Headed for???

The good news is that it will be a “jobless” disaster. Probably “worse than expected” too.

The Train of Insanity is going to come to crashing end. I wish I could get off of it some how.

And the #1 reason is a Communist, Muslim, non-citizen who has three more years left in his effort to bring America down.

He won’t need the full three years.

Zombie Alert.

Bump for later......C

ping

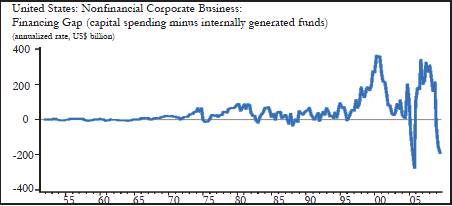

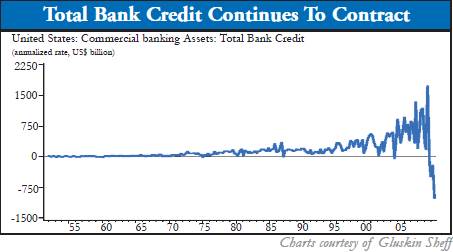

I don’t believe the first sentence is true. Most Americans know we are in trouble. Debt is being paid down, household assets are increasing and few are speculating on a bright future by expanding or starting a business (unless they are connected to this administration and its cronies).

Add this one:

Citibank is cancelling uptodate perfect credit cards, and just announced they may require a 7 day notice before withdrawals are made, starting in April.

So what’s up at Citibank?????

Here’s a question on China. Who is their largest importer? If we go under... so do they. Besides, I understand China is not doing so well either.

#1 illegally occupies the Oval Office.

Sing it Ray!

http://popup.lala.com/popup/432627052160645780

My bills are all due and the baby needs shoes and I’m busted

Cotton is down to a quarter a pound, but I’m busted

I got a cow that went dry and a hen that won’t lay

A big stack of bills that gets bigger each day

The county’s gonna haul my belongings away cause I’m busted.

I went to my brother to ask for a loan cause I was busted

I hate to beg like a dog without his bone, but I’m busted

My brother said there ain’t a thing I can do,

My wife and my kids are all down with the flu,

And I was just thinking about calling on you and I’m busted.

Well, I am no thief, but a man can go wrong when he’s busted

The food that we canned last summer is gone and I’m busted

The fields are all bare and the cotton won’t grow,

Me and my family got to pack up and go,

But I’ll make a living, just where I don’t know cause I’m busted.

I’m broke, no bread, I mean like nothing, forget it, over.

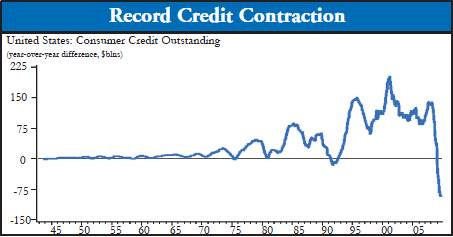

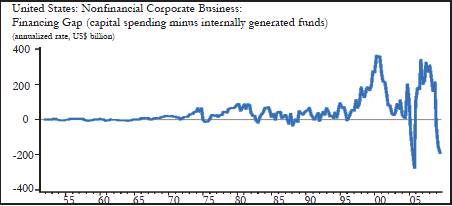

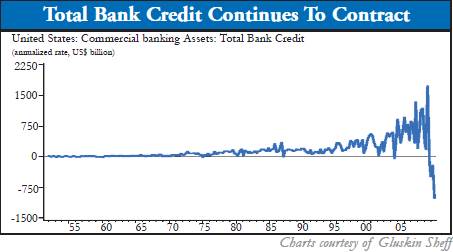

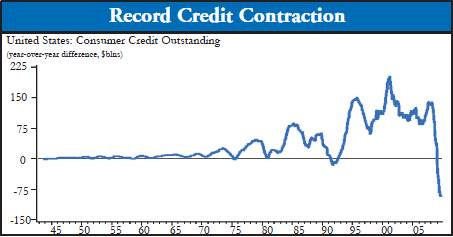

Deflationary recession, with prices, interest rates, stocks, commodities, employment rates, and wages all declining? If so, cash and near-cash (CDs, money market, treasuries, investment grade bonds) is the place to be. Shorting equities, too, for those with strong stomachs.

Severe inflation, even hyper-inflation? Commodities, including precious metals, would make sense.

marker