Posted on 10/08/2019 9:21:08 AM PDT by SeekAndFind

See where you fit on the money accumulation curve.

If you are curious about whether you are keeping up with the Joneses, our calculator will help.

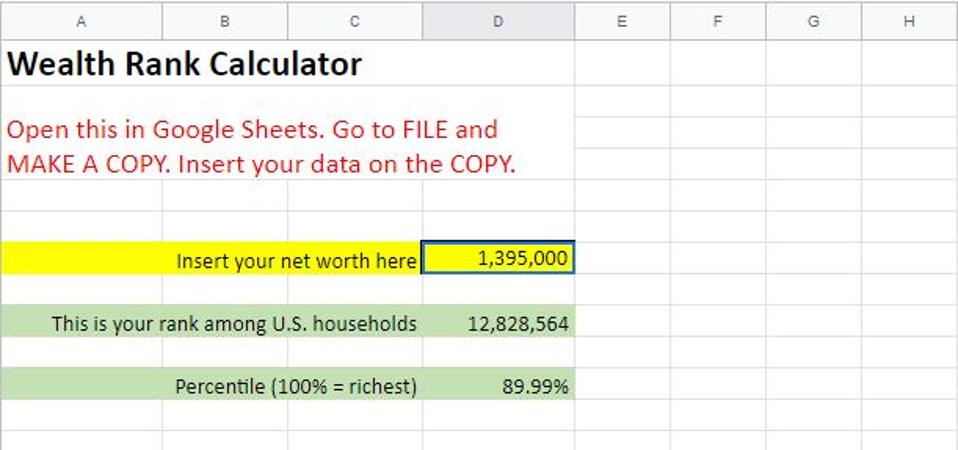

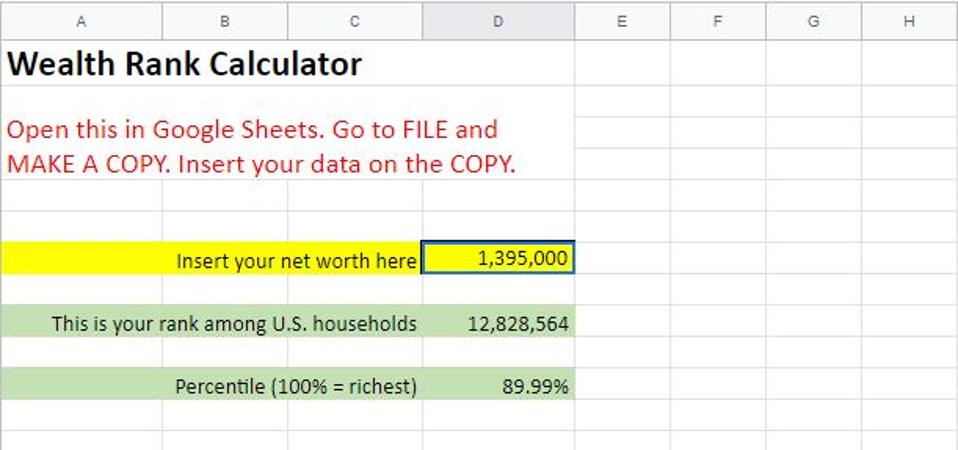

Open the Google Sheet document. Make a copy. Insert your net worth. The spreadsheet will tell you where that ranks you among 128 million U.S. households. Wealth Calculator Google Docs

Wealth calculatorForbes

You need just shy of $1.4 million to be in the top 10%. To be a one-percenter, accumulate $10.2 million.

In this ranking, wealth includes home equity (often excluded in discussions of millionaires). It does not include the value of pensions, annuities or future Social Security benefits.

The calculations are based on: the 2016 Survey of Consumer Finances; estimates of population growth, asset appreciation and inflation in the past three years; the pattern of wealth distribution uncovered in the Forbes Billionaire and 400 reports, and hunches about how many rich people escape detection by our Rich List investigators.

Understand that there is a fair amount of uncertainty in this or in any assessment of wealth. The fed surveyors may or may not get an honest figure for how much a $400,000 household has in home equity and 401(k) accounts. They assuredly do not get representative and candid answers from $40 milllion households, especially about the value of artwork and offshore investments.

As for the missing billionaires, there are probably none at the $20 billion level but enough at the low end to affect the shape of the wealth curve. Bear in mind that mere suspects do not make it onto published lists and that sometimes a sale or stock offering causes a previously unsuspected candidate to pop into view.

(Excerpt) Read more at forbes.com ...

I'm breaking out the top 10% in 1% increments for more clarity.

| Net Worth Percentile |

Net Worth |

| 10.0% | -$950 |

| 20.0% | $4,800 |

| 30.0% | $18,900 |

| 40.0% | $49,100 |

| 50.0% | $97,300 |

| 60.0% | $170,000 |

| 70.0% | $279,000 |

| 80.0% | $499,350 |

| 90.0% | $1,186,570 |

| 91.0% | $1,317,500 |

| 92.0% | $1,445,700 |

| 93.0% | $1,686,700 |

| 94.0% | $2,044,300 |

| 95.0% | $2,387,250 |

| 96.0% | $2,838,000 |

| 97.0% | $3,693,600 |

| 98.0% | $5,794,500 |

| 99.0% | $10,400,000 |

-PJ

You said something and I was interested enough to ask a question. Aren’t you glad someone is following up on your notion?

A million dollars to retire on today is not that much. Better hope you have a good pension plan and SS to offset.

If you retire at 65 it may not get you to age 90 especially if there is another 2008 style downturn or two.

Our fixed yearly cost right off the bat is almost $50k a year-high property tax, almost $20k for health insurance, utilities, food, maintenance, house and car insurances etc and we have zero debt. The 20k health insurance cost will drop when we go on Medicare.

Forbes readers are always comparing themselves to others. They are probably advertiser gold, easily triggered to buy something ridiculous they don't need.

If my investments go south before I die, I’ll move into a sleazy, cheesy trailer park and live like a king.

There was a study (The Trinity Study) that suggest that one needs about 25x annual expenses to retire on.

Annual "safe withdrawals" is 4% of that amount in the first year, and then that initial amount is increased yearly by inflation for 30 years.

$1 million in savings would generate an annual income of $40,000. Assuming 2% inflation, year 2 would be $40,800, year 3 would be $41,616, year 4 would be $42,448...

-PJ

-PJ

Be sure to include your iPhone 11, too.

That could put some people over the top.

We’re in the top five percent, and that is liquid net worth, does not count the value of our paid-off house.

Your property taxes are $50k per year? Unbelievable, where do you live? I live in AZ, our property taxes are currently $2900 per year.

-PJ

“Your property taxes are $50k per year? “

No, our annual fixed cost are at present $50k per year. Property tax, health/car/house insurance etc. and we have zero debt.

It was an answer, a drolly humorous one, which suited the question.

Thanks for that.

What’s the real answer?

That’s the real one, the only one you get or deserve. If you’ve got someone here on FR you want to “out” as one of the US’ own 1 percenters, do it, otherwise sod off.

“Entering your net worth into a Google Sheet document is not something I would recommend.”

Not a problem - just password protect it with your credit card number and PIN...

THATS FUNNY !!! LOL....

SQRT(-1) is “j” in electrical engineering because “i” means something else entirely. It means the same thing in physics, but physicists manage to handle the ambiguity.

The ‘j’ is a dead giveaway.

If I entered my SS# and drivers’ license number, would google calculate it for me?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.