Posted on 06/03/2023 5:58:45 AM PDT by MtnClimber

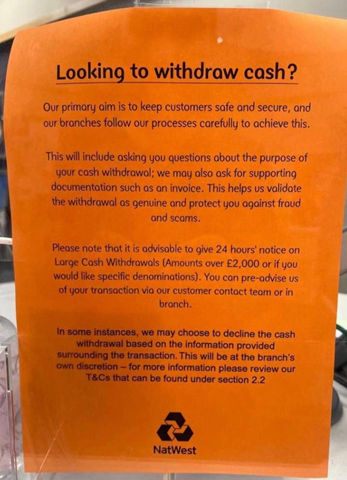

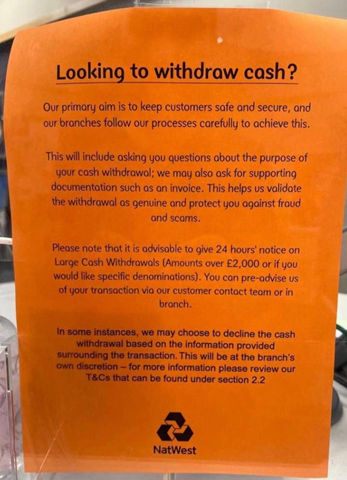

A reader sent me this graphic which is circulating on social media. Whenever I see an unattributed image like this going around I want to verify it, lest it be photoshopped, a deep-fake or some derivation of “urban legend”.

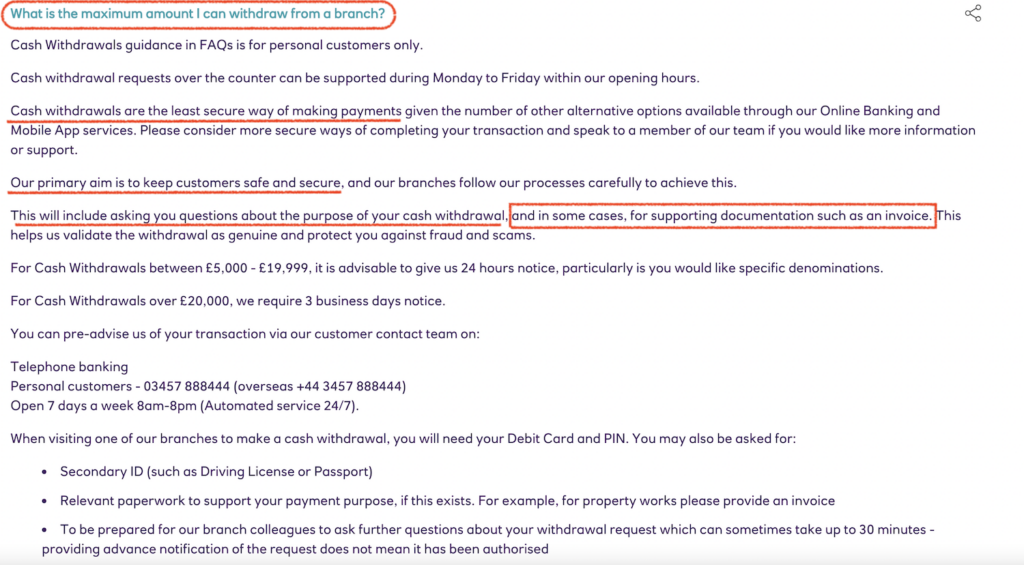

Sure enough, if you go to NatWest bank’s website, right here – you see this cash withdrawal policy spelled out for all to see:

This isn’t actually new

Here in Canada, for at least a few years – predating COVID, the big four banks have been routinely asking you why you are taking cash out whenever you withdraw anything over a couple thousand dollars. However, you can tell them pretty well anything (“because I want it”, “none of your business” or even “to blow it all on booze and hookers”, will all work). I haven’t heard of a case where a withdrawal has been denied based on the reason supplied, yet.

But now that we’re starting to see it formalized in policy language of banks, we can all see where this is going.

The war on cash has been in full swing for a long time, India banned large denominations bills in 2016 and will now start eliminating them from the monetary base. France has been signalling a prohibition on cash payments over 1,000 € since 2013 and finally, quietly, it seems, made it part of the framework this year.

It portends a wider initiative across the entire Eurozone (who is also trying to lump in crypto payments under the restrictions).

