That’s pretty scary actually.

You can believe statistics released by the Obama administration or your eyes. Somehow an economy built on trillions of borrowed money, trillions more printed, with a hundred trillion of unfunded liabilities, continued deficit spending, led by a man who abhors productive capitalism, leads an anti carbon energy crusade, and publishes thousands of restrictive rules and regulations does not seem to sit on a firm foundation.

“Anxiety among investors” explains 99 percent of what happens in any market.

While it may be an indicator that something is changing if you look at the historical chart back to 2000 you’ll see that it appears to be very high compared to historical values - part of that I’m sure i inflation, but I think there is more to it. Have there been component changes in the index, etc

Because you can only put so much perfume on a pig?

Scouts Out! Cavalry Ho!

Well, the experts are lucky to have something on their side defying all logic and seeing stock prices bid to ridiculous values during a Great Recession. I don’t know what it is, since the Fed declared that they ended QE.

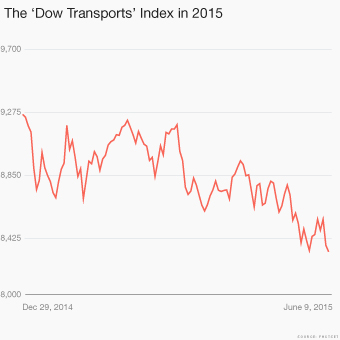

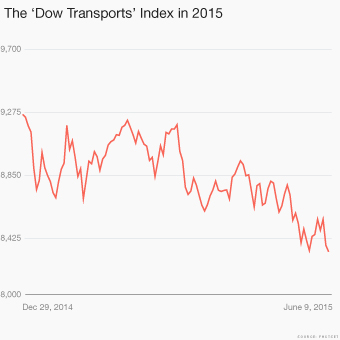

Only an idiot would think that the markets move in a straight line up or down. We have not had a healthy market correction since 2011 (defined as a decline of at least 10% from the index high). Corrections are a necessary function of the markets. If the Dow Transports are down 9% since 12/29, then perhaps the long awaited correction in the broader indexes is on the horizon. This is a good thing.