Skip to comments.

'The US housing bubble will disappear'

in2perspective ^

| September 11, 2006

| Laurie Osborne

Posted on 10/14/2006 9:48:44 AM PDT by GodGunsGuts

'The US housing bubble will disappear'

By Laurie Osborne, Editor

Published 11th Sep 2006

That the US housing bubble will disappear someday is a certainty. That it will blow up catastrophically is a fair bet, warns The Daily Reckoning's Bill Bonner.

Observing recent statistics, Bonner calls the evidence "formidable".

The total value of residential property in developed countries rose by more than $30 trillion, to $70 trillion, over the past five years – eclipsing the combined GDPs of those nations.

Consumer spending and residential construction have accounted for 90 percent of the total growth in the American GDP over the last four years, and more than 40 percent of all private-sector jobs created since 2001 have been in housing-related sectors, including construction and mortgage brokering.

America made some of its biggest gains this past year, with average prices of homes rising 12.5% in the year and prices in Florida, California, Nevada, Hawaii, Maryland and Washington, DC, rising more than 20 percent, while in Palm Beach County, Florida, it rose over 35%. Sales of existing homes in the US set a new high at 7.18 million in April.

Some foreign countries showed bigger gains than the US in the last year, with prices up by 23.6 percent in South Africa, 19 percent in Hong Kong and over 15 percent in Spain and France. But average house prices have actually fallen by 7% in Australia since 2003; Sydney's bubblicious prices have plunged by 16%. In Britain, sales have contracted by a third from last year and have also slowed down in Ireland, the Netherlands and New Zealand. In Britain and Australia, these declines followed what were only very modest interest rate increases.

23 percent of all American houses bought last year were for investment and in Miami, one speculation hot spot, 70% of condo buyers are investors/speculators.

Last year, 42 percent of America's first-time buyers – and 25 percent of all buyers – put no money down.

In California, 60 percent of all new mortgages this year are interest-only or negative-amortization.

House prices in relation to rent have hit all-time highs in the US, Britain, Australia, New Zealand, France, Spain, the Netherlands, Ireland and Belgium. In the US, the ratio is 35 percent above its 1975-2000 average. The price to rent ratio is a cardinal indicator of over valuation.

TOPICS: Business/Economy

KEYWORDS: bubble; bubblebrigade; depression; despair; doom; dustbowl; eeyore; goldpimpalert; goregloomgutless; grapesofwrath; housingbubble; joebtfsplk; realestate

Navigation: use the links below to view more comments.

first previous 1-20 ... 121-140, 141-160, 161-180 ... 461-475 next last

To: palmer

Just make sure your spec house isn't one of 10,000 just like it on 1/4 acre with many acres of undeveloped land around it.You're right, in a market like this you need to be sure you are building a desirable house in a good area. Add a few amenities that would not be there in a normal market, keep the price in a marketable range, and 'presto' (yeah right!) you've got a buyer.

141

posted on

10/14/2006 12:46:24 PM PDT

by

Balding_Eagle

(God has blessed Republicans with political enemies who are going senile.)

To: GodGunsGuts

Hate to burst their bubble, but our market has already turned.

Big builders had stopped new construction earlier in year; now over supply is shrinking and getting back in balance. Home are moving much faster in the last 2 weeks. Lower interest rates and increased confidence with lower fuel prices are a big plus.

142

posted on

10/14/2006 12:49:03 PM PDT

by

HereInTheHeartland

(Never bring a knife to a gun fight, or a Democrat to do serious work...)

To: Fan of Fiat; martin_fierro

That's funny right there, I don't care who y'are.

143

posted on

10/14/2006 12:52:59 PM PDT

by

Petronski

(Living His life abundantly.)

To: HereInTheHeartland

Our free market system is a marvel of immediate adjustments to changes in the economy. When the economy started to slow down, bond traders brought down interest rates immediately and caused a quick adjustment in mortgage rates that prevented a serious housing slowdown. You'd never see that in a government-controlled economy. Our economy is so quick and flexible and responds to changing conditions in just a couple of days. Free markets are by far the best economic managers.

144

posted on

10/14/2006 12:56:18 PM PDT

by

defenderSD

(The concept of national martyrdom, combined with nuclear weapons, is extremely dangerous.)

To: Fan of Fiat

GGG is a good dancer.

145

posted on

10/14/2006 12:59:32 PM PDT

by

Toddsterpatriot

(Goldbugs, immune to logic and allergic to facts.)

To: montag813

the number of sales, price, and price per square foot of New York City condos rose unexpectedly"Unexpectedly" to whom?

To: GodGunsGuts

I'm still laughing out loud! Found the link below by accident. It features unsold flipper houses and urges people to sign up to sell their houses at reduced prices:

"Reno is one of the fastest declining real estate markets in the country. . . . Home prices in Reno Nevada have dropped by at least 10% in the last 6 months and are widely forecasted to drop another 10% or more in the next year. . . . If you want to buy a home in Reno Nevada - you have unprecedented negotiating clout to make "low-ball" offers on a wide variety of beautiful homes across the region. With home inventories of 6 months or more on the market - sellers (many are already in foreclosure) are often desperate to take any semi-reasonable offer to move on with their lives. "

Wow! House going down in price 20% in about one year. Nevada properties are jumping off a cliff just like lemmings. Too far fetched? Naaah! This looks to be the normal result of novices playing flipper games. Real estate is not as simple as monopoly. [Learn More?] Oh, well . . .

http://www.myrenorealestate.com/

147

posted on

10/14/2006 1:24:16 PM PDT

by

ex-Texan

(Matthew 7: 1 - 6)

To: M. Thatcher

"Unexpectedly" to whom? To "experts"

To: Irish Eyes

Ah yes, Pinetop in the beautiful White Mountains. Next weekend, I'm going up there for a day trip. The 5.0 liter V8 in my SUV is going to burn two tanks of gasoline at the new low price of $2.15 per gallon. Just got the oxygen sensor replaced thanks to AZ state vehicle inspections and it's running much better now...it fixed that annoying knock I had for a couple of months. Yes, October is the "most wonderful time of the year" in Phoenix when the weather cools off.

149

posted on

10/14/2006 1:31:19 PM PDT

by

defenderSD

(The concept of national martyrdom, combined with nuclear weapons, is extremely dangerous.)

To: montag813

Leading experts?

150

posted on

10/14/2006 1:42:38 PM PDT

by

Petronski

(Living His life abundantly.)

To: GodGunsGuts

Why is my old wedding ring so valueless? I was thinking of selling it and the first and only place I went so far offered only 48.00. I know I paid much more than that for it some 20 years ago. Just curious.

151

posted on

10/14/2006 1:58:51 PM PDT

by

bkepley

To: bkepley

Maybe it's fake? Just kidding. The gold alone should be worth a lot more than that!

To: Fan of Fiat

He is not very convincing but the dancing girl seems very happy.

153

posted on

10/14/2006 2:24:30 PM PDT

by

winodog

To: fella

Debt free here!

Most people aren't.

154

posted on

10/14/2006 2:40:52 PM PDT

by

nmh

(Intelligent people recognize Intelligent Design (God) .)

To: EGPWS

Nah, we just subsidize the lazy and the irresponsible.

We're getting sick and tired of it too.

155

posted on

10/14/2006 2:42:19 PM PDT

by

nmh

(Intelligent people recognize Intelligent Design (God) .)

To: Petronski

Leading experts? Strange direction this thread is taking. Yes, real estate experts (I cannot vouch for individual veracity of such) had expected all three catgegories to decline due to rising inventories and heretofore slackening demand. They did not. Sales and prices in New York picked up marketedly, and in contrast to practically every other metro area nationwide.

To: defenderSD

Enjoy your trip to the mountains. Do not think I would like to drive up and back in one day. Have a safe trip.

To: defenderSD; ex-Texan; durasell; Pelham; djf; RobRoy; winodog; Toddsterpatriot; Fan of Fiat; ...

Hi DefenderSD, I'm back to continue the debate. I have pinged a few people who are pro and con to get their thoughts as well. To answer your questions...