Here Come the CBDCs

This is all to lay the groundwork for the march into Central Bank Digital Currencies (CBDCs) which will seek to accomplish three objectives of Late Stage Globalism:

1. Eliminate privacy – making all transactions trackable, traceable and taxable in realtime.

2. Introduce controls on how, when and why you are spending your own money. Think China-style social credit, which in its Westernized form will almost certainly involve personal carbon footprint quotas. And most importantly (otherwise we wouldn’t be calling it “Late Stage Gobalism”):

3. Extend the runway of fiat currencies – which are about to hit the wall as a long-wave debt super-cycle reaches its crescendo. The antidote to all this, is of course, Bitcoin. The only digital asset that is scarce, truly decentralized, has frictionless portability, and is backstopped in physical reality (the “7th property”) in away gold isn’t.

“I’d like to close my account, please.”

The proper response of an account holder seeking to withdraw a cash amount they have defined and encountering such a roadblock:

A pause, a stern look, then (all business-like):

“I changed my mind. I’ll be closing my account. I’ll take cash in the amount of my original request and a cashier’s check for the balance.

NOW, please.”

It is not the bank’s job to protect us from scams. They are to hold my money and give it to me when I ask for it.

I wasn’t asked a single question when I withdrew a substantial sum to pay cash for a new vehicle. Not one.

The, err, money quote is right there at the end:

“The antidote to all this, is of course, Bitcoin.”

Uh-huh, sure... But who wouldn’t inherently trust anything published by bombthrower.com, right?

The posted NatWest withdrawal policy uses the monetary symbol for the British Pound.

The posted policy is for NatWest Bank in the United Kingdom - not for Canada

The next step is to limit the amount of cash transactions. Then eliminate them entirely.

I bought my current car about 14 years ago. I paid cash for the car. I paid the dealer with a $500 CC transaction to cement the deal. The dealer wouldn’t take any more. I had to write a check for the rest..

"Yes Sir/Ma'am, right away....aaand done! Will there be anything else we can do for you today?"

"Yes, my money please."

"Oh, we're sorry, but that won't be possible. You just closed your account."

“F___ YOU! THAT’S WHY!”

LOL

Hookers, beer and horse races. What is the problem?

The rest of the money, I'll just squander.

Never tell the bank you're closing your account.

Open a new account at another bank first. Deposit a few hundred bucks into it.

Take your account and routing number, logon to your new bank's Online Banking System.

Do a wire transfer from your old to new bank. Leave $100 in the old bank.

Wait for confirmation of the wire transfer, and check the balance at your new bank to confirm.

If you really want the pleasure of closing your old account face to face and telling your old bank to stick it, go in and close your account.

They'll look at your current transactions first and then ask about any outstanding checks (if you're closing a checking account.) When they see the current transactions and the wire transfer to the new bank, that's when they start asking questions about why you're closing your account and that's when you can tell them to stick it and demand your $100.

Recently I closed my last Bank of America account and rather than go in and close it, I opened an account at another bank, wired all but $100 over to the new bank, waited for that to clear, then wired the remaining $100 to close it.

By leaving the account open, BoA couldn't put a hold on my money (which they legally can do) and ask what I was doing and why. I was a platinum client and they lost me because of their politics. I didn't want to deal with them F2F because IMO it wasn't worth my time.

That's why they're hiring 87,000 armed IRS agents!

87000 Gestapo agents.

“I’m buying crack, hookers and art supplies.”

and no doubt wasting the rest of it ...

“why they’re hiring 87,000 armed IRS agents!”

It’s mainly to ensure the middle class pays the much higher tax rates soon to be levied.

There will also be a crackdown on tax credit refund fraudsters.

“That’s why they’re hiring 87,000 armed IRS agents!”

I’ve had to staff departments in corporations. Usually, although a degree was required, the tasks were nowhere near as complex or varied as dealing with tax law. Finding even a hundred tax agents would be a near impossible task. So I wonder what these agents will be assigned to do. Certainly, it won’t be complex taxes. My taxes aren’t that hard. I have an LLC and an inheritance with some special requirements. H and R Block had one heck of a time finding someone who could do the work. And, how much are we paying these agents? If you were to do a cost benefit analysis you’d find they have to each, bring in ten to twenty times their pay as they also have really good retirement benefits which also must be paid for. I think this is an additional 187,000 guaranteed Democratic voters like the TSA agents.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.