Posted on 10/26/2021 9:29:53 PM PDT by SeekAndFind

The average American needs their retirement savings to last them 14 to 17 years. With this in mind, Visual Capitalist's Carmen Ang asks (and answers below), is $1 million in savings enough for the average retiree?

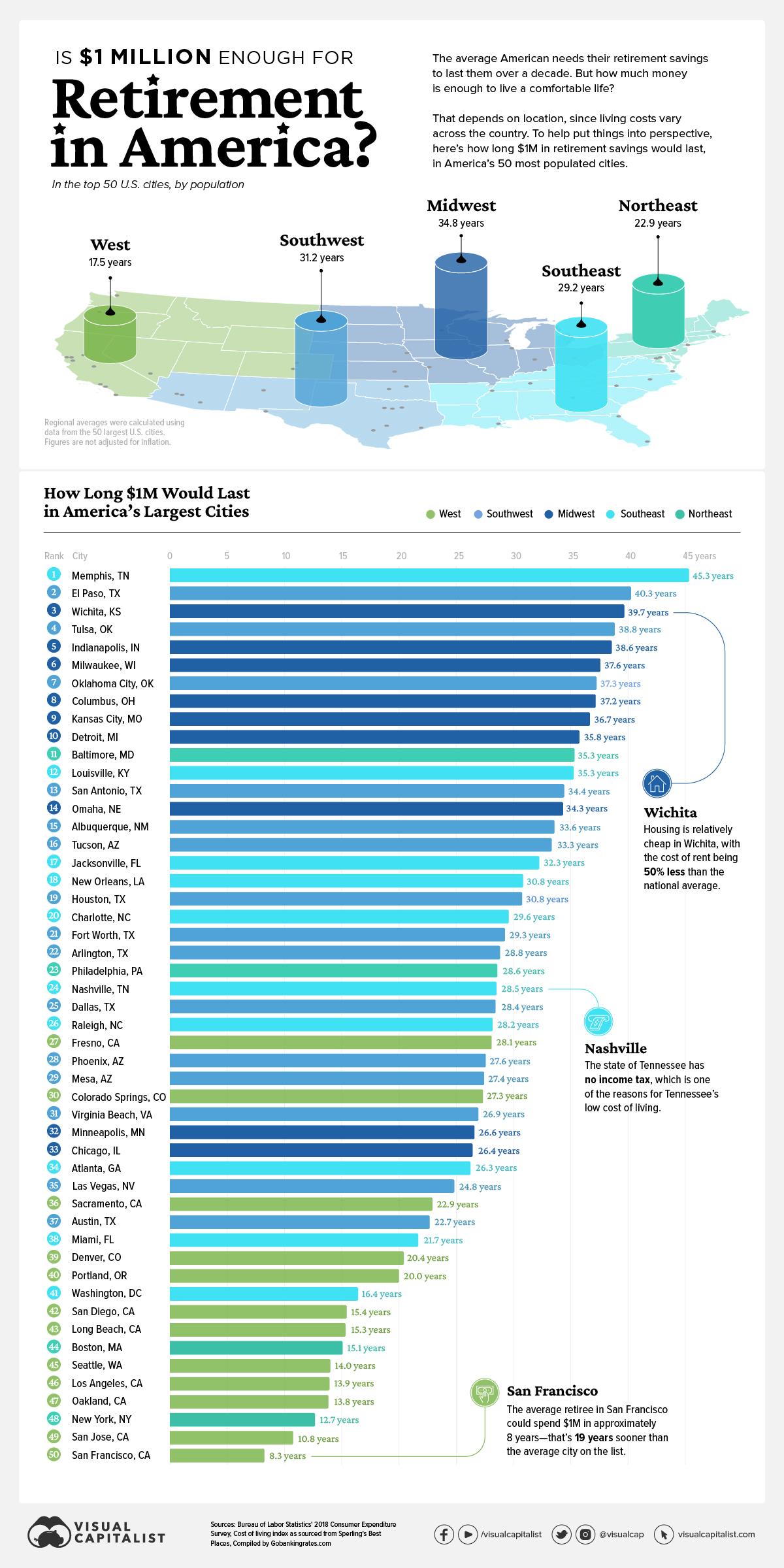

Ultimately, it depends on where you live, since the average cost of living varies across the country. This graphic, using data compiled by GOBankingRates.com shows how many years $1 million in retirement savings lasts in the top 50 most populated U.S. cities.

Editor’s note: As one user rightly pointed out, this analysis doesn’t take into account interest earned on the $1 million. With that in consideration, the above calculations could be seen as very conservative figures.

To compile this data, GOBankingRates calculated the average expenditures of people aged 65 or older in each city, using data from the Bureau of Labor Statistics and cost-of-living indices from Sperling’s Best Places.

That figure was then reduced to account for average Social Security income. Then, GOBankingRates divided the one million by each city’s final figure to calculate how many years $1 million would last in each place.

Perhaps unsurprisingly, San Francisco, California came in as the most expensive city on the list. $1 million in retirement savings lasts approximately eight years in San Francisco, which is about half the time that the typical American needs their retirement funds to last.

A big factor in San Francisco’s high cost of living is its housing costs. According to Sperlings Best Places, housing in San Francisco is almost 6x more expensive than the national average and 3.6x more expensive than in the overall state of California.

Four of the top five most expensive cities on the list are in California, with New York City being the only outlier. NYC is the third most expensive city on the ranking, with $1 million expected to last a retiree about 12.7 years.

On the other end of the spectrum, $1 million in retirement would last 45.3 years in Memphis, Tennessee. That’s about 37 years longer than it would last in San Francisco. In Memphis, housing costs are about 2.7x lower than the national average, with other expenses like groceries, health, and utilities well below the national average as well.

Regardless of where you live, it’s helpful to start planning for retirement sooner rather than later. But according to a recent survey, only 41% of women and 58% of men are actively saving for retirement.

However, for some, COVID-19 has been the financial wake-up call they needed to start planning for the future. In fact, in the same survey, 70% of respondents claimed the pandemic has “caused them to pay more attention to their long-term finances.”

This is good news, considering that people are living longer than they used to, meaning their funds need to last longer in general (or people need to retire later in life). Although, as the data in this graphic suggests, where you live will greatly influence how much you actually need.

Nope! Not in America unless you want to end up doing handies for cash in back alleys outside of bars.

I have been retired for 24 years…never had close to a million dollars.

.

I’m just not going to retire. The new mortgage is gonna outlast me.

Pretty soon, it might buy you your last car before retirement.

“Pretty soon, it might buy you your last car before retirement.”

Actually, our last (real) cars are likely to end by 2030, if not much sooner, so buying one soon is not a bad idea.

Or your last PC video card.

Well, I guess it depends...

We ain’t got but a quarter of that, and we do OK.

We live a simple life, and we enjoy every day of it.

I was at least hoping to get one more computer and a pound of Filet Mignon. But I might have to settle for that video card.

Today, yes, if you live sanely.

Next year or two, it probably won’t get you through a month.

Certainly true if you have your money in CDs or T-Bills. It’s a gamble, but equities and real estate are the only hedges against this insanity and malfeasance.

With the current “war against the Kulaks’ I wouldn’t count on real estate either.

I could make it work.

in my next life, I will go directly to civil service and get that fat pension no matter what.....

bookmark

Yes, one million bucks is enough. However, that is assuming that the money is properly invested to spread risk and to hedge for inflation so you don’t lose nearly as much buying power as you would if you simply held it in USD.

Buy a small house too with a low rate mortgage.

In inflationary times, your liabilities s/b in USD at low rates if possible.

Don’t invest in bonds or other debt investments since interest rates are currently low.

Remember if times are really bad, you can supplement your life-style with a few bandit plunder trips.

Put that AR to productive use for your neighborhood. :-)

Who the hell comes up with these ‘retirement figures’?

Been living and doing just fine of half that amount........

Don’t have hardly any savings but I own my house, have excellent health insurance, and enough income from three pensions to live comfortably.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.