Posted on 12/10/2021 9:47:56 PM PST by SeekAndFind

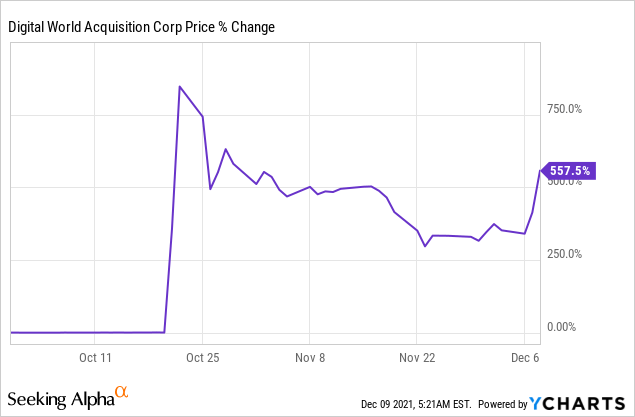

* Trump Media & Technology Group's paid subscription offer, TMTG+, offers massive upside.

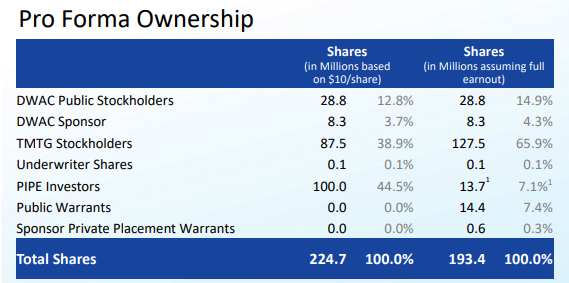

* $1.0B PIPE deal shows strong demand for a rival social network.

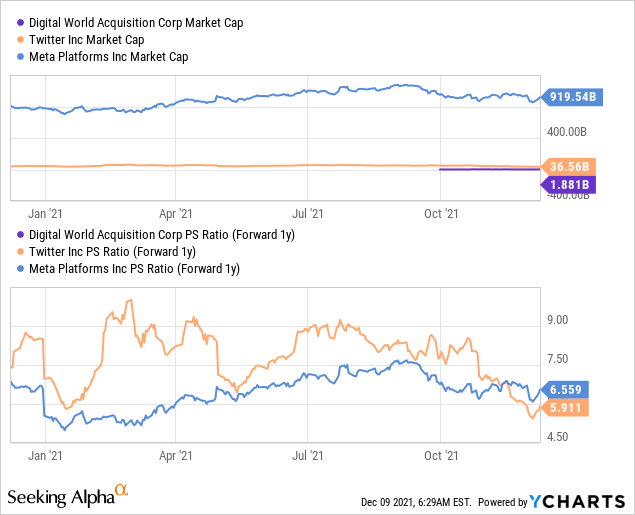

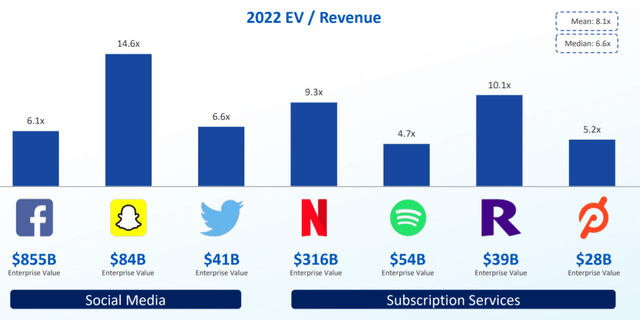

* If Trump Media & Technology Group gets the same valuation as Twitter or Meta Platforms, based on sales, Digital World Acquisition Corp.'s market cap could rise by a factor of 3X.

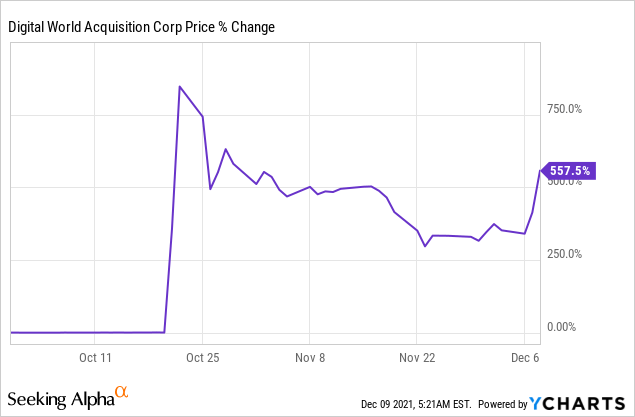

Blank check company Digital World Acquisition Corp. (DWAC) is merging with Trump Media & Technology Group. The announcement initially created a frenzy for shares of Digital World Acquisition Corp. but shares have started to surge again. TRUTH Social could become a major Twitter (TWTR) rival and has massive market cap upside!

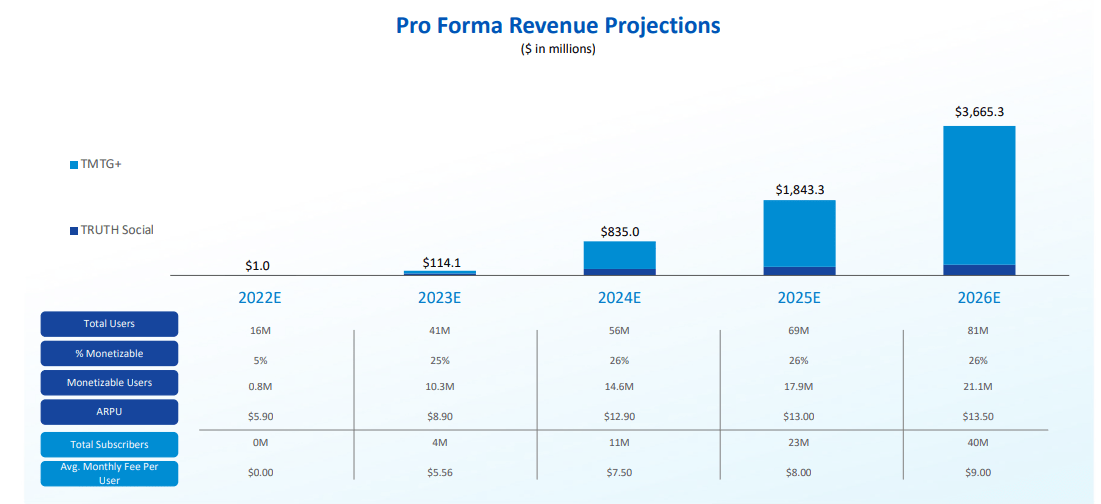

TRUTH Social has very good chances to become a social media hit, not only for the former president but also for investors that consider DWAC. This is because Donald Trump attracts a lot of attention, and attention is the ultimate currency in the social media world. He was banned from using his social media accounts in FY 2021, accounts that were followed by close to 150M people across multiple platforms. Trump’s social media accounts on Twitter, Meta Platforms (FB) and Instagram were followed by 89M, 35M and 24M people. These numbers matter because they allow an estimate for how many people could potentially create accounts on the former president’s new social media platform.

(Excerpt) Read more at seekingalpha.com ...

Trump can do the most good running a free speech media and technology company while DeSantis runs for President in 2024.

I’ve been buying very small amounts and averaging in. Being pro-Trump is not a reason to dive into this all at once.

I’m inclined to agree. My hope is this media company has the staying power that will only happen if it is secured against spamming or other forms of Liberal online sabotage.

Time will tell. If this media company survives mostly uninterrupted for the first calendar year, I will be both surprised and delighted. Maybe this time, he has hired the right people to make it happen.

Trump’s media and technology company needs to have people whose sole task is to figure out ways that the company could be sabotaged and how to prevent that from happening.

Yes. This is not something that should be entrusted to or dependent on one single individual.

Remember how that tall guy, Brad Parscale was so helpful during the campaign, but after a few years, all the pressure seemed to weaken or distract him. Brad suddenly unraveled and needed to stop working for anybody for a good while.

The one person in Trump’s orbit with the ability and knowledge to see this through is Peter Thiel.

According to article, it is better to buy shares of DWACW instead of DWAC, because DWACW shares (warrants) act like options to buy DWAC for $11.50 around October 2022. However, DWACW shares cost about 1/3 the price of DWAC. If you think the company will be successful on or after October 2022, then DWACW is a better buy.

Here is another good article from Oct. 24, 2021: A Boring Legal Look At Digital World Acquisition Corp. - What Investors Need To Know

It might be worth it to invest in this company.

"And most importantly! When you exercise a warrant it is taxed as ordinary income. This means that if they get called and you're sitting there looking pretty with 10k of these things, you'll be immediately cutting a check to Uncle Brandon for the highest possible tax bracket you can reach. Taxation of Stock Warrants (zacks.com)The amount per share you will owe tax on is the price of the stock P minus the Cost Basis C and the Strike Price SP - (C + S); and you will need to pay the strike from out of pocket."That extra tax offsets some of the discount you get buying DWACW instead of DWAC.

.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.