Skip to comments.

This Stock Gave investors 5,460%; It's About to Do It Again

Investment U ^

| 04/10/2009

| David Fessler

Posted on 04/11/2009 2:41:23 AM PDT by Swordmaker

click here to read article

Navigation: use the links below to view more comments.

first 1-20, 21-35 next last

To: ~Kim4VRWC's~; 1234; 50mm; 6SJ7; Abundy; Action-America; acoulterfan; Aliska; aristotleman; ...

Somebody's really bullish on AAPL stock—PING!

Disclosure, someday soon, I will have some Apple stock...

Apple Investor's Ping!

If you want on or off the Mac Ping List, Freepmail me.

2

posted on

04/11/2009 2:43:14 AM PDT

by

Swordmaker

(Remember, the proper pronunciation of IE is "AAAAIIIIIEEEEEEE!)

To: Swordmaker

It’s just too bad I didn’t have it way back then.... :-)

To: Swordmaker

Forest Gump and Bubba did real well with Apple, IIRC. :)

4

posted on

04/11/2009 2:45:06 AM PDT

by

mountn man

(The pleasure you get from life, is equal to the attitude you put into it.)

To: Swordmaker

To: Swordmaker

6

posted on

04/11/2009 3:38:24 AM PDT

by

tx_eggman

(Clinton was our first black President ... Obama is our first French President.)

To: Swordmaker

This Stock Gave investors 5,460%; It's About to Do It AgainLet's see... AAPL currently has a market capitalization (combined value of all stock) of US$106.5 billion. If that were to again rise by 5,460%, it would then have a market capitalization of US$5.8149 TRILLION.

According to the CIA World Factbook, the U.S. had a G.D.P. (official exchange rate) of US$14.33 trillion in 2008. So the author of the article is predicting that Apple's stock will have a value of roughly HALF of our country's G.D.P.

You know, I find that prediction a little incredible.

Regards,

To: Swordmaker

Granted, I’m a little biased ... (more than a little)

Apple may or may not be a wise financial investment, but to listen to anyone who is emotionally involved in a company's products for purposes of investment advice, is a huge mistake.

To: webschooner

Apple may or may not be a wise financial investment, but to listen to anyone who is emotionally involved in a company's products for purposes of investment advice, is a huge mistake. Or to anyone who is sitting on a pile of it. (The stock.)

9

posted on

04/11/2009 4:35:29 AM PDT

by

Gorzaloon

(Roark, Architect.)

To: alexander_busek

Yeah, the hype is way over the top. Perhaps Apple will go over $200 again by the end of this year and perhaps head to $300 next year. A great return for a stock, but if the economy recovers there will be lots of stocks doing that. Apple is a very solid company that has a bright future.

10

posted on

04/11/2009 4:36:57 AM PDT

by

Always Right

(Obama: more arrogant than Bill Clinton, more naive than Jimmy Carter, and more liberal than LBJ.)

To: alexander_busek

According to the CIA World Factbook, the U.S. had a G.D.P. (official exchange rate) of US$14.33 trillion in 2008. So the author of the article is predicting that Apple's stock will have a value of roughly HALF of our country's G.D.P.Curses on you! How darest thou invect reason into a specious argument?

11

posted on

04/11/2009 4:44:48 AM PDT

by

raybbr

(It's going to get a lot worse now that the anchor babies are voting!)

To: Swordmaker

Monopolies are good.

12

posted on

04/11/2009 4:52:36 AM PDT

by

McGruff

(I guess it all depends upon what the meaning of "bow" is.)

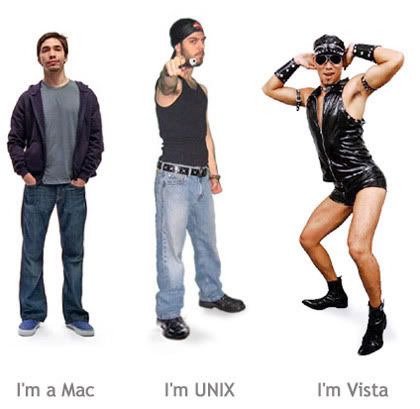

To: tx_eggman

A Unix user would have a better shooting stance.

Other than that, I agree with the image and go Unix.

Thank you.

13

posted on

04/11/2009 5:19:12 AM PDT

by

cizinec

(The truth is . . . . . 127!)

To: cizinec

AAPL stock rocks as i type this from my shiny macbook......while i listen to my ipod.......they are truly on their game....just need rumors of an iBook reader for next hysteria.......

To: alexander_busek

According to the CIA World Factbook, the U.S. had a G.D.P. (official exchange rate) of US$14.33 trillion in 2008. So the author of the article is predicting that Apple's stock will have a value of roughly HALF of our country's G.D.P. You know, I find that prediction a little incredible.

not if a loaf of bread cost $50 and a gallon of gas $70.... hyperinflation is kewl.

just look to the east and praise TOTUS.

15

posted on

04/11/2009 6:56:00 AM PDT

by

erman

(Outside of a dog, a book is man's best companion. Inside of a dog, it's too dark to read.)

To: Swordmaker

All I had to do was look at the headline and I knew what company it was and who had posted it..

16

posted on

04/11/2009 7:46:26 AM PDT

by

cardinal4

(Dont Tread on Me)

To: Swordmaker

Thanks sm. Fiftyfold increase? Walmart did it, but that was years ago, over a long period of time (Peter Lynch called it a "fifty bagger" in Beating the Street).

17

posted on

04/11/2009 8:14:43 AM PDT

by

SunkenCiv

(https://secure.freerepublic.com/donate/____________________ Profile updated Monday, January 12, 2009)

To: cardinal4

Look, Apple is a great innovator. However, Apple rarely stays at the top of its markets for long.

First, technology companies rarely stay on top of a market they invented.

Second, Apple is known for having too tight a grip on hardware, leading users to migrate to less restricted imitators.

18

posted on

04/11/2009 8:39:07 AM PDT

by

Erik Latranyi

(Too many conservatives urge retreat when the war of politics doesn't go their way.)

To: Erik Latranyi

Second, Apple is known for having too tight a grip on hardware, leading users to migrate to less restricted imitators.It is that fact that is sending me into Apple's camp when I buy my next computer. I want computer whose hardware and software is all made by the same folks..

19

posted on

04/11/2009 8:43:35 AM PDT

by

cardinal4

(Dont Tread on Me)

To: Swordmaker

Isn’t Steve Jobs on his death bed? What will their stock do when he is six feet under?

20

posted on

04/11/2009 8:56:49 AM PDT

by

Sawdring

Navigation: use the links below to view more comments.

first 1-20, 21-35 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson