Posted on 10/17/2025 8:16:04 PM PDT by SeekAndFind

Friedrich Merz has called for the creation of a pan-European stock exchange in a move that would help it compete with Asian and US counterparts and eclipse the liquidity offered on London’s ailing bourse.

In an address to parliament in Berlin, the German Chancellor said European businesses need a “sufficiently broad and deep European capital market so they can finance themselves better and faster.

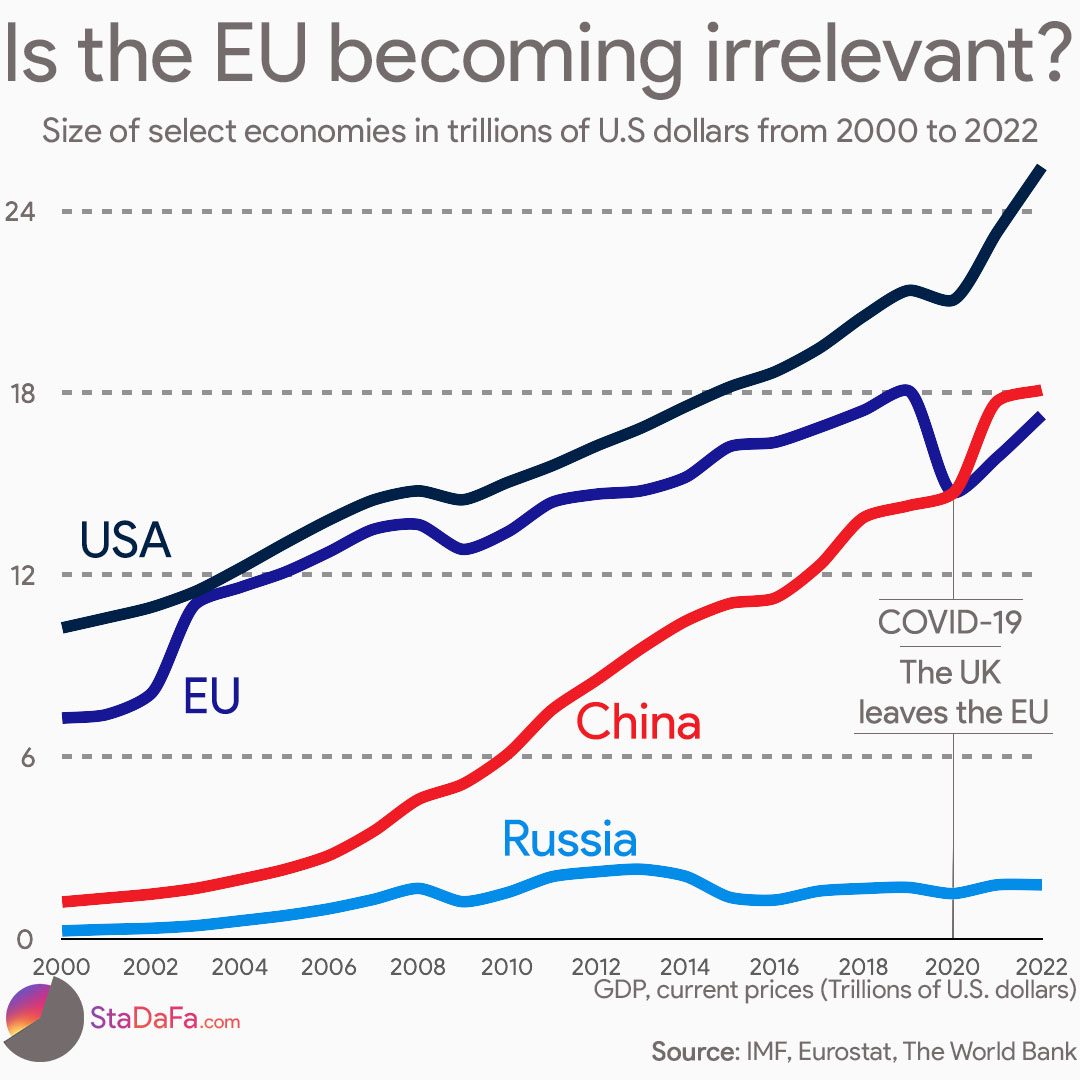

“It is crucial for the future of our country and our countries in Europe that we fulfil these tasks with renewed vigour,” Merz told German lawmakers. “It is about our prosperity and whether Europe will remain a player in the global economy in a few years or become a plaything of major economic centres in Asia and America.”

The remarks from the leader of the Christian Democratic Union reflect growing concerns around the European Union’s competitiveness, and echo findings from a pair of landmark reports from former European Central Bank chief Mario Draghi and ex-Italian Prime Minister Enrico Letta, which proposed a radical overhaul of the continent’s capital markets.

The papers – both published in the last 18 months – called for a radical shake-up of the EU’s single market to encompass equity and commodity exchanges, and for the 27-state bloc to unify its bond markets.

Much like in the UK, a lack of liquidity and stubbornly low valuations has left European bourses struggling to attract and retain some the continent’s fastest growing firms. Swedish buy-now-pay-later firm Klarna listed in New York last month in a blow to both EU lawmakers and the London Stock Exchange. And in his address on Thursday, Merz bemoaned the fact firms like Mainz’s BioNTech SE have chosen to trade their shares in the US over Germany.

(Excerpt) Read more at oilprice.com ...

Any pan-EU stock market would immediately pose a threat to London’s status as the eminent bourse in Europe. The UK capital has faced similarly well-documented challenges to encourage top firms to float in Britain amid an embedded pattern of outflows and falling liquidity relative to its American counterparts.

Does he still own that apartment building in New York City?

GMTA

If the EU doesn’t take care of its “immigrant” problem none of this will matter.

“Eees just so re-deek-u-lous, Fred.”

“Germany’s Friedrich Merz Calls for Unified European Stock Exchange to Rival U.S. and Asia”

well, don’t just “call” for it: snap your fingers, wave your magic wand, build it and see if anyone comes ...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.