Skip to comments.

Wells Fargo Customers Complain About Missing Deposits, Fresh off the Silicon Valley Bank Collapse

Red State ^

| 03/10/2023

| Jennifer Oliver O'Connell

Posted on 03/10/2023 7:53:54 PM PST by SeekAndFind

It hasn’t been a good day for the banking industry. As our Senior Editor Joe Cunningham reported, Silicon Valley Bank was taken over by bank regulators. The 16th largest bank in the nation, and once a darling of tech industry, its downfall could be directly connected to the woes, layoffs, and setbacks in that very industry.

Silicon Valley Bank (SVB), a financial institution that focused primarily on investing in tech start-ups, has been taken over and shut down by federal regulators in one of biggest financial failures in history, and the biggest since the Global Financial Crisis over a decade ago.

The banking giant Wells Fargo Bank (WFB), which was one of the main drivers of that 2008 global financial crisis, has also been showing cracks that portend more problems. The Street gave the lowdown on WFB’s prior missteps and latest woes.

Between the $3.7 billion loan mismanagement fine it was hit with in December 2022 and lawmakers like Elizabeth Warren (D-Mass.) calling for its dissolution, Wells Fargo is not looking so hot lately.

That’s not even including barely believable stories about its top brass — such as the story of the Wells Fargo VP that urinated on a female passenger during a flight in January.

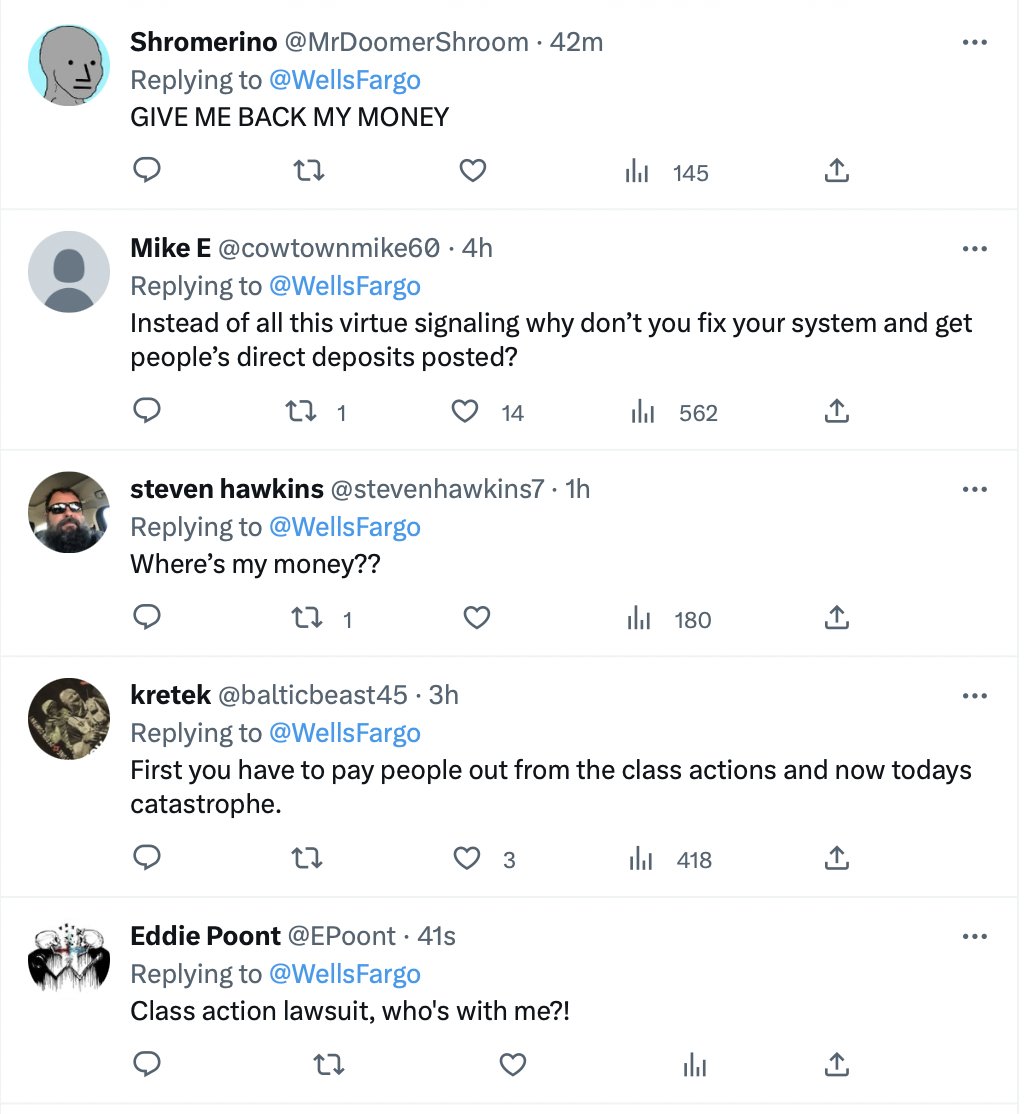

But now Wells Fargo is trending on Twitter yet again — this time due to numerous customer reports of missing deposits and paychecks.

As George Takei delights in saying, “Oh. My.”

From NBC News:

Some Wells Fargo customers woke up Friday morning to find deposits missing from their checking accounts.

In a statement to NBC, the bank acknowledged some direct deposit transactions were not showing up in accounts and that they were working on a resolution. Wells Fargo said the accounts were safe and secure.

That is of little comfort. For most Americans, security means our money is there when we need it, and in this time of inflation and slim margins, that’s every day. I know of very few people that have money just sitting around in the bank—not at less than 2 percent interest, anyway.

It’s the beginning of March, and we just scraped out our checking account to pay rent, as many others had to do for their mortgages and rents. So, to find that any amount previously deposited, or scheduled to be deposited is now missing, would have caused us to go ballistic. As the tweet above indicates, Wells Fargo’s social media accounts, not to mention their customer service phone lines, are on meltdown.

Upset customers began reaching out to the bank on social media overnight Thursday to report recent deposits that had been listed in their account were now missing, or deposits that were expected Friday were not there, affecting what showed in the available balance.

In a statement to customers early Friday morning, the bank said the missing deposits were due to an unspecified technical issue.

“If you see incorrect balances or missing transactions, this may be due to a technical issue and we apologize. Your accounts continue to be secure and we’re working quickly on a resolution,” the bank said in a statement posted to customers on their website.

Again, cold comfort. On top of mortgages and rents, there are automatic payments being pulled and then rejected from these accounts because of non-sufficient funds. That can only add to an already scary and stressful ordeal. (Note: Language warning)

It was not immediately clear how widespread the issue is or how many customers it affected.

Wells Fargo has not yet released any further details about the problem or when it will be resolved.

Unacceptable. When the situation is reversed and we are the ones on the hook to the bank, all measures to bleed us dry are employed until they receive their funds. When the shoe is on the other foot? We’ll get back to you.

The customers who haven’t already done so, are threatening to close their accounts. Better late than never, I guess.

At the rate things continue to go with banking and the stock market, I’d say: go to the mattresses… literally.

TOPICS: Business/Economy; Society

KEYWORDS: bankcollapse; deposits; svb; wellsfargo

To: All

2

posted on

03/10/2023 8:06:20 PM PST

by

BipolarBob

(The rumor has not been confirmed until the FBI officially denies it.)

To: SeekAndFind

“If you’re still banking with Wells Fargo, after all the nonsense they’ve pulled in the last 20 years, you’re an idiot.”

My first thought reading this but added Bank of America…don’t get why people let it hold their money, especially when Credit Unions have opened up their membership criteria to so many more people in the same time period.

To: SeekAndFind

Looks like generation Woke is finding out what a lot of us knew about WF and BoA for years.

Funny to watch

4

posted on

03/10/2023 8:30:10 PM PST

by

Regulator

(It's fraud, Jiim)

To: SeekAndFind

"Recent complaints of bank problems has been discredited by 51 banking experts as financial disinformation."

-Janet Yellen.

5

posted on

03/10/2023 8:42:28 PM PST

by

blackdog

((Z28.310) Forget "Global Warming", new grants are for "Galaxy Dimming")

To: All

‘You ain’t seen nothin yet’

To: blackdog

Is that a real quote? Or satire? Where have I seen the “51 experts” ( yes, THAT number) figure before?

To: SeekAndFind

The Laptop being discredited by 51 current and former government intelligence officials as Russian disinformation.

8

posted on

03/10/2023 8:50:54 PM PST

by

blackdog

((Z28.310) Forget "Global Warming", new grants are for "Galaxy Dimming")

To: SeekAndFind

Point being our institutions are corrupt and unreliable because the holders of office and bureaucracies are thoroughly corrupt and unaccountable.

9

posted on

03/10/2023 8:53:41 PM PST

by

blackdog

((Z28.310) Forget "Global Warming", new grants are for "Galaxy Dimming")

To: SeekAndFind

Wells Fargo tried to steal my house several years ago. They should be ashamed of themselves, and stop besmirching the name of a US cultural icon.

10

posted on

03/10/2023 8:53:48 PM PST

by

P.O.E.

(Pray for America.)

To: LegendHasIt

To quote Chicago...it’s only the beginning.

11

posted on

03/10/2023 8:54:26 PM PST

by

RckyRaCoCo

(Please Pray For My Brother Ken.)

To: mikey_hates_everything

Where ya gonna put It?

.

Cash is King but...

To: SeekAndFind

Wells Fargo is something else, but the topic of recession bank failures is unrelated. It’s best to ask yourself, “Who would profit by causing a quick panic in the markets?” Publications trying to grab traffic and notoriety? Investors? As for Silicon Valley Bank, some VCs became hysterical and started a panic.

Read the economic history of the ‘70s and ‘80s for some clues to the real thing. It hasn’t even started, yet. You’ll know that it’s begun, when truly large numbers of consumer defaults, repossessions and foreclosures happen. It’s a long process.

And even that didn’t start a general collapse.

13

posted on

03/11/2023 1:33:00 AM PST

by

familyop

("For they that sleep with dogs, shall rise with fleas" (John Webster, "The White Devil" 1612).)

To: SeekAndFind

Feast your eyes on a preview of Brandon’s digital currency utopia.

14

posted on

03/11/2023 5:01:41 AM PST

by

NautiNurse

(There was a 2022 mid-term Red Wave...in Florida! )

To: Big Red Badger

Too many of the banks (WF, BoA, Truist, Chase, etc.), don't pay interest on checking, and they toss insultingly paltry 0.01% interest on savings accounts. Might as well keep it under your mattress if you don't want to move it into a fair interest account.

There are banks paying 4% for a savings account with no minimum balance. You can buy short term treasury bills earning 5% for six or twelve months.

15

posted on

03/11/2023 5:11:27 AM PST

by

NautiNurse

(There was a 2022 mid-term Red Wave...in Florida! )

To: NautiNurse

I’m gonna look into this.

I’ve never been very concerned

as I was to busy working but

Now being retired I need to.

😊

To: SeekAndFind

Not the first time for Wells Fargo or Bank of America been happening for a few years now.

Large accounts hit hardest

17

posted on

03/11/2023 8:24:43 AM PST

by

Vaduz

(LAWYERS )

To: SeekAndFind

This is nothing new with Wells Fargo and it isn’t tech errors. It is human errors in data entry. Wells Fargo has brought me to tears so many times that at times I thought I was losing my mind.

We pay most of our bills on-line, through the bank, all on one page. It is very convenient, when the bank works right, but when it doesn’t, it is very traumatizing. I have had Wells Fargo post bills from one credit card on two companies at the same time. The only reason that I noticed it was because it was for a washer and dryer, a large amount and I had a zero balance on the one card.

I had them fail to process the payment for the phone bill for three months, until I cancelled the home phone because I thought it was the phone company who was losing the payments.

I received almost $14,000 in overcharges on mortgages and refi charges through a class action law suit.

But I am still using Wells Fargo. I will say that the bank is very good at catching fraud and have prevented several fraud attempts, one from ATT, when I purchased a new phone over the phone and the girl (in Dallas) sold my credit card number and I started getting charges all over the country.

So, my problem is how to switch banks and what bank to switch to that offers all the same services. The task seems almost insurmountable, when you have many automated payments, insurance, social security, etc.

18

posted on

03/11/2023 10:15:03 AM PST

by

Eva

To: SeekAndFind

I Use PNC. They are very good, and all the WaWa’s have them.

19

posted on

03/11/2023 3:26:55 PM PST

by

cowboyusa

(There is no co- existence with Pinks and Reds)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson