Posted on 01/31/2026 12:20:12 PM PST by Bobbyvotes

Bitcoin slid toward $81,000 on Saturday as thin weekend liquidity magnified selling pressure, with traders pointing to Middle East tensions, U.S. political risk and lingering crypto-specific uncertainty.

What to know: Bitcoin slipped below $81,000 in thin weekend trading, extending a bout of weakness as risk appetite faded. Geopolitical tensions, including an explosion at Iran’s Bandar Abbas port and a brief U.S. government shutdown, pushed investors away from riskier assets like cryptocurrencies. Crypto-specific pressures, from negative spot bitcoin ETF flows to ongoing deleveraging and industry infighting, have left bitcoin rangebound around $80,000 to $82,000 and vulnerable to further downside.

(Excerpt) Read more at coindesk.com ...

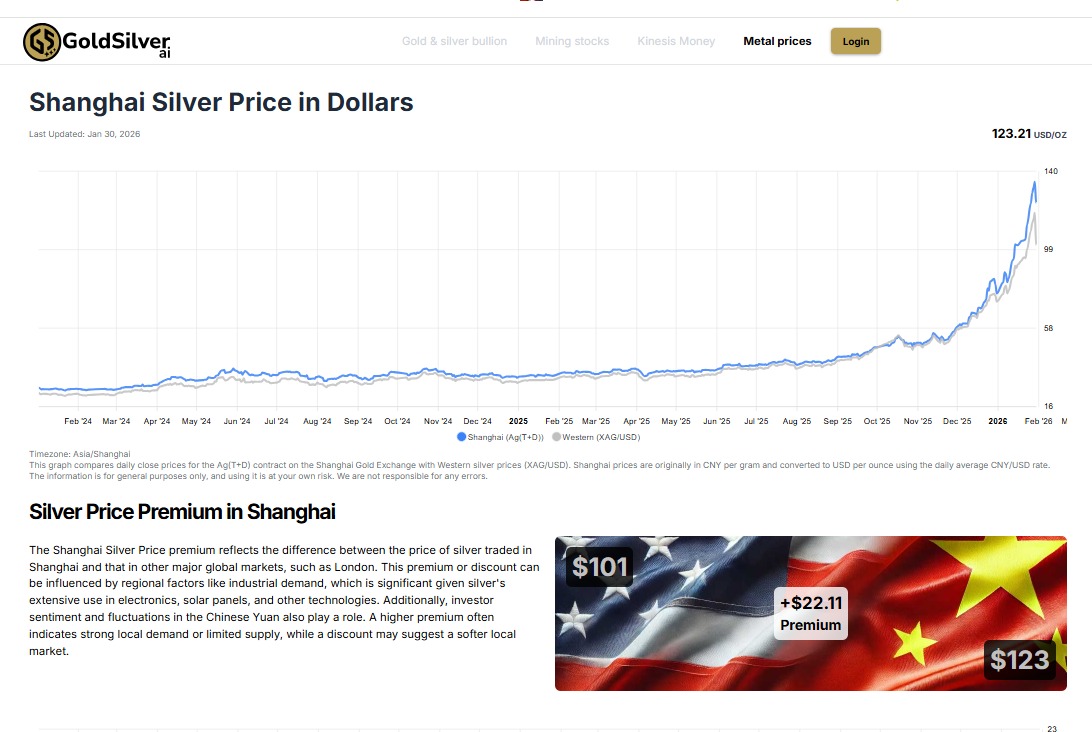

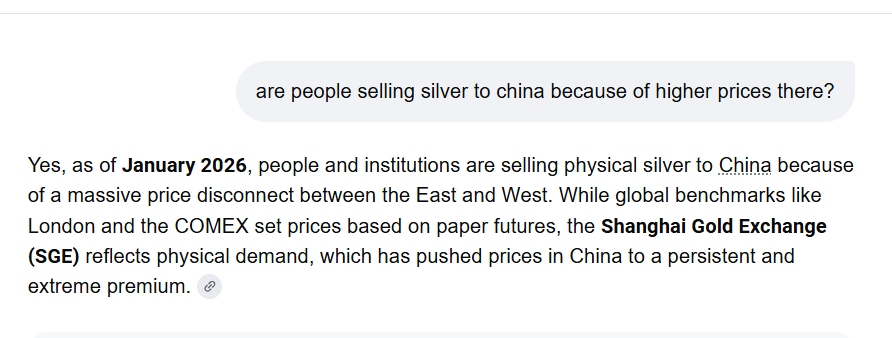

and silver was above $120 yesterday ...

If you want to buy high and sell low, buy when it’s going up and sell when it’s going down.

That goes for anything.

At $77k now.

That is a proven good strategy.

So you didn’t hold it for a period.

You bought it when it was going up and sold it the the next day because it was going down?

Bitcoin, Metals and AI.

All part of the monetary excess bubble that started in the 2008 financial crisis, and exploded in the 2021 Pandemic crisis.

The Fed pumped out money like it was going out of style.

Recently that money has collected within the bubble that is metals, crypto and attempts to create digital consciousness...the Babble Super Being.

As the bubble pops all that excess money goes to the last person smart enough to sell.

Or not:)

Correction: The FIRST person smart enough to sell.

purported gas leak explosion in bandar abbas, Iran

gas explosion in the city of Ahvaz near the Iraqi border

I only buy SP500 index funds. And hold on for many years. I don’t have the nerves to trade anything as volatile as crypto coins.

You are doing exactly the right thing. Doing other than that is pure speculation, not investment.

.

“I only buy SP500 index funds. And hold on for many years.”

Ah ... a wise investor rather than a speculator or gambler. Nothing wrong with that. S&P500 is up over 700% over the last 20 years. Also diversification is good and nothing wrong with having a chunk in gold as well. It is not either/or but both IMO.

Margin calls can move a huge male African elephant.

I lost $330,000 in 1970’s due to margin calls. Learned my lesson and never again bought anything on margin.

It’s on a 4 year business cycle.

It always makes the same moves.

The current length of this cycle, when it peaked at October 2026, sorry October 2025, day 1062.

The day before the cycle for that, 1059 days.

Cycle for that, 1068 days.

The bottom will occur between Oct 3,2026 and Oct 11th.

You are good at keeping track of cycles. I will make a note to watch it in October 2026.

Despite the PM hits, Silver still closed out at an all time monthly high, $85.

2025

January $41.02

February $42.50

March $45.00

April $48.00

May $50.00

June $55.00

July $60.00

August $65.00

September $70.00

October $75.00

November $78.00

December $80.00

Jan 26 $85.

The B Coin has been taking the “ Down”:elevator for some time.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.