Posted on 10/15/2025 7:18:00 AM PDT by delta7

Right now, you can’t sell silver unless it is .999 or .0000 to the refiners. And dealers are paying less than spot for .999 and even less for 90% silver, if they are even buying.

not sure about this story. I went to a silver web site and was told many, many silver products are available. https://www.apmex.com/category/80253/silver-available-products

The current spot price of silver is about USD 47.96 per troy ounce

There is a thread about 3D printed aluminum.

It might make a good conductor for solar panels.

I am seeing silver at around $53 per ounce.

“In Australia, the globally respected Perth Mint has halted all silver product sales,”

False.

I posted the story into ChartGPT and asked it to evaluate. This is a summary of the response:

Overall evaluation: mostly false / exaggerated, with kernels of truth

The central numeric claim ($128/oz raw silver in China) appears to be false or massively exaggerated relative to real-world data.

The general idea that physical premiums can deviate from paper spot pricing, and that tightness and regional stress can ripple outward, is plausible and consistent with known market dynamics (though usually on a much smaller scale).

Many of the sweeping statements about global shortage, systemic collapse of supply in every region, and wholesale defaults are unsupported by credible data and verge on sensationalism.

If I had to rate the claim’s truthfulness: I’d assign it a ~10–20 % credibility—it mixes real tension in physical markets with dramatic exaggeration and speculative leaps.

Remember when the Hunt bros. tried to corner the silver market back in the day. Remember how that turned out.

Why would China do this, aside from the economic chaos it created?

Is there some new technology heavily dependent on silver?

That would make sense from a military point of view.

Buy up all or most of the silver and deny your enemy the advantage....................

“Raw silver is commanding $128 per ounce in China, “

Silver bars $53

https://silverprice.org/silver-price-china.html

I was just looking at JM Bullion. They were buying silver at $0.13 under spot. That’s the best price they’ve had in a long time.

They are paying about $10/oz over spot for gold.

“Right now, you can’t sell silver unless it is .999 or .0000 to the refiners.”

Refiners don’t buy refined silver. They SELL refined silver.

silver spot price is reported at $53.29 per troy ounce, representing a $1.56 increase from yesterday

They are not buying anything less than .999, You can find it yourself all over the internet.

.

Back in 1980, the Hunt Brothers borrowed heavily from the COMEX exchange to buy silver futures on margin. As soon as the COMEX (with prodding from US Treasury) changed their margin requirements, the Hunt Brothers were finished. By the way, Lamar Hunt's son, Clark Hunt, is the present owner of the Kansas City Chiefs football team - so the family is still doing OK.

This time, instead of two rich Texans, its the country of China, which is simply buying up real, physical silver, and don't expect it to ever leave China again, except possibly in the form of computers, solar panels, weapons, etc...

So its a very different situation.

“China....the worlds Wealth is moving from the West to the East, as forecasted.”

Drowning in Debt: is China’s economy the Walking Dead?

https://youtu.be/qdeZcOAj2fo?si=p67VBf51YMQOtYVi

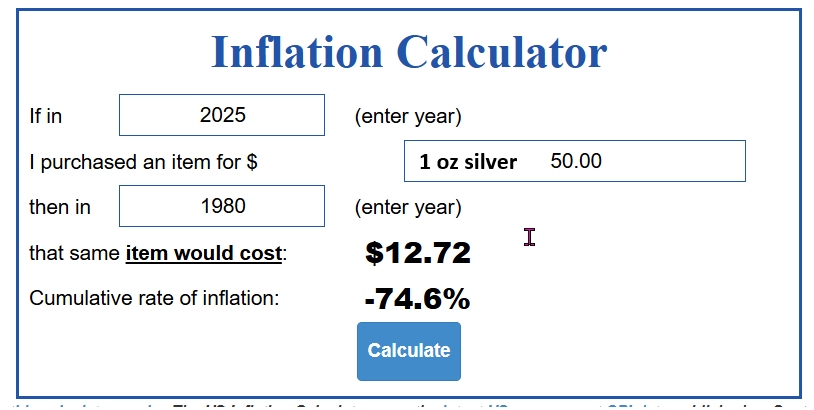

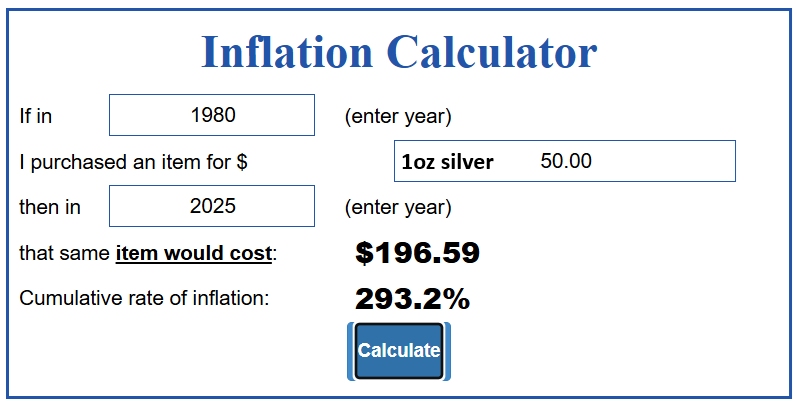

I assume your calculation is based on government-issued CPI figures.

what would the price be if you doubled the government-stated inflation rate?

Just playing it safe so as to not to rile up the US dollar fan base.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.