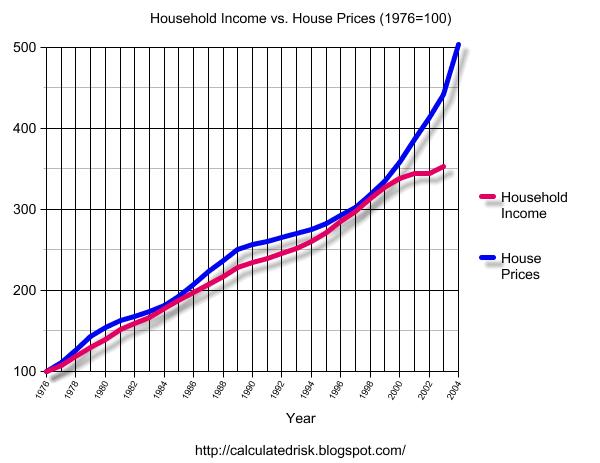

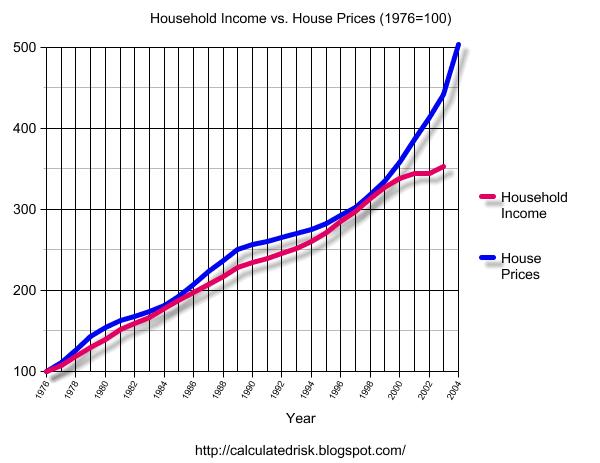

When I speak of a credit bubble, I don't just mean artificially low interest rates, I also mean loose lending standards. These two things combined to fuel the real estate bubble IMO. Not only did declining interest rates make ever more expensive houses more affordable, but loose lending practices encouraged people to take on risky loans *and* engage in speculation. As you can see from the following graph, house prices have a close correlation with household income. When house prices rise above household income, as can be clearly seen in the early 1980s and mid 1990s, a housing bubble followed. And if this chart is any indication of things to come, the bubbles of the early '80s and mid '90s will be considered mild in comparison to the bubble we find ourselves in now.

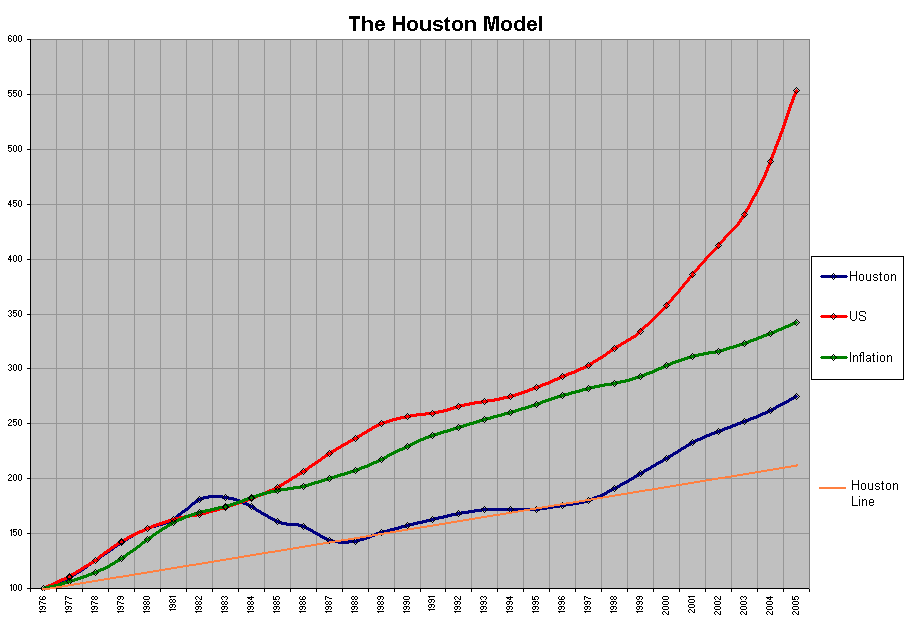

And for that matter, population and building cost increases don't explain the phenomenal rise in home prices either:

Nor do inadequate supply explain the rapid appreciation in housing prices. Indeed, it's just the opposite. We have built millions more homes than there are buyers:

http://www.safehaven.com/article-5841.htm

So unless you can give me a solid alternative explanation, it would appear that low interest rates combined with loose lending standards are the cause of the current housing bubble.

And finally, let me leave you with an idea of how housing bubbles deflate. The following three housing busts occured in the 1980s and 1990s. Notice how long the corrections lasted, and how far they fell in real terms. My contention is the next housing bust will be nationwide, last longer, and take a huge toll on the larger economy:

To: All

I would be remiss if I didn't through in these charts as well (as they paint an equally ominious picture IMO):

To: Toddsterpatriot

"That the US housing bubble will disappear someday is a certainty."

Everything must go away someday I suppose.

160

posted on

10/14/2006 11:12:45 PM PDT

by

1035rep

Navigation: use the links below to view more comments.

first previous 1-20 ... 121-140, 141-160, 161-180 ... 461-475 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson