Click here: to donate by Credit Card

Or here: to donate by PayPal

Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794

Thank you very much and God bless you.

Posted on 12/18/2025 5:05:46 AM PST by Presbyterian Reporter

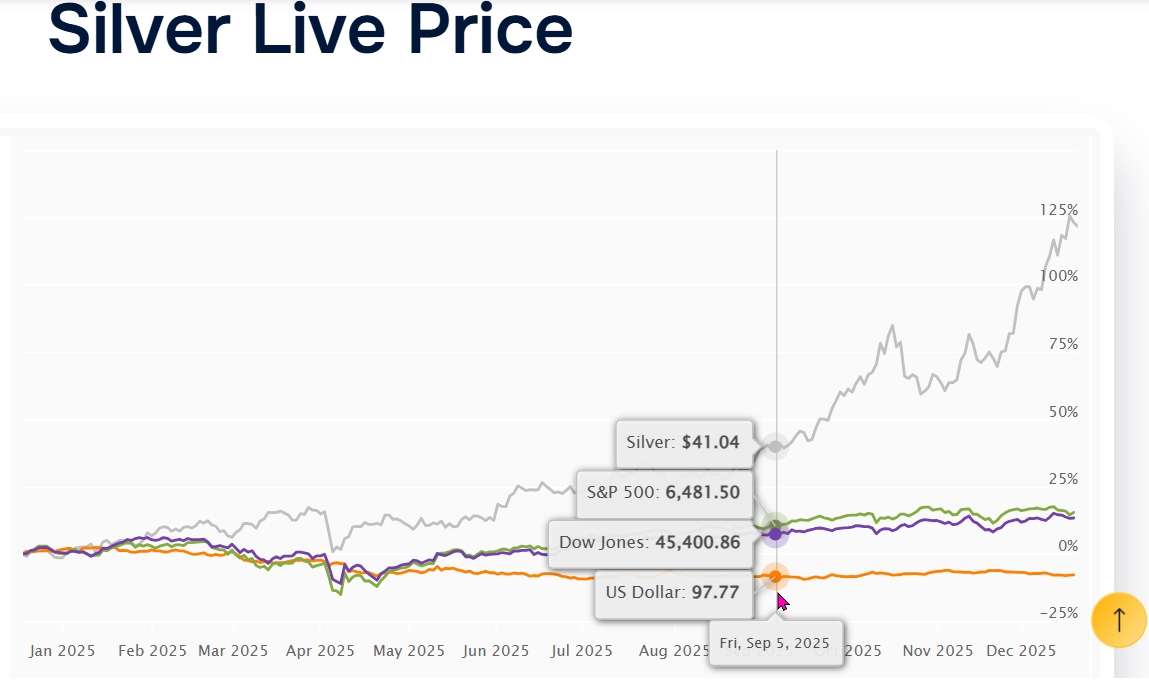

Silver prices surpassed $66 an ounce to a record high Wednesday, while gold firmed as hopes of rate cuts by the U.S. Federal Reserve renewed after signs of a weak labor market, and as escalating U.S.-Venezuela tensions boosted safe-haven demand. Spot silver rose nearly 4% to $66.22 an ounce, after touching an all-time high of $66.88 earlier in the session. "Silver is pulling gold up with it... there is some rotational money going out of gold and into silver, platinum and palladium," said Marex analyst Edward Meir. "$70/oz (for silver) looks to be the next logical target in the short-term." Spot gold gained 0.7% to $4,334.01 an ounce by 01:56 p.m ET (18:56 GMT), after rising over 1% earlier in the day. U.S. gold futures settled 1% higher at $4,373.9. Silver is up 129% this year, outpacing gold, which has notched a 65% annual rise. On Tuesday, data showed a stronger-than-expected increase of 64,000 jobs in the U.S. last month, but the unemployment rate rose to 4.6%, its highest level since September 2021. Weakness in the labor market could increase the likelihood of rate cuts, and in turn benefit non-yielding assets like gold. "Markets continue to see the Federal Reserve cutting its interest rates two times during the first part of 2026, which could continue to support gold over that period," said Bas Kooijman, CEO and asset manager of DHF Capital S.A. Last week, the U.S. Federal Reserve delivered its third and final quarter-point rate cut of the year. Investors are now pricing in two 25-basis-point cuts in 2026. Market now awaits November's Consumer Price Index due on Thursday, and Personal Consumption Expenditures price index on Friday.

(Excerpt) Read more at newsmax.com ...

|

Click here: to donate by Credit Card Or here: to donate by PayPal Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794 Thank you very much and God bless you. |

I know, I have bought many things from them this year. I am in process of buying every silver proof set.

Recently I bought a 1951 proof set. I now have 1951, 1953, 1955-1964, when they went to clad. I am also buying 1992 and later silver prrof sets when they started making them again.

I hope to have all silver proof sets from 1950-1964, and 1992-present by this time next year.

And yes, I do have the sets with the 40% Kennedys also, along with the 40% Ikes.

I even started posting on youtube some of my aquations.

https://www.youtube.com/@packratcollector

I was just coming to post about the Hunt brothers driving silver to $50 back in about 1979-80. You beat me to it.

Adjusted for inflation $66 is not so much.

https://www.in2013dollars.com/us/inflation/1980?amount=1

Looks like it was about $260 in today’s dollars.

Everyone who has Dollars are being hit.

“Silver: Samsung Prepays Mine For 2 Years Supply.”

https://www.zerohedge.com/news/2025-12-17/silver-samsung-prepays-mine-2-years-supply

“GFN – TORONTO: Canadian miner Silver Storm Mining has secured a US $7.0 million prepaid offtake financing facility with Samsung Construction and Trading and two of its subsidiaries to restart operations at its La Parrilla Silver Mine Complex in Durango, Mexico. The agreement, announced October 10, 2025, includes a two-year offtake commitment for all concentrates produced as part of the financing arrangement. First seen and noted by Arcadia today, where Chris Marcus gives some insights into its importance; This news insight gives much credence to the silver supply scramble that is beginning to ensue”

👊🏽🪙

$66 highest ever??

LOL+BS. Silver hit $80+ under Little Jimmy Carter.

Gold COMEX (Feb′26) $4409.50

Gold finally set a new 52 week high on the Feb 26 futures contract today.

While silver has been soaring for the past two months, gold has languished.

Platinum and Palladium are not money.

AI: ( it does not understand the money, wealth differences).

“Platinum was first used as money in Russia, where coins were minted and circulated between 1828 and 1845. Prior to that, it was used in Spanish-colonized America in the 18th century, but its use as a regular currency was impractical.

Early Uses

18th Century: Platinum was first used for minting coins in Spanish-colonized America. However, it was not effectively utilized due to the lack of technology for processing the metal.

Russian Coinage

1828: Russia began minting platinum coins, making it the first country to use platinum as regular national currency.

1845: Russia discontinued its platinum coinage, marking the end of its use as a standard currency.

Other Countries

Since 1983, various countries have minted platinum coins, primarily as bullion coins rather than as regular currency. Examples include the American Platinum Eagle and the Canadian Platinum Maple Leaf.

Platinum’s use as money has been limited and often impractical due to its properties, but it has been valued in various forms throughout history.”

As long as sovereign countries mint coinage in Silver, Gold and Platinum, I consider them Wealth....all their paper currencies are just paper notes that devalues and debases over time.

LOL+BS. Silver hit $80+ under Little Jimmy Carter.

I was in Carters Army and a PM bug back then, never even touched close to $80oz/t.

,,, I've only been buying over the last three or so years after working out the price of everything was going up but not really silver. I could see that commentators who were asserting the market was rigged were right. That was my motivation. Now, if we need to liquidate our holdings it seems dealers aren't buying. I may be holding longer, but I have no need to sell.

“I may be holding longer, but I have no need to sell.”

If I were you, I’d keep buying physical PMs as you can afford to. This run is going to last a good long while, IMHO. And even if it doesn’t, you’ll be better off than when you started. Again, IMHO. ;)

The only other time I’ve sold in the past 20+ years was when Dad needed some additional funds for medical expenses before we were able to get him on Medicaid on top of his Medicare. He had a lousy $10K in an old IRA that had to be ‘spent up’ on his needs only before he would be eligible. (For Medicaid you cannot have more than $2K in assets at any given time).

At that point in time he was no longer driving so no vehicle and was renting not far from me, so I could take care of him every day. He did not want to live with me, which was probably for the best. He said I was too bossy, LOL!

It took a good three years to spend that down - he was stocked up on socks, underwear, slippers, tennies, clothes, canned goods and non perishables for LIFE.

Now I get to spend some $$ on practical & needed items for ME. Livin’ La Vida Loca, Baby! ;)

,,, winner. Good times!!

That's for sure and everyone else is treading water because of that.

.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.