Posted on 08/16/2022 8:00:07 PM PDT by SeekAndFind

I saw this on Twitter today. Apparently this clip is circulating in the Chinese internet right now. Buy more property, comrades!

If this is real, the Chinese are screwed.

This has gone viral on Chinese internet.

Hao HONG 洪灝, CFA

@HAOHONG_CFA

“买了三套买四套”

“I call on every comrade to take the lead to buy a property.

If you are on your 1st property, then buy a 2nd one; if on 2nd, then buy a 3rd; already on 3rd? There’s always room for the 4th.”

Now let the buying begin.

https://t.co/gj8PmvkJVs— Robert Tracinski (@Tracinski) August 17, 2022

This is a response to the real estate crisis that has been brewing in China for months. While it may sound odd to encourage people to buy multiple homes, it’s not that unusual in China. Limits on foreign investment mean a lot of people have no better place to put their money than in real estate. The problem with owning 2, 3 or 4 properties is that ultimately there are more homes than people who need them. At present there are about 50 million empty apartments in China.

Liu Hong and her parents own four homes in different cities across mainland China. At any one time, as many as three of them are unoccupied.

The 36-year-old, who works as an auditor in Shanghai, bought a flat in her hometown of Harbin in northern Heilongjiang province 13 years ago for 320,000 yuan (US$47,500)…

Liu bought herself a two-bedroom apartment in Shanghai for 2.6 million yuan when the market was sizzling in 2015, after deciding to settle down in the city.

When both Harbin and Shanghai are too cold, between October and April, her parents travel to Haikou, in southern China’s Hainan province, where they own a small holiday home.

“It is not easy to find a tenant or buyer in . So we just leave our old apartments there, empty for years. Theoretically, our family alone has two or three homes no one stays in throughout the year,” Liu said…

The average vacancy rate across mainland China is 12.1 per cent, according to BRI’s report, released earlier this month. That compares with 11.1 per cent in the US and 9.8 per cent in Australia, and is far higher than in the UK, where only 0.9 per cent of houses are empty.

Naturally, when the economy is facing a downturn, as it is now in China thanks in part to zero COVID, people decide to put some of those empty properties on the market. But because there is such a huge supply it creates a glut that further drives down values.

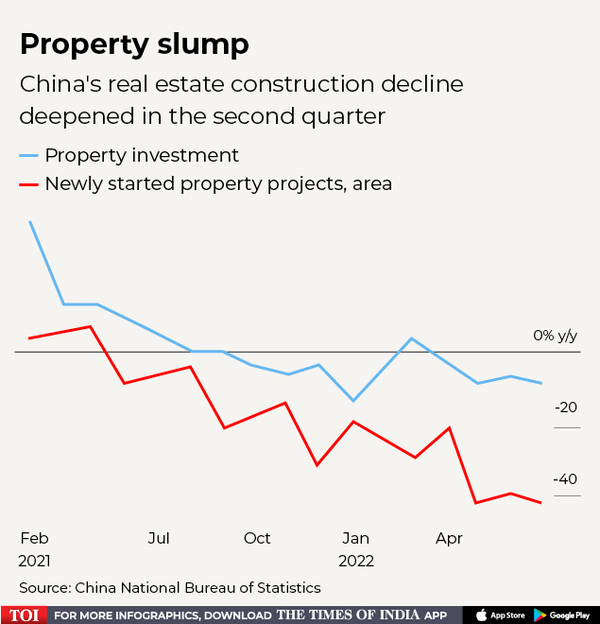

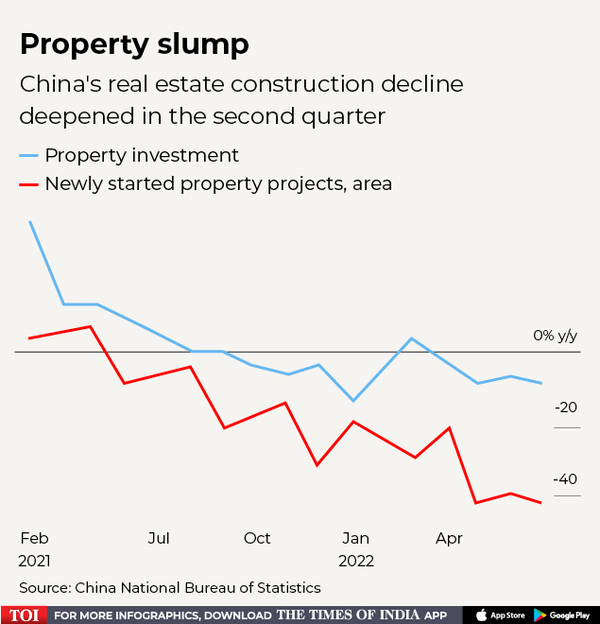

That real estate market, which propelled China’s rapid growth ever since the 2008 financial crisis, is in the midst of a housing bust that has now recorded its 11th straight month of price declines…

New home prices in 70 cities, excluding state-subsidized housing, declined in July by just over 0.1% from June, according to China’s National Bureau of Statistics.

Last year, China’s largest real estate company defaulted on its debt. And that default meant that many people who had already invested in a new apartment were no longer certain they would ever be built.

With Evergrande, the risk is high: A sudden unwinding of the company could hit the country’s financial system or, potentially, the many homeowners in China who have already paid for Evergrande apartments that are yet to be built…

These defaults are testing a long-held understanding among foreign investors that Beijing would ultimately step in to save its biggest companies.

For years, many investors gave money to companies like Evergrande on the basis of this assumption. More recently, the authorities have shown greater willingness to let companies fail in order to rein in China’s unsustainable debt problem.

The response from some Chinese buyers was to simply stop paying the mortgages on properties they believed would no longer be completed as promised.

As of July 12, homebuyers in 22 Chinese cities had threatened to stop their mortgage payments over construction delays and sinking real estate prices, affecting 35 projects, Citigroup analysts wrote in a note. As of Monday, that figure had surged to over 80 cities, affecting over 200 projects, according to data from E-house China Research and Development Institution, a Chinese real-estate database.

Homebuyers’ discontent is spreading both offline and online. Now, Chinese online platforms are deleting crowd-sourced documents and social media posts tabulating the number of mortgage boycotts and project delays nationwide, according to a Bloomberg report.

In China, property developers rely on pre-sale funding, whereby buyers pay upfront for unbuilt apartments, analogous to interest-free loans for the building company. The current mortgage boycott is rooted in developers’ dependence on pre-sales for funding, Alicia García-Herrero, chief Asia-Pacific economist at French investment bank Natixis, tweeted on Friday. “For households who have pre-paid unfinished units due to developers’ defaults, it makes sense not to pay,” she wrote.

Obviously, stopping those payments makes it more likely the developers will not be unable to finish their projects. That in turn could convince more people to stop paying mortages. It’s a cycle that is leading China into a bust.

The real estate bust isn’t the only headwind China is facing right now. Large parts of the country are still dealing with zero COVID lockdowns and there is evidence that is leading to a broader economic downturn.

Figures for both retail sales and industrial production grew last month compared with the same month last year, rising 2.7 percent and 3.8 percent, respectively. But they fell well short of forecasts of 5 percent and 4.6 percent growth, and both metrics slowed compared with increases recorded in June, according to the National Bureau of Statistics…

“The momentum of economic recovery has slowed,” government spokesman Fu Linghui said during a news conference, the Associated Press reported. “More efforts are needed to consolidate the foundation of economic recovery.”

In short, China is facing a slightly different mix of problems than the rest of the world right now but they are still struggling.

Coming to a socialist country near you.

Rocation rocation rocation

“Buy more property, comrades!”

Until recently they were, but it was all here.

No matter - remember in the 70s and 80s when Japan, Inc. was buying up everything in Hawaii and the West Coast? Where are they now?

Whatever happened to ‘You’ll own nothing and be happy’?

Property is theft.

China has too many homes and we have too many homeless.

Anybody else see the obvious solution?

Right now in my area they’re carving up empty space and plastering them with prefab apartment buildings that go up in a matter of weeks. It’s usually 10 to 20 units of at least 50 apartments a piece if not more.

I’m just wondering where all these people that can’t afford rent or houses because they’re not working are coming up with money to buy all these places.

And banks are defaulting on people’s savings.

It’s a Ponzi scheme.

People buy apartments in not even begun complexes.

That money is used to build shoddy complexes for earlier buyers.

Now people aren’t paying their mortgages on apartments that haven’t even begun to be built.

The Japanese also bought a 51% interest in Rockefeller Center and I think they paid $100 million for the U.S. News & World Report building in Washington, D.C.

They lost their shirts on both investments.

But the Chinese are outright, non-penitent racists. Blacks, whites and others can go to the hard labor work camps. They believe Chinese are the master race and the coming overlords of all the world's people.

From Covid to Blackface on TV, China's Racism Problem ...https://www.hrw.org › news › 2021/02/18 › covid-blac... Feb 18, 2021 — China's anti-Black racism shows in its media and its treatment of Africans during the pandemic.

Racism in China - Wikipedia https://en.wikipedia.org › wiki › Racism_in_China Racism in China arises from Chinese history, nationalism, sinicization, and other factors. Racism in modern China has been documented in numerous situations ...

I actually did laugh out loud.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.