Research by River

Posted on 08/18/2025 8:33:53 PM PDT by SeekAndFind

Quote of the week: “Bitcoin is a remarkable cryptographic achievement, and the ability to create something that is not duplicable in the digital world has enormous value.” - Eric Schmidt, former CEO and executive chairman of Google.

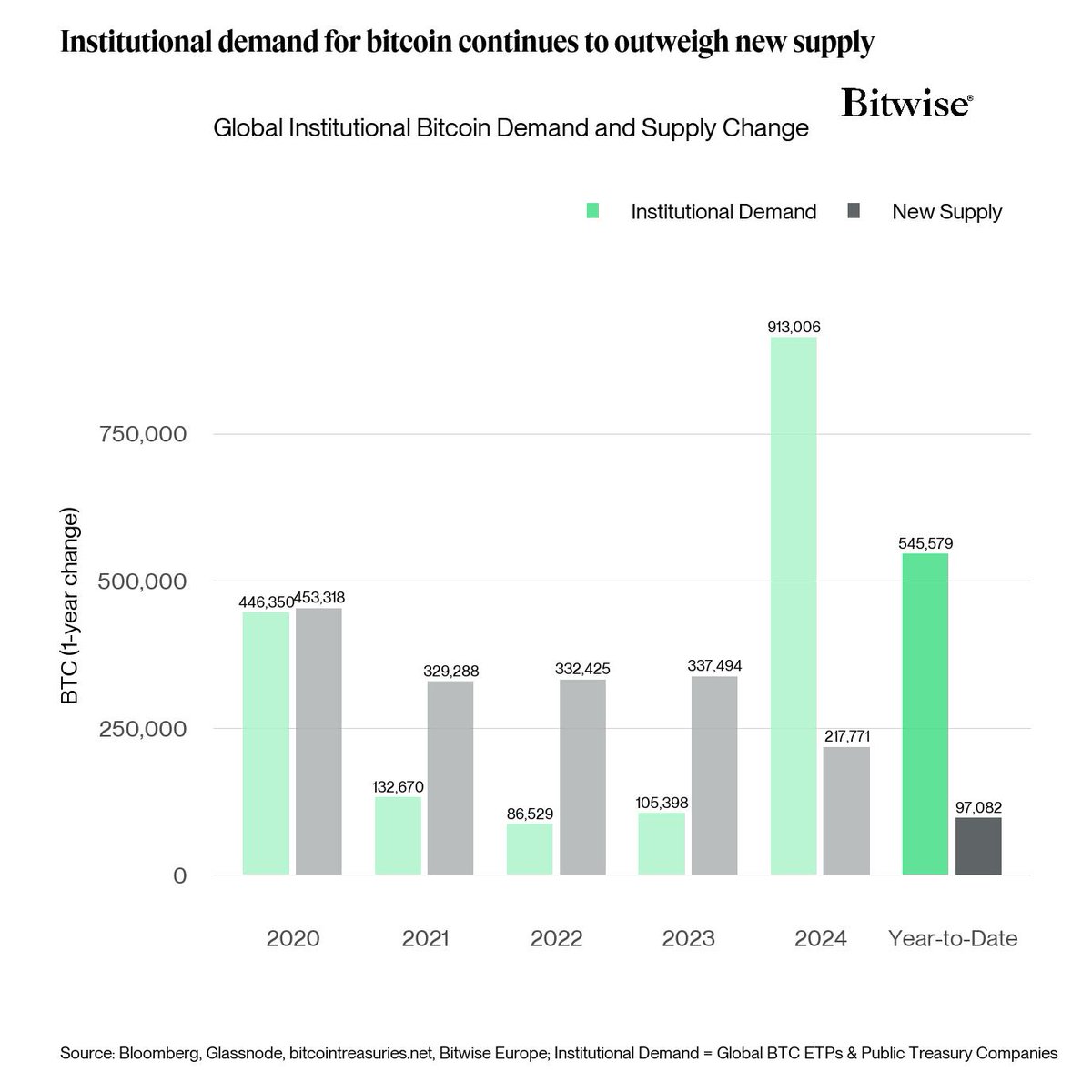

Back in December of last year, we mentioned how institutional adoption of Bitcoin could change the narrative.

It seems that the narrative is playing out.

Since we wrote that piece, we now have endowments, corporations, and the U.S. government openly allocating capital to bitcoin (or at least planning to).

So this week, we’re going to look at the regulatory changes, how adoption has been trending, and one of the risks with the ETFs.

However, it’s sitting at a $2.4 trillion market cap as of this writing, making it the 8th largest currency in the world, just behind the Hong Kong dollar and just ahead of the Taiwan dollar.

In the US, the more favorable regulatory climate and increasing federal budget deficits have probably encouraged investors to review its potential in their portfolio as a store of value and inflation hedge.

Owning a form of money that has a pre-determined supply cap and is decentralized in nature does have its benefits.

Let’s start with what’s changed in the U.S. regulatory landscape.

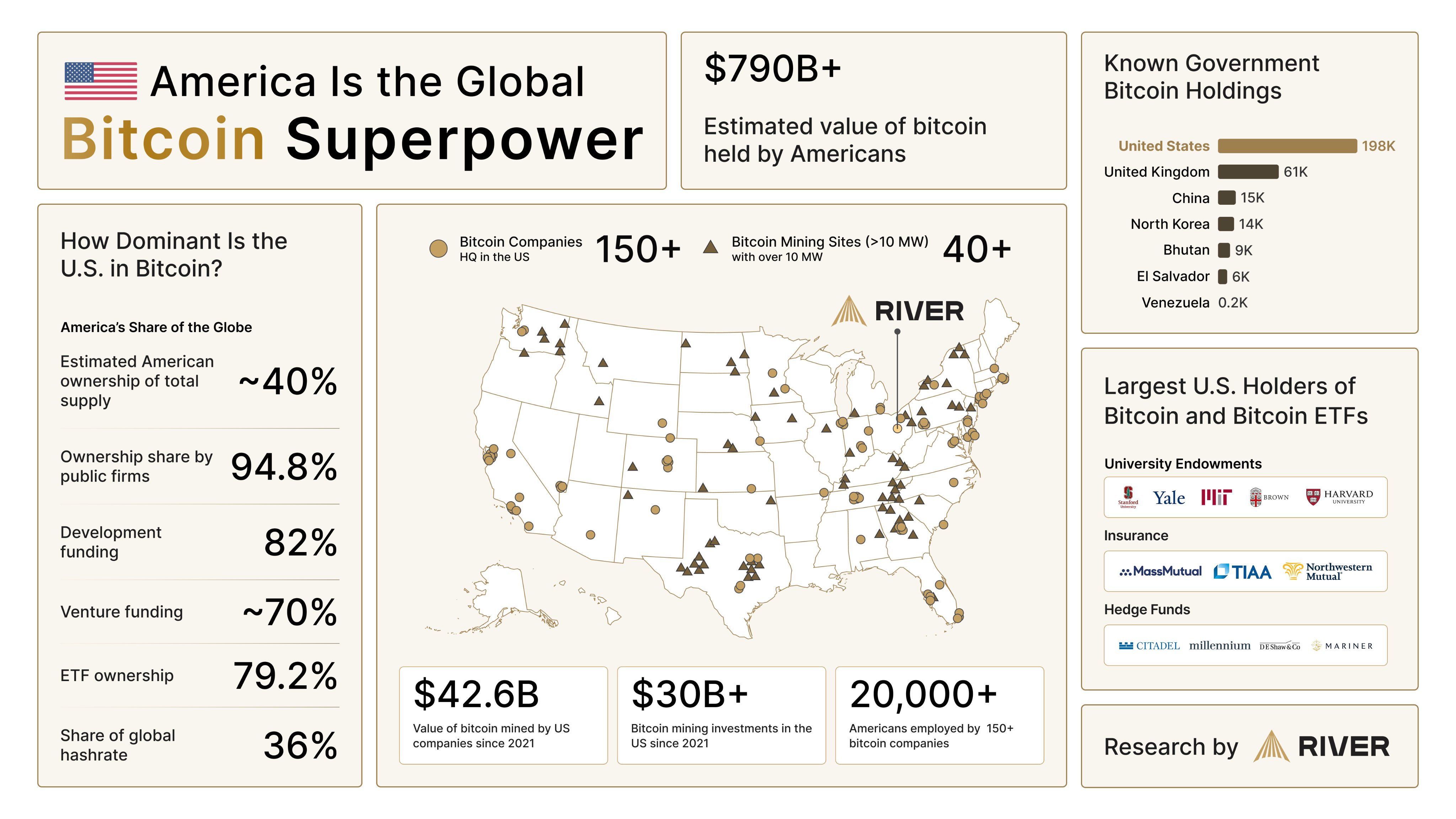

Research by River

The thing to note here is that t he se developments are removing major compliance barriers, giving institutional allocators less cause for concern in adding small Bitcoin positions to their portfolios.

One year ago, the regulatory tone around Bitcoin was “proceed with caution” . Today, with all the above changes, it’s “come on in, the water’s fine.”

And investors are taking that invite. This probably helps explain why the bitcoin ETFs have been the best-performing ETF launches in history.

The performance of the ETFs in just 18 months would indicate as much. The publicly listed players who have issued these ETFs, like BlackRock , Fidelity , Wisdom Tree , Franklin Templeton , and Invesco , will all be happy, some more than others.

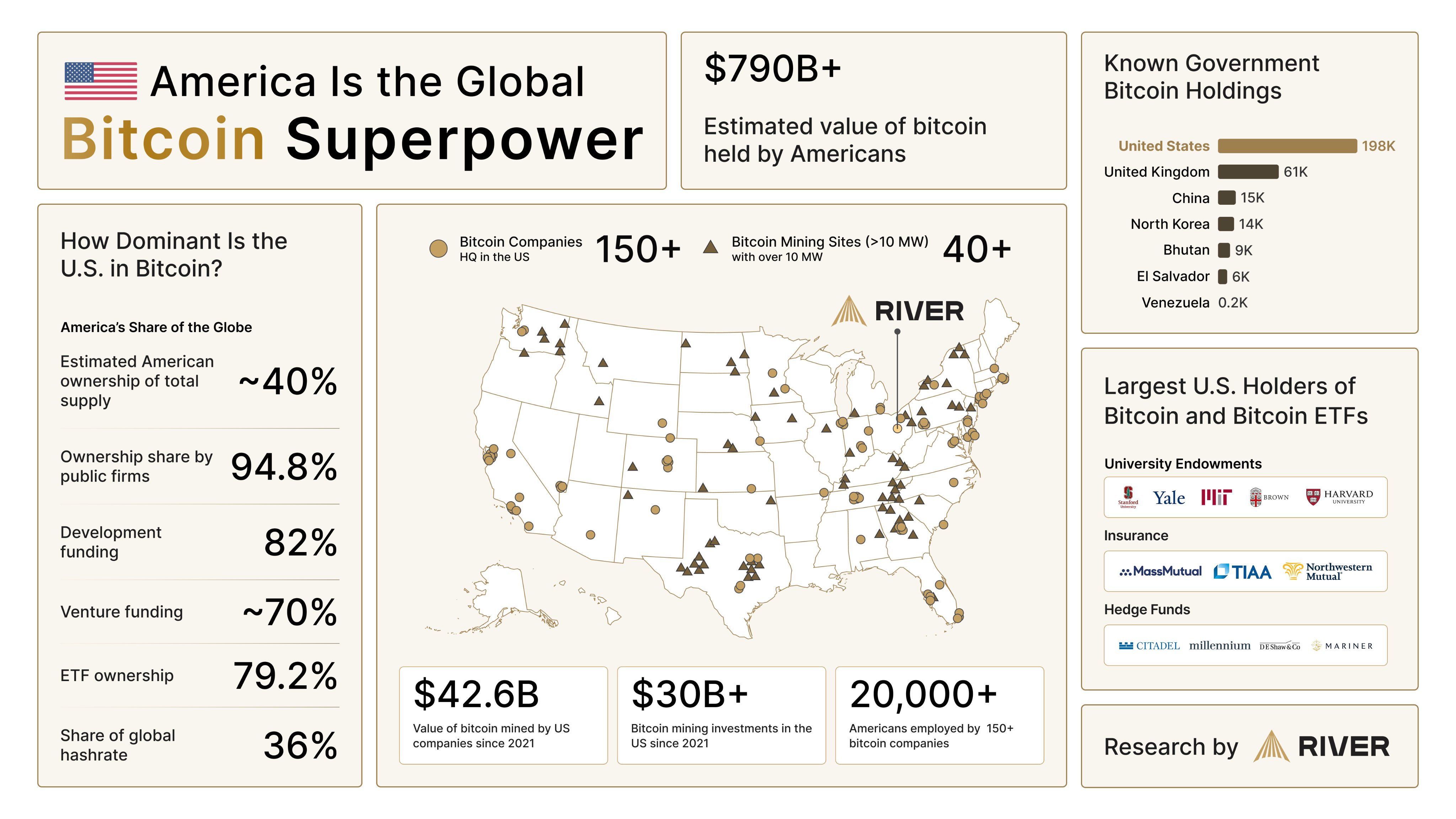

According to Bloomberg’s ETF analyst Eric Balchunas, BlackRock’s IBIT reached $80 billion AUM in just 374 days (by July 11th), which is 5x faster than the next fastest ETFs to hit that threshold. IBIT AUM compared to other successful US ETFs - Eric Balchunas

IBIT AUM compared to other successful US ETFs - Eric Balchunas

A month later, by the 15th of August, it hit $91b in AUM.

