In today’s

article in Bloomberg View I explore reasons for the current weak recovery, and in particular whether there is an analogy with what happened in the recession of 1937-38 which interrupted the recovery from the Great Depression. Several charts elaborate on numbers provided there which argue against such an analogy.

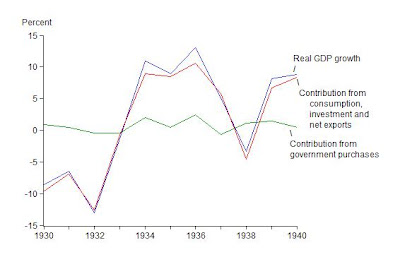

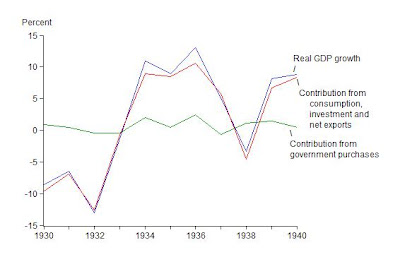

The first one relates to fiscal policy. It shows the ups and downs of real GDP growth in the 1930s and the contributions to that growth coming directly from government purchases and other components of GDP. (The data come from this interactive

table at the Bureau of Economic Analysis ). Clearly the change in government purchases contributed little to the downturn in 1937 and 1938. Even with generous multiplier effects on consumption, the changes in government purchases are too small to make much difference. Given that any decline in government purchases now due to the end of the 2009 stimulus is even smaller than the declines in 1937, the fading out of the stimulus is unlikely to have much to do wht the current slowdown.

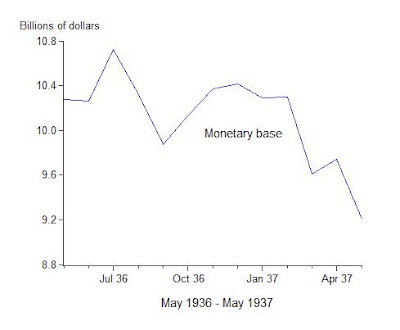

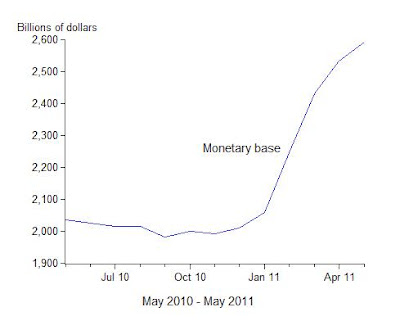

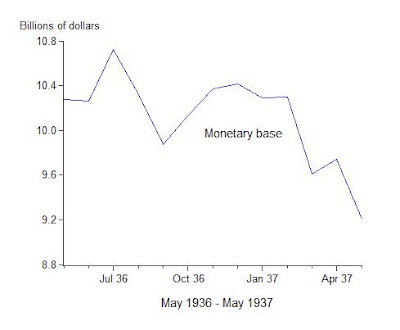

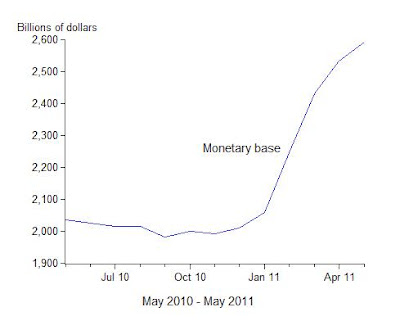

The other two charts relate to monetary policy. One shows the large decline in the monetary base (currency plus reserves) from May 1936 to May 1937 and the other shows the large increase in the monetary base from May 2010 to May 2011. While the decline in the monetary base is likely to have been a reason for the slowdown in the 1930s, there is no such decline now to explain the current slowdown. The recent ups and downs in the monetary base are due to the quantitative easings and at some point the monetary base will have to decline again. The challenge for the Fed will be to carry out this exit strategy in a clear and transparent manner in order to minimize disruption and uncertainty.

John B. Taylor is the Mary and Robert Raymond Professor of Economics at Stanford University George P. Shultz Senior Fellow in Economics at the Hoover Institution

RE: Is this guy saying that a decrease in the monetary base caused a recession?

If I read him correctly, he is saying that it is ONE OF THE MANY REASONS for the slowdown. Not the only one mind you, but one of many.

Similarly, it takes more than one blow to send our economy reeling. But if a perfect storm strikes, depending on the ferocity of the storm, it will send the economy in a tailspin ( e.g. the threat of increased taxes, healthcare mandates, over-regulation, high oil prices, uncertainty about the direction of government and debt, etc.). All of these factors seem to be coming to a head in America today.

I have not found a very clear source for direct comparison of the 30’s to now. If it exists some FReeper will know of it.

Well, if you want to know whether we are on the inflation or deflation side of the curve watch the stock market. During QEII share prices were rising even though the economy was still in the tank and companies were not performing better than they had in the past.

At first I could not figure out why this was happening. Then I realized that it was simply because the companies affected had not changed their value as a percentage of the total value of the economy, but there were a lot more dollars out there. So it took more dollars to buy the same percentage of an individual company (which is what a share of stock represents — a fixed percentage of the total value of a company), so that the price of the stock went up.

Does not make me comfortable.

Incidentally, I started one pararaph “In the 1880s and early 1990s, when the United States was on the gold standard, something like this happened.” I meant “1880s and early 1890s.”

... and I am not even certain that our economy can be saved as it is. Well LLS...you are much more optimistic than I...I am SURE...POSITIVE...KNOW we are screwed. It's over.

When Paul Ryan's budget is seen as manna from heaven by many Freepers (IE-A great thing)...when in fact even it falls far short of where we need to head...and when that budget is DOA...then I know we are screwed.

If we can't even go down the "Ryan" road to curing our problem without wailing and gnashing of teeth...and that road is still incurs too much debt...then the path we really must head in is not even a possibility.