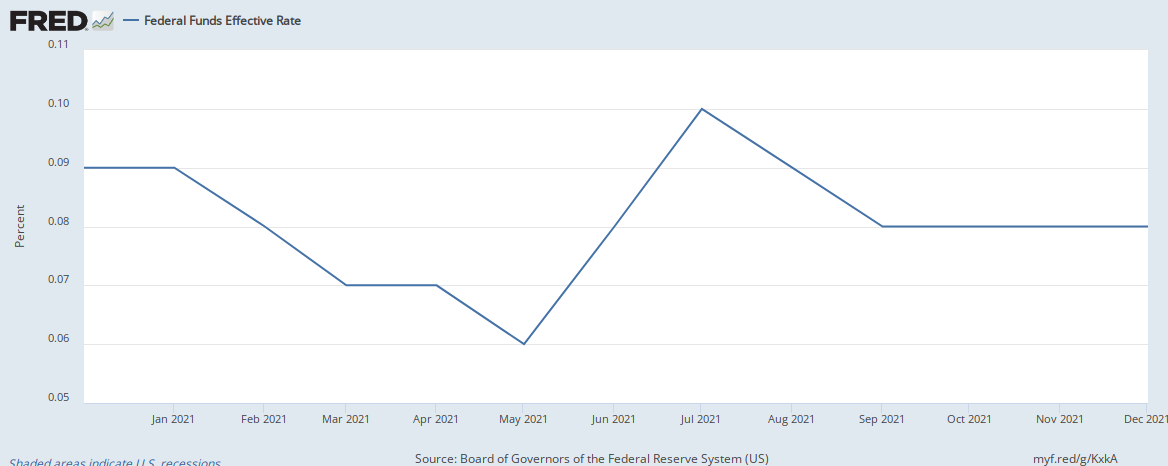

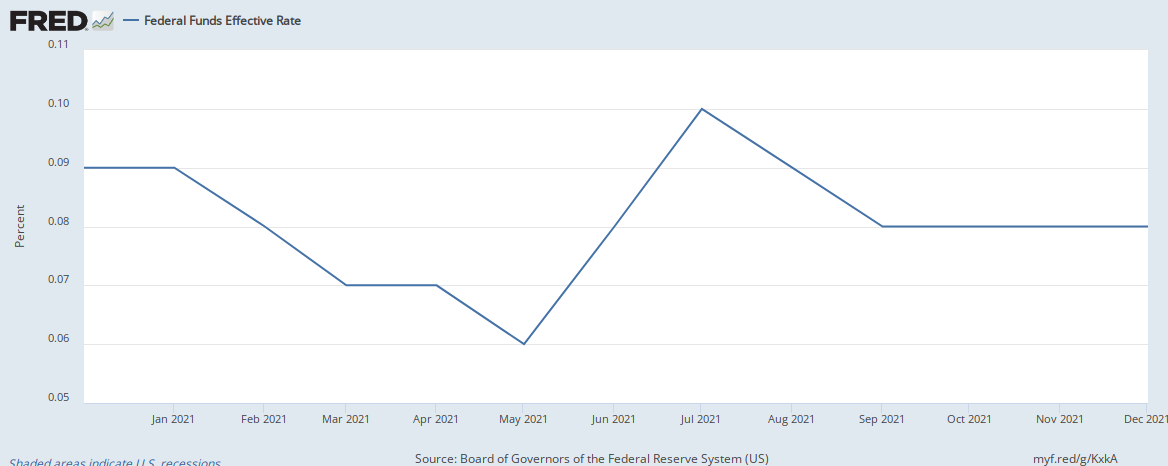

What Fed actions here, over the last year....

Have caused these fluctuations?

Posted on 01/17/2022 8:11:41 AM PST by millenial4freedom

Call your financial adviser.

In any recession, Cash is King. I bought my first two homes during recessions. Lower prices, more bang for the buck.

Raising rates has to be done. There will be winners, losers, and whiners as this process is implemented.

It is a process and it is important to keep that foremost in your mind as one considers the whole picture.

Who loses with rate increases?

Who wins with rate increases?

And who are the one’s that are going to make a lot of noise about how bad things are, will be, and on and on.

The question is if you have funds, stocks, assets where do you move them to NOW to take advantage of the rate increases? Are you even able to make those moves? Many are not in that favorable of a position. Speak with your Financial person about what is best for you.

Investopidia Recommends:

KEY TAKEAWAYS

Investing in rising interest rates can be successfully done by investing in companies that will do well with higher rates—such as brokers, tech and healthcare stocks, and companies that have a large cash balance.

Investors can also capitalize on the prospect of higher rates by buying real estate and selling off unneeded assets.

Short-term and floating rate bonds are also good investments during rising rates as they reduce portfolio volatility.

https://www.investopedia.com/articles/investing/120715/10-ways-profit-interest-rate-increase.asp

It doesn't work this way.

Banks are generally the primary way that the money supply grows - through loans.

Consumers and businesses also increase the money supply through use of credit cards and lines of credit, etc.

The Fed has increased the money supply in the past, through Quantitative Easing - using the banks as an intermediary to the corporations.

That’s Juan Manteiga at Oppenheimer. I have a call in to him and this thread has had some influence.

Some years ago the Department of Homeland Security wanted to set up an options market where people could buy and sell related to terrorist events. The idea was that the law of large numbers would allow the “market” to more accurately predict when and where such events would occur. It raised such an uproar that they had to cancel the idea. But I think it was sound and this thread, in the aggregate, is probably an accurate forecast of what the Fed will do. (Three to four very small adjustments, but nothing major. They’re trying to affect the market by barking loudly and thus cooling the “irrational exuberance.”) I’ll probably come back and revisit the entire thread later.

yes, they will raise rates and there will be a recession

The 10-year bond fluctuates on a daily basis - and it moves primarily as a result of Fed actions with the Fed Funds Rate.

The 10-year has recently moved - anticipating an increase in the FFR.

I don't believe that the FFR will increase - thus I believe the 10-year will readjust to where it was, and probably go lower in the future.

As I've stated in other posts - a negative FFR would not surprise me in the future.

The Fed has not increased the FFR, and they have not recently done any QE (Quantitative Easing).

The Fed does not dictate the amount of the money supply. They set a rate that others then interpret to gauge how much a particular bank wants to loan, and at what rate. It also greatly affects the bond market.

So...the Fed has not been increasing the money supply by themselves lately. That's not to say that the money supply isn't increasing - just that the Fed is not the current cause.

Remember how fast the money supply was increasing from 1920 - 1929. Also from 2000 - 2007.

History can be a great guide, if one looks at all of the economic signals - especially those coming from other nations who are suppliers to us.

It's definitely an economy of persons.

Those in power seek to be the masters, by holding as many "claims on future labor of the rest of us" as they can.

Insanely rich people aren't in love with their money. They're in love with their power.

“The Millionaire Next Door”

By far that is one of the best books I have ever read that helped me in life.

But of course this is the intend!

The usual way to find a way out of trouble is a war.. Biden is too weak to fight China, Russia, Iran or N.Korea, so he fighting a so far victorious war against the US.

More important: the economic policy choice by Brandon will likely not improve the things overall..but may make a major difference as to which special interests will end up less damaged. Low interest rates in particular are bad for the banks — mortgage assets become losing assets and the $ are huge. The banks generally supported Biden.. is he going to throw them a lifeline?

Or is it that the most important special interests are Big Techs and Big Pharma? If so, screw the banks?

We will see...

I read that and may other books on the subject, and, knock on wood, I’ve done reasonably well investing over decades.

I definitely agree on the start early part. It’s the get rich slowly that works.

Your description is correct for how it has generally worked in the past utilizing banks. Direct payments of digital fiat credits to the populace is a game changer. I don’t think you are adequately considering that. Banks are not needed to grow the money supply when you deliver helicopter money the way congress did the last 2 years.

Congress (or any other part of our government) has no authority to deliver money directly to the citizens through creation.

They can pass legislation. There can be increased Treasury auctions. But all money creation has to go either through bank loans, credit vehicles that consumers/business use such as credit cards and lines of credit, or quantitative easing by the Fed.

In the case of the stimulus checks, bankers bought new Treasury debt at auction, and distributed the government debt out to the populace.

The Fed could have told the government to go pound sand and not held any extra auctions - but the bankers want the power that new debt obligations bring.

Yes.

It has to be done.

It does not appear Fed has any tools to deal with the problem, every move loses.

They can let some bonds mature, stop buying new bonds with the interest payments and even sell some bonds.

What Fed actions here, over the last year....

Have caused these fluctuations?

The Fed hasn't stopped QE since COVID.

Overall, as shown in table 1, the size of the Federal Reserve's balance sheet increased from about $7.4 trillion at the end of 2020 to nearly $8.5 trillion as of September 29, 2021. On the asset side of the balance sheet, this increase was concentrated in securities held outright. These holdings rose by $1.2 trillion as the Federal Reserve continued its monthly net purchases of $80 billion in Treasury securities and $40 billion in agency MBS.

“It has to be done. They can let some bonds mature, stop buying new bonds with the interest payments and even sell some bonds.”

We survived Volcker’s tough love when others had waited around too long. The longer they wait to act the harsher the remedy will feel.

I can’t wait to see what higher rates will do to the ridiculously high California RE market. I won’t be surprised if prices here are cut in half. It is that crazy.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.