Skip to comments.

Laffer Curve Works Again

HUMAN EVENTS ^

| Dec 28, 2005

| Jerry Bowyer

Posted on 12/31/2005 8:45:33 AM PST by george76

Ronald Reagan once said an economist is someone who sees something that works in practice and wonders if it would work in theory.

So why is it that when confronted with a concept that works in both practice and theory, so many people refuse to believe it?

The Laffer Curve, popularized by economist Arthur Laffer, says the government can maximize tax revenue by setting the tax rate at ...

The logic is obvious on the ends of the spectrum: if the tax rate is 0%, the government collects no money.

If it is 100%, people have no reason to earn, and the government still collects no money.

Federal tax receipts for October and November (the first two months of fiscal 2006) were $288 billion. This is up from the first two months of fiscal 2005 ...

Despite cutting tax rates in May 2003, tax receipts for this two-month period have risen for three consecutive years.

We were on the wrong side of the curve (and may still be):

Tax rates were too high.

(Excerpt) Read more at humaneventsonline.com ...

TOPICS: Business/Economy; Front Page News; Government; News/Current Events; Politics/Elections; US: District of Columbia

KEYWORDS: bush; bush43; economicnews; economics; economist; growingeconomy; laffer; laffercurve; reagan; ronaldreagan; tax; taxes; taxrates; taxrevenue

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120 ... 161-170 next last

To: RedStateRocker

i was only talking about corporations, but... if all private loopholes were closed, with properly adjusted rates, they might not make any difference and not be missed. i'll have to look into it.

81

posted on

12/31/2005 1:06:46 PM PST

by

Chode

(American Hedonist ©®)

To: george76

The main problem with our tax code is the concept of a 'progressive' income tax. In the interest of 'perceived fairness' (as defined by the left) we punish those who become more successful. Why should everyone in the country have their VERY OWN LAFFER CURVE based on their particular income level?

How does the Laffer Curve adjust for penalizing those who have higher incomes (work more days,,,overtime,,,,second job,,,investment income,,,promotions,,,higher pay due to the extra effort in increasing their educational level,,,etc)?

To: stockstrader

As has been said before, it's not a tax on the wealthy; it's a tax on those trying to get wealthy.

83

posted on

12/31/2005 6:25:40 PM PST

by

inquest

(If you favor any legal status for illegal aliens, then do not claim to be in favor of secure borders)

To: CPOSharky

From the graph above I read the optimum at a 50% rate.

84

posted on

12/31/2005 6:31:51 PM PST

by

Baraonda

(Demographic is destiny. Don't hire 3rd world illegal aliens nor support businesses that hire them.)

To: gridlock

I'm not gonna disagree with you because I realize they would just waste it. If they were going to pay down the debt and then turn the social programs over to state and local, I would go along with it, but they wont.

85

posted on

12/31/2005 10:41:32 PM PST

by

Paloma_55

(Which part of "Common Sense" do you not understand???)

To: george76

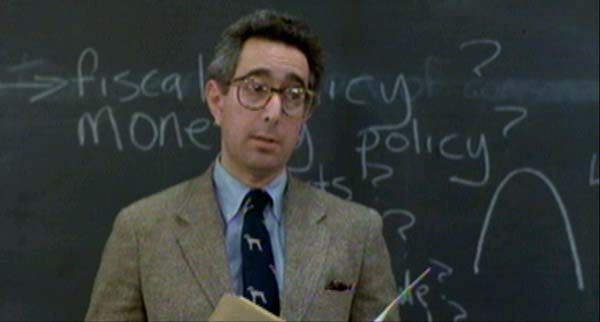

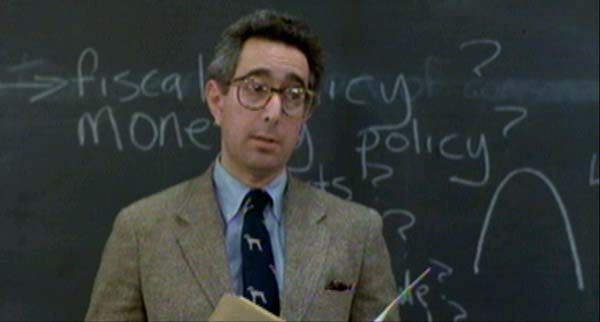

Ben Stein as the Economics teacher in Ferris Bueller's Day Off:

Anyone know what this is? Class? Anyone? Anyone? Anyone seen this before. The Laffer Curve. Anyone know what this says? It says that at this point on the revenue curve, you will get exactly the same amount of revenue as at this point. This is very controversial. Does anyone know what Vice President Bush called this in 1980? Anyone? Something-d-o-o. economics. "Voodoo economics."

86

posted on

12/31/2005 11:23:14 PM PST

by

LayoutGuru2

(Know the difference between honoring diversity and honoring perversity? No? You must be a liberal!)

To: remember; Mase; Toddsterpatriot

For Bowyer, a chart with five data points, each showing just the first two months of a fiscal year, rates as an exhaustive analysis.Your 2005 data stop short. Your 1980 numbers are off topic. Lets focus just on the article (at humaneventsonline.com) and decide if Bower's main points are valid:

---Laffer curve is correct because zero tax rate = zero revenue, 100% rate = zero revenue, in-between rate makes revenue > zero. [Please stop here if we're not still in complete agreement]

---The 2003 tax cuts preceded increased revenue. This is more clearly seen with the latest treasury numbers that the article featured:

| Federal tax receipts for October and November (the first two months of fiscal 2006) were $288 billion. This is up from the first two months of fiscal 2005 ($271 billion), 2004 ($254 billion), and 2003 ($244 billion). |

To: Ghost of Philip Marlowe

So we raise our tariffs on imports and reduce our income tax. Who pays that tariff? The American consumers when they purchase an import.Or the American consumer can choose to purchase domestic goods tariff free.

They raise tariffs on our exports. We sell less.

The Trade Deficit indicates they're not buying our exports anyway, so who cares?

Besides, they have the sovereign right to determine their own tax policies, why should I care what their consumers pay? Sheeeesh, look at what the Euroweenies pay for gasoline tax! -- as long as I don't have to pay it, it doesn't bother me a bit!

Their economy slows.

Well tough beans for them, I suppose.

I don't care about their economy.

I care about OUR economy.

Our economy slows.

No, our economy is flexible.

The shift in tax policy would revitalize those sectors that make us more independent and self-sufficient.

As Thomas Sowell says, you're in a boat and the guy at the front of the boat shoots a hole in his end -- raising tariffs is like trying to fix the sinking boat by shooting a hole in your end of the boat.

Thomas Sowell isn't much of a sailor.

He's so confused that he doesn't even understand that we're not in the same boat with other nations. Our boat is overburdened by the federal regulatory bureaucracy, and George W. Bush is the one who's shooting a hole in our hull with excessively low tariffs. It's "The Race to the Bottom".

To: Baraonda

From the graph above I read the optimum at a 50% rate.Except for the end points, it is impossible to predict what a Laffer curve will look like. It can only be determined by trial and error and it is constantly changing.

It's sorta like trying to catch a butterfly but only being able to open your eyes for one second every minute.

89

posted on

01/01/2006 7:01:48 AM PST

by

CPOSharky

(Taxation WITH representation kinda sucks too.)

To: Dutch Boy

If the feds collect enough money to fund pork barrel projects then they have collected too much. The less money they have the better.I remember that "starving the beast" was part of W's rationale when he cut taxes '01. To achieve that he should have raised taxes. We have a dichotomy here!

90

posted on

01/01/2006 8:30:42 AM PST

by

chiller

(MSM is more correctly 'OLD Media'. USE IT ! Please !)

To: Willie Green

We should be shifting our tax policy to lower the income tax by increasing the tax on imports. But wouldn't the population in the frontier provinces resort to a kind of whiskey rebellion, threatening the republic, and requiring the use of a show of immense force to quell the disturbance?

91

posted on

01/01/2006 9:50:15 AM PST

by

Simo Hayha

(An education is incomplete without instruction in the use of arms to protect oneself from harm.)

To: CPOSharky; Baraonda

Except for the end points, it is impossible to predict what a Laffer curve will look like. It can only be determined by trial and error...Besides the end points, we also know (without trial or error) that virtually all points between the ends are more than zero, and that they're not all equal, which means that there has to be a maximum point in there somewhere. The way we know whether we're on the right side of the maximum (excessive rates and diminishing returns) is by cutting taxes (we did) and seeing if revenue goes up (it did).

Tell me if I'm missing something, but it sure looks to me that this proves that before the cuts we were over taxed.

To: Simo Hayha

But wouldn't the population in the frontier provinces resort to a kind of whiskey rebellion, threatening the republic, and requiring the use of a show of immense force to quell the disturbance?No, the Whiskey Rebellion was in response to an excise tax (domestic sales tax), not tariffs on imports.

93

posted on

01/01/2006 10:44:53 AM PST

by

Willie Green

(Go Pat Go!!!)

To: muir_redwoods

Giving money to the government is like giving whiskey and car keys to a 15 year-old Kennedy. More appropriate in light of your tag line...

Cheers!

94

posted on

01/01/2006 10:47:15 AM PST

by

grey_whiskers

(The opinions are solely those of the author and are subject to change without notice.)

To: Chuck_101

Additional help

here.

Cheers!

95

posted on

01/01/2006 10:48:54 AM PST

by

grey_whiskers

(The opinions are solely those of the author and are subject to change without notice.)

To: Recovering_Democrat

I seem to recollect that Mr. Laffer endorsed President Clinton, though.

To: Willie Green

First of all, when you reply to me, please don't take every sentence I wrote, copy it, italicize it, and respond to each. I wrote it. I know what I wrote. It does nothing to make your responses seem more logical. It's just irritating and wastes bandwidth on the FR server.

Second, if you can look at the trade between us and our international trading partners and you can not see that we are in the same "economic boat" then there's no discussing this further. It's like you're buying a newspaper from the guy who runs the newsstand and seeing only your purchase and not seeing his sale and then declaring, "this economy of mine is fine. I bought a paper. And that's all that matters." One side of the "free exchange" does NOT an economy make.

Your insult of Thomas Sowell is pathetic. The man is an economic genius of the Milton Friedman variety.

I find it incongruous that on the one hand you want to seal off our trade borders "to balance out the trade deficit" and improve our economy while also acknowledging that it will result in American citizens having to buy only American products, which means not buying any foreign-made products, which means our trading partners won't buy our products....which means trade has been reduced to zero...and then you claim that W. is shooting a hole in the boat because he dares to maintain an unbalanced trade, which is somehow worse than no trade.

Allowing the government to impose tariffs that restrict our freedom to choose, freedom to purchase and invest in what we want, is hardly being a "flexible economy." That is the tactic of the centrally managed economy so adored by Socialists.

Believe me, I'm no free traitor and I'd like our trade deficits to be balanced out. But I don't think pulling a bag over our head and pretending that if we just isolate ourselves everything will be better is the way to go. Not only is unrealistic, I want to be free to do as I please. If I want to buy an umbrella made in England, I shouldn't be punished by the government for making that choice. The Laffer curve proves that if such restrictions are imposed, eventually either the trade will die off or that part of the economy will go underground.

97

posted on

01/01/2006 11:04:29 AM PST

by

Ghost of Philip Marlowe

(Liberals are blind. They are the dupes of Leftists who know exactly what they're doing.)

To: chiller

We have a dichotomy here!No, because even if lowering taxes raises revenues in a strict dollar sense, it still means government has less money compared to everyone else. That means it has less influence over us.

98

posted on

01/01/2006 11:14:11 AM PST

by

inquest

(If you favor any legal status for illegal aliens, then do not claim to be in favor of secure borders)

To: expat_panama

...and seeing if revenue goes up (it did).And why hasn't Bush been shouting that fact from the rooftops at every opportunity?

99

posted on

01/01/2006 11:15:03 AM PST

by

inquest

(If you favor any legal status for illegal aliens, then do not claim to be in favor of secure borders)

To: george76; Clemenza; rdb3

The problem is that liberals and leftists couldn't care less about economic theory. Nor do they really give a damm if the economy improves. They couldn't care less about the standard of living of us peons. To them taxes are a measure of control. The higher the taxes, the greater the control. They would tax at 100% if they could. They would still be in control living like soviet aparatchiks separate and apart from the rest of us. That is why conservatives will never convince liberals with facts. They are simnply not interested in them. They have different goals than we do. We want to improve the economy and our standard of living. They simply want to dictate to the rest of us.

100

posted on

01/01/2006 11:19:17 AM PST

by

Cacique

(quos Deus vult perdere, prius dementat ( Islamia Delenda Est ))

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120 ... 161-170 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

i was only talking about corporations, but... if all private loopholes were closed, with properly adjusted rates, they might not make any difference and not be missed. i'll have to look into it.

i was only talking about corporations, but... if all private loopholes were closed, with properly adjusted rates, they might not make any difference and not be missed. i'll have to look into it.

i was only talking about corporations, but... if all private loopholes were closed, with properly adjusted rates, they might not make any difference and not be missed. i'll have to look into it.

i was only talking about corporations, but... if all private loopholes were closed, with properly adjusted rates, they might not make any difference and not be missed. i'll have to look into it.