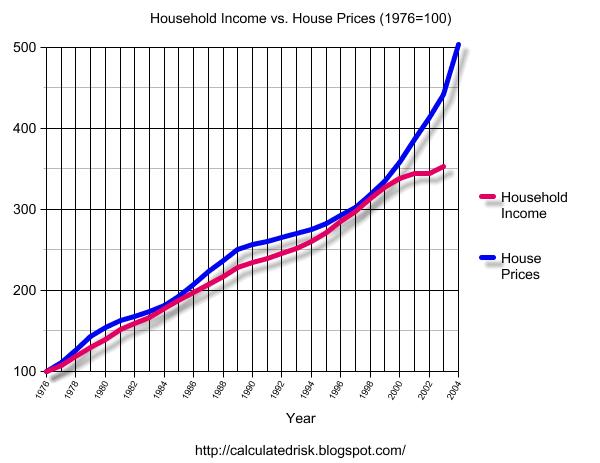

When I speak of a credit bubble, I don't just mean artificially low interest rates, I also mean loose lending standards. These two things combined to fuel the real estate bubble IMO. Not only did declining interest rates make ever more expensive houses more affordable, but loose lending practices encouraged people to take on risky loans *and* engage in speculation. As you can see from the following graph, house prices have a close correlation with household income. When house prices rise above household income, as can be clearly seen in the early 1980s and mid 1990s, a housing bubble followed. And if this chart is any indication of things to come, the bubbles of the early '80s and mid '90s will be considered mild in comparison to the bubble we find ourselves in now.

And for that matter, population and building cost increases don't explain the phenomenal rise in home prices either:

Nor do inadequate supply explain the rapid appreciation in housing prices. Indeed, it's just the opposite. We have built millions more homes than there are buyers:

http://www.safehaven.com/article-5841.htm

So unless you can give me a solid alternative explanation, it would appear that low interest rates combined with loose lending standards are the cause of the current housing bubble.

And finally, let me leave you with an idea of how housing bubbles deflate. The following three housing busts occured in the 1980s and 1990s. Notice how long the corrections lasted, and how far they fell in real terms. My contention is the next housing bust will be nationwide, last longer, and take a huge toll on the larger economy: