FairTax FAQ

http://www.fairtaxvolunteer.org/smart/faq-main.html#47I know the FairTax rate is 23 percent when compared to current income taxes. What will the rate of the sales tax be at the retail counter? 30 percent. This issue is often confusing, so we explain more here.

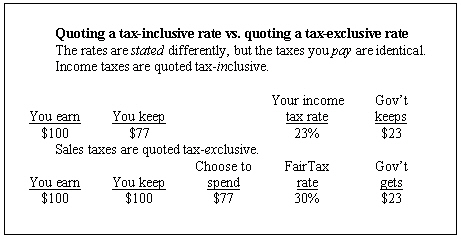

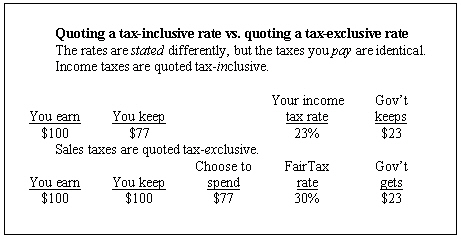

When income tax rates are quoted, economists call that a tax-inclusive quote: “I paid 23 percent last year.” If that were the case, for $100 one earned, $23 went to Uncle Sam. Or, “I had to make $130 to have $100 to spend.” That’s a 23-percent tax-inclusive rate.

We choose to compare the FairTax to income taxes, quoting the rate the same way, because the FairTax replaces such taxes. That rate is 23 percent.

Sales taxes, on the other hand, are generally quoted tax-exclusive: “I bought a $77 shirt and had to pay that same $23 in sales tax. This is a 30-percent sales tax.” Or, “I spent a dollar, 77¢ for the product and 23¢ in tax.” This rate, when programmed into a point-of-purchase terminal, is 30 percent.

Note that no matter which way it is quoted, the amount of tax is the same. Under an income tax rate of 23 percent, you have to earn $130 to spend $100.

Spend that same $100 under a sales tax, you pay that same $30, and the rate is quoted as 30 percent.

Perhaps the biggest difference between the two is under the income tax, controlling the amount of tax you pay is a complex nightmare. Under the FairTax, you may simply choose not to spend, or to spend less.

Figure 4: 23 percent tax-iunclusive vs. 30 percent tax-exclusive

|