He was also a guest on Onramp’s podcast recently, and he listed a few statistics just to emphasise how well IBIT and the other ETFs have performed:

Firstly, these Bitcoin ETFs have transformed Bitcoin’s accessibility to investors.

They provide operational simplicity, deep liquidity, and audit-backed legitimacy without the friction, complexity, or risks of self-custody.

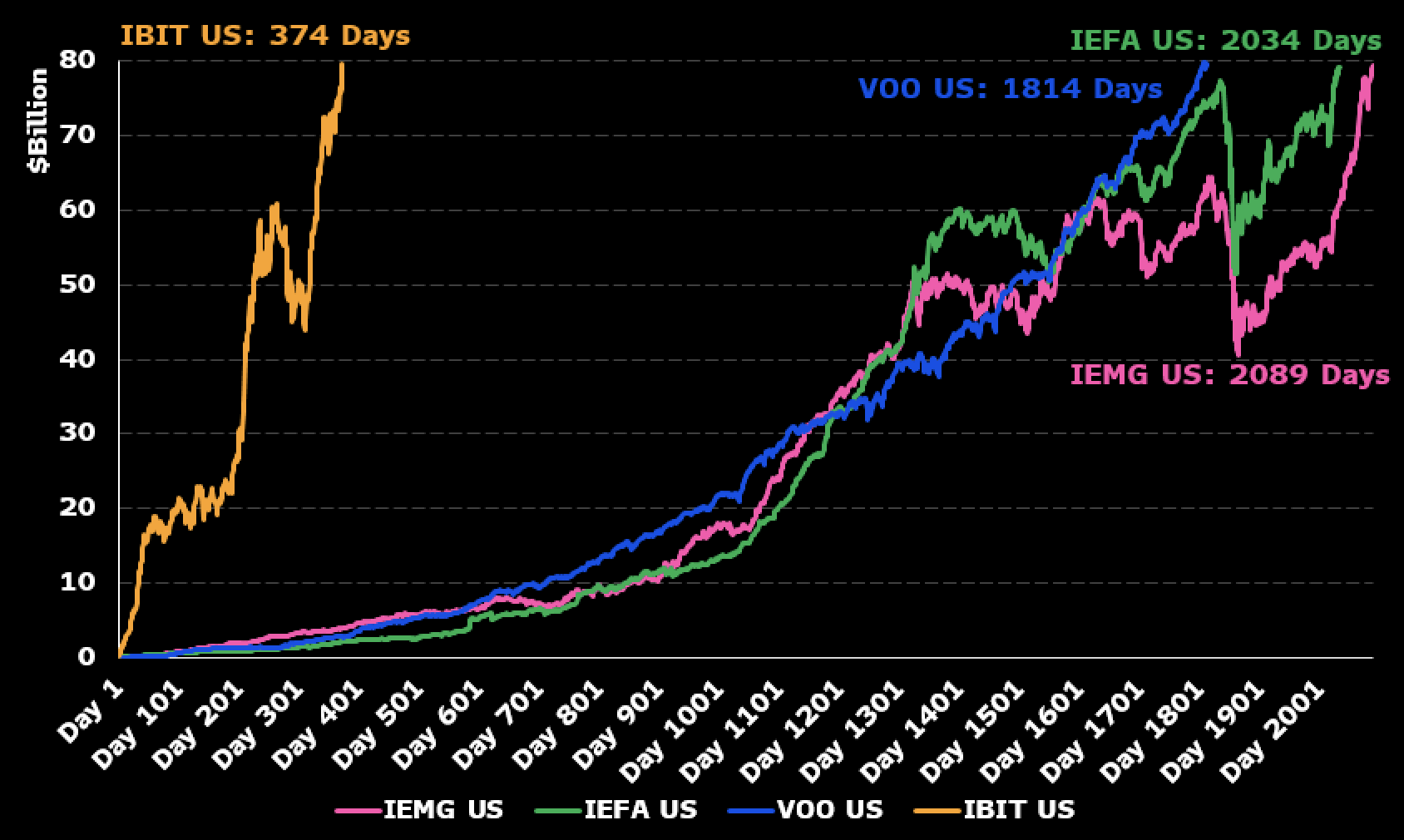

Secondly, institutional investors are clearly interested.

Eric mentioned that big institutions typically move more slowly because they need big volume and legitimacy before they initiate positions. The fact that there are already 1,600 institutional holders after 18 months is impressive.

SOURCE: BITWISE

While some institutions are completely happy owning a security that gives them exposure to the underlying, others want to own the real thing themselves for the many upsides of self-custody. We will talk more about that next week!

Now, while the momentum is bullish for now, we need to point out a pretty large risk present with this trend.

Coinbase Custody is the main player here , holding roughly 81% of ETF bitcoin assets and working with 8 of the 11 U.S. spot Bitcoin ETFs, including heavyweight IBIT .

The rest go their own way:

If Coinbase were hit by a cyberattack, a technical outage, or a legal freeze, multiple ETFs could face delays in rebalancing, redemptions, or coin transfers.

Plus, bitcoin custody isn’t FDIC insured. It relies on private insurance and comes with its own operational quirks.

If something did happen, moving tens of billions to new custodians is no quick swap. It would involve KYC checks, fresh audits, and wallet whitelisting.

Basically, it wouldn’t be an overnight project, and it would put serious doubt in investors' minds about the suitability of these products, or even the bitcoin itself.

Thankfully, it isn’t these custodians' first rodeo, and they’ve taken many measures to minimise them, including:

Where assets are bankruptcy-remote from their main businesses.

Custodians emphasize offline storage, mul ti‑party approval workflows, SOC‑audited controls, and even NYDFS oversight.

So while custodian concentration is a non-zero tail risk , strong legal structures, controls, insurance, and an expanding roster of custodians do help to reduce the probability or severity of losses from custodian-related failures.

Many are treating it similarly to gold in their portfolios. For example, the Harvard endowment is buying both Gold and Bitcoin .

It recently disclosed a position in IBIT, but it also initiated a position in SPDR Gold Trust. The bitcoin position is a 0.2% exposure of their fund, which means it’s “market neutral” (Bitcoin’s market value is 0.2% of global assets).

So if you’re also concerned about inflation or currency weakness, Bitcoin’s value proposition and history make it a compelling exposure.

But remember: Portfolio sizing matters!

If you do decide to add any of the ETFs to your Portfolio , make sure your position sizing makes sense for your financial goals, objectives and risk profile.

For those concerned about the custody risk we mentioned, you can spread your exposure across ETFs like IBIT , FBTC , and HODL because they’re held at different custodians.

If the bulls are right, a small position could help protect against further currency debasement, similar to gold exposure.

If they’re wrong, though, the cost of holding a very small 1–3% position is not catastrophic.

Where are the Tulip barkers?

Was there ever an attempt by the Dutch government to regulate the Tulip market during its time like the government is doing to Bitcoin?

Doubtful

The best part of Bitcoin is that it has multiple framistans in the convergent stream, which allows it to bipramulate the peer-to-peer hyperintensities. Can cash do that??

Can you repeat that in plain English?

In fairness - Tulips did NOT have a 17 year bull market, like Bitcoin did.

On the other hand...

First - why do Bitcoin transactions, recorded in the Block Chain, need to be verified by massive computing power?

Second - what happens when the value of one Bitcoin no longer justifies the huge expense of verifying transactions?

1-thats how it works

2-its pretty much going to be around from now on. Crypto is truly the wild west, capitalism at it’s best and worst. The price will adjust.

It takes roughly 10 minutes to mine and distribute each new Bitcoin.

If it took 10 minutes of massive computer power, plus huge electricity costs, to verify every transaction at my bank, it would be bankrupt in one business day.

Besides personal financial anonymity, I see no other advantages to a Bitcoin economy.

People keep telling me I need to read this book or that book.

If someone like me cannot understand a financial system without reading entire books, that is a huge barrier to general acceptance.

Bitcoin has dropped 10% in value in the last week. What happens if it drops 25%, and "Pool Miners" start turning off their hugely expensive, transaction verifying, computers?

To my eye, this looks like a "Last Man To The Exit Door" enterprise.

Specifically - the only winners will be the guys who convert their Bitcoins to fiat currency - BEFORE the whole thing stops.

My tulip garden is doing great.

Thanks for asking!

Yup—one major problem with Bitcoin is that anyone who owns any now has a conflict of interest if they recommend it to anyone else.

That is one reason I cannot take the Bitcoin pushers seriously.

Time will tell.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.