Skip to comments.

The Global Housing Boom: In come the waves (a cautionary tale)

The Economist ^

| 06/16/2005

Posted on 09/21/2006 8:02:27 PM PDT by GodGunsGuts

The worldwide rise in house prices is the biggest bubble in history. Prepare for the economic pain when it pops

NEVER before have real house prices risen so fast, for so long, in so many countries. Property markets have been frothing from America, Britain and Australia to France, Spain and China. Rising property prices helped to prop up the world economy after the stockmarket bubble burst in 2000. What if the housing boom now turns to bust?

According to estimates by The Economist, the total value of residential property in developed economies rose by more than $30 trillion over the past five years, to over $70 trillion, an increase equivalent to 100% of those countries' combined GDPs. Not only does this dwarf any previous house-price boom, it is larger than the global stockmarket bubble in the late 1990s (an increase over five years of 80% of GDP) or America's stockmarket bubble in the late 1920s (55% of GDP). In other words, it looks like the biggest bubble in history.

(Excerpt) Read more at economist.com ...

TOPICS: Australia/New Zealand; Business/Economy; Japan; United Kingdom

KEYWORDS: 2005article; bahog; comedyhour; depression; despair; doom; dustbowl; grapesofwrath; housing; housingbubble; lieabouttheagenda; whataretheyselling

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100 ... 261-272 next last

To: Petronski; nopardons; Moonman62

How dare you, um, parade on his rain, or something like that.

To: nopardons

I am confident you will eat your words re: gold. Don't worry, I'll ping you to say "I told you so" when the time comes--GGG

To: durasell

The Economist has a decidedly anti-Bush slant. So do the goldbugs and RE bubblers.

63

posted on

09/21/2006 8:42:54 PM PDT

by

Petronski

(Living His life abundantly.)

To: Mase

The story is just as valid today as the day it was written.

To: GodGunsGuts

Your threads have all the credibility and utility of a dinner-time cold call.

65

posted on

09/21/2006 8:44:29 PM PDT

by

Petronski

(Living His life abundantly.)

To: durasell

For the '92 market! My memories of the N.Y.C. housing market of '73-'74 still give me the shakes; even though we DID finally sell and made some money on the co-op. :-(

Pricey and really cheap housing sells the fastest. It's the middle area that always gets hit the hardest when there is a cooling down period.

To: Petronski

Oh wait, they're functionally equivalent.

67

posted on

09/21/2006 8:45:04 PM PDT

by

Petronski

(Living His life abundantly.)

To: Petronski

The Eonomist has always been a consevative publication. However, they tend to be fiscally conservative, which might explain why they could be perceived as "anti-Bush."

But for the sake of argument, what does President Bush have to do with the RE bubble?

68

posted on

09/21/2006 8:45:41 PM PDT

by

durasell

(!)

To: Mase

Hey there! :-)

If only they would wait in silence. These Cassandras LOVE "bad" news.....no matter how out of date it is.

To: durasell

Nobody has a crystal ball. It will pop when it pops. Prices are not supported by fundamentals and will fall (and stay down) until the RE market's equilibrium is reestablished. Of course, reaching said equilibrium will involve much more than just real estate. It will be felt across the entire economy.

To: durasell

But for the sake of argument, what does President Bush have to do with the RE bubble?The constant and incredulous drumbeat of impending RE bubble doom is orchestrated to make the President look bad, so as to elect a democrat congress.

All this to put impeached felon Alcee Hastings in the chair of the House Intelligence Committee.

Rave on.

71

posted on

09/21/2006 8:47:47 PM PDT

by

Petronski

(Living His life abundantly.)

To: Larry Lucido

ROTFLMAOPIMP

You owe me a new laptop for that!

To: Petronski

I would imagine your life would be a lot more fulfilling if you spent less time coming up with silly quips, and more time engaged in meaningful pursuits.

To: GodGunsGuts

Oh goody, goody, goody.....by that time I shall be a VERY old lady, indeed. hehehehehehe

Will YOU promise to stop posting to FR, when gold hits 400?

To: Petronski

From a penny stock pushing boiler room operation.

To: GodGunsGuts

Exposing goldbuggerring fraud is very meaningful and fulfilling.

Got any salient analysis of the 1978 real estate market you want to post? Send me a ping.

76

posted on

09/21/2006 8:51:57 PM PDT

by

Petronski

(Living His life abundantly.)

To: GodGunsGuts; nopardons

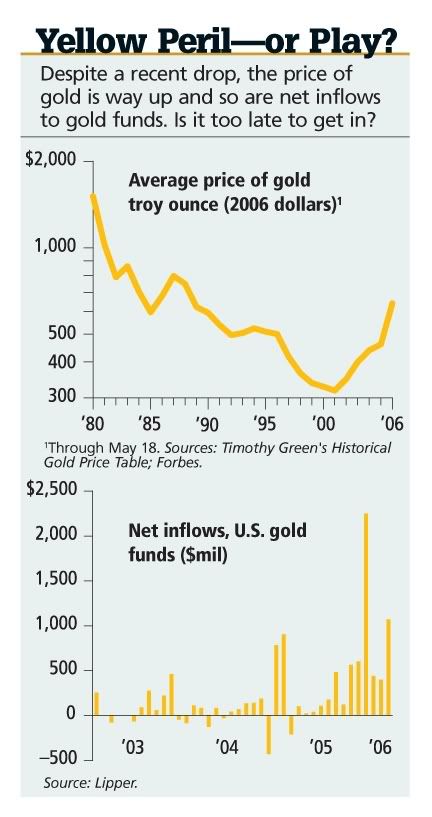

Gold is already telling us something is very wrong,

It's telling us it's finally gotten back to the same level it achieved in 1993?

We as consumers and as a country have gone on a credit binge

Yeah right. Look, our debt to income ratio has climbed a whole half a percent over the past 10 years. We must be doomed.

You'd think that someone as studied in economics as you claim to be would understand that any discussion about debt is meaningless without including assets. Since the credit binge assertion doesn't stand up to scrutiny, tell us again about what's driving those global economic imbalances.

77

posted on

09/21/2006 8:52:18 PM PDT

by

Mase

To: Petronski

The constant and incredulous drumbeat of impending RE bubble doom is orchestrated to make the President look bad...

Whoa Nelly! The real estate bubble is a plot against the President or there is no real estate bubble?

Either way, I got nothing. Nada. You made my brain lock gears.

78

posted on

09/21/2006 8:53:33 PM PDT

by

durasell

(!)

To: GodGunsGuts

Yeah, yeah, yeah..........is that WHY you ignored my post, wherein I have told you all about the LONDON market, which just fizzled a bit and made a SOFT LANDING?

To: Petronski

That's the first time you have made sense to me. Petronski is the functional equivalent of Petronski. Brilliant!

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100 ... 261-272 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson