Skip to comments.

Current European Natural Gas Storage Data (21-SEP-2022)

Celsius Energy ^

| 21-SEP-2022

| Celsius Energy

Posted on 09/22/2022 6:03:39 AM PDT by SpeedyInTexas

European natural gas inventories rose by +73 BCF over past 7 days.

EU nat gas storage 87% full.

Current inventories at 3316 BCF.

21.3% higher than 1 year ago.

EU goal is at least 80% full by Nov 1st for winter.

Current projection is for EU to reach 93% by Nov 1st.

(Excerpt) Read more at celsiusenergy.net ...

TOPICS: Chit/Chat

KEYWORDS: 93percentof20percent; energyschadenfreude; harderwhenurstupid; itistolaugh; keinerdgasfursie; lolol; mathishard; moregasfromcelsius

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41 next last

To: BeauBo

The markets assess that Europe is on now track to get through the Winter, with or without Russian gas. Natural gas prices in Europe have dropped almost in half over the last month.At what costs? You sound like Biden describing how much people are saving with the declining gas prices. He ignores the price people were paying when he was inaugurated.

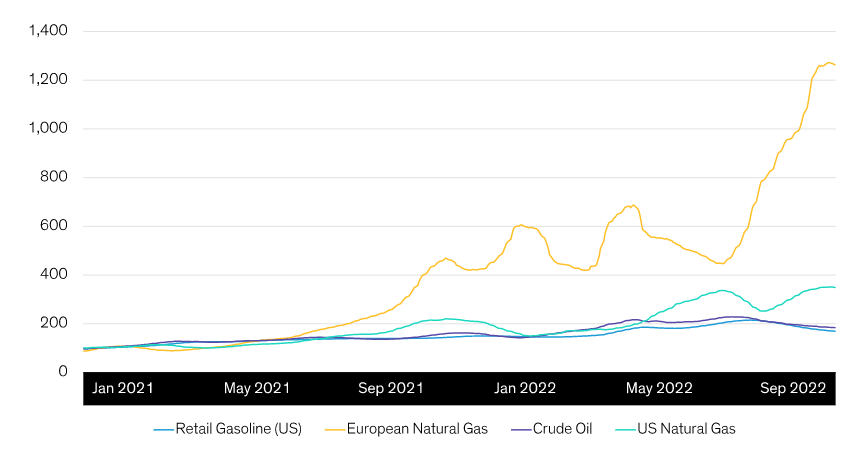

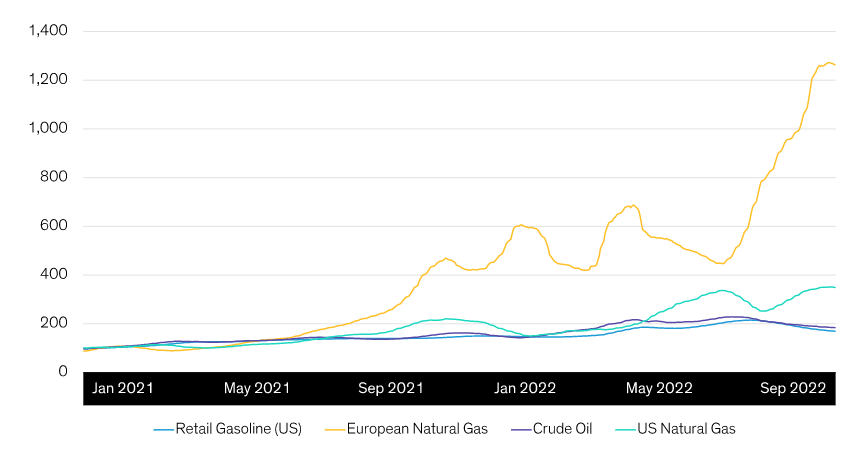

Europe has seen the price of natural gas increase dramatically.

Europe's Policymakers Grapple With Soaring Natural Gas Prices

UK prime minister Liz Truss announced a price cap on natural gas to shelter households from the 80% increase scheduled for next month and more price resets slated for January and April 2023.

With no action, UK inflation could easily have topped 15% this year. With the cap, we expect inflation to end the year around 10%.

Even though the gas price caps will tamp down inflationary pressures, we still see plenty of scope for tighter BoE monetary policy.

Still Plenty of Room for Tighter BoE Monetary Policy

What about economic growth? We think the gas price cap will ease, but not eliminate, household pain. Even with the cap, natural gas costs almost 10 times today what it did at the start of 2021—a run-up that’s much more pronounced than other global commodity price increases.

Europe’s Natural Gas Prices Have Soared

Indexed Energy Prices (January 1, 2021 = 100) (Source: Refinitiv and Thomson Reuters Datastream)

21

posted on

09/22/2022 8:33:40 AM PDT

by

kabar

To: kiryandil; hinckley buzzard; SpeedyInTexas

The EU-27 gas storage capacity amounts to 1147 TWh across 18 Member States[1] – approximately 100 bcm, or one-fourth of the total EU yearly gas demand.

https://fsr.eui.eu/the-role-of-gas-storage/

It is about ten weeks of peak Winter use Europe-wide (if all other supply was halted), but not evenly distributed across Countries. Germany, Switzerland and the Netherlands have relatively more, Bulgaria relatively less.

Out of the ongoing supplies, Russia now accounts for less than 20%.

Several new LNG terminals, and a new pipeline from Norway, are on track to start up before the end of this year. The first new terminal at Willhelmshaven alone will be able to supply 8% of German’s annual use. It is one of eight new LNG terminals funded for just Germany, three of which are scheduled to begin operating before the end of this year.

Europe-wide, the funding is already sunk for a strong surplus of LNG import capacity over the next two years, with a front loaded push to meet this Winter’s use.

22

posted on

09/22/2022 9:08:26 AM PDT

by

BeauBo

To: BeauBo

Blah-blah-blah, we're all a team, yadda-yadda-yadda.

Thanx for the gaseous blastFAX from Senile Joe's puppeteers at the White Hospice, BooBoo.

You still don't get any credibility today.

23

posted on

09/22/2022 9:13:51 AM PDT

by

kiryandil

(China Joe and Paycheck Hunter - the Chink in America's defenses)

To: hinckley buzzard

Germany is getting piped nat gas from Norway, Belgium and Netherlands.

24

posted on

09/22/2022 9:15:42 AM PDT

by

SpeedyInTexas

(The Only Good RuZZian is a Dead RuZZian)

To: BeauBo

It's almost time to start up your covid blastFAXes again, BooBoo.

Time waits for no bot.

25

posted on

09/22/2022 9:17:40 AM PDT

by

kiryandil

(China Joe and Paycheck Hunter - the Chink in America's defenses)

To: kabar

“ The markets assess that Europe is on now track to get through the Winter, with or without Russian gas. Natural gas prices in Europe have dropped almost in half over the last month.”

“At what costs?”

Tens of billions of euros for new infrastructure, hundreds of billions for higher fuel costs during the roughly two year transition period. Maybe a trillion total.

Bottom Line: European Governments signed the check, and are already over the hump for this Winter. Russia is screwed.

Putin did that.

26

posted on

09/22/2022 9:21:26 AM PDT

by

BeauBo

To: kiryandil

Russians are screwed for a decade or more, because of what Putin and his willing accomplices have done. He has led the Nation to its doom.

27

posted on

09/22/2022 9:26:56 AM PDT

by

BeauBo

To: BeauBo

28

posted on

09/22/2022 9:33:44 AM PDT

by

kiryandil

(China Joe and Paycheck Hunter - the Chink in America's defenses)

To: kiryandil

29

posted on

09/22/2022 9:37:22 AM PDT

by

BeauBo

To: BeauBo

Bottom Line: European Governments signed the check, and are already over the hump for this Winter. Russia is screwed.Again, at what price? There will be civil unrest in Europe over energy and food prices. A deep recession is inevitable. Europe is not over the hump. What fantasy world are you living in?

‘The situation has deteriorated.’ Deutsche Bank forecasts deeper Europe recession amid a war-fueled energy crisis

Hopes for a “mild recession” in Europe this winter have been abandoned by Deutsche Bank strategists, who have dramatically slashed their 2023 growth forecasts.

The economists explained what they see as a persistent competitiveness threat from the gas crisis. First, countries will see output losses from gas consumption cuts and this will amplify through supply chains. The drag from higher energy prices may then hit real incomes, then comes the uncertainty shock and finally second-round impacts via trade.

“The near-term impact this winter will be most affected by the extent of rationing — whether through enforced cuts or price-based mechanisms — as well as uncertainty effects on consumer and firm behavior,” they said.

And while the impact of gas demand cuts has been moderate so far, Deutsche Bank warns it will worsen this winter as countries move into the heating season. They see Germany and Italy most at risk, given the reliance those countries have had on Russian gas. German GDP is expected to drop 3.5% in 2023, and Italy is forecast to see a 2% decline, with a recession and higher rates also a threat to Italian stability. General elections will be held September 25.

While less impacted by a gas shock, countries such as France and Spain will still be exposed to a “deepening real income squeeze, competitiveness of higher energy prices and contagion via trade.”

The economists seemed unable to see any near-term light at the end of the tunnel.

“Beyond the winter, the expected U.S. recession next year and the tightening of financial conditions on the back of the ECB’s more front-loaded hiking cycle will limit the speed of the recovery during the remainder of 2023. We see quarterly growth moving above potential only in Q2 2024,” they said.

Russia is screwed.

Oil and gas are global commodities. China and India are becoming alternate markets for Russian energy,

China spent a record-breaking $8.3 billion on Russian energy in just 1 month as Europe shuns the supplies

China spent a record-breaking $8.3 billion importing Russian oil products, gas, and coal in August, official customs data showed.

Chinese buyers have now purchased a record-breaking $44 billion of Russian energy in the six months since President Vladimir Putin's forces invaded Ukraine in February. August's fuel spend rose 68% when compared with a year prior, according to the customs data.

30

posted on

09/22/2022 9:52:10 AM PDT

by

kabar

To: BeauBo; All

Look for Scholz to sign long term LNG contracts in next couple of days.

“German Chancellor Olaf Scholz is set for a two-day visit to the Middle East on Sept. 24-25 where potential LNG supply deals with the UAE and Qatar are expected to be high on the agenda.”

31

posted on

09/22/2022 11:01:23 AM PDT

by

SpeedyInTexas

(The Only Good RuZZian is a Dead RuZZian)

To: kabar

RuZZia has limited ability to export nat gas to Asia.

Its been covered on FR a number of times.

Oil on the other hand can be shippped easily. But oil prices are way down. If there is a global recession, oil prices are going even lower.

32

posted on

09/22/2022 11:03:25 AM PDT

by

SpeedyInTexas

(The Only Good RuZZian is a Dead RuZZian)

To: kabar; SpeedyInTexas

Again, at what price? There will be civil unrest in Europe over energy and food prices. A deep recession is inevitable. Europe is not over the hump. What fantasy world are you living in?

Nobody said kicking Russian corruption and influence out of Europe would be cheap or unwind easily. They’ve spent decades and billions of dollars corruptly buying influence in Europe.

We are living in President Trump’s world. He’s spoken many times about the importance of this and his policies back that up.

33

posted on

09/22/2022 11:36:31 AM PDT

by

lodi90

To: BeauBo; All

34

posted on

09/22/2022 11:44:30 AM PDT

by

SpeedyInTexas

(The Only Good RuZZian is a Dead RuZZian)

To: lodi90

Europe’s knee jerk reaction to the Russian invasion was ill-thought out. The sanctions backfired. The unintended consequences of declaring economic war on Russia will cause a global political realignment and possible end of the dollar as the world’s reserve currency.

In the meantime, we have become stuck in another endless war that will cost many billions of dollars that we must borrow adding to our 31 trillion dollar national debt. And with the Fed raising interest rates, our debt servicing costs will continue to increase taking money away from other priorities.

In late May, the Congressional Budget Office (CBO) projected that annual net interest costs would total $399 billion in 2022 and nearly triple over the upcoming decade, soaring from $442 billion to $1.2 trillion and summing to $8.1 trillion over that period. However, if inflation is higher than CBO’s projections and if the Fed raises interest rates by larger amounts than the agency projected, such costs may rise even faster than anticipated.

The growth in interest costs presents a significant challenge in the long-term as well. According to CBO’s projections, interest payments would total around $66 trillion over the next 30 years and would take up nearly 40 percent of all federal revenues by 2052. Interest costs would also become the largest “program” over the next few decades — surpassing defense spending in 2029, Medicare in 2046, and Social Security in 2049.

Ballooning interest costs threaten to crowd out important public investments that can fuel economic growth in the future. CBO estimates that by 2052, interest costs are projected to be nearly three times what the federal government has historically spent on R&D, nondefense infrastructure, and education, combined.

35

posted on

09/22/2022 1:31:12 PM PDT

by

kabar

To: kabar

The sanctions are half baked and full of loopholes. We can thank the EU and Brandon for that. President Trump had effective sanctions on Russia and they were removed by Biden.

I’m quite surprised you think Russian corruption and influence in Europe is in the strategic interest of the US. President Trump certainly disagrees with that and so do I. Kicking Russia out of Europe will bring tremendous economic benefit to the US and that makes any support to Ukraine now a good investment.

36

posted on

09/22/2022 5:06:14 PM PDT

by

lodi90

To: kabar

“ Again, at what price?”

Again, at high price.

Hundreds of millions, perhaps billions of people will be made poorer because of the brutal aggression and atrocities of Putin and his willing accomplices. Surrendering to that would be disgracefully cowardly, and only invite more such aggression.

Putin did this. He is a monster who must be defeated, whatever the cost.

Again, the bottom line is that the industrial democracies have knowingly accepted to pay the costs, approved by their legislatures with overwhelming bi-partisan support. Russia is screwed.

“Oil and gas are global commodities. China and India are becoming alternate markets for Russian energy”

Of the gas that went to Europe last year (then 85% of Russia’s gas exports), only 4% can be physically shipped to other customers. If China’s 7% of last year’s volume doubles, that is small consolation. Many years and massive investment would be needed to develop Eastern fields or pipelines thousands of miles long, to bring much more than that to Chinese market. But Russia is now cut off from the capital markets and technology to do it. Russia is screwed.

Russia has inherently higher oil production and transportation costs (the highest of any major producer), and now it’s higher transaction costs under sanctions, make Russian oil even less competitive in a commodity market. That is why it’s sales to India just came to a dead halt.

https://oilprice.com/Energy/Crude-Oil/Why-India-Is-Suddenly-Buying-Less-Russian-Crude.html

Russia’s normally weak competitive position in the oil market, is made significantly weaker by the added expenses of current sanctions, but stronger secondary sanctions are coming in December, if not sooner, because of the mobilization escalation. Global recession is coming fast and hard. On an objective price basis, Russia will absorb the lion’s share of the drop in demand.

Russian oil exports made up about 7% of last year’s global oil export volume. Recessions typically reduce global demand 5-15%. This one looks like it will be a bad one, based on the energy shock, and the harshest Central Bank tightening in a half century. Swing producer Russia is so screwed. Like once in a century screwed.

Putin did that.

37

posted on

09/23/2022 8:25:01 AM PDT

by

BeauBo

To: SpeedyInTexas

“Annual pipeline gas exports are set to drop by almost 40%”

… and that is just the official public Party line.

Russia is screwed.

38

posted on

09/23/2022 8:30:23 AM PDT

by

BeauBo

To: BeauBo

Putin did this. He is a monster who must be defeated, whatever the cost.Insane. Ukraine is not the hill to die on. The global economy is in recession headed towards a possible depression. European economies are headed into the toilet along with ours.

Putin isn't the existential threat to the US and our allies. China is. We are spending billions of dollars of borrowed money in endless wars. The US is the world's biggest debtor nation by far. The only reason that we can print money to cover deficit spending is because the USD is the world's reserve currency. That will be the biggest casualty of the war in Ukraine.

Great empires fall from within. When asked what the greatest threat was to American security, Admiral Mike Mullen, Chairman of the Joint Chiefs of Staff, said. "Our national debt is our biggest national security threat."

In late May, the Congressional Budget Office (CBO) projected that annual net interest costs would total $399 billion in 2022 and nearly triple over the upcoming decade, soaring from $442 billion to $1.2 trillion and summing to $8.1 trillion over that period. However, if inflation is higher than CBO’s projections and if the Fed raises interest rates by larger amounts than the agency projected, such costs may rise even faster than anticipated.

The growth in interest costs presents a significant challenge in the long-term as well. According to CBO’s projections, interest payments would total around $66 trillion over the next 30 years and would take up nearly 40 percent of all federal revenues by 2052. Interest costs would also become the largest “program” over the next few decades — surpassing defense spending in 2029, Medicare in 2046, and Social Security in 2049.

Ballooning interest costs threaten to crowd out important public investments that can fuel economic growth in the future. CBO estimates that by 2052, interest costs are projected to be nearly three times what the federal government has historically spent on R&D, nondefense infrastructure, and education, combined.

39

posted on

09/23/2022 8:44:58 AM PDT

by

kabar

To: kabar

I guess by your logic, it would have been more economical to allow Hitler to conquer Russia, or to let Saddam conquer all of the oil reserves of the Middle East.

No. Putin must be defeated, for the future of human freedom.

40

posted on

09/23/2022 9:02:36 AM PDT

by

BeauBo

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson