And for irreligious fiscal conservatives (such as who attack Christians for making abortion and LGBTQ a political issue), then there are the

And for irreligious fiscal conservatives (such as who attack Christians for making abortion and LGBTQ a political issue), then there are the

Medicare Part B

$100 doctor bill

$20 patient co-pay

$20 covered by Part B premiums

$60 paid via taxation

doctor pays ~40% marginal 1040 rate

staffers pay ~27% marginal rate

~$33 paid via doctor office earned income taxation

~$27 paid by outside party taxation, including that of corporations

I believe that interest on the debt now consumes 76% of federal revenue. And the rest they mostly waste.

For Medicare Part A, the hospital part, from my profile page:

ENHANCED HOSPITAL SERVICE COMPETITION

To reduce hospital costs, state law would be changed to allow:

1. large hospital complexes and systems to be split up

2. competitive hospitals to be built adjacent to existent hospitals

(if a building purchase request is refused)

3. independent surgical, imaging, lab and nursing care facilities to coordinate

to state law requirements to effectively function as hospitals

Entitlement spending is a form of heroin.

From my profile page [true negotiated drug coverage]:

NEW DRUG PLANS

Federal PPACA exchanges would offer Interstate Class Drug Plans,

exempt from state control, that to be fully federally subsidy eligible must cover at least:

1. 80% of all recombinant drugs by key active entity

(or 100% less the percentages held by the top three domestic rights holders by percentage),

2. 80% of all FDA breakthrough drugs by key active entity

(or 100% less the percentages held by the top three domestic rights holders by percentage),

3. 80% of all drugs covered by a key active entity patent

(or 100% less the percentages held by the top three domestic rights holders by percentage),

4. 90% of all WHO “essential” drugs

Any percentage shortfalls would result in twice the percentage reduction in the federal subsidy amount and must have the word ‘Deficient’ in the drug plan name to at be all federally subsidy eligible.

This system would allow for genuine negotiation between drug plans and drug companies. Drug plans would have an incentive to try to buy drugs from drug companies and drug companies would have an incentive to make deals to make sales.

All drugs would be supplied at on an all-the doctors prescribe basis. The co-pays would be roughly equal to mere manufacturing cost.

The baseline federal drug subsidy would be the average policy holder age (as of the beginning of the policy period) divided by 3 taken as a percent of PPACA baseline subsidy amount for the PPACA household.

EXAMPLE A: For a PPACA household with a 34-year-old, a 36-year-old, and a two-year-old, the baseline federal drug subsidy would be 8% ((34+36+2)/(3*3))% of the PPACA household’s baseline subsidy amount.

EXAMPLE B: For a single PPACA policy of age 60, the baseline federal drug subsidy would be 20% (60/3)% of the PPACA household’s baseline subsidy amount.

How is social security and Medicare an “entitlement program?” I’ve been paying for that shit for 50 years. I’m OWED that money mfers!!

Entitlement my ass.

This is nothing more complicated than politicians buying the votes of the idiots with the idiots’ own money, and ours, too.

It will never be stopped.....unless the money flow dries up.

Art 1 sec 8 has 17 Federal job duties they are allowed to do... Everything else is prohibited.

Paying for your medical bills and providing income “security” are NOT on that list. Fully some 70% of what the FedGov does is not on that list. Only through extreme abuse of the Commerce Clause do they even attempt legitimacy however wrong they are.

We could run the whole government on less than $500B if they stuck to just what they are contractually obligated to do.

I would say to end baseline budgeting but it is probably too late for that. If one of us owed 8 or more times our income and growing we would probably call it bankruptcy.

Gov. spending since 2020: I’ve got your hockey stick right here (or maybe it’s a scythe).

Mr. & Mrs. Alter might have paid $100,000 in school taxes after their kids have finished school.

In return, the kids in the schools funded by those school taxes might pay $100,000 in FICA/SE taxation that gets passed on to Mr. & Mrs. Alter via Social Security.

I remember distinctly an arguments against a single-payer system as being the long wait times and not being able to get what one needed. And it occurs to me that it is happening now with insurance companies.....Health Insurance companies = privatized single payers.

“Tontines enable subscribers to share the risk of living a long life by combining features of a group annuity with a kind of mortality lottery. Each subscriber pays a sum into a trust and thereafter receives a periodical payout. As members die, their payout entitlements devolve to the other participants, and so the value of each continuing payout increases. On the death of the final member, the trust scheme is usually wound up.

“Tontines are still common in France.”

https://en.wikipedia.org/wiki/Tontine

In theory, sicker people die sooner than healthy people, so flatter rate, quite fair combined health coverage/old age tontine coverage might be possible.

Miss Purdy’s Private School

Tuition 2024-2025

$10,000

Parents & child: But we only have $200/month to pay upfront

Miss Purdy: See the middle-age older investors over there.

Mr. & Mrs. Investor:

How about for your $7600, I and my parents promise to pay after I (would) reach age 26, .5% of my income per month, with three other relative backers as listed promising jointly and severely to pay .5% of the then annual tuition per such month as a minimum monthly payment for as long as you live?

Do I really need to add the /s? Money may not be everthing but try living without it. Getting our house in order should be our most pressing issue.

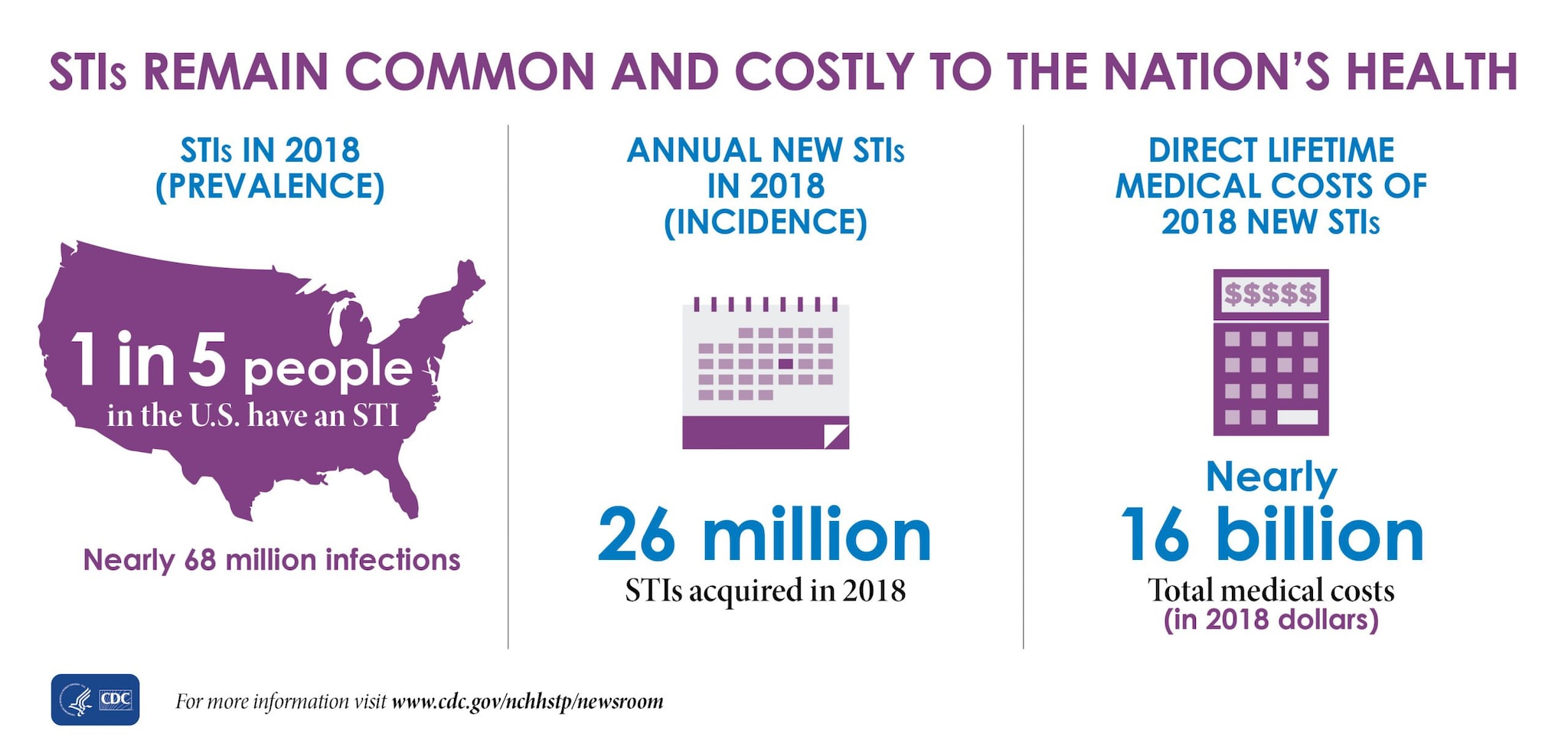

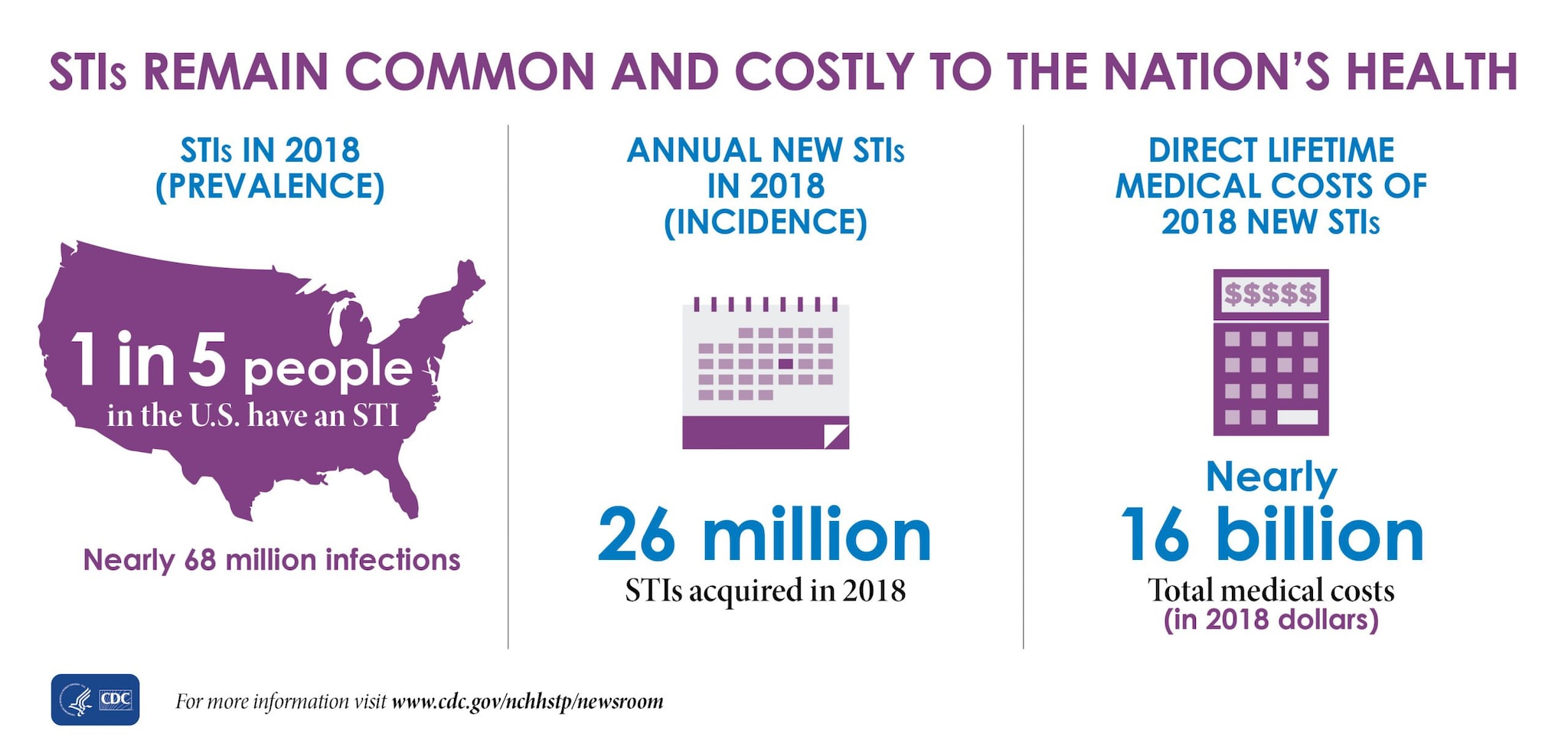

According to recent numbers we are spending $2.78 Trillion on Health Care.

We take in about $450 Billion in Medicare Taxes, the rest is borrowed.

To balance the budget on Healthcare each one of us would need to pay about $6000 a year in Medicare taxes, that doos not include income Taxes.

Now Kamala Harris wants Medicare for all so then we would need about $12,000 per person in Medicare Taxes, i.e. approximately a $14 Trillion dollar budget.

If she got all the giveaways and extras she wants we would be looking a an increase in the National Debt in 4 of between $15 and $20 Trillion, that does not include Reparations.

We cannot afford for Healthcare Costs to go to 25% of GDP, in reality our costs should be about 5% of GDP.

I just heard RFK, Jr say soon half the budget will be going to the federal debt. Sounds bad.