Skip to comments.

A National Sales Tax

Town Hall ^

| March 31, 2005

| George Will

Posted on 03/31/2005 4:42:13 AM PST by CSM

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120 ... 181 next last

To: rwrcpa1

Right well I'd propose giving everyone their SS money back, with interest. If you are 67 today, and have a life expectancy to 80 years, I'd give you 13 years of SS payment in one lump sum. Of course, I would mandate that this money be placed in a lock box of your own, like an IRA, which sets a maximum and minimum withdrawal. This would encourage investment in the economy, protect your retirement money from tomfoolery, take it out of the hands of the government AND prevent all this money from causing inflation.

If you are approaching retirement age, I'd give you all your payments back, with CD rate interest, under the same scenario as above. You must lock it up and protect it, and draw it upon retirement at regular intervals.

If you are younger, I'd give you your SS money back, with interest, under the same restrictions but they will not apply to you after a certain amount of time.

Eventually, say over a 30 year period, the restrictions would slowly (and automatically) strip away so that eventually the entire SS system would be closed and private and secure retirement accounts would be the norm.

That is my Social Security Reform Plan.

To: lewislynn; rwrcpa1; ancient_geezer

Uhh, exactly what are these "other taxes and fees excises " that you maintain will bring this up to 30%?

As I read it, 23% is 23% which translates to $123 on $100.

Enlighten us, please!

CA....

82

posted on

03/31/2005 9:30:15 AM PST

by

Chances Are

(Whew! It seems I've once again found that silly grin!)

To: RockinRight

Read the link I gave you in #77.

83

posted on

03/31/2005 9:30:32 AM PST

by

rwrcpa1

(April 15. Let's make it just another day.)

To: RockinRight

Yes, and no. Taxes on homes could be phased in, and perhaps even an exemption granted for sites that have been planned and approved for development by the cities and states even if the homes were not yet built. This would allow a certain inventory to be planned out in advance to lessen the blow. There is no hard and fast rule with how to implement the NRST and the major hurdles could be buffered to phase in over a reasonable, but hopefully not too long, a time.

Sure, this may cause a deficit in the short run, but I don't see too many congressmen complaining about deficit spending anyway.

To: Chances Are

Tarriffs for one, I guess.

To: Logos124

You're right. Also, illegals, drug dealers, prostitutes, etc. who don't pay taxes now still have to buy bread and milk. Go to PAFairTax.org and find out about the prebate that these people would not receive. Find out how much your state government pays in FICA taxes and you will see how much your state would save in their budget. In Pennsylvania we would save 700 million dollars. The tax would be collected by each state. 47 states already collect sales taxes so they already have the mechanism in place. For their efforts in collecting the tax each state would receive 1/4 of 1% of what they. Each company (Wal-mart)also receives 1/4 of 1% of the taxes they collect.

The FairTax also eliminates all the hidden taxes paid by companies. Remember companies don't pay taxes. They add them on to the price of goods and services. We pay their taxes. Under the FairTax these prices should be reduced by about 24%. You say how do we know prices will come down? I call it the Wal-mart factor. If they can sell something for 24% less they will and everyone else will follow.

If Burger King reduces their prices and the other's don't we'll go to Burger King.

This bill eliminates the IRS.

If you want to make congress aware that we need to pass this HR25 call your representative and request a copy of the bill. Call your senators and request a copy of S25.

86

posted on

03/31/2005 9:37:58 AM PST

by

mombrown1

(The CPAC taxi driver)

To: rwrcpa1

I did, but had only browsed it when I first replied.

I assume that buyers can pay the tax in installments or escrows somewhat like property taxes are done today. If someone refinances they could choose to pay off the whole tax remaining (if they've built enough equity) or continue to escrow it. That could work.

Lower rates could trigger another refi boom-which is good for me (I am a mortgage loan officer).

I still think there will be at least a little tremor, but that makes it look do-able.

Interesting article, thanks.

87

posted on

03/31/2005 9:40:20 AM PST

by

RockinRight

(Electing Hillary president would be akin to giving a drunken teenage boy keys to the Porsche)

To: RockinRight

I assume the tax would just be added to the mortgage and be part of the monthly payment. It is interesting to note that the Associated General Contractors of America has given their formal endorsement to the Fair Tax legislation http://www.worldnetdaily.com/news/article.asp?ARTICLE_ID=22428 26th paragraph down.

88

posted on

03/31/2005 9:52:01 AM PST

by

rwrcpa1

(April 15. Let's make it just another day.)

To: rwrcpa1

89

posted on

03/31/2005 9:54:17 AM PST

by

RockinRight

(Electing Hillary president would be akin to giving a drunken teenage boy keys to the Porsche)

To: Phantom Lord

The power to tax involves, as Chief Justice John Marshall said, the power to destroy. So does the power of tax reform, which is one reason why Rep. John Linder, a Georgia Republican, has a 133-page bill to replace 55,000 pages of tax rules.

The statistic for "55,000 pages of tax rules" comes from the fact that CCH's Standard Federal Tax Reporter is 55,000 pages long. The Standard Federal Tax Reporter is a cumulative record of the Internal Revenue Code (including CCH's commentary). It's a history of every law and rule ever. If the 133 page FairTax was passed and added to the IRC, there would be 55,133 "pages of tax rules."

His bill would abolish the IRS and the many billions of tax forms it sends out and receives. He would erase the federal income tax system -- personal and corporate income taxes, the regressive payroll tax and self-employment tax, capital gains, gift and estate taxes, the alternative minimum tax and the earned income tax credit -- and replace all that with a 23 percent national sales tax on personal consumption. That would not only sensitize consumers to the cost of government with every purchase, it would destroy K Street.

The common way to express sales taxes is the exclusive rate which, for the FairTax, is 29.87%, not 23% (the inclusive rate). To state that the FairTax sales tax rate is 23% without mentioning that that is the inclusive rate or explaining the difference is a lie by omission.

``K Street'' is shorthand for Washington's lawyer-lobbyist complex. It exists to continually complicate and defend the tax code, which is a cornucopia from which the political class pours benefits on constituencies. By replacing the income tax -- Linder had better repeal the 16th Amendment, to make sure the income tax stays gone -- everyone and all businesses would pay their taxes through economic choices, and K Street's intellectual capital, which consists of knowing how to game the tax code, would be radically depreciated.

Anyone who thinks the lobbyists of K Street are just going to pack up and leave if the FairTax is passed is nuts. The first time a little girl dies because her parents couldn't afford the FairTax on her lifesaving surgery, the health-care lobbyists will be out trying to get lifesaving health care exempt. Once the first exemption of this type gets passed, the genie is out of the bottle.

Under his bill, he says, all goods, imported and domestic, would be treated equally at the checkout counter, and all taxpayers -- including upward of 50 million foreign visitors annually -- would pay ``as much as they choose, when they choose, by how they choose to spend.'' And his bill untaxes the poor by including an advanced monthly rebate, for every household, equal to the sales tax on consumption of essential goods and services, as calculated by the government, up to the annually adjusted poverty level.

Stating that the 50 million foreign visitors would pay tax on their consumption while visiting but not mentioning that the ~50 million Americans who visit foreign countries won't be paying U.S. tax while they are out of the country is another lie by omission. Foreign visitors are offset by foreign travel by Americans.

Today the percentage of taxpayers who rely on professional tax preparers is at an all-time high. The 67 percent of tax filers who do not itemize may think they avoid compliance costs, which include nagging uncertainty about whether one has properly complied with a tax code about the meaning of which experts differ. But everyone pays the cost of the tax system's vast drag on the economy.

This paragraph seems OK.

Linder says Americans spend 7 billion hours a year filling out IRS forms and at least that much calculating the tax implications of business decisions. Economic growth suffers because corporate boards waste huge amounts of time on such calculations rather than making economically rational allocations of resources. Money saved on compliance costs would fund job creation.

I believe Linder is using the flawed Arthur D. Little study on compliance from the early 80s. The IRS has since dumped that model and contracted IBM to create a comprehensive system to model compliance costs. The result of their model states that for 2000 individuals spent 3.21 billion hours on tax compliance (and this includes self-employeed persons), no 7 billion.

Corporations do not pay payroll and income taxes and compliance costs, they collect them from consumers through prices. So the 23 percent consumption tax would allow taxpayers to stop paying the huge embedded cost of corporate taxation. Linder says the director of the Congressional Budget Office told him it costs individuals and businesses about $500 billion to remit $2 trillion to Washington. And studies show that it costs the average small business $724 to collect and remit $100.

As has been stated numerous times, the incidence of the corporate tax is impossible to determine precisely but it is most assuredly not fully seen in prices. George Will bought into the "embedded" tax myth.

The $500 billion costs is BS. The stats I've seen put it at ~$200 billion.

In 1945, corporations paid more than one-third of the government's revenues. Now they pay only 11 percent because corporations, especially multinationals, are voluntary taxpayers. In a world increasingly without borders that block capital movements, corporations pay where the burden is lowest. Linder says $6 trillion in offshore accounts would have an incentive to come home under his plan.

"Linder says $6 trillion..." Linder says a lot. I don't believe much of it.

Furthermore, by ending payroll and corporate taxes, America would become the only nation selling goods with no tax component -- such as Europe's value added tax -- in their prices. With no taxes on capital and labor, multinationals would, Linder thinks, stampede to locate here, which would be an incentive for other nations to emulate America. ``This,'' Linder says, ``would unleash freedom around the globe.''

Europe's VAT is no more in prices than the FairTax would be. And multinationals would not stampede to locate here because the FairTax imposes a tax on income earned by foreign corporations and workers. Yup, it's an income tax on foreign entities.

Critics argue that ending the income tax, with its deductibility of charitable contributions, would depress giving. Linder says: Piffle. In 1980, when the top personal income tax rate was 70 percent, a huge incentive for giving, individual charitable contributions were $40.7 billion. In 1986 the top rate was reduced to 28 percent, and by 1988 charitable giving was $86.7 billion. The lesson, says Linder, is that we give more money when we have more money.

Your Nightmare says: Piffle. Linder picked a high-point for his comparison. In the link, look at the spike in giving before the reduction in the top rate and the drop after. So taxes have nothing to do with charitable giving? And what about the fact that charities would be paying the FairTax on their consumption? The real value of a contribution would be reduced 23% under the FairTax.

When Speaker Dennis Hastert published a book last year, he was startled that interviewers were most interested in talking about Linder's bill, which then had 54 co-sponsors. This year Hastert added Linder to the Ways and Means Committee. Linder cheerfully says his bill would reduce Ways and Means to ``a B committee'' by ending the political fun of making the tax code ever more baroque for the benefit of K Street's clients. Bliss.

It had 54 co-sponsors, now it has 29.

To: phil_will1

Ok. I can think outside of the box. I support a flat 15% tax across the board. I think this tax should pay everything, and should be split between federal and local. No property taxes or any other taxes. If it isn't enough money, then we will have to cut programs. Likely? Not with our two party oligarchy spending like drunken sailors and with us sending them back for more every 2 or 6 years.

I stand by my statement that the sales tax won't happen. And that it would create an enormous blackmarket in tax free goods.

91

posted on

03/31/2005 10:49:20 AM PST

by

mysterio

To: rwrcpa1

Actually, the equivalent tax exclusive rate is 29.87%. Otherwise your math is correct. However, under current law I have to earn $148.48 (25% marginal tax rate) to buy the $100.00 item. I would rather earn $130.

Your math is incorrect. With a 25% statutory marginal tax rate you would have to earn $133 to buy a $100 item. And you really should be using an "effective" marginal tax rate instead of a statutory rate.

To: Your Nightmare

93

posted on

03/31/2005 11:14:55 AM PST

by

rwrcpa1

(April 15. Let's make it just another day.)

To: Your Nightmare

Your math is incorrect. With a 25% statutory marginal tax rate you would have to earn $133 to buy a $100 item. And you really should be using an "effective" marginal tax rate instead of a statutory rate.No, your math is incorrect. When you add in the FICA tax $148.48 * (.25+.0765)=$48.48.

The "Marginal" tax rate IS the statutory rate. By "effective" rate I assume you mean tax/total gross income. "Effective marginal" tax rate is not a valid term.

94

posted on

03/31/2005 11:23:27 AM PST

by

rwrcpa1

(April 15. Let's make it just another day.)

To: rwrcpa1

To: Chances Are

Uhh, exactly what are these "other taxes and fees excises " that you maintain will bring this up to 30%?

From the Fair Tax website:

FairTax FAQ

http://www.fairtaxvolunteer.org/smart/faq-main.html#47I know the FairTax rate is 23 percent when compared to current income taxes. What will the rate of the sales tax be at the retail counter? 30 percent. This issue is often confusing, so we explain more here.

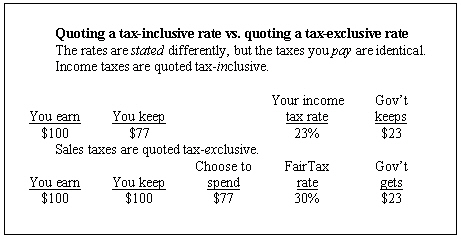

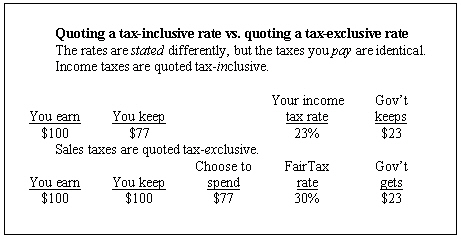

When income tax rates are quoted, economists call that a tax-inclusive quote: “I paid 23 percent last year.” If that were the case, for $100 one earned, $23 went to Uncle Sam. Or, “I had to make $130 to have $100 to spend.” That’s a 23-percent tax-inclusive rate.

We choose to compare the FairTax to income taxes, quoting the rate the same way, because the FairTax replaces such taxes. That rate is 23 percent.

Sales taxes, on the other hand, are generally quoted tax-exclusive: “I bought a $77 shirt and had to pay that same $23 in sales tax. This is a 30-percent sales tax.” Or, “I spent a dollar, 77¢ for the product and 23¢ in tax.” This rate, when programmed into a point-of-purchase terminal, is 30 percent.

Note that no matter which way it is quoted, the amount of tax is the same. Under an income tax rate of 23 percent, you have to earn $130 to spend $100.

Spend that same $100 under a sales tax, you pay that same $30, and the rate is quoted as 30 percent.

Perhaps the biggest difference between the two is under the income tax, controlling the amount of tax you pay is a complex nightmare. Under the FairTax, you may simply choose not to spend, or to spend less.

Figure 4: 23 percent tax-iunclusive vs. 30 percent tax-exclusive

|

96

posted on

03/31/2005 12:03:30 PM PST

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Your Nightmare

So what would you use for my effective marginal tax rate?

97

posted on

03/31/2005 12:08:39 PM PST

by

rwrcpa1

(April 15. Let's make it just another day.)

To: Your Nightmare

Okay, using my 2003 tax return numbers, including income tax and payroll taxes, my family's effective tax inclusive rate was 24.27%. I did not itemize deductions in 2003, BTW. Under the Fair Tax, and using the 2004 prebate table, my effective tax inclusive rate would have been 20.53%, IF I spent everything I made on taxable items. Which I wouldn't, because I give money to charity, I have a mortgage payment, I have my parent loans from my childrens' college, investments and other tax free items I would use my money for.

Tell me why I wouldn't be better off.

98

posted on

03/31/2005 12:31:56 PM PST

by

rwrcpa1

(April 15. Let's make it just another day.)

To: rwrcpa1

Tell me why I wouldn't be better off.

You calculation looks like you are better off but you are assuming the FairTax rate would be 23%. It wouldn't. Lawrence Kotlikoff

has stated that "Simulation analysis and a variety of empirical calculations suggest that the retail sales tax rate needed for revenue neutrality under the Fair Tax, assuming no decline in the real value of government purchases, would be roughly 30 percent when measured on a tax-inclusive basis."

So 30% instead of 23%. You also aren't accounting for the federal taxes you would be paying through your state and local taxes due to the FairTax.

To: Cicero5

I caught the statement about giving some kind of break to low income people. Huh? The consumption allowance is available to everyone, regardless of income.

Bill Gates & Warren Buffett would get it if they filed for it.

100

posted on

03/31/2005 12:54:49 PM PST

by

dread78645

(Sarcasm tags are for wusses.)

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120 ... 181 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson