Skip to comments.

Mark Steyn: Debt ceiling more an abyss

OC Register ^

| August 5, 2011

| Mark Steyn

Posted on 08/07/2011 12:31:06 PM PDT by Immerito

On Thursday, in honor of Barack Obama's 50th birthday, the Dow dropped 10 points for every year he has walked among us. It was the ninth-largest drop in history. We should be relieved he wasn't turning 80.

The markets are apparently concerned that the entire global economy may be "stalling."

You don't say? Observant fellows, these market chappies.

And yet, in a certain sense, these are still the good times. At the end of the week, U.S. Treasury yields plunged to Eisenhower-era rates. America, explained Ethan Harris of Bank of America Merrill Lynch, "still gets the safe-haven money." That's to say, as crazy as Washington is, Europe is perceived to be crazier. In confirmation of the point, over in Italy, which is (believe it or not) a G7 economy, police raided Moody's and Standard & Poor's over allegations that all the meanie things that the rating agencies have been saying about the Italian economy were having an impact on Italian stock prices. Apparently that's a crime in Italy. They're not yet shooting the messenger. But they are dragging him through the streets in chains pour encourager les autres. Good luck with that.

****

No author writes a dystopian apocalyptic doomsday book because he wants it to happen: Apart from anything else, the collapse of the banking system makes it hard to cash the royalty check. You write a doomsday book in hopes you can stop it happening. But time is running short. If you think we've got until 2050 or 2025, you're part of the problem.

(Excerpt) Read more at articles.ocregister.com ...

TOPICS: Miscellaneous

KEYWORDS: debt; debtceiling; marksteyn

1

posted on

08/07/2011 12:31:11 PM PDT

by

Immerito

To: Immerito

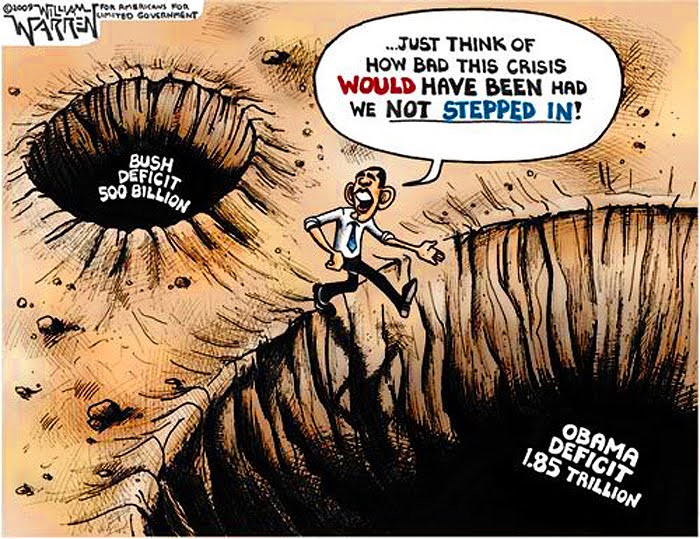

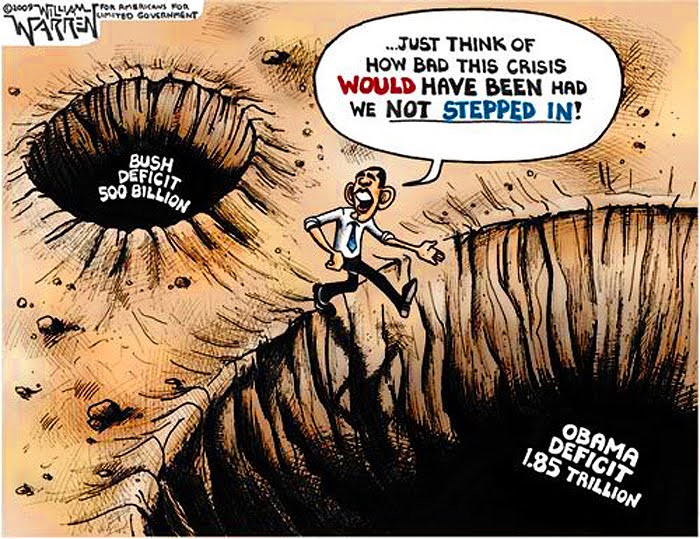

Obama’s Deficit Avalanche isn’t Bush’s Fault / scottuystarnes.com / 2/9/2010

SOURCE http://scottystarnes.files.wordpress.com/2010/02/obama-deficit.jpg?w=400&h=308

Washington Times reports: Even more staggering than the mountains of snow in the capital are the deficits the Obama administration plans for the next decade. Huge spending increases will add about $12 trillion to the national debt for budget years 2009 to 2020.

The scariest part is that these deficits are based on unrealistic budgeting assumptions; the real fiscal outlook is much bleaker. In the proposed 2011 budget, the White House defensively attacks the “irresponsibility of past” deficits.

For example, the 2009 budget deficit of $1.4 trillion is blamed on the George W. Bush administration as if President Obama’s $862 billion stimulus package and more than $400 billion supplemental spending bill had nothing to do with it. Mr. Obama’s planned 2010 budget deficit rises to an even higher record level of $1.6 trillion.

By comparison, all of Mr. Bush’s deficits from 2002 to 2008 – the seven years during which his team had the most control over the budget – produced a combined deficit of $2.1 trillion.

Obama has spent more in 2 years than Bush did in 7 years. Obama’s BIOB (Blame it on Bush) defense just won’t work anymore.

2

posted on

08/07/2011 12:36:11 PM PDT

by

Liz

( A taxpayer voting for Obama is like a chicken voting for Col Sanders.)

To: Immerito

To: Liz

4

posted on

08/07/2011 12:47:47 PM PDT

by

expatguy

(The Expat Needs Beer Money - Cough Up!)

5

posted on

08/07/2011 12:59:50 PM PDT

by

devolve

(. . . . . . . . . . . . Fat & Furious - Burger & Fries Queen*s 1700+ calorie lunches . . . . .)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson