Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Posted on 01/14/2023 5:57:23 AM PST by Kaiser8408a

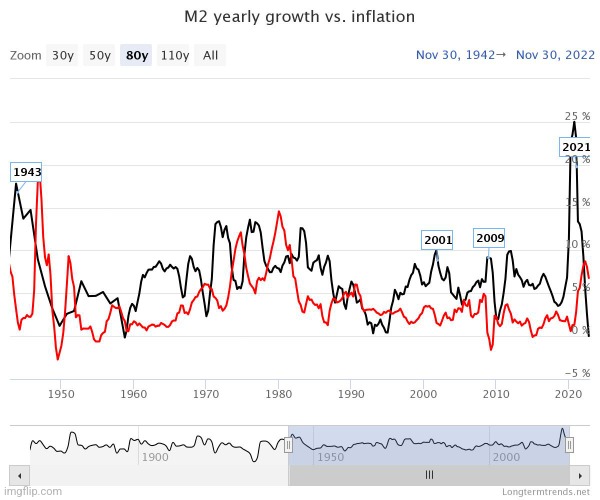

The 2020 Covid outbreak and the resulting government shutdowns and school closures begat a Washington DC spending spree and Federal Reserve monetary stimulus barrage unlike anything other time in history. Congress and Administrations love to spend other people’s money, but as Rahm Emanuel once said “You never let a serious crisis go to waste. And what I mean by that it’s an opportunity to do things you think you could not do before” And wow, did they ever binge spend and expand the M2 Money supply. I call it “The Great Dislocation” of the economy and we never recovered.

Or as Ray Wylie Hubbard sang, “Drinking with my low life companions, dancin’ with a woman who is not my wife.” This should be the theme song for Washington DC and their manic spending.

But after the massive spending splurges and Fed monetary stimultypto, The Fed finally started withdrawing “the punch bowl” to combat inflation. M2 Money growth year-over-year (YoY) is now 0%. And with inflation, US average weekly earnings growth YoY turned negativc and has been negative for 21 straight months.

Even worse, we have Joe Biden as President, who curiously has been found to have classified documents in his possession from when he was Vice President, at least, at two locations (his Wilmington DL home that his son Hunter had access to and the now infamous Penn Biden Center in Washington DC). Even worse, Biden seems to be talking to dead world leaders like Germany’s Schmidt and France’s Mitterand.

Knowing Biden’s penchant for blatant lying and carelessness, I wouldn’t be surprised if this is a stack of classified documents on the table during his meeting with Treasury Secretary Janet Yellen.

Let’s hope Biden isn’t saying that he is talking to late Robert Kennedy, the former US Attorney General.

(Excerpt) Read more at confoundedinterest.net ...

2023 will be in economic textbooks if we make them again…

More silliness.

There is a very broad presumption that inflation is understood and a result of “too many dollars chasing too few products”, and of course this means money supply can define and predict.

Money is a substance created from nothingness on a whim by the Fed or some other central bank. Some confusing aura is draped around this basic truth by inventing terms like Quantitative Ease. But never forget it is whimsy.

Money supply (M2) via QE grew enormously from 2009 til last year. Trillions of whimsical dollars created.

There was no significant inflation over that decade.

Now we have inflation. We didn’t for all those years of huge money supply, but somehow now it is supposed to be relevant.

It is a substance created from nothing. Why should anything about it conform to any supposed laws of nature?

All they are doing is removing the world's unnecessary people that keep consuming the Earth's resources that belong to the elite.

Shut up and perish, peasant.

Every month I read the same headline about M2.

While M2 is an important metric, it is NOT a sole indicator of everything in the economy.

As with most economic metrics, year over year comparisons are sketchy because we are coming out of a three year economic disaster.

You VILL EAT ZEE BUGS! 🦋🐞🦗🪲🐜🦟

The expansion of the money supply was the predictable result of the Federal Reserve flooding the economy with liquidity to avoid economic stress during the pandemic. The pause in the expansion is actually a good thing and indicates that the overall system is undershooting before it returns to a normal growth rate.

The only risk is that the Federal Reserve doesn’t take this into account when making its decisions to control inflation by raising interest rates. If they keep their foot on the brake too long it will prevent returning to the necessary natural growth rate in M2 and tank GDP leading to a recession or worse.

The final graph in the source article is the most telling. We are at par with 1967.

Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

History is written by the victors.

True.

It’s not over yet...

You did not go back far enough.

https://fred.stlouisfed.org/series/M2SL

Have a look at the late 1970s when there was double digit inflation. Where is the M2 spike to explain it?

Friedman can say what he says about a substance created by whimsy, and it will always be possible to find instances where it proves untrue.

There is no sometimes. If it’s a law of nature it is a law of nature. It can never fail. If you find one instance of fail, per the late 70s, then it is not a law.

Friedman has proven this over and over with all kinds if historical examples from Ancient Rome to the modern day. Watch his brilliant series “Free to Choose” or any of his talks on YouTube at various colleges and economic forums to get an understanding on M2, a term he invented, and it’s relationship to inflation.

Here you go

In the chart you can see the increase in M2 and resultant inflation spike in the 70s.

There is no spike. Inflation went to much higher levels than now with much lower M2.

It fails. The theory fails because there can be no theories about a substance created on a whim.

It is right there in the chart I just posted.. The double digit inflation you are talking about which followed the spike in M2 in the late 70s.

See my post #14

It would appear to be in conflict with the Fed’s data, and btw, it is the Fed that tracks M2.

I just don’t know why you are doing this.

The St Louis Fed is the source of data. They are the gold standard.

https://fred.stlouisfed.org/series/M2REAL there, with different scaling. Inflation was far more severe in the late 70’s and there is no M2 spike.

How is this even debateable?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.