Let's just get this over with.

Posted on 01/09/2006 9:07:21 AM PST by DebtAndDelusion

Gold scaled a new near-25-year peak on Monday as fund managers poured money into the metal due to worries about inflation and dollar weakness against the yen, dealers said. Market talk that some central banks might buy gold to increase the metal's share in their reserves boosted sentiment.

Gold also gained in other currencies. In trading Monday, gold was at $537.9 an ounce on the New York Mercantile Exchange. Earlier, in Asian trade, the precious metal briefly hit prices not seen since March, 1981. "In the near term, we are very close to an important level of $550 (an ounce) and I would expect that we would trade (at that level) sometime this week," said John Reade, precious metals analyst at UBS Investment bank.

Market talk that China and other central banks in Asia — which jointly have $2.6 trillion in foreign currency assets — may be looking to diversify some of their reserves into gold has underpinned sentiment since late last year.

China said on Thursday it planned to explore new ways of using the country's foreign exchange reserves and broadening their investment scope. It has 600 tons of gold in its reserves, accounting for only 1.2 percent of the total.

"The risk of playing in the market from the short side is quite high currently. I still see further gains over the short term, but once it hits $550 then the sentiment could change," said Yingxi Yu, precious metals analyst at Barclays Capital.

"But the risk of liquidation is still quite small at the moment."

(Excerpt) Read more at foxnews.com ...

Oh, I see now...

Those darn Asians are buying all the lifeboats!

HG

Let's just get this over with.

Yea they are protecting us from knowing that the reason gas is so high is that they now compete with us for it (thanks to unfettered "free " trade)

Be happy dont worry DVD players have come down in price!

The Asians finally figuered out they don't like collecting pictures of dead presidents on green paper. All those pieces of paper have got to come home............

Watch gold and the other precious metals markets in near real time here.

http://www.kitco.com/market/

Over in China the upscale working man gets ten dollars a day if he's lucky and is darn happy to have it. Of course he saves a quarter of his money and buys gold regularly at a Chinese bank with the full encouragement of the government there.

Now in America nobody saves any money and maybe one out of a hundred knows anything about gold and maybe one out of a thousand own any. In a strange way the price of gold is a battle between one out of every thousand Americans and the Chinese working man.

Looks like we have a clear winner. Unless of course you believe all this talk about how western Central Bankers are short selling gold they don't have to suppress the price.

Better hope that's not the case because right about now a short seller would be getting crushed. Then again who could believe that an Asian making ten dollars a day could crush the western central banks. They couldn't do that unless there was a whole lot of 'em acquiring dollars, saving them and then buying gold.

Oh, I see now. Gosh, the Federal Reserve won't live to be a hundred at this rate. Oh well, you get to be my age you see a lot of scoundrels pass away.

HG

Maybe you can help me. I lurk on that board and now when I try to read comments I get HTTP 404 page not found.

I emailed Kitco but no response.

So, if I had been foolish enough to invest in gold back during Jimmah Carter's mismanaged inflationary economy of 1980, I could finally get my money back and break even (not including what I lost due to inflation)?

25 years to break even. Worse even than social security.

I'm not a gold bug, I prefer real money.

I don't know about that Kitco board. But I do read most of these columns every day, to find contrarian POVs instead of the usual MSM ever-rosy stock touting.

http://www.321gold.com/archives/archives_date.php

http://www.prudentbear.com/homepage.asp

All those greenbacks must eventually come back to the US in order to get something of value that the holder wants, ie tools, technology, raw materials, etc. A wave of trillions of dollars of "investment capital" will wash up on our shore like a tsunami in a hurricane........

If you think that the totally unbacked-by-anything greenback fiat-currency paper Federal Reserve Note dollar is "real money" for the long haul, you are about to find out what "real money" is and what is not.

From the Roman Denarius to the French Assignat to the Weimar Deutch Mark and on and on, EVERY single unbacked fiat currency in the history of the world has ultimately failed, gone to zero, and left only a trail of tears and often civil wars in their wake.

Every single time, in recorded history.

"B-b-but, this time, it's different."

I won't say much now. I think we are almost at the top of the first wave up of major wave #2. I expect it to top in about a week or two, and then to go through a sharp medium-term correction lasting maybe six weeks or a couple of months. Then seasonalities kick in, and the next wave up may not start until July or so.

It's interesting, however, that we have seen substantial profits in both gold and silver, metal and shares, since around last August, and every time anyone mentions it on FR it is immediately condemned as the ravings of gold bugs.

That's a bullish sign, actually. When everyone on FR thinks that gold is great, it will be time to sell. Freepers are smart, but markets are contrary.

And in any case, tech stocks and oil, and the broad market as well, are all currently in upwaves. My bet is on gold and silver, but it's not a good time to go in now because this wave is almost over. My guess is a couple more weeks, but I wouldn't advise betting my shirt on it this late in the current bull leg.

\

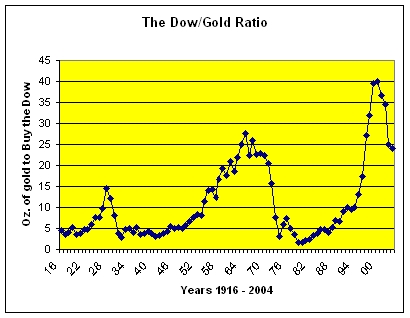

If the fed continues to "monetize" our debt, and the DOW remains above 11,000 pumped up with brand new "helicopter money," then history says gold will go to the neighborhood of $3,000 per ounce.

If Bernanke's scheme fails, and we see a deflationary cycle like Japan experienced during the last 15 years, (you can't get lower than ZERO % interest!) then the DOW will drop to around 2,000, and gold will remain above $500 an ounce.

It's the base line ratio that is the ball you need to keep your eye on. That is where history says we are going: 2 to 4 ounces of gold to buy one share of each listed DOW stock.

The lesson is clear, for those who can see.

Dow has dividends, gold has none. That said, the Dow dividends are 1.8%, pretty meager. Only 2.7% if you toss the Dow stocks with no dividends.

Or, if we deflate our way (Japan NIkkei index style) down to DOW 2,000-- is THAT really where you want to park your money for the next few years?????

Friends, I don't care what you do with your money, it's your business.

But I hope you will spend a minute or two really pondering the significance of the charts I posted at 15 and 16.

One other thing, the Dow is manipulated (good stocks added, bad stocks dropped) and gold is not. But my gold stocks are doing really well.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.