Posted on 08/25/2006 12:45:28 PM PDT by Toddsterpatriot

WASHINGTON (MarketWatch) -- The United States is headed for a recession that will be "much nastier, deeper and more protracted" than the 2001 recession, says Nouriel Roubini, president of Roubini Global Economics.

Writing on his blog Wednesday, Roubini repeated his call that the U.S. would be in recession in 2007, arguing that the collapse of housing would bring down the rest of the economy.

Roubini wrote after the National Association of Realtors reported Wednesday that sales of existing homes fell 4.1% in July, while inventories soared to a 13-year high and prices flattened out on a year-over-year basis.

'This is the biggest housing slump in the last four or five decades: every housing indicator is in free fall, including now housing prices.'

The decline in investment in the housing sector will exceed the drop in investment when the Nasdaq collapsed in 2000 and 2001, he said.

And the impact of the bursting of the bubble will affect every household in America, not just the few people who owned significant shares in technology companies during the dot-com boom, he said. Prices are falling even in the Midwest, which never experienced a bubble, "a scary signal" of how much pain the drop in household wealth could cause.

Roubini is a professor of economics at New York University and was a senior economist in the White House and the Treasury Department in the late 1990s. His firm focuses largely on global macroeconomics.

While many economists share Roubini's concerns about imbalances in the global economy and in the U.S. housing sector, he stands nearly alone in predicting a recession next year.

Fed watcher Tim Duy called Roubini the "the current archetypical Eeyore," responding to a comment Dallas Fed President Richard Fisher made last week in referring to economic pessimists as "Eeyores," after Winnie the Pooh's grumpy friend.

"By itself this slump is enough to trigger a U.S. recession: its effects on real residential investment, wealth and consumption, and employment will be more severe than the tech bust that triggered the 2001 recession," Roubini said.

Housing has accounted, directly and indirectly, for about 30% of employment growth during this expansion, including employment in retail and in manufacturing producing consumer goods, he said.

In the past year, consumers spent about $200 billion of the money they pulled out of their home equity, he estimated. Already, sales of consumer durables such as cars and furniture have weakened.

"As the housing sector slumps, the job and income and wage losses in housing will percolate throughout the economy," Roubini said.

Consumers also face high energy prices, higher interest rates, stagnant wages, negative savings and high debt levels, he noted.

"This is the tipping point for the U.S. consumer and the effects will be ugly," he said. "Expect the great recession of 2007 to be much nastier, deeper and more protracted than the 2001 recession."

He also sees many of the same warning signs in other economies, including some in Europe.

Rex Nutting is Washington bureau chief of MarketWatch.

Gee, I wonder which administration THAT was?

Wonderful point! Why does everybody sees these things negatively?

Just in time for the presidential campaigns. What a coinkydink!

Yeah, and that 10-yr bond rate was what, about 16% during the Carter days?

I remember money market rates at 16%, so that should be about right.

Wait a minute, we survived that...

PFA?

More like "POOHA".

Or maybe the 'A' in your acronym would more accurately represent another word that you sit on.

Good luck with that strategy, I am still waiting for Southern California real estate to go back to the prices they were in 1963

Rokkiee.

Sniroo.

Petloou.

If you don't understand, you are clearly not a Prestige Freeper.

He's not really alone...leftists are hoping for a recession. Pelosi, Reid, The Swimmer, Hitlery, and the entire cabal of lunatics at moron.org are hoping and wishing for painful economic times to fall upon Americans.

keyword

ECONOMICFORECAST

attached for future reference in 2007

Clearly the guy wants "in" to a Democrat administration following the 2008 election, and he's doing his bit for "the cause" to try and talk gloom and doom so that the Demo/Commies running for Prez can wail and gnash their teeth about the worst recession since 1801... Folks, this is just one of the early shots in what will be a planned all-out assault by the media and the other usual suspects intended to make Americans feel insecure and to plant the seeds for a Demo/Commie coup...

( No more Olmert! No more Kadima! No more Oslo!)

Yep, Dems pumping up the gloom and doom right before the election. We've seen it for the last two cycles, 2002 and 2004.

I just had a flashback to the 2000 election, during which

Greenspan was tightening...and tightening...and tightening

...and the stock market was falling...and falling. I seem

to remember then-candidate Bush warning that the economy

was slowing at that time...and guess who was accusing him

"trying to talk down the economy"?

"HOOVER ECONOMY!"

...Bush's fault.

The 2001 recession, if compared to other recessions, was chicken feed. It wasn't even close to anything else.

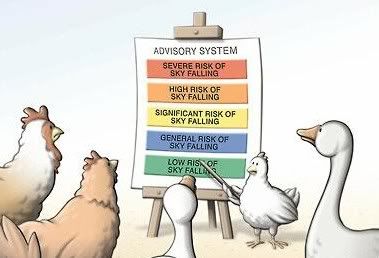

Having said that.... We're DOOOMMMMMEEEED!

"We're all gonna die!!!!"

...Bush's fault.

Ah yeah, I remember him now.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.