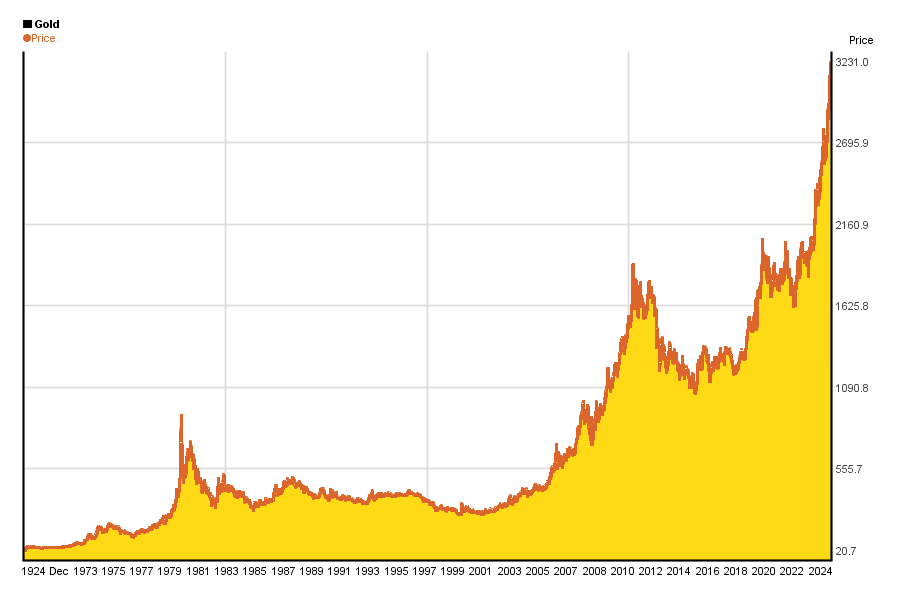

GOLD:

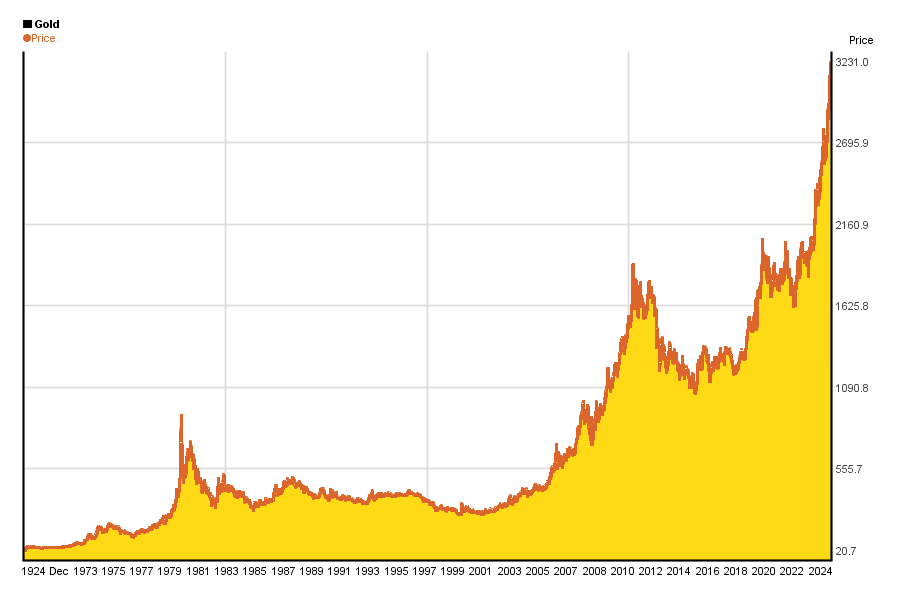

U.S. HOME PRICES:

Posted on 06/12/2025 6:38:21 AM PDT by delta7

The consumer price index rose by 0.1% in May, bringing the annual rate of inflation to 2.4%. Excluding food and energy, the core CPI came in respectively at 0.1% and 2.8%.

Energy prices fell 2% last month, with gasoline experiencing a 2.6% decline that marked nearly a 12% year-over-year decrease. Fuel oil is down 9.6% for the year, but rose slightly by 0.9% on the month. Energy services rose 0.7% MoM and 6.2% YoY. Electricity ticked up 0.9% for the month; 3.6% for the year. Utilities have been experiencing a notable downtick after declining 1% in May and 15.7% for the year.

Food prices rose 0.3% on the monthly and 2.8% annually. Eggs, the media’s favorite item to watch, fell 2.7% for the month but still remain elevated by 41.5% compared to May 2024. Meats, poultry, fish, eggs saw a significant annual increase of 7%. Dairy items are up 1.6% in the past 12 months, and nonalcoholic beverages rose 3.2% in the same period. Food away from home rose 3.9% in the past year, with food at home rising 2% in the same time period. Full service meals and snacks are up 4.3% on the annual.

Shelter is the other major pain point for Americans, with costs rising 0.3% for the month and 4% in the past year. Rentals are increasing by 4% annually, with owners’ equivalent rent rising by 4.3%.

Inflation is still above the Fed’s 2% target. The Federal Open Market Committee will meet next week to discuss rates, a hotly debated topic. Vice President JD Vance lashed out at Fed Chair Jerome Powell for not lowering rates. “The president has been saying this for a while, but it’s even more clear: the refusal by the Fed to cut rates is monetary malpractice,” Vance wrote.

Interest rates are not some magic lever to fix job numbers or inflation. Vance, like many in Washington, is using Powell as a scapegoat for economic issues that stem from decades of fiscal mismanagement, overregulation, and government spending. Six months of a new administration cannot undo decades of failed policies. Moody’s downgraded the nation’s credit score for the first time. Powell must signal that US Treasuries remain a safe haven.

Cut prematurely, and we risk capital flight. Jerome Powell is doing his job in the face of real inflation, which isn’t malpractice. It’s what you do when you want the bond market to keep financing US debt.

If I didn’t eat and never used any electricity, I would be in a very good financial situation, for about 40 days.

To be fair to Trump/Vance, it doesn’t seem fair that all his predecessors get to enjoy the vast flow of free printed money, and they have to fight the resultant headwinds while doing the right things to bring the economy back to some level of success.

Strange seemingly political timing when Powell cut rates 3 times under Biden when the “ Inflation Reduction Act” and wild govt “ spending” was fueling inflation….

I’m not sure what a Fed rate cut would even accomplish when the 10-year Treasury yield is almost 4.5% and these government bonds have had their ratings degraded.

“ is using Powell as a scapegoat for economic issues that stem from decades of fiscal mismanagement, overregulation, and government spending.”

Exactly.

It would greatly reduce the cost of refinancing $9.2 TRILLION in maturing debt needed to be rolled over this summer.

Save taxpayers hundreds of billions!

Hence Trump’s urgency and irritation with Powell

Some goats deserved to be scaped

That only works if the Fed ramps up its "quantitative easing" all over again -- and buys U.S. Treasuries at low rates that no rational investor would ever accept.

Isn't that what got us into this position in the first place?

Would you rather we refi the debt at 5% or 4%?

Inquiring minds want to know.

The refi is due this month I believe

I would rather refinance it at 10% if the alternative is refinancing at 4% where I’m paying the 6% difference through a continuous degradation in the value of the U.S. dollar.

GOLD:

U.S. HOME PRICES:

Please send your suggestions to Scott Bessent and he can adjust the debt upward by half a trillion in spending to accommodate your reasoning.

His goal is a 3.5% rate. The current rate almost 5.5%

To calculate the savings from refinancing $10 trillion of debt from an interest rate of 5.5% to 3.5%, follow these steps:

1. **Calculate the current annual interest cost:**

- Annual interest at 5.5% = $10 trillion × 0.055 = $550 billion

2. **Calculate the new annual interest cost:**

- Annual interest at 3.5% = $10 trillion × 0.035 = $350 billion

3. **Determine the annual savings:**

- Savings = $550 billion - $350 billion = $200 billion

So, refinancing $10 trillion of debt from 5.5% to 3.5% would save the government **$200 billion per year** in interest payments, assuming the full amount is refinanced and no additional factors (like fees or changes in debt terms) are involved

Now ….do your suggested rate of 10%.

“ Some goats deserved to be scaped”

The Feds dual mandate job is price stability and employment .

Not their job to bail out the politicians poor policy choices.

“”The Feds dual mandate job is price stability and employment.

Not their job to bail out the politicians poor policy choices.””

Which is exactly what the Fed did during the past Democrat administrations by keeping interest rates at near zero. Only when “orange man bad” got into the WH have they shown interest in raising rates. Obvious and telling re: their agenda. Fire Powell and get someone in there that can, for a refreshing change, be politically impartial.

It's a ripple effect, difficult to quantify I would imagine.

“”To be fair to Trump/Vance, it doesn’t seem fair that all his predecessors get to enjoy the vast flow of free printed money, and they have to fight the resultant headwinds while doing the right things to bring the economy back to some level of success.””

There is no “fair” with communists and/or their sympathizers running and ruining things. Never has been, never will be. And they would laugh hysterically if you brought up the subject to them.

When the Fed began cutting rates in September 2024, the 30-Year Treasury rate was 137 basis points LOWER than the Fed Funds rate.

Investors have less confidence in the U.S. dollar today than they did a year ago. They aren't going to suddenly gain confidence in the dollar just because the Fed wants them to.

You obviously did not understand post 13.

We’re done and agree to disagree that Trump and Bessent know what they’re doing to push for a fed rate cut.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.