Posted on 05/03/2005 12:39:32 PM PDT by Reaganghost

A Million Bucks; and

What Do I Have to Show For It?

I have meticulously tracked my finances in Quicken ever since I got my first computer in 1995. A few days ago, I shared my recent telephone bill experience with the members of FreeRepublic. This article provides a more in depth review of taxes circa the United States, 1995- 2004.

The table below summarizes my experience, but a few explanations are helpful. As a retiree for the entire period, I have not had any debt for more than twenty years, so debt service is not part of this experience. I track all of our spending as taxes, consumption or investment. Years in which our consumption deviates significantly from the mean usually reflect the years in which we purchased cars. My average property taxes run in the neighborhood of 15-20000 per year. On the advice of our CPA, I lumped the property tax payments into a single year so that one year I can itemize and the next year I take the standard deduction. Our 2002 taxes reflect an extraordinary capital gain that was to be married to an extraordinary capital loss, but it turned out that I did not qualify to take the loss at that time. Here is the table:

| Year | Consumption | Taxes |

| 1995 | 28696 | 34938 |

| 1996 | 32261 | 44082 |

| 1997 | 31010 | 25686 |

| 1998 | 27987 | 47914 |

| 1999 | 39002 | 23521 |

| 2000 | 26437 | 47550 |

| 2001 | 24514 | 24156 |

| 2002 | 45737 | 81352 |

| 2003 | 21423 | 35297 |

| 2004 | 24773 | 58475 |

| Totals | 301839 | 422971 |

| Average | 30184 | 42297 |

All of the data is rounded to the nearest dollar. The totals for the chart do not total the million bucks that was advertised, but trust me, the totals in my quicken report for consumption versus taxes totals more than a million. I limited the chart data to the past ten years to make the math simple and the relative percentages do not differ materially.

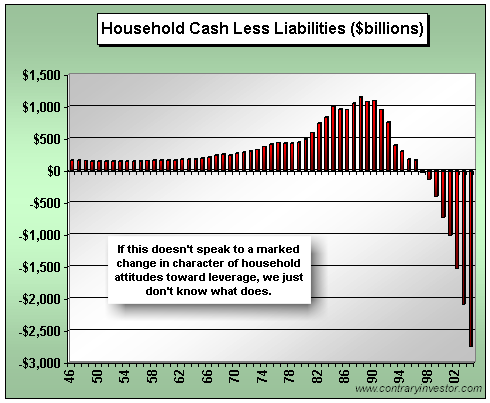

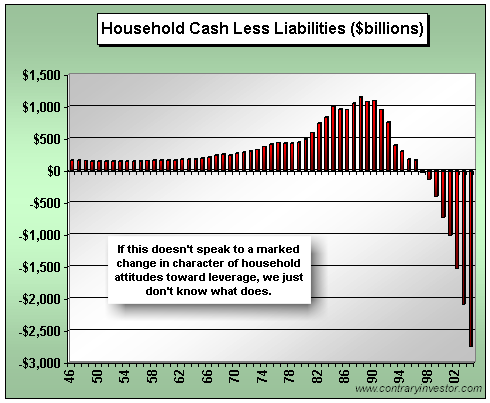

Over the past ten years, governments have taxed me 140% of my average annual consumption. Precisely who are the beneficiaries of the fruits of my productivity, my family or the politicians that use the tax dollars to buy the votes of voters who live at the expense of others? I admit to being rich when measured by commonly used parameters. If you think this is just my problem, here is a terrifying graphic that reflects the experience of all Americans:

Click here to do something about it. Read more about the Reagan Renaissance to find out how you can play an instrumental role in restoring our Constitutional freedoms. President Reagan said, "You and I have a rendezvous with destiny. We will preserve for our children this, the last best hope of man on earth, or we will sentence them to take the last step into a thousand years of darkness." Socialism sent the Soviet Union to the Ash-heap of History where it belongs. The Reagan Renaissance can prevent the United States from suffering the same fate. The collapse of Rome plunged the world into the Dark Ages. Do you remember the old adage about "nothing new under the sun since the Greeks?" Plutarch warned, "The real destroyer of the liberties of the people is he who spreads among them bounties, donations and benefits." The same factors that led to the downfall of Rome are the same ones that led to the fall of the Soviet Union and are now threatening the United States. How about it Freepers, can the "Information Age" prevent us from repeating the mistakes of the past?

Your consumption + taxes is averageing 72,ooo per year? You don't work, and are debt free? There's a whole lot of unanswered questions before I feel too sorry for you.

I don't know about your assumptions re: Property Taxes. I pay almost 6,000/year and my home is probably worth no more than about $480,000, Assuming a similar rate on his home would make it closer to 2 Mill (Maybe less if the tax rate is high) not 20 Mill.

In the 'burbs of Philly, a house worth $650,000 will cost $22k in property taxes.

yep, see 24. Sorry about that.

Hate to say it guys, but in lots of places in this country, a $20,000 property tax bill would not be all that uncommon, and you wouldn't need a $200 million home or anything close to it. I live in the city of Annapolis, Maryland. Somebody in Annapolis with a $3 to $4 million dollar (assessed value) house on the water -- and there are plenty of those -- would be right in that neighborhood. If you bought that house 15 or 20 years ago, you are sitting on a nice slug of equity in today's market. But if you are a boomer looking to live there through the early years of your retirement and then maybe sell it to finance the later years, you better hope there will still be a good supply of folks with plenty of cash around to take it off your hands.

BTW W's 'Tax Cuts' are really another Gov't illusion. The Alternative Minimum Tax, like the Property Tax, assures a continual rise in effective tax rates as wages keep pace with inflation. So I expect we'll be seeing lots of 'Tax Cuts' that really aren't, all in the attempt to foist upon the general public that, somehow, their Gov't is 'Giving' them something.

Nice post. Thank you.

In this land of the free and the home of the brave.

The problem with comparing taxes from state to state is that you are often comparing apples to oranges. I moved from Philadelphia down to Maryland 17 years ago. I was pleasantly surprised at how low my property taxes were in comparison to what I was used to in Philadelphia, but then I finished my first year and paid my Maryland state and county income taxes -- OUCH! The overall tax burden is somewhat higher in Maryland, but not hugely different. It is just that the Maryland tax burden is more heavily weighted toward income taxes, where in Pennsylvania it is more heavily weighted toward property taxes and those hugely annoying personal property taxes. Much as I hate to say anything good about Maryland in the area of taxes, its system is probably kinder to retirees, whose incomes tend to be significantly reduced, but whose property values may still be rising at a significant rate.

Make no mistake, I understand. But to cry over sitting on an untapped 3 to 4 million dollar asset , gets little sympathy from me. ( And I am the biggest 'we pay to much in taxes guy' around). Also the ability to spend 72K in taxes and consumption, would suggest a modest cash flow stream from somewhere.

You are absolutely correct. Right now I'd rather pay less income tax, but I'm sure when (if) I ever retire I'm going to want to have the situation reversed.

Here's an idea: Send me a million dollars and I will tell everyone that you are a great, great guy!

Ahhhh... the AMT, got hit with it once, never again.

Rush cited a statistic that 800 people a day are moving to Florida. Property values can only go up in that environment.

I was recently in Altoona FL and every available bare lot was for sale or sold. Amazing. Surely is no money in this economy...

I see you as a government employee...

You'd make a great politician!

Nope, not a gov't employee.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.