FLT-bird:

"By the way......since the goods landed in Northern ports mostly shouldn't the lack of tariff revenue from Southern ports have been no problem?

Gosh....its almost as if the ports weren't paying the tariff but instead the OWNERS OF THE GOODS were paying the tariff and the owners of those goods were overwhelmingly Southerners....thus the massive drop in revenue." Map posted by DiogenesLamp many times

until he finally realized it doesn't support his argument:

Sadly, that's a lot of nonsense to unpackage; we'll start here:

Sadly, that's a lot of nonsense to unpackage; we'll start here:

- As we can see from the map at right, well over 90% of all tariffs were paid from Union ports like New York, Boston, Philadelphia, Baltimore and San Francisco.

- The 1846 Warehousing Act was proposed by former Texas Sen. Robert Walker, then Southern Democrat Pres. James Polk's (TN) Secretary of Treasury -- along with what became the 1846 Walker Tariff, which was so highly commended by Georgians in their "Reasons for Secession" document.

Walker's Warehousing Act set up bonded warehouses in ports like New York, which allowed unsold import goods to be stored duty free until they were sold.

Once sold, duties were paid and those imports were then shipped anywhere in the country. - There's no evidence that more than a small fraction of US imports shipped to Southerners, for the primary reason that most imports were raw materials for manufacturers, such as wool, cotton, silk and iron.

Other imported consumables -- like sugar, coffee, tea and wines -- would obviously ship to major centers of population, such as New York, Philadelphia, etc. - This table shows 1860 tariff revenues from the top US imports, while noting where those materials were also produced in the US:

TOP 1860 US IMPORT TARIFF ITEMS

| Commodity | 1860 revenue $ | Also US Produced? |

|---|

| Cotton | 6,500,000 | in the South |

|---|

| Brown Sugar | 7,430,000 | in the South |

|---|

| Molasses | 1,800,000 | in the South |

|---|

| Flax & Hemp | 1,728,000 | in the South |

|---|

| Total collected | $17,458,000 | Southern products |

|---|

| ** | | |

|---|

| Woolens | 8,155,000 | in the North |

|---|

| Iron & Iron mfg | 4,458,000 | in the North |

|---|

| Total collected | $12,613,000 | Northern products |

|---|

| ** | | |

|---|

| Silks | 5,589,000 | only China |

|---|

| Coffee | 3,962,000 | only South America |

|---|

| Tea | 1,339,000 | only China |

|---|

| Wines | 1,134,000 | France |

|---|

| Total collected | $12,024,000 | No US made |

|---|

- Finally, "...thus the massive drop in revenue," is more myth than real.

- In 1861 US cotton exports fell by over 80% -- due to Southern secession and Civil War.

- However, by 1862, US merchandise imports fell only about half from 1860 levels.

- Further, from 1860 to 1862, Federal tariff revenues fell by only 12%.

For comparison -- US tariff revenues fell 1/3 after the Panic of 1857. - Compared to their low in 1861, Federal tariff revenues had doubled by 1864 and doubled again by 1866.

FLT-bird:

"No, they reached HIGHER than the Tariff of Abominations.

The Morrill Tariff was the highest in US history and stayed in place for over FIFTY YEARS.

This played a large role in reducing the South from the richest region of the country to the poorest in that time.....exactly as Southern political leaders knew it would when they opposed it." I'm sorry, but -- contrary to what they taught you in propaganda school -- you can repeat and repeat that lie as often as you like, you still can never make it true.

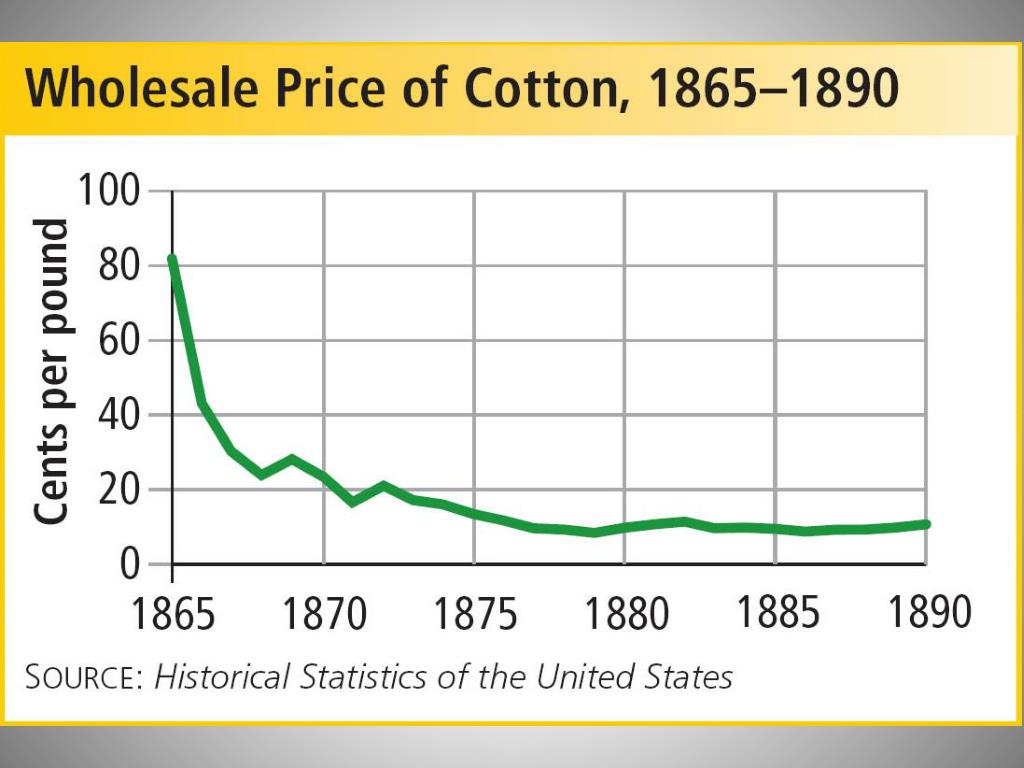

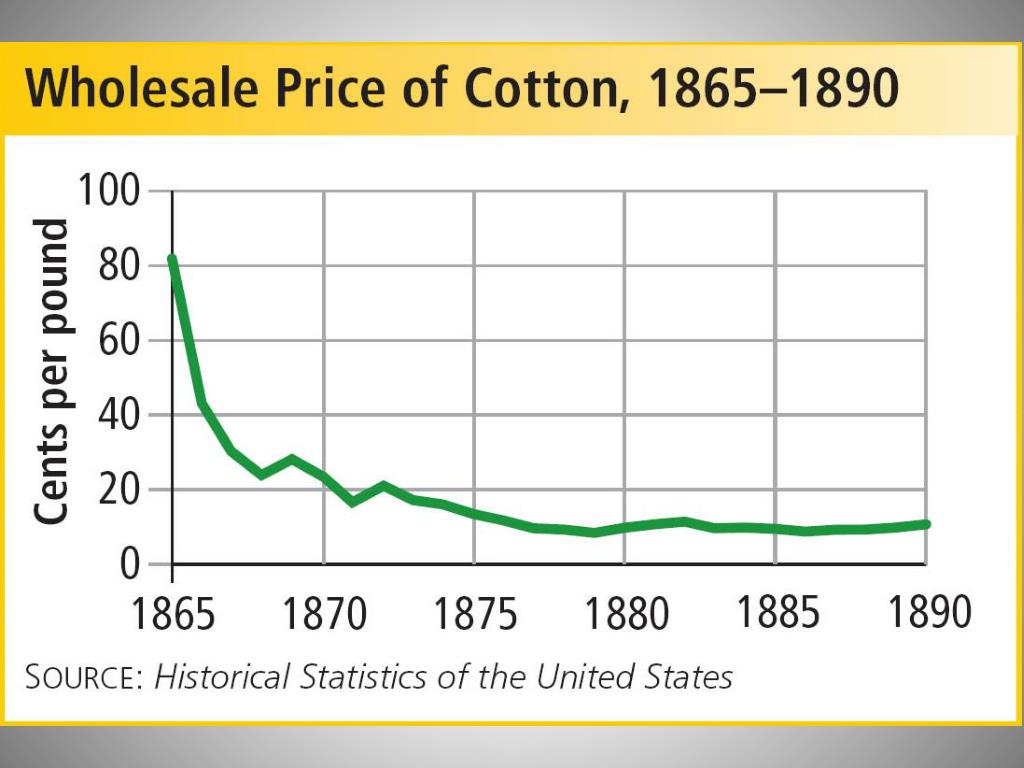

Here is the truth, laid out in graphic form:

Here is the truth, laid out in graphic form:

- First, notice there are two lines on this chart, the blue line is the important one, because it represents the total average tariff rate each year.

- Second, notice both lines reach a peak, nearly 60%, around the 1828 "Tariff of Abominations", then rapidly fall.

- Notice, after the Tariff of 1857, by 1860 the total blue-line rate fell to it's lowest, so far, on this chart of circa 16%.

These were roughly the same levels of Pres. Washington's earliest years. - During the Civil War the total blue-line rate nearly tripled, but never reached levels of the 1828 Tariff of Abominations.

- After the Civil War the total blue-line rate quickly fell back to the 1842 Black Tariff levels.

These levels were thought necessary to Make America Great, Put Americans First and also generate enough revenues to pay down the national war debt. - Also, interesting to notice that during the Democrat administrations of the 1890s (Grover Cleveland), total blue-line tariffs were reduced to roughly levels of the Democrat 1846 Walker Tariff.

- Finally, as to what caused post-Civil War relative Southern poverty -- tariffs were the least of the South's problems and would have been no problem.

He's what did keep the South relatively backward:

- Climate, especially before widespread air-conditioning kept the Northern industrial revolution bottled in the North.

- Health issues like malaria and yellow fever, which helped prevent Northern industries from moving into the South.

- Civil War destruction of physical and financial wealth in the South.

- Statistics!

The average standard of living of a white family in, say, Alabama in 1890 was not necessarily less than a similar family in, say, Pennsylvania, once you've adjusted for different costs of living.

But statistics which included impoverished blacks, and did not adjust for costs of living, made it look like Alabamians were much poorer. - Falling cotton prices after 1865.

- Agricultural issues such as boll weevil and exhausted farmland.

Bottom line: after 1865, US tariff rates were the very least of the South's problems.

FLT-bird: "Straight from wikipedia if anybody cares to look: 'The tariff inaugurated a period of continuous protectionism in the United States, and that policy remained until the adoption of the Revenue Act of 1913, or Underwood Tariff.

The schedule of the Morrill Tariff and both of its successors were retained long after the end of the Civil War.'

"Though this is hardly a definitive source, the general thrust here is undeniable.

It is exactly as I said above.

Starting with the Morrill Tariff, Tariff rates remained very high until passage of the 16th amendment allowed the federal government to impose an income tax in 1913."

Well, then, far be it from me to dispute Wikipedia, especially since I use their numbers myself whenever I can. 😂

Not!

We're obviously looking at a "glass half full vs. glass half empty" situation.

The graph I posted above clearly shows what average US tariff rates were since 1820, and it shows total blue-line rates reduced drastically after 1870, even returning to pre-Civil War levels briefly during the 1890s.

FLT-bird: "Nope!

Its completely true and furthermore everyone can see that its completely true.

The Confederate Constitution did not allow a protectionist tariff - only a tariff for revenue which was universally understood to never be more than 10%."

Your words, "universally understood" and "everyone can see" can't mask the fact that you are using the same ad populum argument as "everyone knows".

In reality, such arguments mean what follows is just your own concoction, with no supporting data.

Here, yet again, is the truth of this: This March 15, 1861 act of the Confederate Congress puts average tariff rates at 15%, not 10%.

There was never an act proposed or enacted in the Confederacy which would further reduce average rates to 10%.

FLT-bird: "So you're saying due to having to fight a war of national survival forced on them by the Lincoln administration, the Confederate Government jacked tariff rates up to raise additional revenue???? Shocker!"

Those sound like your words to me.

I'm simply saying that your alleged 10% tariff rate, which supposedly "everyone knows", is pure fantasy.

The reality was 15% at best, or roughly the same rates as the US Tariff of 1857, with the CSA 15% rate passed on March 15, 1861 -- well before any military conflict between USA and CSA.

FLT-bird: "Sorry but the denial is simply an unfactual pack of lies.

The historical records make quite clear that the vast majority of federal subsidies went to the Northern states, not the Southern states."

Naw... the fact is that outside the babblings of some Southern politicians, you have not a single fact to confirm such claims.

What both logic and available data suggest is that Federal spending was balanced out pretty well according to each region's congressional representations, such that any serious claims in one Congress were addressed in the next.

FLT-bird: "Not all Democrats were Southern.

Northern Democrats were often as motivated to support the federal pork going to their districts as Northern Republicans were.

And yes, the vast majority of federal expenditures went to the Northern states."

Now you're just ignoring the facts -- from the beginning in the 1790s, Southerners dominated their Democrat party.

While Northerners frequently switched parties -- from Federalists to Democrats, to National Republicans, to Whigs, to Republicans -- Southern Democrats remained in control of their Democrat party until they walked out in 1861.

And despite your constant repetitions of the claim alleging disproportionate Federal expenses "in the North", you cannot present a single fact to support it.

FLT-bird: "This is so much nonsense.

The push to raise tariff rates was about protectionism much more than about raising revenue for the federal government.

Northern manufacturers stood to benefit directly from high tariff rates."

All US tariffs -- even the first one in 1789 -- were protectionist, including protection for Southern products like tobacco, cotton and rice.

The only question is what exact rates were necessary to fund Federal expenses, and the Southern Democrats' Tariff of 1857 proved itself inadequate for Southern Democrats' profligate Federal spending.

Ergo, the proposed Morrill Tariff in 1860.

BroJoeK: Sadly, that's a lot of nonsense to unpackage; we'll start here: As we can see from the map at right, well over 90% of all tariffs were paid from Union ports like New York, Boston, Philadelphia, Baltimore and San Francisco.There certainly is a lot of nonsense to unpackage.They may have been paid FROM union ports but they were paid BY Southerners who owned the goods.

BroJoeK: The 1846 Warehousing Act was proposed by former Texas Sen. Robert Walker, then Southern Democrat Pres. James Polk's (TN) Secretary of Treasury -- along with what became the 1846 Walker Tariff, which was so highly commended by Georgians in their "Reasons for Secession" document. Walker's Warehousing Act set up bonded warehouses in ports like New York, which allowed unsold import goods to be stored duty free until they were sold. Once sold, duties were paid and those imports were then shipped anywhere in the country. There's no evidence that more than a small fraction of US imports shipped to Southerners, for the primary reason that most imports were raw materials for manufacturers, such as wool, cotton, silk and iron. Other imported consumables -- like sugar, coffee, tea and wines -- would obviously ship to major centers of population, such as New York, Philadelphia, etc.

You're still clinging to the false notion that somehow the port or the city - presumably out of the goodness of their hearts? - is going to pay the tariff. No. The owner of the goods pays the tariff. It does not matter where he sells them. He has to pay the tariff.

If Target has a shipload of cheap Chinese crap, they have to pay the tariff whether than ship lands in Long Beach, CA or NYC. It doesn't matter. The city does not pay. The state does not pay. The customers in the locality do not pay the tariff (directly). Target is the one who has to pay. Why? They own the goods. It worked the same way back then. You seem determined not to understand this.

BroJoeK: Finally, "...thus the massive drop in revenue," is more myth than real. In 1861 US cotton exports fell by over 80% -- due to Southern secession and Civil War. However, by 1862, US merchandise imports fell only about half from 1860 levels.

LOL! They were importing all kinds of war materials and racking up debt to pay for it.

BroJoeK: Further, from 1860 to 1862, Federal tariff revenues fell by only 12%. For comparison -- US tariff revenues fell 1/3 after the Panic of 1857. Compared to their low in 1861, Federal tariff revenues had doubled by 1864 and doubled again by 1866.

See above. What do US exports look like during these years? Oh I see.

BroJoeK: I'm sorry, but -- contrary to what they taught you in propaganda school -- you can repeat and repeat that lie as often as you like, you still can never make it true.

Obviously you never learned that lesson because you keep repeating your lies hoping that will somehow make them true. It won't.

BroJoeK: t, notice there are two lines on this chart, the blue line is the important one, because it represents the total average tariff rate each year. Second, notice both lines reach a peak, nearly 60%, around the 1828 "Tariff of Abominations", then rapidly fall. Notice, after the Tariff of 1857, by 1860 the total blue-line rate fell to it's lowest, so far, on this chart of circa 16%. These were roughly the same levels of Pres. Washington's earliest years. During the Civil War the total blue-line rate nearly tripled, but never reached levels of the 1828 Tariff of Abominations. After the Civil War the total blue-line rate quickly fell back to the 1842 Black Tariff levels.

The Morrill Tariff raised the average dutiable ad valorem tax on imports from just under 20 percent in 1860, regulated by the low-tariff 1857 Act, to an average of over 36 percent in 1862, with dutiable rates scheduled to go to 47 percent within three years. First page of a Google search. It was that easy to find.

more

In 1860, the South accounted for almost 82 percent of U.S. export business. 5 Over 58 percent was from cotton alone. 6 The South was largely dependent, however, on Europe or the North for the manufactured goods needed for both agricultural production and consumers. U.S. tariff revenues already fell disproportionately on the South, accounting for over 83 percent of the total, even before the Morrill Tariff. Furthermore, the population of the South was less than half that of the North. Still more galling was that 75 to 80 percent of these tax revenues were expended on Northern public works and industrial subsidies, thus further enriching the North at the expense of the South.

https://www.timesexaminer.com/mike-scruggs/8856-the-morrill-tariff

BroJoeK: These levels were thought necessary to Make America Great, Put Americans First and also generate enough revenues to pay down the national war debt.

By "make America Great and Put Americans First" you of course mean Make the North Great and put Northerners first.

BroJoeK: Finally, as to what caused post-Civil War relative Southern poverty -- tariffs were the least of the South's problems and would have been no problem. He's what did keep the South relatively backward: Climate, especially before widespread air-conditioning kept the Northern industrial revolution bottled in the North. Health issues like malaria and yellow fever, which helped prevent Northern industries from moving into the South. Civil War destruction of physical and financial wealth in the South.

Laughable to try to simply waive away the exact thing - high tariffs - which had caused so much economic damage to the Southern states in the 1820s and which the Southern states seceded to avoid in 1860-61.

BroJoeK: Falling cotton prices after 1865.

That was a factor and was going to be a factor no matter what. The reality is that all commodities decreased in relative price during the late 19th and early 20th centuries. Still, given the high earnings of cotton and other cash crops, an Independent South would have had the time and money to industrialize at a much faster pace. You are wrong by the way to say climate hindered industrialization in the Southern states. The States of the Upper South were already industrializing to a significant degree by 1860. That's what was starting to kill off slavery there just as it did elsewhere.

BroJoeK: Bottom line: after 1865, US tariff rates were the very least of the South's problems.

Bottom line, that's ridiculous. It was among the very greatest of their problems.

BroJoeK: Well, then, far be it from me to dispute Wikipedia, especially since I use their numbers myself whenever I can. 😂 Not! We're obviously looking at a "glass half full vs. glass half empty" situation. The graph I posted above clearly shows what average US tariff rates were since 1820, and it shows total blue-line rates reduced drastically after 1870, even returning to pre-Civil War levels briefly during the 1890s.

And I've posted several different sources which say something very different from your graph - namely, that the Morrill Tariff was the highest in US History.

BroJoeK: Your words, "universally understood" and "everyone can see" can't mask the fact that you are using the same ad populum argument as "everyone knows". In reality, such arguments mean what follows is just your own concoction, with no supporting data.

Again this took no time to refute

"As long as, the import tax was ten percent or less it was classified as a “revenue tax” to which the South did not object. In fact, the new Confederate Constitution adopted in March of 1861, placed a maximum tax on imports of ten percent. However, when an import tax or tariff exceeded ten percent, it became known as a “protective tariff” for the protection of domestic (Northern) industry."

Furthermore it seems rather strange that several Northern sources reacted in horror that the Confederate Constitution set the tariff rate so low - directly contrary to what you are trying to claim.

On 18 March 1861, the Boston Transcript noted that while the Southern states had claimed to secede over the slavery issue, now "the mask has been thrown off and it is apparent that the people of the principal seceding states are now for commercial independence. They dream that the centres of traffic can be changed from Northern to Southern ports....by a revenue system verging on free trade...."

[the North relied on money from tariffs] “so even if the Southern states be allowed to depart in peace, the first question will be revenue. Now if the South have free trade, how can you collect revenues in eastern cities? Freight from New Orleans, to St. Louis, Chicago, Louisville, Cincinnati and even Pittsburgh, would be about the same as by rail from New York and imported at New Orleans having no duties to pay, would undersell the East if they had to pay duties. Therefore if the South make good their confederation and their plan, The Northern Confederacy must do likewise or blockade. Then comes the question of foreign nations. So look on it in any view, I see no result but war and consequent change in the form of government. William Tecumseh Sherman in a letter to his brother Senator John Sherman 1861.

“Let the South adopt the free-trade system and the North’s commerce must be reduced to less than half of what it now is.” Daily Chicago Times Dec 10 1860

BroJoeK: Here, yet again, is the truth of this: This March 15, 1861 act of the Confederate Congress puts average tariff rates at 15%, not 10%. There was never an act proposed or enacted in the Confederacy which would further reduce average rates to 10%.

Here is the truth of this: when the largest army in the world is right on your border threatening to invade and you are thus forced to fight a war of national survival, you too will do whatever you can to raise money and resources with which to defend yourself during the emergency. So would anybody.

BroJoeK: Those sound like your words to me. I'm simply saying that your alleged 10% tariff rate, which supposedly "everyone knows", is pure fantasy. The reality was 15% at best, or roughly the same rates as the US Tariff of 1857, with the CSA 15% rate passed on March 15, 1861 -- well before any military conflict between USA and CSA.

I'm saying that your claims are pure fantasy. A revenue tariff was considered anything up to 10%. Oh and

"The Confederate Constitution outlawed protectionist tariffs altogether, calling only for a modest “revenue tariff” of ten percent or so."

https://www.lewrockwell.com/2017/11/thomas-dilorenzo/the-causes-of-the-civil-war-in-the-words-of-abraham-lincoln-and-jefferson-davis/

BroJoeK: Naw... the fact is that outside the babblings of some Southern politicians, you have not a single fact to confirm such claims.

Yeah. I've already provided ample evidence to show this. Your denial is just a lie.

BroJoeK: What both logic and available data suggest is that Federal spending was balanced out pretty well according to each region's congressional representations, such that any serious claims in one Congress were addressed in the next.

ROTF! A ridiculous like countered by commentators and newspapers on both sides as well as by economists who have looked at the issue.

BroJoeK: Now you're just ignoring the facts -- from the beginning in the 1790s, Southerners dominated their Democrat party. While Northerners frequently switched parties -- from Federalists to Democrats, to National Republicans, to Whigs, to Republicans -- Southern Democrats remained in control of their Democrat party until they walked out in 1861.

Now you're trying to ignore what I said. I did not say Southern Democrats did not in fact dominate the Democrat Party. What I said was that there were Northern Democrats too AND they were as likely as Republicans to support federal pork going to their districts.

BroJoeK: And despite your constant repetitions of the claim alleging disproportionate Federal expenses "in the North", you cannot present a single fact to support it.

I've provided numerous comments from politicians on both sides as well as newspapers on both sides. You're just lying here as usual.

BroJoeK; All US tariffs -- even the first one in 1789 -- were protectionist, including protection for Southern products like tobacco, cotton and rice.

Laughable since Southern products did not need protection. The US or more specifically the South was a huge net exporter of those goods. The North meanwhile exported very little.

BroJoeK: The only question is what exact rates were necessary to fund Federal expenses, and the Southern Democrats' Tariff of 1857 proved itself inadequate for Southern Democrats' profligate Federal spending.

Except it wasn't Southern Democrats who spent so profligately. It was Republicans and Northern Democrats. Overwhelmingly directing the federal pork to their districts in the North.

BroJoeK: Ergo, the proposed Morrill Tariff in 1860.

See what it says on the bottom there? It wasn't about raising revenue. It was about protectionism. This was the Republicans' 1860 campaign poster.

Sadly, that's a lot of nonsense to unpackage; we'll start here:

Sadly, that's a lot of nonsense to unpackage; we'll start here:  Here is the truth, laid out in graphic form:

Here is the truth, laid out in graphic form: